S&P 500 ETFs: A Gateway to the Stock Market’s Elite

In the realm of investing, S&P 500 ETFs (exchange-traded funds) stand out as popular choices for investors seeking exposure to the U.S. stock market’s heavyweights. These ETFs provide a convenient and efficient way to diversify your portfolio and potentially enhance your long-term returns.

Benefits of Investing in S&P 500 ETFs

S&P 500 ETFs offer numerous advantages that make them attractive to investors of all levels:

Diversification: Don’t Put All Your Eggs in One Basket

One of the key benefits of investing in S&P 500 ETFs is the level of diversification they provide. These funds track the S&P 500 index, which comprises 500 of the largest publicly traded U.S. companies. By investing in an S&P 500 ETF, you gain exposure to a broad range of industries and sectors, reducing your risk compared to investing in individual stocks.

Low Expense Ratios: Keeping Fees at Bay

Expense ratios are a significant factor to consider when investing in any ETF. S&P 500 ETFs typically have low expense ratios, which means that a larger portion of your investment goes towards potential growth and not towards fees. The lower expense ratios of S&P 500 ETFs make them an attractive option for cost-conscious investors.

Long-Term Growth Potential: Riding the Market’s Ups and Downs

S&P 500 ETFs have historically provided investors with the potential for long-term growth. Over time, the U.S. stock market has generally trended upward, and S&P 500 ETFs have benefited from this growth. While the market may experience fluctuations in the short term, investing in S&P 500 ETFs can provide opportunities for substantial gains over the long haul.

S&P 500 ETFs: A Journey into the Stock Market’s Heart

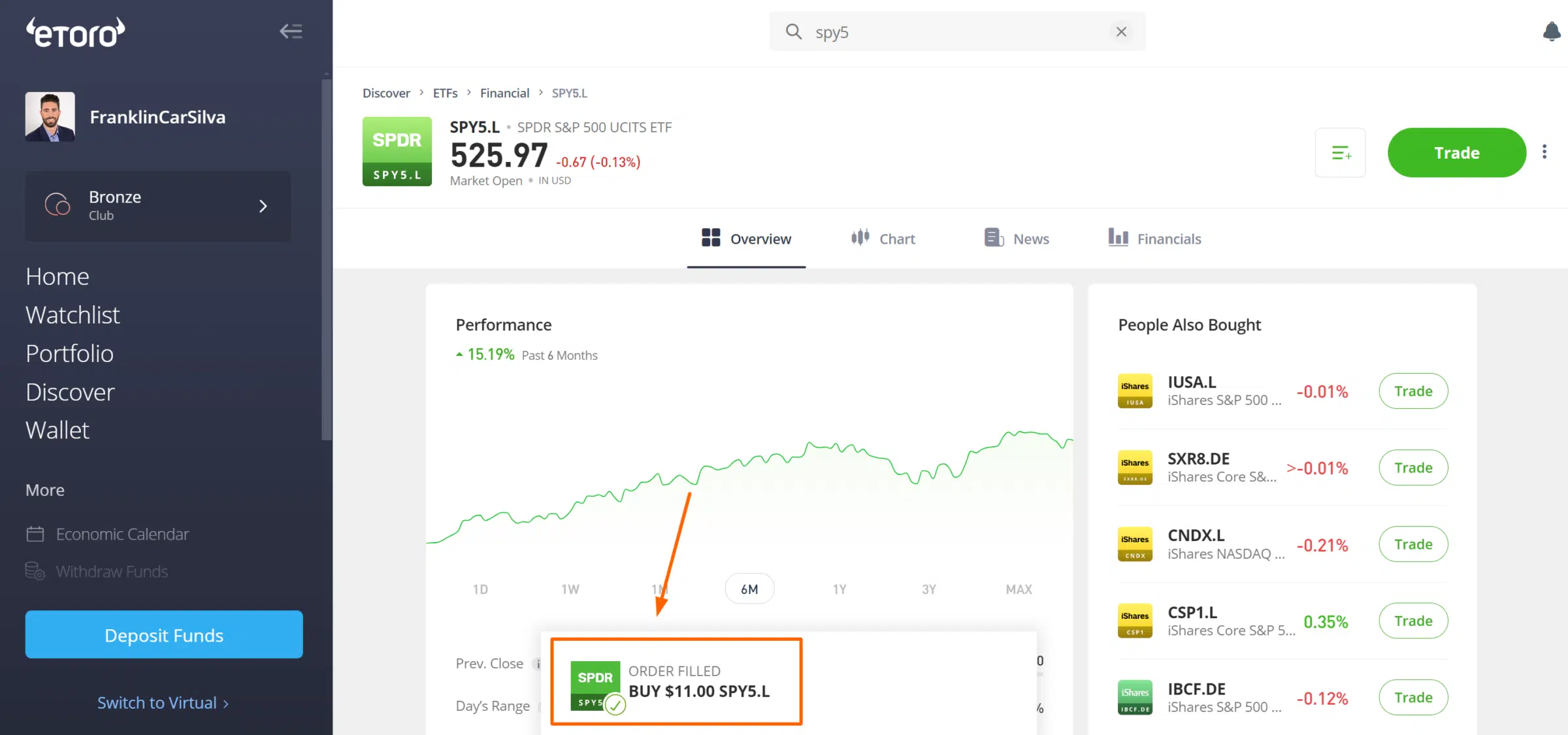

In the realm of investing, few things ignite as much interest as the S&P 500 index. It’s a beacon of market health, representing the 500 largest publicly traded companies in the United States. And with the advent of exchange-traded funds (ETFs) that mirror its performance, investing in the S&P 500 has never been easier. One such ETF, the SPDR S&P 500 ETF Trust (SPY), has become a household name among investors.

Risks of Investing in S&P 500 ETFs

While S&P 500 ETFs are generally considered safe investments, they are not without potential risks. Just like any investment, there’s always the possibility that you could lose money. Here are a few key risks to keep in mind:

Tracking Error

ETFs strive to replicate the performance of an index, but they don’t always hit the mark perfectly. Tracking error measures the difference between an ETF’s returns and the returns of the index it tracks. While small tracking errors are common, significant deviations can erode your returns over time.

Expense Ratio

ETFs charge an annual expense ratio to cover their operating costs. These fees can eat into your investment returns. Comparing the expense ratios of different S&P 500 ETFs is crucial to minimize these costs.

Market Volatility

The stock market is inherently volatile, and S&P 500 ETFs are not immune to its swings. Economic downturns, political instability, or global events can trigger market selloffs, leading to losses in the value of your ETF.

Fund Liquidity

Liquidity refers to the ease with which you can buy or sell an ETF. While S&P 500 ETFs are generally liquid, fluctuations in market conditions can impact their liquidity. During periods of high volatility, it may be challenging to sell your ETF quickly and at a fair price.

Concentration Risk

S&P 500 ETFs are heavily concentrated in large-cap stocks. While this concentration can provide stability, it also means that you’re exposed to the risks associated with specific industries and companies. A downturn in a single sector could significantly impact the value of your ETF.

Conclusion

Investing in S&P 500 ETFs can be a smart move for long-term investors seeking exposure to the U.S. stock market. However, it’s crucial to be aware of the potential risks involved. By understanding and managing these risks, you can increase your chances of achieving financial success with S&P 500 ETFs.

No responses yet