.

Introduction

If you’re looking for a way to make your money work for you, dividend stock investment is an excellent option. Dividend-paying stocks are a great way to generate passive income, and can provide a steady stream of income that can help you reach your financial goals. And because many companies increase their dividends over time, you can enjoy even more income in the years to come.

One of the best things about dividend stocks is that they can help you minimize risk. When the stock market takes a downturn, the value of your stocks may decline, but you’ll still continue to receive dividend payments. This can help you to ride out market downturns and protect your portfolio from losses.

If you’re new to dividend stock investment, don’t worry, it’s easy to get started. Here are a few tips to help you get started:

- Do your research. Before you invest in any stock, it’s important to do your research and understand the company’s financial health. This will help you to make informed investment decisions.

- Diversify your portfolio. Don’t put all of your eggs in one basket. Instead, diversify your portfolio by investing in a variety of different stocks. This will help to reduce your risk.

- Reinvest your dividends. One of the best ways to grow your dividend income is to reinvest your dividends. This will allow you to compound your earnings and build a larger portfolio over time.

Dividend stock investment is a great way to generate passive income and reach your financial goals. By following these tips, you can get started today and start enjoying the benefits of dividend stock investment.

Dividend Stock Investment

Investing in dividend-paying stocks is like hitting the trifecta of investing: steady income, capital appreciation, and portfolio diversification. These stocks, issued by companies that share a portion of their profits with shareholders, offer a unique blend of stability and growth potential. Let’s delve into the myriad benefits of dividend stock investment.

Benefits of Dividend Stock Investment

Steady Income

Dividend stocks provide a steady stream of passive income, much like a part-time job without the hassle of commuting or punch cards. Whether you’re nearing retirement or seeking to supplement your regular income, dividends can help you achieve financial independence. They’re particularly valuable in times of market volatility, acting as a financial cushion that can ride out the ups and downs.

Capital Appreciation

Contrary to popular belief, dividend stocks don’t just sit there collecting dust. They have the potential to grow in value over time, just like their non-dividend-paying counterparts. In fact, some dividend-paying companies have outperformed the broader market over the long haul. Why? Because dividend payments are often a sign of a company’s financial health and stability, which investors tend to reward.

Portfolio Diversification

The old adage “don’t put all your eggs in one basket” applies to investing too. By investing in dividend stocks, you’re diversifying your portfolio across different sectors, companies, and asset classes. This strategy helps reduce overall risk and smooth out returns, protecting your investments from sudden market shifts.

Tax Advantages

In many countries, dividend income enjoys tax advantages over other forms of investment income. For instance, in the United States, qualified dividends are taxed at a lower rate than ordinary income. This tax break can make a significant difference in your overall investment returns.

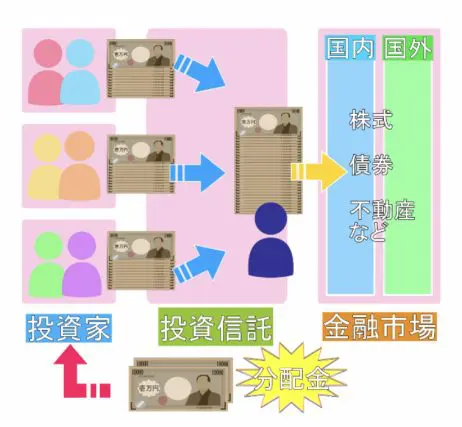

Investment Options

Dividend stocks come in all shapes and sizes. You can invest in individual companies, mutual funds that focus on dividend-paying stocks, or exchange-traded funds (ETFs) that track dividend indices. This flexibility allows you to tailor your investment strategy to your specific needs and risk tolerance.

Example

Let’s say you invest $1,000 in a dividend-paying stock that yields 5%. You can expect to receive a dividend payment of $50 each year. Over time, the stock’s value may also increase, providing you with capital appreciation. And if the company’s financial performance remains strong, the dividend may even grow, further boosting your income.

Conclusion

Dividend stock investment offers a winning combination of benefits that can help you secure your financial future. Whether you’re a seasoned investor or just starting out, consider adding dividend stocks to your portfolio. Remember, the key to successful dividend investing lies in diversification, due diligence, and a long-term investment horizon.

Dividend Stock Investing: A Surefire Way to Grow Your Nest Egg

Are you tired of your savings account gathering dust? It’s time to consider dividend stock investing, where you can earn a steady stream of income while potentially growing your wealth over time. Think of it as a win-win: You get paid just for holding onto the stock. Here’s a detailed guide to help you navigate the world of dividend stocks.

Types of Dividend Stocks

Dividend-paying companies come in various flavors, each with its own strengths and weaknesses. Let’s dive into the three main types:

High-Yield Dividend Stocks

These stocks offer mouthwatering dividend yields, often higher than 5%. They’re like the Ferraris of the dividend world, offering a thrilling ride with the potential for impressive returns. But hold your horses, because these high yields often come with higher risks. Companies may have to cut dividends when the going gets tough, so proceed with caution.

Growth Dividend Stocks

Growth dividend stocks may not offer the highest yields, but they more than make up for it with their potential for long-term growth. These companies reinvest a significant portion of their earnings back into the business, fueling growth and increasing dividend payments over time. Consider them the marathon runners of the dividend world, with a steady pace that pays off in the end.

Value Dividend Stocks

Value dividend stocks are the underdogs of the dividend world. They’re often undervalued compared to their peers, offering a higher yield than might be expected at first glance. These stocks may not be as glamorous as growth stocks, but they can provide a solid foundation for a diversified dividend portfolio. Think of them as the zuverlässig workhorses of the stock market, providing a steady flow of income with less volatility.

Dividend Stock Investment: A Path to Passive Income

In the pursuit of financial freedom, dividend stock investments have emerged as a time-tested strategy. By carefully selecting companies that consistently pay out a portion of their profits as dividends, investors can generate a steady stream of passive income. The allure of dividend stocks lies in their ability to mitigate market volatility and provide predictable cash flow. Here’s a comprehensive guide to help you navigate the complexities of dividend stock investing:

Factors to Consider When Investing in Dividend Stocks

Investing in dividend stocks requires a discerning eye. Consider the following key factors to enhance your investment decisions:

- Dividend Yield: This indicator measures the annual dividend payout relative to the stock’s price. A higher dividend yield suggests a greater income potential, but it’s crucial to assess if the company can sustain such payments.

- Dividend Stability: Look for companies with a history of consistent dividend payments. Avoid companies that have recently cut or eliminated dividends, as this may signal financial distress.

- Financial Health: Evaluate the company’s financial statements to assess its ability to generate profits and cash flow. Factors such as debt levels, revenue growth, and profit margins provide insights into the sustainability of dividend payments.

- Industry Outlook: The industry in which a company operates can significantly impact its dividend-paying capacity. Industries with stable demand and low competition tend to offer more reliable dividend stocks.

- Valuation: Ensure the stock is reasonably priced relative to its intrinsic value. Overpaying for a dividend stock may undermine the yield’s attractiveness. Consider using valuation metrics like the price-to-earnings ratio to determine if the stock is fairly priced.

Diversify Your Portfolio with Dividend Stock Investment

Dividend stock investment has emerged as a lucrative avenue for wealth creation, particularly for long-term investors seeking passive income. These stocks, issued by companies that distribute a portion of their earnings to shareholders, offer multiple benefits. They provide a steady stream of dividend payments, the potential for capital appreciation, and the opportunity to compound returns over time.

Strategies for Dividend Stock Investment

Successful dividend stock investment requires a strategic approach. Consider these three proven strategies:

1. Dividend Capture Strategy

This strategy focuses on identifying undervalued dividend-paying stocks. Investors aim to buy these stocks at a discount to their intrinsic value and hold them until they reach their target price. The dividends earned during this holding period provide a buffer against market fluctuations and generate additional income.

2. Dividend Growth Strategy

This strategy prioritizes companies with a history of consistently increasing their dividend payments. Investors select companies that have a strong track record of earnings growth and a commitment to shareholder value. As the company’s earnings increase, so too does the dividend payout, providing investors with higher passive income over time.

3. Dividend Reinvestment Strategy

This strategy involves reinvesting the dividends received into additional shares of the same stock. By doing so, investors leverage the power of compounding to accelerate their portfolio growth. The dividends earned from the reinvested shares, in turn, generate additional dividends, creating a snowball effect that can significantly increase long-term returns.

4. Dividend Aristocrats

Dividend aristocrats are companies that have consistently raised their dividends for at least 25 consecutive years. These companies are typically blue-chip stocks with strong financial performance and a commitment to rewarding shareholders. Investing in dividend aristocrats can provide investors with a stable and reliable income stream.

5. Dividend ETFs

Dividend ETFs (exchange-traded funds) offer a convenient way to diversify a dividend portfolio. These funds consist of a basket of dividend-paying stocks and trade on major stock exchanges like stocks. Dividend ETFs provide instant exposure to a diversified portfolio of dividend-paying companies, with lower fees and trading costs than individual stock purchases.

Dividend Stock Investment: A Time-Honored Way to Grow Your Nest Egg

Dividend stock investment has long been a favorite strategy for savvy investors seeking to build wealth over time. It’s a simple yet effective approach that combines the power of compounding interest with the stability of regular income. One popular dividend stock for long-term investors is Coca-Cola. Its consistent dividend payments and strong brand recognition make it a solid choice for those seeking a steady stream of income.

The Allure of Dividends

Dividends are payments made to shareholders from a company’s profits. They not only provide investors with a regular income but also have the potential to grow over time as the company’s earnings increase. Over the long haul, reinvested dividends can make a significant contribution to your portfolio’s growth. It’s like planting a seed and watching it grow into a mighty oak.

Choosing Dividend Stocks

Selecting dividend stocks requires careful consideration. Look for companies with a strong track record of paying dividends, solid financial performance, and a commitment to shareholder value. Consider factors such as dividend yield, payout ratio, and dividend growth history. Remember, the best dividend stocks are those that can withstand the ups and downs of the market and continue to reward shareholders.

The Power of Compounding

One of the most compelling aspects of dividend stock investment is the power of compounding. When you reinvest your dividends, you essentially buy more shares of stock. Over time, these additional shares will generate even more dividends, which can then be reinvested. It’s a snowball effect that can lead to substantial long-term growth.

Diversification Is Key

As with any investment, diversification is crucial when it comes to dividend stocks. Don’t put all your eggs in one basket. Spread your investments across different companies and industries to reduce risk. A well-diversified portfolio of dividend stocks can help you weather market volatility and maximize your chances of long-term success.

Long-Term Perspective

Dividend stock investment is a long-term game. Don’t expect to get rich quick. The real power of this strategy lies in the accumulation of dividends and the compounding effect over time. Stay invested for the long haul and let your dividends work their magic. Think of it as planting an acorn and watching it grow into a towering tree that provides shade and nourishment for years to come.

Conclusion

Dividend stock investment can be a valuable component of a balanced investment portfolio, providing income and potential for long-term growth. By carefully selecting dividend-paying companies, diversifying your investments, and maintaining a long-term perspective, you can reap the benefits of this time-honored strategy. Remember, the stock market may go through ups and downs, but quality dividend stocks have the potential to weather the storm and reward investors with a steady stream of income and impressive long-term growth.

No responses yet