Introduction

Are you a risk-averse investor looking for a company with a history of high dividend yields? If so, AGNC Investment Corp (AGNC) is worth considering. AGNC is a mortgage real estate investment trust (REIT) that has been providing consistent dividends to shareholders for over a decade.

What exactly does AGNC do? The company invests in residential and commercial mortgage-backed securities (MBS). These are essentially loans that have been bundled together and sold to investors. When borrowers repay their mortgages, AGNC collects interest payments and passes them on to its shareholders in the form of dividends.

AGNC’s business model is relatively simple, but it has proven to be very effective. The company has consistently generated high levels of income, which has allowed it to pay out substantial dividends to shareholders. In fact, AGNC has increased its dividend every year since its initial public offering in 2008.

AGNC Investment Corp: A High Dividend Yield

For income-seeking investors, AGNC Investment Corp (AGNC) stands out with its consistently high dividend yield. The company’s unwavering focus on agency mortgage-backed securities (MBS) has proven to be a lucrative strategy.

Business Model

AGNC’s business model is built on a solid foundation. It invests heavily in MBS, which are backed by the full faith and credit of the US government or government-sponsored enterprises, such as Fannie Mae and Freddie Mac. These securities offer a stable stream of interest payments, which AGNC uses to fund its generous dividend payouts.

The company’s portfolio is carefully managed to mitigate risk. It maintains a diversified mix of MBS with varying maturities, reducing exposure to interest rate fluctuations. AGNC’s skilled investment team continuously monitors the market and adjusts its portfolio accordingly.

Why Such a High Dividend Yield?

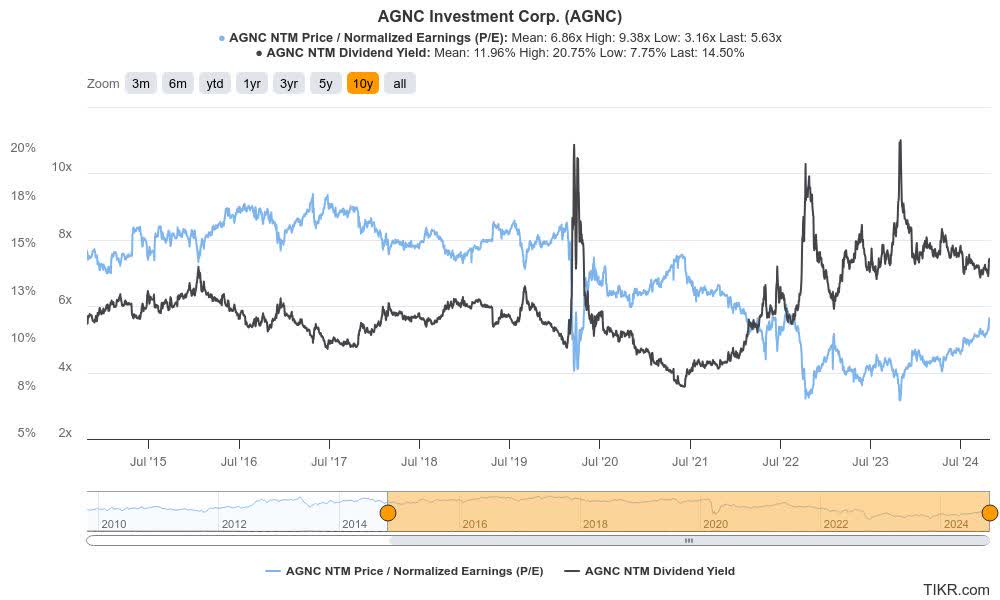

AGNC’s dividend yield often surpasses that of other income-oriented investments. This is partly due to its unique business model. By focusing on MBS, the company can generate a steady stream of income, which enables it to maintain a high level of dividend payments.

Another factor contributing to AGNC’s high dividend yield is its use of leverage. The company finances its investments with debt, amplifying its returns. However, this strategy does increase risk, and investors should be aware of potential fluctuations in dividend payments.

Is AGNC Investment Corp Right for You?

AGNC Investment Corp can be an attractive option for investors seeking income. Its high dividend yield is a major draw, providing a potentially steady stream of passive income. However, it’s important to consider the company’s risk profile before investing.

Investors should carefully assess their investment goals and risk tolerance before making a decision. Those seeking a stable dividend stream may find AGNC appealing, while those more concerned with capital appreciation may want to consider other investment options.

Furthermore, AGNC’s dividend yield fluctuates depending on market conditions and interest rates. Investors should be prepared for potential variations in their dividend payments.

If you’re considering investing in AGNC Investment Corp, consult with a financial advisor to determine if it aligns with your investment goals and risk profile.

No responses yet