How Can I Earn Passive Income?

The allure of passive income—money that magically appears in your bank account without any effort—is as tantalizing as it is elusive. But what does it take to generate this financial unicorn?

Passive Income Basics

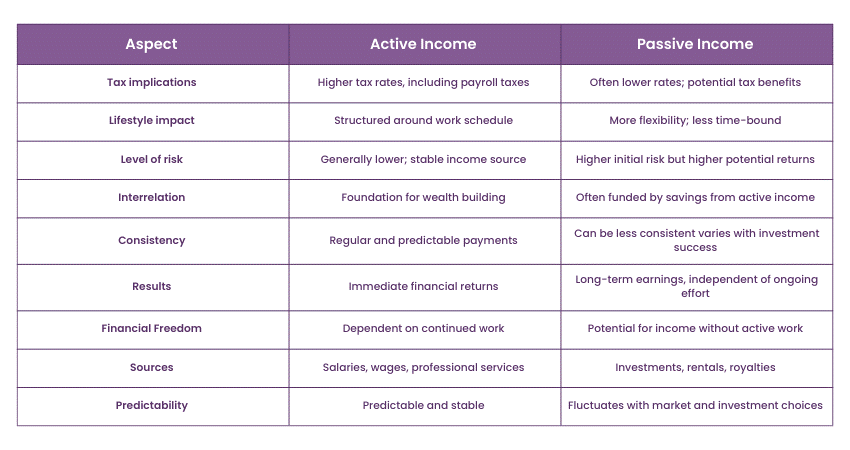

Passive income is an income that requires minimal or no effort to maintain. It’s the antithesis of active income, which you earn through direct labor, such as a salaried job or freelance work. The key to passive income is to create a system that generates money even while you’re sleeping, traveling, or simply enjoying your favorite pastime.

Imagine this: You buy a rental property. You hire a property manager to handle the day-to-day operations. The tenants pay rent every month, and you pocket the profit without lifting a finger. That’s the essence of passive income—it’s like owning a money-making machine that operates on autopilot.

How to Generate Passive Income

While the concept of passive income is simple, generating it is a different beast altogether. Here are a few proven ways to get started:

- Invest in rental properties: Rental properties can be a great source of passive income, but they also require a significant upfront investment and ongoing maintenance costs.

- Create digital products: If you have a skill or knowledge that others value, you can create and sell digital products such as ebooks, online courses, or software.

- Start a blog or website: You can earn money from your blog or website through advertising, affiliate marketing, or selling your own products and services.

- Invest in dividend-paying stocks: Dividend-paying stocks can provide a steady stream of passive income, but keep in mind that stock prices can fluctuate and dividends are not guaranteed.

- Start an online business: An online business can be a great way to generate passive income, but it requires a lot of upfront work to establish yourself and build a customer base.

How Can I Earn Passive Income?

Passive income, often a pipe dream for many, can be a reality with a bit of planning and effort. From renting out properties to investing in stocks, there are numerous ways to generate income without having to actively work for it. This article will delve into some tried-and-true methods that can help you achieve your passive income goals.

Rental Properties

Owning rental properties can be a lucrative way to earn passive income. When you rent out a property, you’re essentially selling the right to use it to someone else. This can generate a steady stream of income, especially if you own multiple properties. The key to success in real estate is finding a reliable tenant who will pay their rent on time and take care of the property.

However, there are also some risks involved with owning rental properties. You may have to deal with vacancies, maintenance issues, and even evictions. It’s important to do your research before investing in rental properties and to make sure you’re prepared to handle the challenges that come with it.

Here are some tips for earning passive income from rental properties:

- Invest in properties in a desirable location. This will help you attract tenants and keep your vacancy rates low.

- Set your rents at a competitive rate. You want to charge enough to cover your expenses and make a profit, but you don’t want to set your rates too high or you’ll scare away potential tenants.

- Screen your tenants carefully. Before you rent to someone, check their credit and rental history. This will help you avoid problems down the road.

- Maintain your properties. This will help keep your tenants happy and prevent costly repairs.

How Can I Earn Passive Income?

Earning a living without the daily grind of a 9-to-5 job is a dream for many, but the path to passive income can seem shrouded in mystery. Fear not, intrepid income seeker, for we’ve got the answers you crave wrapped up in a concise and comprehensive guide.

Dividend Stocks

Dividend-yielding stocks are akin to a financial oasis, offering a steady stream of income in the form of regular payments. These trusty investments represent ownership in companies that share a portion of their profits with their shareholders. With each dividend you collect, you’re essentially getting paid to own a piece of the business.

Rental Properties

Investing in rental properties is like owning your very own cash-generating ATM. When you become a landlord, you’re not just providing shelter; you’re also earning passive income every time your tenants pay their rent. It’s a tried-and-true strategy that can provide a steady stream of revenue for the long haul.

Online Courses

If you’ve got a knack for teaching or sharing your knowledge, creating and selling online courses is a superb way to generate passive income. By packaging your expertise into bite-sized lessons, you can earn a recurring revenue stream while helping others learn and grow. The best part? You only need to create the course once and reap the rewards for years to come.

Affiliate Marketing

Affiliate marketing is a low-cost way to tap into a vast ecosystem of potential customers. By partnering with businesses and promoting their products or services, you can earn a commission on every sale generated through your unique referral link. It’s a win-win-win situation: you provide value to your audience, businesses get access to a broader reach, and you earn a cut of the profits.

High-Yield Savings Accounts

High-yield savings accounts are a safe and simple way to grow your money without actively managing investments. These accounts offer interest rates significantly higher than traditional savings accounts, so you can watch your savings compound over time without lifting a finger. It’s not the most glamorous way to earn passive income, but it’s consistent and requires minimal effort.

How Can I Earn Passive Income?

Generating passive income can be the key to financial freedom. Here are some proven ways to do it.

Online Course Creation

Think about what you know well and how you can teach it to others. Creating online courses on platforms like Udemy and Coursera can generate income for years. Courses can be pre-recorded to minimize effort.

How can I Earn Passive Income?

Passive income, the holy grail of money-making. Who wouldn’t want to earn money while they sleep? Well, it’s not a pipe dream. Here are some ways to get your passive income hustle on:

Affiliate Marketing

Think of affiliate marketing as the cool kid in class who gets paid to promote the latest gadgets. You don’t have to create your own products or services. Instead, you partner with other businesses and earn commissions by promoting their stuff. How’s that for effortless earnings?

Investing in Real Estate

Real estate is like the steady Eddie of passive income. Buying rental properties can generate a steady stream of rent payments. It’s like owning a money-making machine that keeps on chugging along. Plus, it can appreciate in value over time, giving you even more bang for your buck.

Dividend Stocks

Dividend stocks are like the wise old uncle who shares his wealth with you. Companies that issue dividends pay out a portion of their profits to shareholders. It may not be a huge chunk, but it adds up over time. Think of it as a little extra cash that keeps flowing into your pocket.

Online Courses

If you’ve got a knack for teaching, creating an online course can be a great way to earn passive income. Share your knowledge and skills with others, and they’ll pay you to learn from you. It’s a win-win situation!

Membership Sites

Membership sites are like exclusive clubs where people pay to access your content or services. They’re a great way to generate recurring revenue. Think of it as having a loyal group of fans who support your work and contribute to your passive income stream.

How Can You Cultivate a Field of Passive Income?

The pursuit of financial freedom often leads us to explore diverse avenues of income generation, with passive income serving as an alluring oasis in this quest. Passive income, unlike its active counterpart, doesn’t require constant, hands-on labor. It’s the income that keeps flowing into your pockets even when you’re taking a well-deserved snooze.

High-Yield Savings Accounts

High-yield savings accounts, like a safe haven for your cash, nurture the growth of your funds over time. By depositing your hard-earned dollars into these accounts, you’ll reap the rewards of compound interest, letting your money work diligently for you in the background.

Dividend-Paying Stocks

Imagine corporations as bountiful fruit trees, generously sharing their profits with stockholders in the form of dividends. Dividend-paying stocks are a fruitful way to earn passive income. As a stockholder, you’re entitled to your slice of the earnings pie, which can provide a steady stream of supplemental income.

Rental Properties

Rental properties, like well-tended gardens, yield a steady harvest of income. Owning and renting out properties can generate a passive revenue stream. Though it requires a more involved approach compared to other methods, the potential returns can be substantial.

Online Courses

If you possess a wealth of knowledge, consider creating and selling online courses. This virtual marketplace allows you to package your expertise into valuable content that others can purchase and learn from. Passive income flows from each course sold, rewarding your intellectual endeavors.

Affiliate Marketing

Affiliate marketing is like a symbiotic relationship between you and other businesses. By promoting their products or services, you earn a commission on every sale generated through your unique referral link. This passive income stream is fueled by your ability to connect businesses with potential customers.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with lenders. By extending loans to creditworthy individuals, you can earn interest on your investments. As borrowers repay their debts, you reap the rewards of passive income, making you a financial bridge between those in need and those with capital to spare.

How Can I Earn Passive Income?

Passive income is money that keeps rolling in even when you’re not actively working for it. It’s like having a magic money-making machine that spits out cash in your sleep. Sounds too good to be true, right? Well, it’s not. There are plenty of ways to earn passive income, and we’re going to share seven of the best with you right now.

Peer-to-Peer Lending

One way to earn passive income is by lending money to individuals or businesses. This can be done through peer-to-peer lending platforms that connect borrowers with lenders. When you lend money through a peer-to-peer platform, you’re essentially acting like a bank. You’re lending your money to someone else, and they’re paying you back with interest. The interest rates on peer-to-peer loans vary depending on the platform you use and the creditworthiness of the borrower. However, you can typically expect to earn a return of 5-10% per year.

How Can I Earn Passive Income?

The good ol’ 9-to-5 grind isn’t always the best way to make a buck! Making money while you’re not actively working? Gimme a high-five! That’s called passive income, and it’s the ultimate game-changer in the financial world. Whether you want to supplement your income or fund your dreams, here are some ways to join the passive income revolution:

Automated Investments

Scaredy cats, behold! Robo-advisors and automated investment platforms are here to rescue you. These whizzes diversify your investments and generate passive income without breaking a sweat. They’re like the cool kids on the block, making investing as easy as ordering pizza.

Rent Out Your Spare Room

Got a spare room that’s doing more hibernating than hosting? Turn it into a cash cow! Rent it out to a friendly tenant and collect rent like a boss. It’s like having a personal ATM in your own home.

Online Courses

Not only will you change people’s lives, but you’ll also earn money while you sleep! Create an online course on something you’re an expert in, from coding to cooking. The beauty is, you do the work once and reap the rewards forever.

High-Yield Savings Accounts

No risk, no fuss, just cold, hard cash! High-yield savings accounts offer higher interest rates than traditional accounts, making your money work harder for you. It’s like a supercharged piggy bank!

Affiliate Marketing

Think of it as being a digital salesperson! Partner with brands you love and earn a commission when people buy their products through your unique referral link. Like a virtual door-to-door sales gig, but without the awkward conversations.

Dividend-Paying Stocks

Invest in companies that pay out part of their profits to shareholders in the form of dividends. These stocks can provide a steady stream of passive income, making you feel like a financial rockstar.

Peer-to-Peer Lending

Become a modern-day Robin Hood, lending money to borrowers through peer-to-peer platforms. You earn interest on your loans, helping others while lining your own pockets. It’s like being a superhero with a cash sword!

No responses yet