Financial Mistakes to Avoid in Your 20s

When you’re in your 20s, it’s easy to make financial mistakes. You’re young, you’re just starting out, and you may not have a lot of experience managing money. But the mistakes you make now can have long-term consequences. That’s why it’s important to be aware of the most common financial mistakes that people make in their 20s and take steps to avoid them.

Not Saving Enough

One of the biggest financial mistakes you can make in your 20s is not saving enough money. When you’re young, it’s easy to think that you have plenty of time to save for retirement. But the sooner you start saving, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time. And if you start saving early, you’ll be able to take advantage of compound interest, which can help your money grow even faster.

There are many ways to save money. You can set up a automatic transfer from your checking account to a savings account each month. You can also cut back on unnecessary expenses. And you can look for ways to increase your income, such as getting a side hustle.

No matter how you do it, make sure you’re saving enough money. It’s one of the best things you can do for your financial future.

Taking on Too Much Debt

Another common financial mistake that people make in their 20s is taking on too much debt. When you’re young, it’s easy to be tempted to use credit cards to buy things you can’t afford. But if you’re not careful, you can quickly end up in debt over your head.

If you do have credit card debt, make sure you’re making more than the minimum payments each month. And try not to use your credit cards for everyday expenses. If you can, pay for things with cash or a debit card instead.

It’s also important to be careful about taking on other types of debt, such as student loans or car loans. Make sure you can afford the monthly payments before you borrow any money.

Not Investing

Investing is one of the best ways to grow your money. But many people in their 20s don’t start investing until they’re much older. That’s a mistake!

The sooner you start investing, the more time your money has to grow. And even if you can only invest a small amount each month, it will add up over time. There are many different ways to invest. You can invest in stocks, bonds, mutual funds, or ETFs. You can also invest in real estate or start your own business.

If you’re not sure how to get started investing, talk to a financial advisor. They can help you create an investment plan that meets your needs and goals.

**Financial Mishaps to Dodge in Your 20s**

The twenties, often seen as a carefree time of life, should also be a period of reflection and prudent financial decision-making. Several common pitfalls can derail your financial future if you’re not careful. Here are five mistakes to steer clear of:

**

Not Saving Early Enough

**

Saving early is like planting a tree; the sooner you start, the more it will grow. Compound interest, the snowball effect of interest on interest, works wonders over time. For instance, if you invest $100 each month at 6% annual interest, it will grow to over $50,000 in 30 years. However, waiting 10 years to start saving the same amount will yield just over $25,000.

Don’t wait until you “have more money” to save. Start small, even $10 a week, and watch it accumulate. Remember, a raindrop may seem insignificant, but it contributes to the mighty ocean.

Imagine your future self thanking you for having the foresight to secure financial freedom through early saving habits. It’s never too late to start, but the sooner you do, the more you’ll benefit from the magical power of compound interest.

Financial Mistakes to Avoid in Your 20s

As a young person just starting out in your financial journey, it’s easy to make mistakes that can have lasting consequences. Many common money blunders can set you back and make it harder to reach your financial goals. This guide will shed light on some of the biggest financial pitfalls to avoid in your 20s. By being aware of these missteps, you can steer clear of costly errors and lay the foundation for a secure financial future.

Spending Too Much on Unnecessary Things

It’s human nature to want things, especially when you’re young and have limited income. However, it’s important to differentiate between needs and wants. Needs are essential for survival, while wants are simply things you desire. When you’re in your 20s, it’s easy to get caught up in the excitement of spending money and buying things you don’t need. But if you’re not careful, this habit can lead to financial ruin.

To avoid overspending, it’s important to create a budget and stick to it. A budget will help you track your income and expenses so that you can see exactly where your money is going. Once you know where your money is going, you can start to make changes to your spending habits. For example, you could cut back on eating out or reduce your entertainment expenses.

Another way to avoid overspending is to avoid impulse purchases. Impulse purchases are those purchases that you make without thinking. They’re often made because you’re feeling stressed or emotional. If you find yourself making impulse purchases, try to take a few deep breaths and walk away from the situation. You can also try using a “cooling off” period to give yourself time to think about the purchase before you buy it.

Not Saving Enough Money

Saving money is essential for financial security. It allows you to build up an emergency fund, save for a down payment on a house, or invest for the future. But many young people don’t save enough money because they think they don’t have enough money to save. The truth is, you don’t need to save a lot of money to start making a difference. Even small amounts of money can add up over time.

To start saving, simply set up a savings account and make automatic deposits from your checking account each month. You can also save money by setting up a budget and sticking to it. By tracking your income and expenses, you can see where your money is going and make changes to your spending habits to free up more money for saving.

Investing Too Aggressively

Investing is a great way to grow your money over time. However, it’s important to invest wisely. If you’re not careful, you could lose money by investing too aggressively. Investing aggressively means investing in high-risk investments with the potential for high returns. While these investments can be lucrative, they can also be very risky. If the market takes a downturn, you could lose money.If you’re not sure how to invest, it’s best to talk to a financial advisor. A financial advisor can help you create an investment plan that meets your individual needs and risk tolerance.

Financial Blunders to Avoid in Your Twenties

The roaring twenties are a decade rife with exhilarating experiences and groundbreaking decisions. Yet, amid the whirlwind of youthful exuberance, it’s imperative to avoid financial pitfalls that can cast a long shadow over your future. Here are some faux pas to steer clear of:

Ignoring Credit Card Debt

Credit cards can be a double-edged sword. While they offer convenience, they also carry the potential for high-interest rates and hefty fees. If you’re not careful, credit card debt can snowball into a formidable foe that can sabotage your financial dreams. To avoid this trap, make it a habit to pay off your credit card balances in full each month and resist the allure of impulse purchases.

Overstretching Your Budget

Living beyond your means is a surefire way to dig yourself into a financial hole. Before you splurge on that designer handbag or that dream vacation, take a hard look at your budget. Ensure you have sufficient funds to cover essential expenses, such as rent, groceries, and utilities, and set aside money for unexpected costs. Living within your means may not be the most glamorous path, but it’s a recipe for long-term financial stability.

Neglecting Retirement Savings

Retirement may seem like a distant concept in your twenties, but it’s never too early to start planning. The sooner you begin investing in your future, the more time your money has to grow through the power of compound interest. Even small contributions can make a significant difference over the long run. So, don’t miss out on the opportunity to secure a comfortable retirement by starting to save now.

Not Setting Financial Goals

Without clear financial goals, it’s easy to drift through life without making significant progress towards your dreams. Take the time to define your goals, whether it’s buying a house, financing a graduate degree, or simply saving for a rainy day. Once you know what you’re aiming for, you can create a roadmap to achieve it.

Ignoring Your Credit Score

Your credit score is a crucial factor that lenders consider when evaluating your financial responsibility. It can impact everything from your ability to qualify for a loan to the interest rates you pay. In your twenties, when you’re building your financial foundation, it’s essential to establish a good credit history. That means making all your payments on time, keeping your credit utilization low, and avoiding unnecessary credit inquiries.

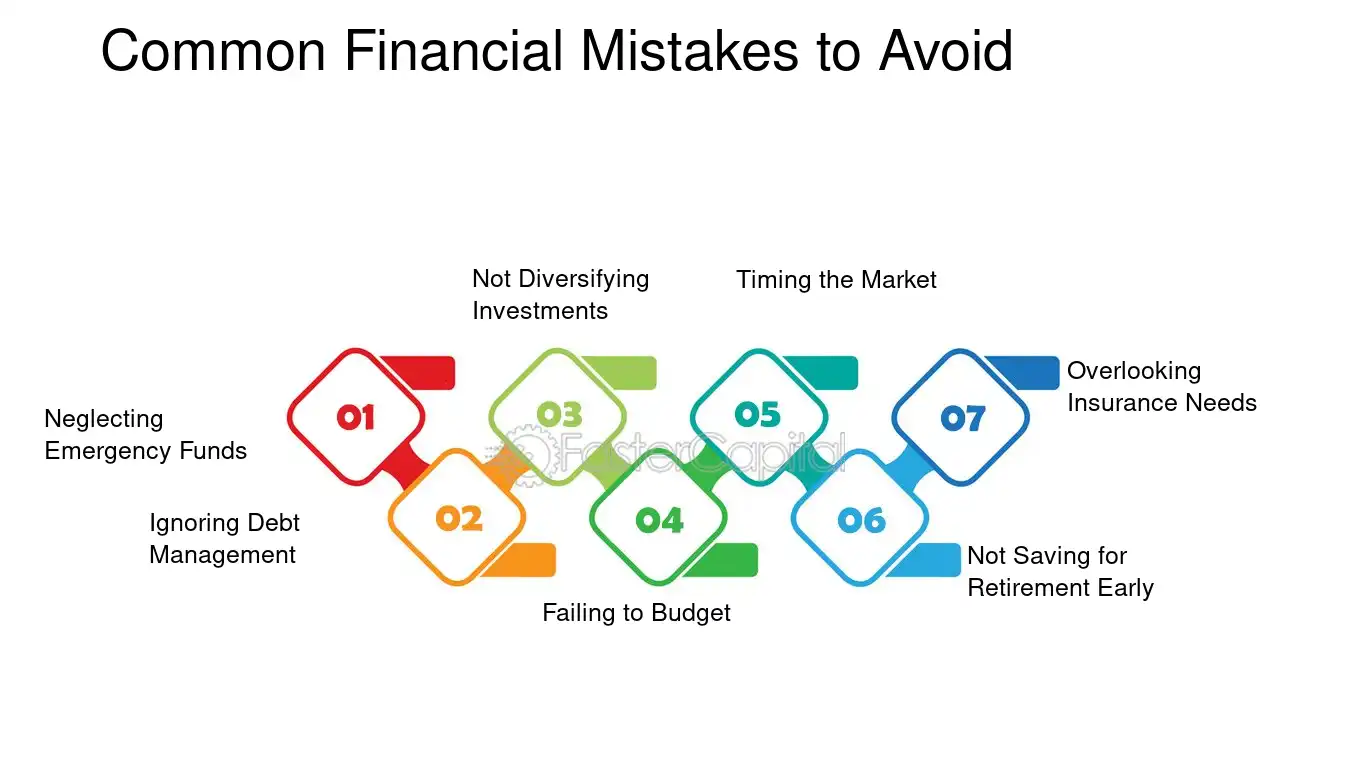

Making financial mistakes in your 20s is like steering a ship without a compass – you’re bound to end up adrift in a sea of regrets. These costly blunders can haunt you for decades, hindering your ability to achieve financial freedom and live the life you envision. To help you avoid these pitfalls, let’s dive into the seven most common financial mistakes young people make and how to steer clear of them.

Not Investing in Retirement

Retirement might seem like a distant mirage, but trust me, it’ll be here before you know it. The sooner you start investing for the golden years, the more time your money has to grow. Even small contributions in your 20s can snowball into a significant nest egg, thanks to the magic of compound interest. It’s like planting a tiny acorn that will one day grow into a mighty oak that will provide shade and sustenance in your twilight years.

Spending More Than You Earn

Living beyond your means is a recipe for financial disaster. If you’re spending more than you earn, you’re digging yourself into a hole that can be very difficult to climb out of. It’s okay to treat yourself occasionally, but don’t get carried away. Keep track of your expenses and make sure that you’re not overextending yourself. Remember, financial freedom comes from living within your means.

Not Having an Emergency Fund

Life is full of unexpected surprises, and not all of them are good. That’s why it’s crucial to have an emergency fund to weather life’s storms. Whether it’s a medical emergency, a job loss, or a car repair, having a financial cushion will help you avoid taking on debt or dipping into your retirement savings. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account.

Ignoring Your Student Loans

For many young people, student loans are a burden that weighs heavily on their finances. However, ignoring them is a costly mistake. Federal student loans typically come with low interest rates, and there are various repayment options available to help you manage your debt. Don’t let student loans derail your financial future. Make sure you understand your repayment options and create a plan to pay them off as soon as possible.

Not Saving for a Down Payment on a Home

Buying a home can be a great way to build wealth and secure your financial future. However, saving for a down payment can seem like an insurmountable task. The good news is that there are many affordable options for first-time homebuyers. Start saving early and explore different down payment assistance programs to help you get into a home sooner rather than later. Owning a home can provide stability, tax benefits, and the potential for appreciation.

Financial Mistakes to Avoid in Your 20s

Hey there, young grasshopper! Ready to navigate the treacherous financial terrain of your 20s? Hold on tight, because we’re about to dive deep into the money pitfalls that can trip you up if you’re not careful. As the saying goes, “A penny saved is a penny earned,” so it’s time to get wise about your finances. Let’s start with the big kahuna: borrowing excessively.

Borrowing Excessively

Student loans, car loans, credit card debt… it can all add up like a stack of poker chips. Before you know it, you’re drowning in a sea of debt that’s weighing you down like an anchor. The temptation to borrow may be strong, especially when you’re trying to finance a higher education or a new set of wheels. But remember, excessive borrowing can limit your financial freedom in the long run. Think twice before taking on too much debt and make sure you have a solid plan for repaying it.

## Blowing Your Budget

Okay, so you’re not exactly living paycheck to paycheck, but are you really sticking to a budget? If you’re anything like most people in their 20s, you’re probably guilty of spending more than you should on things you don’t really need. It’s easy to get caught up in the whirlwind of social media, where everyone seems to be living a life of luxury. But don’t fall into the comparison trap! Create a realistic budget that works for you and stick to it like glue.

## Not Saving for the Future

Retirement? That’s for old people, right? Wrong! The sooner you start saving for the future, the better off you’ll be. Even if it’s just a small amount each month, put some money aside for your golden years. Trust us, future you will thank you for it. Think of it as planting a seed today that will grow into a mighty oak tree of financial security.

## Ignoring Insurance

Insurance may not be the most exciting topic, but it’s crucial for protecting yourself financially. Get adequate health, dental, and car insurance to cover yourself in case of an emergency. It’s like having a financial airbag: it might not prevent an accident, but it can soften the blow when life throws you a curveball.

## Not Investing

Investing may seem like something only rich people do, but it’s actually a smart move for anyone who wants to grow their money over time. Even if you don’t have a lot to invest, start small and gradually increase your contributions as you’re able. Remember, the stock market is like a rollercoaster: it has its ups and downs, but in the long run, it tends to go up.

**Financial Blunders to Avoid in Your 20s**

Mistakes happen to everyone, but when it comes to your finances, you want to avoid making them as much as possible. In your 20s, you have a lot of opportunities to learn and grow financially. But if you make some of the common mistakes people make in their 20s, it could cost you a lot of money in the long run. Here are 7 financial mistakes to avoid in your 20s:

Financial Planning

Have you ever heard the saying, “If you fail to plan, you plan to fail”? This is especially true when it comes to your finances. One of the biggest mistakes you can make is not having a financial plan. A financial plan will help you track your income and expenses, set financial goals, and make wise investment decisions.

Tracking Your Spending

Do you know where your money goes each month? If not, you’re not alone. But if you want to get your finances under control, you need to start tracking your spending. There are many different ways to do this, such as using a budgeting app, a spreadsheet, or simply writing down everything you spend in a notebook.

Seeking Professional Advice

If you’re feeling overwhelmed by your finances, don’t be afraid to seek professional advice. A financial advisor can help you create a budget, track your spending, and make wise investment decisions. They can also help you avoid some of the common financial mistakes that people make in their 20s.

Accumulate Debt

Debt is a common problem for people in their 20s. But if you’re not careful, it can quickly spiral out of control. Avoid taking on too much debt, and if you do have debt, make sure you have a plan to pay it off.

Not Saving Enough Money

One of the best things you can do for your future is to start saving money early. Even if you can only save a small amount each month, it will add up over time. Make saving a priority, and you’ll be glad you did when you’re older.

Investing Too Aggressively

Investing is a great way to grow your money, but it’s important to do it wisely. If you’re not comfortable with taking on a lot of risk, don’t invest too aggressively. Start with a diversified portfolio of stocks and bonds, and gradually increase your risk tolerance as you get older.

Buying a House Too Early

Buying a house is a big decision, and it’s not one that you should make lightly. If you’re not financially ready to buy a house, don’t do it. Wait until you have a stable job, a good down payment, and a plan for paying off your mortgage.

No responses yet