Types of Retirement Plans

Retirement plans are financial accounts designed to help you save for your retirement, the golden years of your life. You’ve worked hard your entire life, so you deserve to enjoy your retirement to the fullest. Of course, you can’t just rely on Social Security to support you. That’s where retirement plans come in.

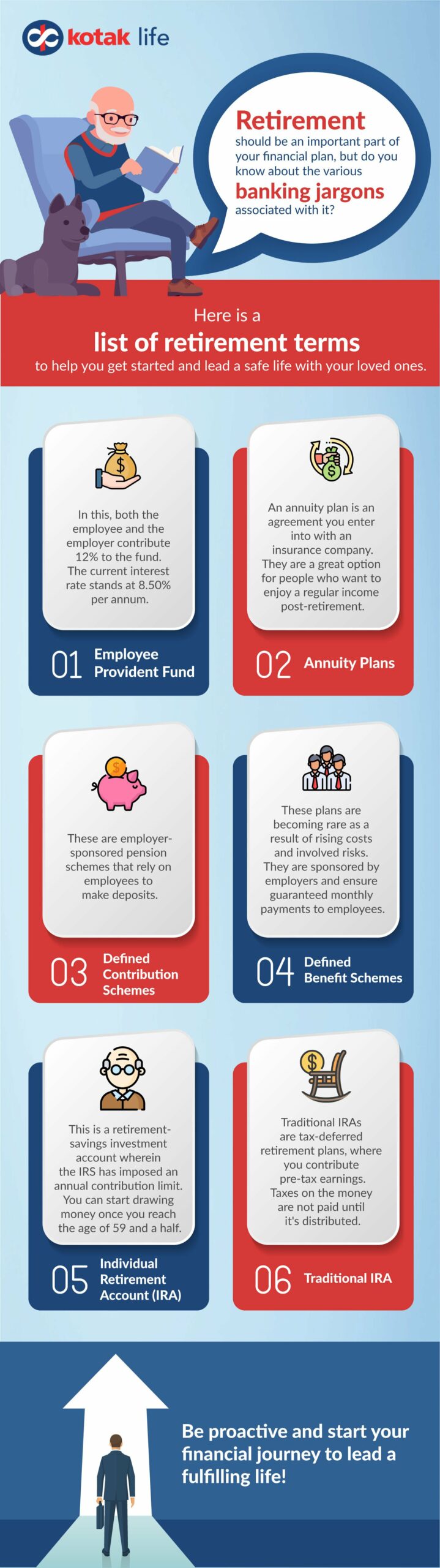

There are many different types of retirement plans, each with its own advantages and disadvantages. The best retirement plan for you will depend on your individual circumstances.

Types of Retirement Plans

401(k) Plans

401(k) plans are one of the most popular retirement plans in the United States. They are offered by employers and allow employees to contribute a portion of their paycheck to a retirement account. Contributions to a 401(k) plan are made on a pre-tax basis, meaning that they are deducted from your paycheck before you pay taxes. This can save you a significant amount of money on taxes.

401(k) plans offer a variety of investment options, so you can choose investments that match your risk tolerance and financial goals. You can also borrow money from your 401(k) plan, but you will have to pay taxes on the money you withdraw.

IRAs

IRAs are another popular retirement savings option. They are individual accounts that are not tied to an employer. Anyone can open an IRA, regardless of their employment status.

There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deferred growth, meaning that you don’t pay taxes on the money in your account until you withdraw it. Roth IRAs offer tax-free growth, meaning that you don’t pay taxes on the money in your account when you withdraw it.

The main difference between traditional IRAs and Roth IRAs is the timing of the tax payments. With a traditional IRA, you get a tax break now, but you pay taxes later when you withdraw the money. With a Roth IRA, you pay taxes now, but you get a tax break later when you withdraw the money.

Annuities

Annuities are insurance contracts that provide you with a guaranteed income stream for a period of time, such as your lifetime. Annuities can be a good way to ensure that you have a steady income in retirement.

There are two main types of annuities: immediate annuities and deferred annuities. Immediate annuities start paying out immediately, while deferred annuities start paying out at a later date.

The main benefit of an annuity is that it can provide you with a guaranteed income stream for life. However, annuities can also be expensive, and they may not be suitable for everyone.

Other Retirement Plans

There are a number of other retirement plans available, such as:

- SIMPLE IRAs are similar to traditional IRAs, but they are designed for small businesses with 100 or fewer employees.

- SEP IRAs are similar to traditional IRAs, but they are designed for self-employed individuals.

- 403(b) plans are similar to 401(k) plans, but they are offered by public schools and other tax-exempt organizations.

The best retirement plan for you will depend on your individual circumstances. It’s important to compare the different types of plans and choose the one that best meets your needs.

Life’s a roller coaster, and you never know what’s lurking around the corner. Retirement planning is no exception. With so many different types of retirement plans out there, it’s hard to know where to start. But don’t worry, we’ve got you covered. In this article, we’ll discuss the various types of retirement plans available, including employer-sponsored plans and individual retirement accounts (IRAs). We’ll also provide a brief overview of each plan so you can make an informed decision about which one is right for you. So, grab a cup of coffee, sit back, and let’s dive into the world of retirement planning!

Employer-Sponsored Plans

Employer-sponsored retirement plans are offered by employers to their employees. These plans offer a variety of benefits, including tax breaks and matching contributions. There are several different types of employer-sponsored plans, including 401(k) plans, 403(b) plans, SIMPLE IRAs, and SEP IRAs.

One of the most common types of employer-sponsored retirement plans is the 401(k) plan. 401(k) plans allow employees to contribute a portion of their paycheck to a retirement account on a pre-tax basis, which means that the money is deducted from their paycheck before taxes are calculated. This can result in significant tax savings. Employers may also choose to match employee contributions, which can further boost retirement savings.

403(b) plans are similar to 401(k) plans, but they are available to employees of public schools and certain other tax-exempt organizations. SIMPLE IRAs are designed for small businesses with 100 or fewer employees. SEP IRAs are similar to SIMPLE IRAs, but they are available to self-employed individuals and small business owners.

Types of Retirement Plans

Planning for retirement is an essential aspect of financial security. With various retirement plans available, it’s crucial to select the one that aligns with your individual circumstances and goals. This article provides an overview of different types of retirement plans, including Individual Retirement Accounts (IRAs), employer-sponsored plans such as 401(k) plans and 403(b) plans, and other options like annuities and pensions.

Individual Retirement Accounts (IRAs)

IRAs are retirement accounts that provide tax advantages and allow individuals to save for retirement without employer involvement. There are three main types of IRAs:

Traditional IRAs

Traditional IRAs offer tax deductions for yearly contributions. Taxes are deferred until the money is withdrawn during retirement. This option is suitable for individuals expecting to be in a lower tax bracket in retirement.

Roth IRAs

Roth IRAs do not provide tax deductions for contributions. However, withdrawals during retirement are tax-free. This option is advantageous for those who expect to be in a higher tax bracket during retirement or who want tax-free income in later years.

SEP IRAs

SEP IRAs are simplified employee pension plans that are designed for self-employed individuals and small business owners. Contributions are made by employers, and they are tax-deductible. The key difference from traditional IRAs is that employer contributions are not subject to the same annual limits as traditional IRAs, making them a more flexible option for certain individuals.

No responses yet