Options as a Strategic Investment

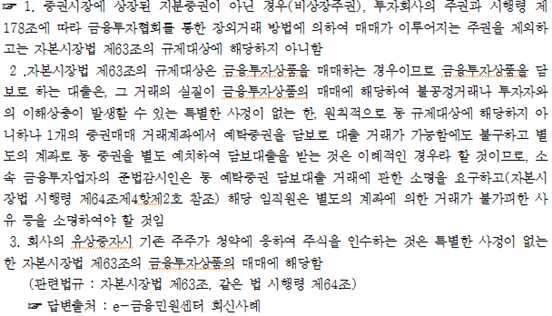

Options are not just for speculators; they can be a powerful tool for investors looking to enhance their returns and manage risk. Options give investors the flexibility to tailor their investments to their specific goals and risk tolerance.

Understanding Options

Options are a type of derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. There are two main types of options: calls and puts.

Call options give the buyer the right to buy the underlying asset, while put options give the buyer the right to sell the underlying asset. The strike price is the price at which the buyer can buy or sell the underlying asset. The expiration date is the date on which the option expires.

Benefits of Options

So what are the benefits of using options as a strategic investment??

There are several benefits to using options as a strategic investment. First, options can be used to enhance returns. By using options, investors can leverage their capital to gain exposure to a wider range of investments. Second, options can be used to manage risk. Options can be used to hedge against the risk of a decline in the value of an underlying asset. Third, options can be used to generate income. Options can be sold to generate income, regardless of whether the underlying asset is rising or falling in value.

Risks of Options

Of course, there are also risks associated with using options. First, options can be complex. Investors need to understand the risks involved before they start trading options. Second, options can be volatile. The value of options can fluctuate rapidly, which can lead to losses. Third, options can expire worthless. If the underlying asset does not move in the expected direction, the option may expire worthless, which means that the investor will lose their entire investment.

**Options as a Strategic Investment**

Options are versatile financial instruments that provide savvy investors with a strategic edge. Empowered with the flexibility to speculate on price movements without the obligation to own the underlying asset, options offer a unique opportunity to capitalize on market shifts. Like a Swiss Army knife for investors, options can serve multiple purposes, offering both offensive and defensive strategies to meet your financial goals.

Understanding Options

Options are akin to a choice on a menu. They grant the holder the right, but not the compulsion, to engage in a transaction involving a specific asset at a predetermined price within a specified timeframe. Options come in two primary flavors: calls and puts. Call options convey the right to purchase an asset, while put options grant the right to sell an asset. The underlying asset can be diverse, encompassing stocks, bonds, commodities, or even currencies.

The anatomy of an option contract encompasses several key attributes. The strike price represents the price at which you have the option to buy or sell the asset. The expiration date specifies the time horizon for exercising the option. Option premiums, analogous to rent, represent the cost of acquiring the option. Premiums are influenced by factors such as the asset’s volatility, time to expiration, and general market conditions.

Options as Strategic Investments

Options offer a smorgasbord of strategic investment opportunities, empowering you to customize your portfolio based on your risk appetite and financial goals. Investors can employ options to hedge against portfolio volatility, speculate on price movements, or generate income through option premiums. Options provide a dynamic tool for navigating market uncertainty, allowing astute investors to capitalize on both rising and falling markets.

Speculating on Price Movements

Options, like crystal balls for market wizards, can illuminate potential price trajectories. By purchasing call options, you can bet on an asset’s rise in value. Conversely, putting options offer shelter from potential declines. This speculative edge enables investors to amplify gains or mitigate losses, adding strategic depth to their portfolios. Unlike traditional investment strategies that solely hinge on price appreciation, options allow investors to profit even when market movements disappoint.

Imagine you’re a weather enthusiast with a hunch that the temperature is poised to soar. You might purchase call options on a heating oil company, anticipating a spike in demand. Conversely, if your meteorological instincts whisper frost, put options on air conditioner manufacturers could offer a cool reprieve from sweltering market conditions.

Hedging Against Volatility

Options, like scuba gear for investors, provide a lifeline in choppy waters. By pairing call and put options, investors can construct a protective hedge against portfolio fluctuations. This strategy, known as a “straddle,” ensures a safety net regardless of the market’s direction. The premium paid for the options acts as insurance against unexpected market jolts, reducing your portfolio’s susceptibility to volatility.

Think of a tightrope walker who relies on a safety net for their daring feats. Options serve as a similar safety net for investors, minimizing the risk of financial missteps and providing peace of mind.

Generating Income

Options, like a virtuoso violinist, can generate a beautiful melody of income. By purchasing options that expire out-of-the-money, investors can collect the option premiums without exercising the option to buy or sell. This strategy, known as “selling options,” transforms options into income-generating instruments. The premiums received represent a steady stream of cash flow, providing investors with a passive income source.

Imagine you own a beautiful painting that you’re not quite ready to part with. You might option to sell it to an art enthusiast for a premium, securing a financial cushion while retaining ownership of your cherished masterpiece.

Conclusion

Options, like versatile financial instruments, empower investors with a strategic edge. By understanding the intricate workings of options, investors can tailor their portfolios to withstand market storms, speculate on price movements, and even generate income. Whether you seek to augment returns or protect against losses, options provide a powerful tool for navigating the complexities of the financial landscape.

Options as a Strategic Investment: Unlocking Market Opportunities

Options, often hailed as a sophisticated financial tool, can serve as a strategic investment, empowering investors to harness the market’s potential while managing risk. For those seeking to delve deeper into this realm, understanding the types of options available is crucial.

Types of Options

Options can be broadly classified into two categories: calls and puts. Call options provide the holder with the right, but not the obligation, to purchase an underlying asset at a specified price (the strike price) on or before a specific date (the expiration date). By contrast, put options grant the holder the right to sell an underlying asset at the strike price within the specified time frame.

The Power of Calls: Betting on Upswings

Call options serve as bullish bets, expressing investor optimism about an asset’s future price appreciation. They enable investors to capitalize on anticipated price increases without committing to purchasing the underlying asset itself. For example, if an investor believes that a particular stock will rise in value, they can buy a call option, giving them the right to buy that stock at a predetermined price if their prediction proves correct.

The Safety Net of Puts: Hedging Against Risk

Put options, on the other hand, provide a defensive strategy, allowing investors to hedge against potential losses in an underlying asset. By purchasing a put option, an investor gains the right to sell an asset at a specific price, no matter how low the market price may fall. This safeguard can protect investors from the downside risks associated with owning the underlying asset.

Strategic Applications: Navigating Market Dynamics

Options can be deployed as a strategic investment tool in various market scenarios. They offer investors the flexibility to speculate on future market movements, hedge against volatility, or generate income through options premiums. Whether you’re a seasoned investor or a novice explorer, understanding the types of options available can empower you to craft tailored investment strategies that align with your risk appetite and financial goals.

Options as a Strategic Investment

In the ever-evolving world of investing, it’s not enough to simply accumulate stocks and bonds. Savvy investors are turning to options as a strategic tool to enhance their portfolios and achieve their financial goals. Options offer a versatile range of possibilities, from hedging against risk to capitalizing on market movements.

Using Options Strategically

Options are contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain time frame. This flexibility allows you to tailor options strategies to suit your specific investment goals. Some common strategies include:

Hedging: Protecting Your Holdings

Imagine you’re sitting pretty with a promising stock in your portfolio. But what if the market takes a sudden downturn? Hedging with options can help you reduce that risk. By buying a put option, you can lock in the right to sell your stock at a predetermined price, even if the market crashes. Think of it as financial insurance, protecting your investment from catastrophic losses.

Speculating: Betting on the Future

Feeling bold? Options let you speculate on the future direction of an asset’s price. By buying a call option, you’re essentially betting that the price will rise before the option expires. If your prediction comes true, you can exercise the option to buy the asset at a lower price than the current market value. Talk about a profitable gamble!

Income Generation: Earning Extra Cash

Options aren’t just for hedging and speculating. They can also be a source of passive income. By selling covered calls, you can earn a premium while potentially limiting your downside risk. In this strategy, you sell an option to someone else while still owning the underlying asset. If the price of the asset rises, the option buyer exercises their right to buy it from you, generating income for you in the process. It’s like a part-time job for your portfolio!

**Options as a Strategic Investment: A Balancing Act of Potential Rewards and Risks**

In the realm of investing, options stand out as a versatile and potentially lucrative instrument, offering investors the promise of substantial returns while providing avenues to mitigate risk. However, like a double-edged sword, options come with their own set of inherent risks, demanding a careful assessment of the potential upsides and downsides before making any decisions.

## Benefits of Options

Options offer investors a bouquet of benefits, making them an attractive proposition for savvy investors. The most notable advantage is the potential for exponential returns, especially compared to traditional investments. Their ability to limit risk is another key selling point, allowing investors to define their potential losses upfront.

## Risks of Options

While options can certainly amplify profits, it’s crucial to acknowledge the risks involved. The primary risk stems from the fact that options are a time-sensitive investment, meaning their value is heavily influenced by the passage of time. If the underlying asset’s price doesn’t move in the expected direction, investors can face the dreaded possibility of losing their entire investment.

## How to Use Options Strategically

Harnessing the power of options as a strategic investment requires a carefully crafted approach. Investors should start by understanding their risk tolerance and investment goals. Options can complement existing investment portfolios, providing diversification and hedging opportunities. However, it’s imperative to avoid over-leveraging and recklessly chasing high-risk strategies.

## Implementing Options Strategies

Implementing options strategies effectively demands both knowledge and discipline. Investors should thoroughly research the underlying asset, evaluating its historical performance and identifying potential price movements. Setting realistic targets and managing emotions is crucial. Remember, the market is inherently unpredictable, and chasing short-term gains can lead to costly mistakes.

Options as a Strategic Investment

Options, a versatile financial instrument, offer investors a strategic advantage in navigating complex markets. They provide investors with the flexibility to tailor their investment strategies, enhance potential returns, and mitigate risks. However, the intricacies of options trading demand a comprehensive understanding of the underlying dynamics and potential pitfalls.

Defining Options & Their Role

Options are financial contracts that grant investors the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as stocks or commodities, at a predetermined price (strike price) on or before a specified date (expiration date). The strategic value of options stems from their ability to provide leverage, speculate on price movements, and protect existing investments.

Benefits of Options

Options offer a myriad of benefits, including:

- Leverage: Options provide a cost-effective way to gain exposure to an underlying asset without committing significant capital.

- Flexibility: Investors can tailor options strategies to their specific risk tolerance and investment goals, allowing for flexibility in market positioning.

- Speculation: Options enable investors to speculate on future price movements of an underlying asset, providing the potential for substantial gains.

- Risk Management: Options can serve as a hedging tool, helping investors mitigate risks associated with existing investments or market fluctuations.

Understanding Options Terminology

Grasping the terminology surrounding options is crucial for effective trading. Here’s a brief guide:

- Call Option: Grants the holder the right to buy an underlying asset at the strike price.

- Put Option: Grants the holder the right to sell an underlying asset at the strike price.

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The date on which the option expires.

Strategies for Option Trading

Numerous options strategies exist, each with varying levels of complexity and risk. Common strategies include:

- Covered Call: Selling a call option against an existing shareholding, aiming to generate additional income.

- Protective Put: Buying a put option to protect against potential losses on an existing investment.

- Bull Put Spread: Buying a lower strike call option and selling a higher strike call option, profiting from a moderate increase in the underlying asset’s price.

Closing Thoughts

Options, when wielded strategically, can be a powerful tool in an investor’s arsenal. They offer leverage, flexibility, and risk management capabilities. However, it is paramount to approach options trading with due diligence, understanding the risks and rewards involved. By carefully considering the nuances of options, investors can harness their potential to enhance their investment performance and navigate market challenges effectively.

No responses yet