Best Ways to Make Money in Your Sleep

No matter how much you love your job, there’s something undeniably appealing about the idea of making money while you sleep. Passive income can seem like a pipe dream, but it’s actually more attainable than you might think. Passive income refers to any type of income that doesn’t require regular work on your part. This can include income from investments, owning a rental property, or selling something online.

There are a number of different ways to earn passive income, each with its pros and cons. So, here we’ll take a closer look at some of the most popular options, so you can find the best way to make money in your sleep.

Passive Income Options

There are many ways to generate passive income, but some of the most popular and effective options include:

1. Investing in real estate

Real estate is a classic way to generate passive income. When you invest in an income-generating property, you can earn rental income from tenants who live in the property. Rental income can be a great way to supplement your regular income or even replace it entirely. However, it’s important to remember that real estate investing can also be a risky business. There are a number of things that can go wrong, such as the property becoming vacant or the tenants damaging the property. Additionally, investing in real estate requires a significant amount of capital, which can be a deterrent for some people. But If you’re willing to take on the risk, real estate investing can be a great way to build lasting wealth.

Pros of Investing in Real Estate

- Can generate a steady stream of passive income

- Potential for capital appreciation

- Can be a hedge against inflation

Cons of Investing in Real Estate

- Requires a significant amount of capital

- Can be a risky business

- Can be time-consuming to manage

2. Investing in Dividend-Paying Stocks or Bonds

Another way to generate passive income is by investing in dividend-paying stocks or bonds. When you buy a dividend-paying stock, you’re essentially buying a piece of a company. The company agrees to pay you a dividend, which is a portion of its profits, on a regular basis. Dividend-paying stocks can be a great way to earn passive income, but it’s important to remember that the value of stocks can fluctuate. Therefore, you could lose money if the stock price goes down. Still, investing in dividend-paying stocks can be a great way to build wealth over time.

Pros of Investing in Dividend-Paying Stocks or Bonds

- Can generate a steady stream of passive income

- Can be a relatively low-risk investment

- Can be a good way to diversify your portfolio

Cons of Investing in Dividend-Paying Stocks or Bonds

- The value of stocks can fluctuate

- Dividends can be cut or eliminated at any time

- Bond prices can be sensitive to interest rate changes

3. Opening a High-Yield Savings Account

One of the simplest ways to generate passive income is to open a high-yield savings account. These accounts offer interest rates that are typically higher than traditional savings accounts, meaning you’ll earn more money on your money. Although It’s important to remember that interest rates can change, and the value of your money can fluctuate. Still, a high-yield savings account can be a great way to save for a down payment on a house or other financial goals.

Pros of Opening a High-Yield Savings Account

- Can generate a small amount of passive income

- A low-risk investment

- Easy to open and manage

Cons of Opening a High-Yield Savings Account

- Interest rates can change

- Not as much of a return as other investments

- May not keep pace with inflation

Best Ways to Generate Passive Income: Smart Moves for Financial Freedom

In an era where inflation nibbles away at savings and the cost of living soars, it’s more crucial than ever to explore ways to generate passive income. From dividend-paying stocks to real estate and online endeavors, let’s dive into some clever strategies that can supplement your income and pave the way to financial freedom.

Dividend-Paying Stocks: A Share in the Earnings Party

Investing in companies that consistently pay dividends is like having a piece of the pie without lifting a finger. Dividends are portions of a company’s profits distributed to shareholders. They offer a steady stream of passive income, especially if you choose companies with a proven track record of dividend payments.

To make the most of dividend-paying stocks, consider reinvesting your earnings. Over time, this can lead to a snowball effect, compounding your returns and growing your investment exponentially. Do your research, consult with a financial advisor, and remember that dividends are not guaranteed, but they can be a powerful tool for long-term wealth accumulation.

Imagine you invest $1,000 in a stock that pays a 5% dividend yield, which means you’ll receive $50 in dividends annually. If you reinvest those dividends, they’ll generate additional dividends the following year, adding another $2.50 to your earnings. And so on, year after year, your income snowball grows.

Best Ways to Generate Passive Income

Earning passive income is like having a magic money-making machine that churns out cash while you kick back and relax. Who wouldn’t want a piece of that? If you’re curious about the best ways to generate passive income, we’ve got you covered. Here are some strategies that can help you turn your dreams of financial freedom into a reality:

High-Yield Savings Accounts

One of the simplest ways to generate passive income is by opening a high-yield savings account. These accounts offer higher interest rates than traditional savings accounts, so you can earn more interest on your hard-earned cash. It’s like putting your money in a cozy nest egg that keeps growing over time.

Dividend-Paying Stocks

Dividend-paying stocks are another great way to earn passive income. When you invest in a company that pays dividends, you receive a portion of its profits on a regular basis. It’s like being a part-owner of the company, collecting your share of the rewards as they roll in.

Rental Properties

For those looking for a more hands-on approach, rental properties can be a lucrative source of passive income. If you purchase a property and rent it out, you can earn a steady stream of income from tenants. Just be prepared for the responsibilities that come with being a landlord, like maintenance and tenant management.

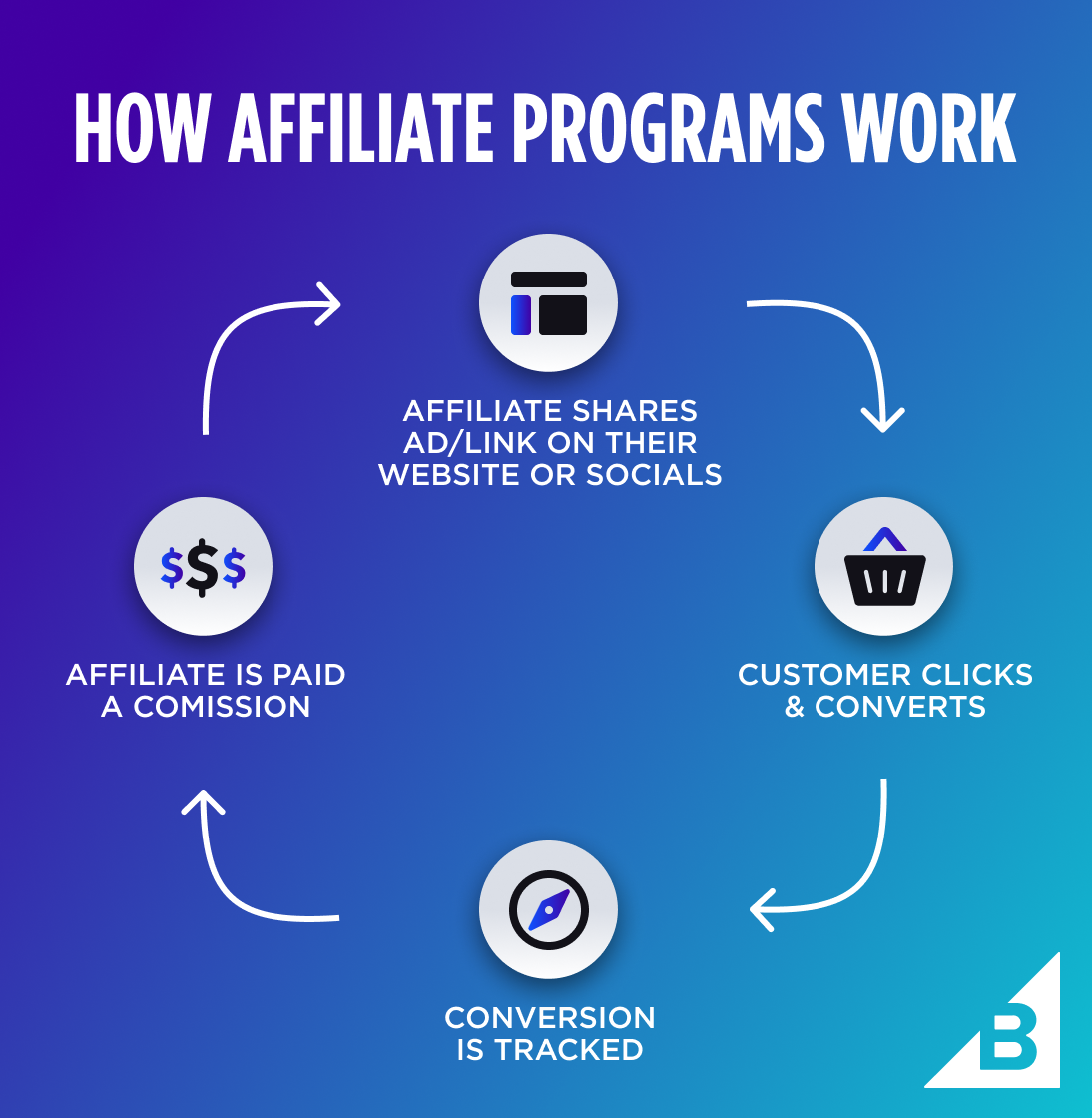

Affiliate Marketing

Affiliate marketing is a great way to generate passive income if you have a knack for promoting products or services. By partnering with businesses and promoting their offerings, you can earn a commission on every sale you generate. It’s like having your own little sales team that works for you 24/7.

Online Courses and Workshops

If you have specialized knowledge or skills, you can create and sell online courses or workshops. This is a great way to share your expertise with others while generating a passive income stream. Think of it as teaching without the hassle of grading papers!

Best Ways to Generate Passive Income

Passive income streams are like having a secret weapon in the financial realm, providing you with a steady flow of cash without too much active effort. If you’re ready to unlock the power of passive income, get ready to delve into the following time-tested strategies.

Rental Properties

Real estate has long been a popular passive income generator. Purchasing properties and renting them out creates a steady stream of revenue that can cover your costs and bring in extra cash each month. However, it’s not all sunshine and daisies. Managing rental properties requires time, effort, and a bit of know-how. Location, proper maintenance, and effective tenant screening are all essential factors that can make or break your financial success. If you’re willing to put in the work, rental properties can be a lucrative way to generate passive income.

Online Courses and Content Creation

Unleash your inner educator and create online courses or content that provides value to others. Sharing your expertise on platforms like Udemy, Coursera, or your own website can create a passive income stream as people purchase or subscribe to your content. The key here is to focus on topics you’re passionate about and creating high-quality content that resonates with your target audience.

Affiliate Marketing

Partner up with brands you love and promote their products or services through your website, blog, or social media channels. When someone clicks on your affiliate link and makes a purchase, you receive a commission. It’s like having a sales force working for you 24/7. However, building a successful affiliate marketing business takes time, effort, and a loyal audience.

Dividend-Paying Stocks and Bonds

Invest in companies that pay regular dividends to shareholders. These dividends provide you with a consistent income stream, even if the stock price fluctuates. Bonds, on the other hand, are loans you make to companies or governments. They typically pay interest payments on a regular basis, providing you with another source of passive income. However, the returns on dividends and bonds tend to be lower than with other passive income strategies.

Peer-to-Peer Lending

Become a lender to individuals or businesses through peer-to-peer lending platforms. These platforms connect borrowers with investors, allowing you to earn interest on your loans. Interest rates vary depending on the platform, the borrower’s creditworthiness, and the loan term. Just like with real estate, peer-to-peer lending comes with its own risks. Careful research and due diligence are essential before you dive in.

Best Ways to Generate Passive Income

In today’s fast-paced world, where financial security is paramount, the quest for passive income streams has become more prevalent than ever. Passive income, like a steady stream of raindrops, offers a consistent flow of revenue with minimal active input, allowing you to enjoy the fruits of your labor without the perpetual grind. Fortunate for us, there’s a myriad of options to explore when it comes to generating passive income, each with its unique set of benefits and challenges.

Affiliate Marketing

Affiliate marketing is a lucrative avenue for those with a knack for persuasion and a loyal following. By partnering with businesses, you can earn commissions on sales generated through your promotions. It’s like having a sales team working for you around the clock, tirelessly converting leads into profits.

The key to success in affiliate marketing lies in building trust and credibility with your audience. Share valuable content that resonates with their interests and provides genuine solutions to their problems. Remember, people are more likely to buy through your recommendations when they know you genuinely care about their well-being.

To maximize your earnings, focus on promoting products or services that complement your niche and align with your audience’s needs. Don’t be tempted to spread yourself too thin by promoting everything under the sun. Instead, specialize in a few products or services that you’re passionate about and can speak to with authority.

Some popular affiliate marketing platforms include Amazon Associates, ClickBank, and ShareASale. These platforms connect you with countless businesses and provide you with marketing materials, tracking links, and reporting tools to help you monitor your progress.

To cut through the noise and make a meaningful impact, consider creating valuable content such as blog posts, videos, or social media updates that provide helpful information and insights to your target audience. This will not only establish you as an authority in your field but also drive traffic to your affiliate links.

The Secret to Wealth: Passive Income Powerhouses

Passive income, the holy grail of financial freedom, allows you to earn money with minimal effort, like the goose that lays golden eggs. If you’re looking for ways to increase your wealth and live a life of ease, here are the top strategies to generate passive income that will turn you into a money-making machine.

1. Online Courses

Create and sell online courses that provide valuable knowledge and skills. If you have expertise in a particular area, share it with the world! Online platforms like Udemy and Coursera make it easy to create and sell your courses, giving you a passive income stream that keeps paying dividends.

2. Affiliate Marketing

Partner with businesses and promote their products or services on your website or social media. When someone purchases through your referral link, you earn a commission, creating a passive income stream that requires minimal effort.

3. Rental Properties

Investing in rental properties can provide a steady flow of income, but it also requires significant upfront investment and ongoing maintenance. Research the market carefully and manage your properties effectively to maximize your earnings.

4. Dividend Stocks

Dividend-paying stocks give you a share of a company’s profits, providing a regular passive income stream. Invest in companies with a history of consistent dividend payments and watch your money grow over time.

5. High-Yield Savings Accounts

Unlike traditional savings accounts, high-yield savings accounts offer higher interest rates, providing a modest but steady passive income stream. Park your money here for a low-risk way to earn passive income.

6. Automated Savings and Investments

Set up automatic savings transfers from your checking to your savings or investment accounts. This forces you to save and invest consistently, creating a passive income stream that grows over time. It’s like having a magic money tree that you don’t even have to water!

By implementing these passive income strategies, you can create a steady flow of cash that supplements your regular income and sets you on the path to financial independence. Passive income is the goose that keeps laying golden eggs, so take advantage of these opportunities and start building your financial fortress today.

Best Ways to Generate Passive Income

Hey there, folks! Are you looking for ways to supplement your income without putting in extra hours at your day job? Passive income can be a great solution, and there are several options to choose from. We’ll dive into some of the best ways to generate passive income in this article, so sit back, relax, and get ready to learn!

Peer-to-Peer Lending

Peer-to-peer lending is a modern take on the age-old practice of lending money. Instead of going through a bank, you can lend money to borrowers directly through online platforms. These platforms connect borrowers with lenders, and you can earn interest on the loans you make. The returns can vary, but it’s a relatively low-risk way to generate passive income.

Dividend Investing

Investing in dividend-paying stocks is another great way to generate passive income. When you own shares of a company that pays dividends, you receive a portion of the company’s profits on a regular basis. Dividends can be a steady source of income, and over time, the value of your stocks may also increase.

Real Estate Investing

Real estate investing is a classic way to generate passive income. Whether you’re buying rental properties or investing in REITs (real estate investment trusts), you can earn money from rent payments, property appreciation, and tax benefits. Real estate investing can be more involved than other forms of passive income, but it can also be very rewarding.

Affiliate Marketing

Affiliate marketing is a great option if you have a website or blog. You can partner with businesses and promote their products or services. When someone clicks on your affiliate link and makes a purchase, you earn a commission. Affiliate marketing can be relatively easy to get started with, but it takes time to build up a following and generate significant income.

Online Courses

If you have a skill or expertise that others are interested in, you can create and sell online courses. Platforms like Udemy and Coursera make it easy to create and publish courses. Once you’ve created a course, you can earn passive income every time someone enrolls.

Drop Shipping

Drop shipping is an e-commerce business model where you don’t hold any inventory. When someone orders a product from your online store, you simply forward the order to a third-party supplier, who then ships the product directly to the customer. Drop shipping can be a great way to generate passive income, but it’s important to find a reliable supplier and market your products effectively.

Blogging

Blogging can be a great way to generate passive income through affiliate marketing, display advertising, or sponsored content. It takes time and effort to build a successful blog, but once you’ve established a loyal audience, you can start earning money while you sleep. Blogging is a great option if you enjoy writing and sharing your thoughts with others.

Conclusion

There you have it, folks! These are just a few of the best ways to generate passive income. With a little research and effort, you can find an option that suits your skills and interests. Remember, passive income takes time to build, but it’s definitely worth it in the long run. So, what are you waiting for? Get out there and start generating some passive income today!

Best Ways to Generate Passive Income

In today’s economy, generating passive income is more important than ever. Who wouldn’t want to make money while they sleep? The good news is that there are plenty of ways to do it. Here are 8 of the best:

Real Estate Investment Trusts (REITs)

REITs are a great way to invest in real estate without having to buy and manage a property yourself. When you invest in a REIT, you’re buying shares in a company that owns a portfolio of real estate properties. This gives you a diversified investment with a steady stream of income from rent and property appreciation.

There are many different types of REITs, so you can find one that meets your investment goals. Some REITs specialize in certain types of real estate, such as apartments, office buildings, or retail space. Others REITs are more diversified, owning a variety of property types.

REITs are a great investment for those who want to generate passive income from real estate without the hassle of being a landlord. They’re also a good option for investors who are looking for a way to diversify their portfolio.

Dividend-Paying Stocks

Dividend-paying stocks are another great way to generate passive income. When you buy a stock that pays dividends, you’re entitled to a portion of the company’s profits each quarter or year.

The amount of dividends you receive will vary depending on the company’s earnings and the number of shares you own. However, over time, dividend-paying stocks can provide a steady stream of income.

When choosing dividend-paying stocks, it’s important to look for companies with a strong financial track record and a history of paying dividends. You should also consider the company’s dividend yield, which is the annual dividend per share divided by the current stock price.

No responses yet