Introduction

Have you been considering investing in the stock market but aren’t sure where to start? If so, you may want to consider investing in an exchange-traded fund (ETF) that tracks the performance of the S&P 500 index, such as VOO. VOO is a popular ETF that offers investors a number of benefits, including diversification, low costs, and the potential for long-term growth.

VOO is designed to track the performance of the S&P 500 index, which is a group of 500 large-cap stocks that are listed on the New York Stock Exchange or the Nasdaq. This means that when you invest in VOO, you are essentially investing in a basket of some of the largest and most well-known companies in the United States. Some of the companies that are included in the S&P 500 index include Apple, Microsoft, Amazon, and Alphabet.

Investing in VOO can be a great way to diversify your portfolio. By investing in a single ETF, you are gaining exposure to a wide range of stocks, which can help to reduce your risk. Additionally, VOO is a relatively low-cost ETF, which means that you can invest in it without having to pay high fees.

Why Invest in VOO?

There are a number of reasons why you should consider investing in VOO. First, VOO is a diversified ETF, which means that it invests in a wide range of stocks. This diversification can help to reduce your risk, as it is less likely that all of the stocks in the ETF will lose value at the same time.

Second, VOO is a low-cost ETF. The expense ratio for VOO is just 0.03%, which means that you will only pay $3 for every $10,000 that you invest in the ETF. This low expense ratio can save you a significant amount of money over time.

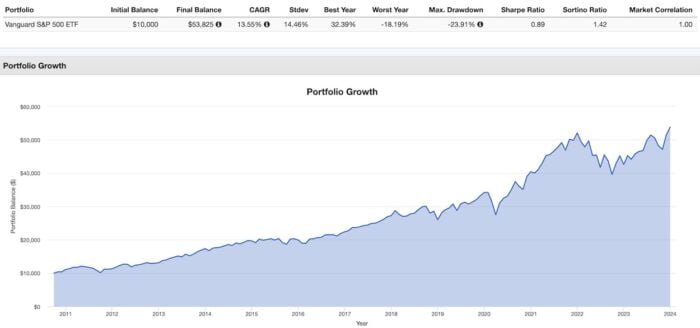

Third, VOO has a long track record of success. VOO was launched in 2004, and it has outperformed the S&P 500 index over the long term. This means that if you had invested in VOO in 2004, you would have made a significant amount of money.

VOO vs. IVV

If you are considering investing in VOO, you may also want to consider investing in IVV. IVV is another ETF that tracks the performance of the S&P 500 index. However, there are some key differences between VOO and IVV. The expense ratio for IVV for VOO is 0.04 %. Also, VOO is domiciled in the United States, while IVV is domiciled in Ireland. This can have tax implications for investors who are not US citizens.

## Vanguard 500 ETF (VOO): A Path to the S&P 500

If you’re seeking a low-cost and straightforward way to gain exposure to the U.S. stock market, the Vanguard 500 ETF (VOO) might be an ideal choice. Tracking the performance of the S&P 500 Index, VOO offers a diversified portfolio of 500 large-cap American companies, providing investors with instant access to a broad cross-section of the U.S. equity market.

How to Invest in VOO

Investing in VOO is as simple as opening a brokerage account. Once you’ve selected a reputable broker, you can fund your account and place a buy order for VOO shares. These shares can be bought and sold throughout the trading day, allowing you to adjust your holdings as needed.

Understanding VOO’s Appeal

VOO’s appeal stems from several key factors:

-

Low Fees: With an expense ratio of just 0.03%, VOO offers one of the lowest management fees in the ETF industry. This means that a greater portion of your investment returns stays in your pocket.

-

Diversification: By investing in VOO, you’re essentially purchasing a piece of 500 of the largest and most established companies in the U.S. This diversification reduces your risk compared to investing in a single stock.

-

Long-Term Performance: The S&P 500 Index, which VOO tracks, has a proven track record of delivering solid returns over the long term. Despite short-term fluctuations, the index has historically trended upward, offering investors potential for growth.

VOO’s Role in a Portfolio

VOO can play a versatile role in your portfolio. It can serve as a core holding for those seeking broad market exposure while also being a suitable choice for tactical asset allocation strategies. Additionally, VOO can provide diversification to portfolios heavily weighted towards specific sectors or asset classes.

Tips for Investing in VOO

-

Buy and Hold: VOO is best suited for long-term investors who are comfortable with market fluctuations. Buying and holding VOO allows you to ride out market ups and downs and potentially capture the index’s long-term growth.

-

Dollar-Cost Averaging: To reduce the impact of market volatility, consider using dollar-cost averaging. This involves investing a set amount in VOO at regular intervals, regardless of the market price.

-

Monitor Your Holdings: While VOO requires minimal active management, it’s still prudent to monitor your holdings periodically. Keep an eye on the index’s performance and make any adjustments to your portfolio as necessary.

Remember, investing involves risk, and past performance is not a guarantee of future results. Before investing in VOO or any other ETF, carefully consider your financial goals and risk tolerance.

Vanguard S&P 500 ETF: A Comprehensive Guide

Are you considering investing in the Vanguard S&P 500 ETF (VOO)? This exchange-traded fund (ETF) tracks the performance of the S&P 500 index, providing investors with exposure to the 500 largest publicly traded companies in the United States. In this article, we’ll delve into the risks associated with VOO, helping you make an informed investment decision.

Risks of VOO

Investing in any asset carries inherent risks, and VOO is no exception. While it offers diversification and potential returns, it’s important to understand the potential pitfalls involved.

**Market Volatility:** VOO is subject to market fluctuations and can lose value just like any other stock or ETF. The S&P 500 index has historically experienced periods of growth and decline, and investing in VOO means you’re exposed to these swings.

**Sector Concentration:** VOO heavily invests in technology stocks, which make up approximately 25% of the portfolio. While technology has been a strong growth sector in recent years, it also carries additional risk. If the technology sector underperforms, VOO’s performance may suffer.

**Interest Rate Risk:** Interest rate changes can impact the value of VOO. If interest rates rise, the value of stocks can fall as investors move their money into fixed-income investments. VOO is particularly sensitive to interest rate movements due to its exposure to growth stocks.

**Currency Risk:** VOO invests primarily in U.S. companies. If the U.S. dollar weakens, the value of VOO may decline as foreign investors sell their shares.

**Consider your Investment Goals:** VOO is a suitable investment for long-term investors with a tolerance for market volatility. However, it may not be a wise choice for short-term investors or those seeking a stable return. Before investing in VOO, determine if it aligns with your risk tolerance and financial goals.

VOO ETF: A Gateway to the S&P 500

When it comes to investing, diversification is key. One of the best ways to diversify your portfolio is by investing in exchange-traded funds (ETFs) that track major market indices. The Vanguard S&P 500 ETF (VOO) is a popular choice for investors seeking exposure to the broader U.S. stock market. VOO tracks the S&P 500 index, which includes 500 of the largest publicly traded companies in the country.

With its low expense ratio and broad market exposure, VOO has become a staple in many investor portfolios. But what if you’re looking for alternatives to VOO? Whether you’re seeking different risk-reward profiles or specific industry exposure, there are plenty of options available.

Alternatives to VOO

There are several ETFs and index funds that offer similar exposure to the S&P 500 index as VOO. Some popular alternatives include:

- IVV: The iShares Core S&P 500 ETF

- SPY: The SPDR S&P 500 ETF

- FXAIX: The Fidelity 500 Index Fund

- SWPPX: The Schwab S&P 500 Index Fund

These ETFs offer comparable performance to VOO, with expense ratios that are typically within a few basis points of each other.

Choosing the Right ETF

When selecting an ETF, it’s important to consider your investment goals and risk tolerance. VOO is a solid choice for investors seeking broad market exposure and long-term growth potential. However, if you’re looking for a more tailored approach, there are other ETFs that may be better suited to your needs.

For example, if you’re interested in investing in specific sectors or industries, there are ETFs that track a variety of market segments. You can also find ETFs that focus on specific investment styles, such as value or growth stocks.

Diversification is Key

Regardless of which ETF you choose, remember that diversification is key to building a strong investment portfolio. Diversify across different asset classes, such as stocks, bonds, and real estate. You can also diversify within your stock portfolio by investing in ETFs that track different market indices and industries.

No responses yet