Introduction

Looking to invest in the stock market without putting all your eggs in one basket? Enter: exchange-traded funds (ETFs). Think of ETFs as a smorgasbord of investments, all bundled up into a single, easy-to-trade package. They’re like mutual funds’ cool, hip, and oh-so-convenient cousins. And get this: we’ve got the inside scoop on the best ETFs out there, so you can level up your portfolio like a pro. Our top pick? Cue the drumroll… the Vanguard Total Stock Market ETF (VTI). It’s like having a slice of the entire U.S. stock market in your pocket.

ETFs: The Ultimate Investment Toolkit

Picture this: ETFs are like the Swiss Army knives of the investment world. They can slice through asset classes, from stocks and bonds to real estate and commodities. The beauty is, you don’t need to be a financial superhero to use them. They’re as simple as buying a stock, but with the added bonus of instant diversification. It’s like having a built-in safety net for your investments.

The Secret Sauce: Low Costs

ETFs have a secret weapon up their sleeves: low costs. They’re way cheaper than mutual funds, which means more of your hard-earned money stays in your pocket. Think of it as keeping the change when you buy that morning latte. Every penny counts, right? Plus, ETFs trade throughout the day, just like stocks, so you can hop on and off the investment train whenever you want.

Best ETFs: A Comprehensive Guide to Maximize Your Investments

The world of investing has become increasingly complex, with a plethora of options available. Among them, exchange-traded funds (ETFs) have emerged as a popular choice, offering investors a diversified and cost-effective way to grow their wealth. Here’s a comprehensive guide to help you navigate the diverse world of ETFs and make informed investment decisions.

Types of ETFs

ETFs come in a wide range of flavors, each tailored to specific investment goals.

Index Tracking ETFs:

These ETFs replicate the performance of a specific index, such as the S&P 500 or Nasdaq 100. They provide broad market exposure and are ideal for investors seeking long-term growth. For instance, the SPDR S&P 500 ETF (SPY) is a popular option for tracking the U.S. stock market.

Sector ETFs:

Sector ETFs focus on specific industry sectors, such as technology, healthcare, or energy. They offer targeted exposure to particular segments of the economy and can provide diversification within a single sector. The Energy Select Sector SPDR Fund (XLE), for example, tracks the performance of energy companies.

Commodity ETFs:

As the name suggests, these ETFs invest in commodities such as gold, silver, or oil. They offer exposure to raw materials and can serve as a hedge against inflation or currency fluctuations. The SPDR Gold Shares (GLD) is a well-known commodity ETF that tracks the price of gold.

Bond ETFs:

Bond ETFs provide exposure to fixed-income investments, such as corporate bonds or government bonds. They offer diversification from stocks and can generate regular income through interest payments. The iShares Core U.S. Aggregate Bond ETF (AGG) is a popular choice for investors seeking stable income.

International ETFs:

International ETFs invest in stocks or bonds from companies outside the United States. They offer access to global markets and can provide diversification from domestic investments. The iShares MSCI EAFE ETF (EFA) is a prime example of an international ETF that tracks the performance of developed foreign markets.

Best ETF: A Comprehensive Guide to Making Informed Investment Decisions

In today’s volatile market, selecting the right exchange-traded fund (ETF) is crucial for long-term financial success. One standout option is the Vanguard Total Stock Market ETF (VTI), providing investors with broad exposure to the entire U.S. stock market. VTI offers diversification, low fees, and impressive historical performance, making it a top choice for both novice and seasoned investors alike.

How to Choose the Best ETF

Choosing the best ETF requires careful consideration of several key factors:

Goals and Risk Tolerance

First and foremost, identify your investment goals. Are you saving for retirement, a down payment on a home, or a college education? Your goals will determine the level of risk you’re comfortable taking, as some ETFs carry higher risks than others.

Investment Horizon

Next, consider your investment horizon. If you plan to invest for the long haul, you may opt for ETFs with higher growth potential but also higher volatility. Conversely, if your time horizon is shorter, you may prefer ETFs that offer more stability and lower risk.

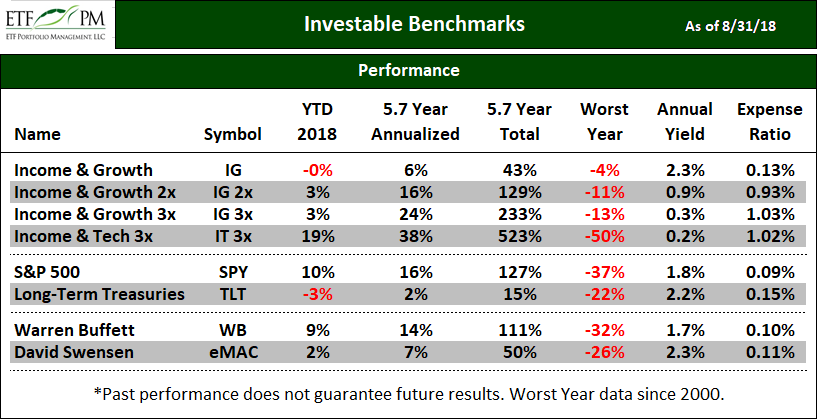

Fees and Expenses

ETF fees, known as expense ratios, can eat into your returns over time. Research the fees associated with different ETFs and compare them to ensure you’re getting the most bang for your buck.

Tracking Index

Finally, consider the index that the ETF tracks. This index determines the portfolio of stocks or bonds included in the ETF. Choose an index that aligns with your investment goals and risk profile.

Diversification and Risk Management

ETFs excel at diversification, allowing investors to spread their investments across multiple assets within a single fund. This diversification helps reduce overall risk and improve returns. However, it’s important to note that ETFs are not immune to market fluctuations, and there’s no guarantee of positive returns.

Investment Strategies with ETFs

ETFs offer a versatile investment tool for various strategies. For long-term growth, you can purchase and hold ETFs that track broad market indices such as the S&P 500. If you prefer a more active approach, you can use ETFs to tactical asset allocation, adjusting your portfolio based on market conditions. ETFs also provide opportunities for income generation through dividend-paying ETFs.

Conclusion

Choosing the best ETF requires careful research and consideration of your individual circumstances. By aligning your investment goals, risk tolerance, and investment horizon with the right ETF, you can set yourself on the path to financial success. Remember that investing involves both the thrill of potential gains and the risk of losses. Always invest wisely and with a long-term perspective.

No responses yet