Introduction

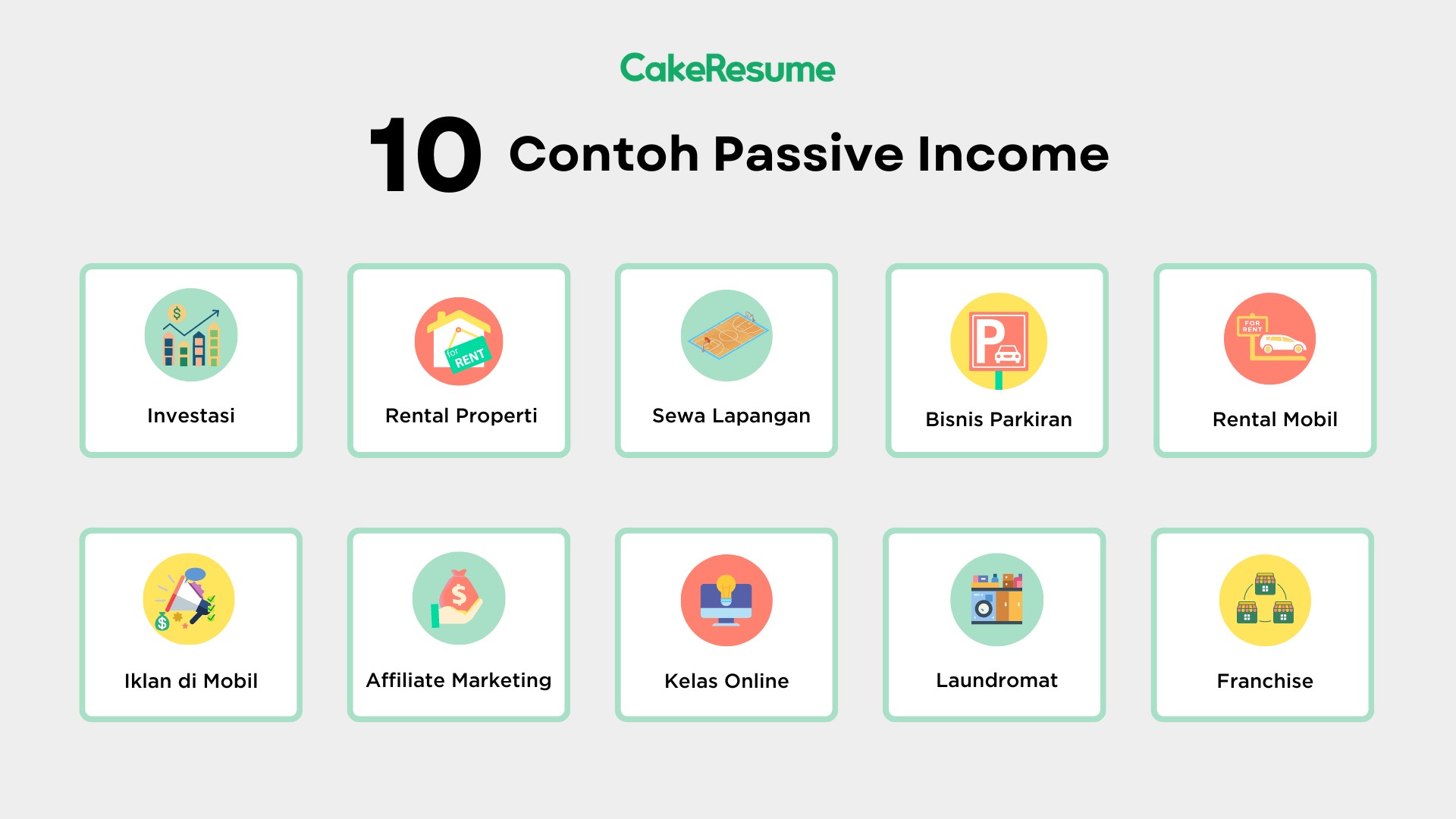

In this cutthroat economic climate, many folks like you and me are seeking ways to boost their income. Venturing into the world of passive income is one strategy that’s gaining traction. It’s like having a trusty sidekick working for you around the clock, generating dough without you having to lift a finger.

One simple yet effective way to tap into passive income is through dividend-paying stocks. These stocks are issued by companies that share a slice of their profits with their shareholders in the form of dividends. Over time, these dividends can accumulate, providing a steady stream of income. It’s like building a money tree that keeps on bearing fruit!

But hold your horses, there’s more! Real estate can also be a lucrative avenue for passive income. By investing in rental properties, you can collect rent from tenants, providing a stable source of cash flow. It’s like owning a never-ending cash cow that keeps on mooing!

And let’s not forget about online businesses. Whether it’s e-commerce, dropshipping, or affiliate marketing, there’s a wealth of opportunities to generate passive income online. It’s like having a virtual ATM machine that spits out money while you sleep!

So, if you’re ready to wave goodbye to the hustle and grind and embrace financial freedom, read on to discover more effortless ways to generate passive income and transform your financial destiny.

Easy Passive Income: A Path to Financial Freedom

The pursuit of financial freedom often leads us to explore passive income streams that allow us to earn money while we sleep. One of the most popular and time-tested methods of generating easy passive income is dividend investing. But what exactly is dividend investing, and how do you get started?

Dividend Investing

Dividend investing is a form of stock investing where you purchase shares in companies that pay regular dividends to their shareholders. These dividends represent a portion of the company’s earnings that are distributed to investors as cash payments or reinvested in the company. Dividend-paying companies often have a track record of profitability and financial stability, making them attractive to long-term investors seeking passive income.

Benefits of Dividend Investing

Dividend investing offers several key benefits that make it an attractive passive income stream:

- Regular income: Dividends provide a steady stream of income that can supplement your salary or other forms of passive income.

- Tax advantages: Dividend income is often taxed at a lower rate than other forms of investment income.

- Long-term growth: Many dividend-paying companies also experience growth in their stock price over time, providing the potential for capital appreciation in addition to dividend income.

- Diversification: Dividend investing allows you to diversify your portfolio across different companies and industries, reducing your overall risk.

How to Get Started with Dividend Investing

Getting started with dividend investing is relatively straightforward. Here are a few steps to consider:

- Research and select companies: Look for companies with a history of consistent dividend payments, strong financials, and a sustainable business model.

- Invest in dividend ETFs: Exchange-traded funds (ETFs) that track dividend-paying stocks can provide instant diversification and lower risk.

- Reinvest dividends: Consider reinvesting your dividends in additional shares of the same or other dividend-paying companies to compound your earnings over time.

Conclusion

Dividend investing offers a simple yet effective way to generate easy passive income while building wealth for the long term. By investing in dividend-paying companies and reinvesting dividends, you can create a steady stream of income that can supplement your financial goals. So why wait? Start exploring dividend investing today and take a step toward financial freedom tomorrow.

Easy Passive Income Strategies to Supercharge Your Finances

Are you tired of toiling away, longing for a way to let your money work for you? Look no further than passive income – a sweet spot where you can earn money without actively participating. One of the best ways to generate passive income is through peer-to-peer lending.

Peer-to-Peer Lending

Let’s break it down: peer-to-peer lending is like a matchmaker for money. It connects you with borrowers who need funds with investors like you who want to lend their dough and earn interest in return. The beauty of this setup is that it cuts out the middleman (i.e., banks), giving you the potential for higher returns.

Before you dive in, do your research! Not all peer-to-peer lending platforms are created equal. Look for platforms with a solid track record, low default rates, and transparent fees. You’ll also want to consider the loan terms – interest rates, repayment periods, and borrower credit profiles – before committing your hard-earned cash.

Remember, peer-to-peer lending is not risk-free, just like any investment. Borrowers can default on their loans, meaning you may not get your money back. To mitigate this risk, spread your investments across multiple loans and borrowers. Diversification is your friend here!

Passive Income: A Path to Financial Freedom

In the relentless pursuit of financial freedom, the notion of passive income looms large. It’s the holy grail of investing, promising a steady stream of income without the relentless grind of active labor. Whether you’re seeking to supplement your current earnings or build a foundation for a secure future, passive income offers a tantalizing path forward.

Rental Properties: A Classic Investment

For centuries, rental properties have been a cornerstone of passive income strategies. Acquiring properties and leasing them out to tenants provides a consistent flow of rental income, creating a steady stream of cash. The allure of rental properties lies in the potential for both income and appreciation, offering the prospect of long-term financial growth. However, it’s important to note that rental properties require ongoing maintenance and management, which can eat into profits if not properly managed.

Dividend-Paying Stocks: Stable Income from Corporate Earnings

Dividend-paying stocks offer another avenue to passive income. These stocks represent ownership in publicly traded companies that distribute a portion of their profits to shareholders in the form of dividends. Dividends can provide a regular income stream, especially when invested in companies with a history of consistent dividend payments. However, it’s crucial to research potential investments thoroughly and diversify your portfolio to mitigate risk.

Online Courses and E-books: Sharing Knowledge for Profit

In the digital age, online courses and e-books have emerged as accessible ways to generate passive income. If you possess specialized knowledge or expertise, creating and selling online content can provide a steady stream of income. Platforms like Udemy, Coursera, and Amazon Kindle Direct Publishing (KDP) offer a global marketplace for creators to share their wisdom and earn from it.

Affiliate Marketing: Earning from Product Endorsements

Affiliate marketing is a performance-based marketing technique that allows you to earn commissions by promoting other people’s products or services. When someone clicks on your affiliate link and makes a purchase, you receive a portion of the sale. Affiliate marketing can be lucrative if you have a loyal following and can effectively promote products that align with their interests. However, it’s essential to build trust and transparency with your audience before promoting any product.

Passive Income: The Ultimate Guide to Effortless Earnings

When it comes to making money, wouldn’t you love a way to earn without actively working? Passive income is the key to financial freedom, offering the chance to generate revenue without the daily grind. Here’s a comprehensive guide to get you started with easy passive income streams that can change your life:

Online Courses

If you have a knack for teaching or sharing your expertise, creating and selling online courses is a fantastic way to earn passive income. Choose a topic you’re passionate about, create high-quality content, and make it available on platforms like Coursera, Udemy, or Skillshare. Once your courses are live, they’ll continue to sell and generate income for you as long as they remain relevant.

Affiliate Marketing

Affiliate marketing involves partnering with businesses and promoting their products or services in обмен за commission. Sign up for affiliate programs in niches you’re interested in, and share unique affiliate links with your audience. When someone makes a purchase through your link, you earn a commission without having to create any products or deal with customer service.

Dividend-Paying Stocks

Investing in dividend-paying stocks is another way to generate passive income. When you buy shares in a company that pays dividends, you receive regular payments from the company’s profits. Make sure to research the companies you invest in, look for those with a strong track record and sustainable dividend policies.

Rental Properties

Owning rental properties can be a great way to earn passive income, but it also requires significant investment and effort. If you have the capital and the willingness to manage tenants, this could be a lucrative option. You’ll earn rent from tenants while the property appreciates in value.

High-Yield Savings Accounts

For those seeking a low-risk option, high-yield savings accounts offer a way to earn passive income without the hassle. These accounts typically pay higher interest rates than traditional savings accounts, providing a steady return on your deposits. Keep in mind that these interest rates can fluctuate, so it’s important to do your research before choosing an account.

Easy Passive Income: Tap into the Power of Low-Effort Earnings

Passive income is like a dream come true, right? You put in the groundwork once and reap the benefits for years to come. We’ve got you covered with some foolproof ways to generate effortless cash flow.

Affiliate Marketing

Partner with businesses and earn commissions by showcasing their products or services to your audience. It’s like being a matchmaker for brands and consumers, with a nice cut for yourself. Think about it, you’re essentially getting paid to share your thoughts on stuff you already love with your followers.

Drop Shipping

Step into the virtual world of e-commerce with zero inventory. Drop shipping allows you to sell products online without ever having to stock or ship them yourself. Simply partner with a supplier, create an online storefront, and let the supplier handle the nitty-gritty. All you do is take orders, collect payments, and watch the profits roll in.

Online Courses

Share your expertise and turn your knowledge into a revenue stream. Craft online courses on topics you’re passionate about or skilled in. From cooking to coding, teaching others what you know can be a passive income goldmine. It’s not just about the money, it’s about making a difference while you’re at it.

Blogging

Passionate about writing? Start a blog and monetize it through advertising, affiliate marketing, or sponsored content. Build a loyal audience by sharing your insights, experiences, and opinions. Consistency is key, so make it a habit to post regularly and engage with your readers.

Rent Out Your Space

If you’ve got a spare room, basement, or driveway, put it to work. Rent it out on platforms like Airbnb or Craigslist. Turn your unused space into a passive income stream while giving travelers or storage seekers a place to rest or stash their stuff. Plus, you can connect with interesting people from all walks of life.

Investments

The world of investments can be a bit daunting for beginners, but it’s worth exploring. Consider investing in stocks, bonds, or real estate. By diversifying your portfolio, you can potentially generate passive income through dividends, interest, or rent. Just remember, investing involves some risk, so research thoroughly before taking the plunge.

Easy Passive Income: Effortless Ways to Earn a Steady Stream of Cash

If you’re looking for ways to supplement your income without a lot of extra effort, passive income might be the answer. These methods allow you to earn money without actively working, giving you more time to do what you love. Here are a few ideas to get you started:

High-Yield Savings Accounts

Traditional savings accounts barely keep up with inflation these days. Consider stashing your savings in high-yield accounts that offer significantly higher interest rates, giving your money a chance to grow faster.

Rental Properties

Owning rental properties can be a great way to generate passive income, but it does require some upfront investment and ongoing management. Rent from tenants covers your mortgage and other expenses, leaving you with a profit.

Dividend-Paying Stocks

Investing in stocks that pay regular dividends is another way to earn passive income. While stock prices can fluctuate, dividends provide a steady stream of income regardless of the market’s ups and downs.

Affiliate Marketing

Promote other people’s products or services on your website, blog, or social media channels. When someone clicks on your affiliate link and makes a purchase, you earn a commission.

Online Courses

Creating and selling online courses is a great way to share your knowledge and expertise while earning passive income. Once you’ve created the course, you can sell it over and over again with minimal effort.

Blogging

Starting a blog can be a great way to connect with an audience and share your thoughts and passions. Over time, your blog can generate income through advertising, affiliate marketing, or sponsored content.

Online Freelancing

Offering your skills as a freelancer on platforms like Upwork or Fiverr allows you to earn money on your own terms. Complete projects when you have free time and get paid for your services.

Conclusion

Passive income can provide a valuable supplement to your regular income or even replace it entirely. By exploring these ideas and others that align with your interests and abilities, you can create a steady stream of cash without the need for excessive effort. So, what are you waiting for? Start earning some easy passive income today!

Passive Income: A Lazy Person’s Guide to Making Money

Who doesn’t dream of earning money without breaking a sweat? Passive income is like a magic wand that makes your money multiply while you’re sipping margaritas on a beach. No more waking up at the crack of dawn and slaving away for a paycheck. Sounds like a fairy tale, doesn’t it?

Well, hold your horses, my friend! Passive income isn’t a myth, but it’s not a walk in the park either. It takes a little bit of work and planning to set up, but once you’ve got it rolling, it’s like having a money-making machine working for you 24/7.

Affiliate Marketing

If you’re a social butterfly who loves sharing your favorite finds, then affiliate marketing might be your calling. Simply partner up with brands you love and earn a commission every time someone buys through your unique link. It’s like being a digital matchmaker, connecting businesses with potential customers and getting paid for it.

Online Courses and E-books

If you’re an expert in something, why not package your knowledge and sell it? Create online courses or e-books that teach others your skills or secrets. The beauty of this passive income stream is that you do the work once, and it keeps generating income for years to come.

Dividend Stocks

Investing in dividend-paying stocks is like owning a piece of a company that pays you a regular income. When the company makes a profit, it shares a portion with its investors through dividends. So, sit back, relax, and watch those dividend checks roll in.

Rental Properties

Owning rental properties is a classic form of passive income. Rent out a spare room in your house, invest in a vacation rental, or build a portfolio of apartments. The rent you collect can cover the mortgage, taxes, and maintenance costs, leaving you with a steady stream of extra income.

Peer-to-Peer Lending

If you’ve got some extra cash lying around, why not put it to work? Peer-to-peer lending platforms allow you to lend money to individuals or businesses and earn interest on your investment.

Blogging and Vlogging

If you’re a natural storyteller or have a knack for sharing your thoughts, then starting a blog or vlog could be your ticket to passive income. Build a loyal following, and you can monetize your content through advertising, affiliate marketing, or sponsored content.

Writing and Selling E-books

If you’re a wordsmith who loves crafting stories or sharing your expertise, then writing and selling e-books could be a rewarding form of passive income.

Photography Stock

If you’ve got an eye for capturing stunning shots, then selling your photos as stock images could be a lucrative side hustle. Websites like Shutterstock and Getty Images allow you to upload your photos and earn royalties every time someone downloads them.

Conclusion

There you have it, folks! These passive income strategies are accessible and practical ways to supplement your income and secure your financial future. Remember, it takes some effort to set up, but once it’s rolling, you can enjoy the fruits of your labor for years to come.

No responses yet