**The Best Options to Invest Your Money: A Comprehensive Guide**

Investing your hard-earned money can be a daunting task, especially with so many options available. The key to successful investing lies in understanding your financial goals and choosing the right strategies to achieve them. Here’s a comprehensive guide to help you navigate the world of investing and make informed decisions:

Understanding Your Financial Goals

Before you dive into any investment, it’s crucial to define your financial objectives. What do you want to accomplish with your money? Are you saving for retirement, a down payment on a home, or your children’s education? Identifying your short-term and long-term goals will guide your investment decisions and help you choose the appropriate strategies.

Determining Your Risk Tolerance

Not everyone has the same level of comfort with risk when it comes to investing. Some people are willing to take more risks in pursuit of higher returns, while others prefer a more conservative approach. Your risk tolerance depends on several factors, such as your age, income, and investment time horizon. It’s important to assess your own risk tolerance and choose investments that align with your financial goals and comfort level.

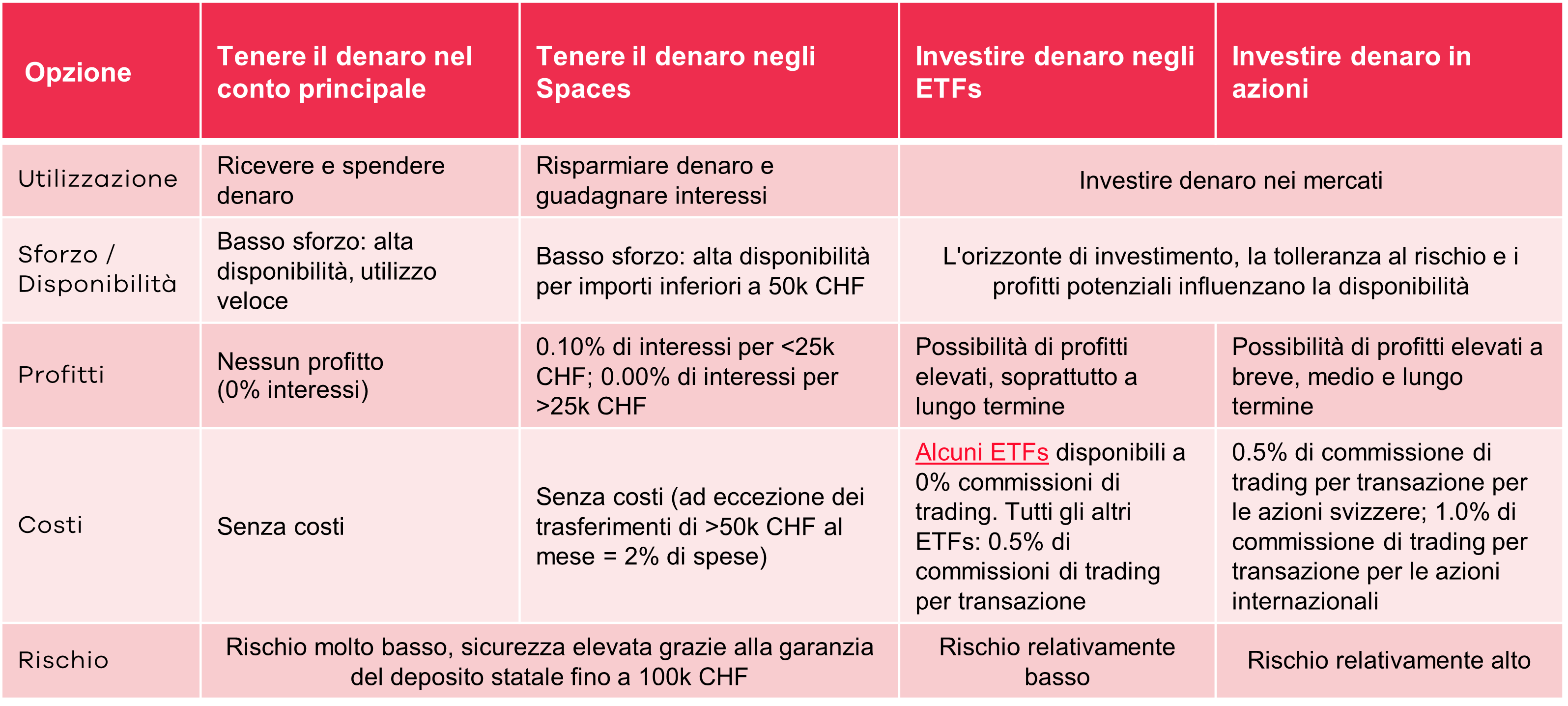

Investment Options at Your Disposal

The world of investing offers a wide range of options to suit every financial goal and risk tolerance. Here are some of the most common and effective investment vehicles:

* **Stocks:** When you buy a stock, you’re essentially investing in a company. Stocks can be risky, but they also have the potential for high returns.

* **Bonds:** Bonds are loans you make to companies or governments. They typically offer lower returns than stocks but are also less risky.

* **Mutual funds:** Mutual funds are baskets of investments that provide instant diversification to your portfolio. They can include stocks, bonds, and other assets, making them a good option for less experienced investors.

* **Exchange-traded funds (ETFs):** ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks. ETFs offer lower costs and more flexibility than mutual funds.

* **Real estate:** Investing in real estate can be a lucrative way to build wealth. However, it’s important to do your research and understand the risks involved.

Seeking Professional Advice

If you’re feeling overwhelmed by the complexities of investing, don’t hesitate to seek professional advice. A financial advisor can help you create a personalized investment plan that aligns with your specific goals. They can also provide ongoing guidance and support as your financial situation evolves.

Conclusion

Investing your money wisely is crucial for achieving financial success. By understanding your financial goals, determining your risk tolerance, and exploring the various investment options available, you can make informed decisions that will help you reach your desired outcomes. Remember, investing is a long-term game, so stay disciplined and don’t let short-term market fluctuations derail your plans.

Deciding the Best Option to Invest Your Hard-Earned Money

In today’s uncertain economic climate, finding a safe and profitable way to invest your hard-earned money can be a daunting task. With a myriad of investment options available, it’s easy to get overwhelmed and make a decision you might regret later.

In this article, we’ll break down the best option to invest your money, exploring the pros and cons of various investment vehicles to help you make an informed decision that aligns with your financial goals and risk tolerance. Whether you’re seeking low-risk options or aiming for higher returns, we’ve got you covered.

High-Yield Savings Accounts

If you’re looking for a low-risk, short-term savings option with competitive interest rates, high-yield savings accounts are a great place to start. These accounts are offered by online banks and typically come with higher interest rates than traditional savings accounts. However, it’s important to keep in mind that interest rates can fluctuate over time, so it’s crucial to choose a bank that offers a consistently competitive rate.

Certificates of Deposit (CDs)

CDs offer a higher return than high-yield savings accounts, but they come with a catch: they typically require you to lock your money in for a specific period of time. The longer the term of the CD, the higher the interest rate. However, if you need access to your funds before the term is up, you may have to pay a penalty. CDs are a good option for investors who don’t need to access their money for a certain period of time and are comfortable with the idea of earning a fixed return.

Stocks

When it comes to potential for higher returns, stocks are hard to beat. Stocks represent ownership in a publicly traded company, and as the company grows and profits, the value of its stock can increase. However, it’s essential to remember that stocks are a high-risk investment and their value can fluctuate significantly. If you’re looking to invest in stocks, it’s important to do your research and choose companies with a strong track record of performance.

Bonds

Bonds are another popular investment option that offers a balance of risk and reward. Bonds are essentially loans you make to a company or government. In return, you receive interest payments over a specified period of time. The interest rate on bonds is typically lower than that of stocks, but bonds are also considered a less risky investment.Bonds can be a good option for investors who are looking for a regular stream of income and are comfortable with the idea of earning a fixed return.

Real Estate

Investing in real estate can be a great way to build wealth over time. Real estate is a tangible asset that can provide rental income and potential for appreciation. However, investing in real estate requires a significant amount of capital, and it’s important to do your research and understand the local market before making a purchase. Real estate can be a good option for investors who are looking for a long-term investment and are comfortable with the responsibilities of owning property.

No responses yet