Understanding ROI: A Comprehensive Guide

What does ROI mean? It’s a ubiquitous acronym in the business world that stands for Return on Investment, a fundamental metric employed by companies and ventures to gauge the efficacy of their financial endeavors. Measuring the ROI helps organizations determine how well their investments are performing and whether they’re achieving their desired outcomes. Equivalently, ROI measures the profit or benefit earned relative to the investment made.

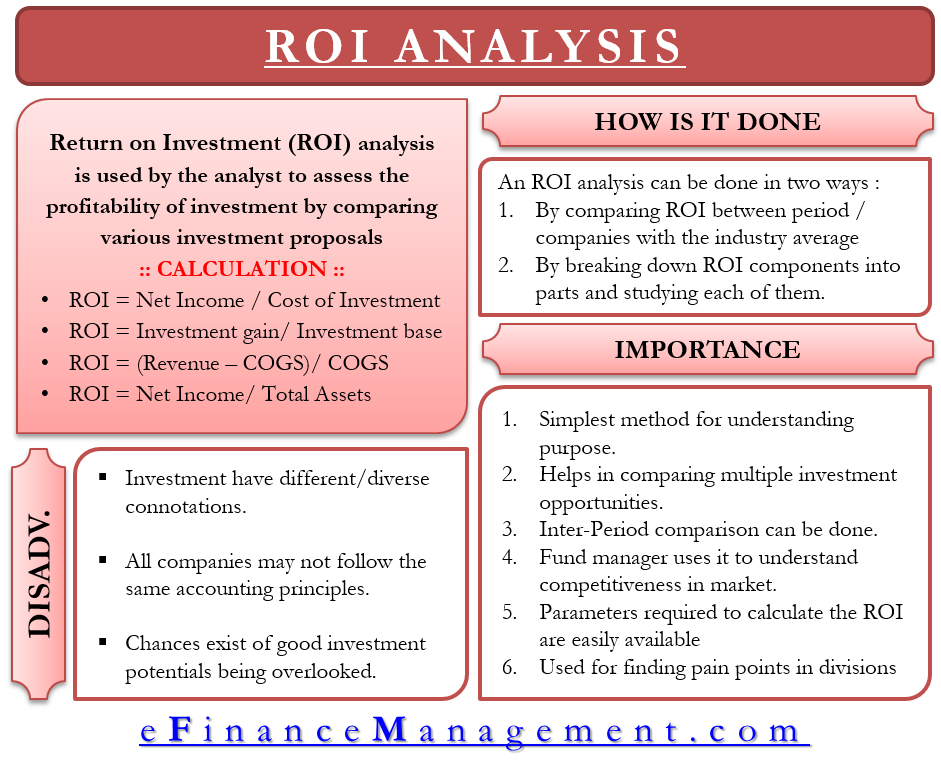

Calculating ROI

Calculating ROI is a straightforward process that involves dividing the net profit by the initial investment cost. The result is expressed as a percentage or ratio. For example, a company that generates $10,000 in profit from an investment of $5,000 has an ROI of 200% or 2:1. In other words, for every dollar invested, the company earns two dollars in return.

Benefits of ROI

ROI serves as a decisive factor for investors considering various funding options. It provides a quantitative assessment of potential return, empowering investors to make informed decisions about where and how to allocate their capital.

Moreover, evaluating ROI prompts decision makers to prioritize investments based on their expected return and risk tolerance. As such, prioritizing investments involves evaluating their potential ROI and aligning them with the company’s overall financial objectives. By doing so, companies can ensure that their investments are in sync with their overarching financial strategy and long-term goals.

Furthermore, tracking ROI facilitates the identification of underperforming investments. Discovering underperforming investments entails scrutinizing their ROI, determining the causes of their subpar performance, and formulating plans to enhance their profitability or divest from them entirely.

ROI also plays a pivotal role in projecting future financial performance. Analyzing ROI can uncover patterns and trends that can inform business decisions and financial planning. This analysis helps companies anticipate future cash flows and make informed decisions about future investments.

What Does ROI Mean?

Return On Investment (ROI) is a critical metric that measures the profitability of an investment. It’s like a financial report card that tells you whether your business decisions are paying off. ROI is calculated by dividing the net profit from the investment by the total cost of the investment. A positive ROI means you’re making money, while a negative ROI indicates you’re losing money.

Importance of ROI

ROI is a vital tool for making smart business decisions. It helps you identify which investments are worth pursuing and which ones to avoid. Without ROI, you’re essentially shooting in the dark, hoping for the best. Let me tell you, that’s not a winning strategy.

ROI also helps you track the performance of your business and make necessary adjustments. You’d be amazed at how many businesses keep pouring money into projects without ever checking the numbers. It’s like driving a car without a speedometer – you have no idea how fast you’re going or if you’re even headed in the right direction.

ROI is crucial for investors as well. They use it to assess the risk and potential return of an investment. A high ROI can attract investors and make it easier for you to raise capital. So, if you’re looking to grow your business, don’t underestimate the power of ROI.

How to Calculate ROI

Calculating ROI is pretty straightforward. Just follow this simple formula:

Profit / Investment = ROI

For example, let’s say you invest \$10,000 in a marketing campaign and generate \$20,000 in sales. Your ROI would be (\$20,000 – \$10,000) / \$10,000 = 1. This means you’ve doubled your investment. Not bad, huh?

What Does ROI Mean?

ROI, also known as Return on Investment, is a crucial metric that indicates how well your business initiatives are performing. It’s like checking the return on your money by calculating the ratio of the profit you’ve made to the money you’ve invested. A high ROI means you’ve made a wise investment, while a low ROI suggests it’s time to rethink your strategy.

Calculating ROI

Calculating ROI is a piece of cake. Just divide the net gain or profit you’ve earned from your investment by the initial investment you made. Then, multiply the result by 100 to get a percentage. Here’s the formula: ROI = (Net Gain/Initial Investment) x 100%. For example, if you invest $1,000 and make a profit of $500, your ROI would be (500/1000) x 100 = 50%. Not bad, right?

Now, let’s dive a little deeper into this calculation. Let’s say you buy a new machine for your business that costs $20,000. Over the next year, you use the machine to increase your productivity and make an extra $30,000 in sales. Your net profit from the machine would be $30,000 – $20,000 = $10,000. Your ROI for the machine would be ($10,000/$20,000) x 100 = 50%. That means for every dollar you invested in the machine, you got back $0.50 in profit. A sweet deal, isn’t it?

What Does ROI Mean?

In the cutthroat world of finance, RETURN ON INVESTMENT [ROI] rules supreme. Simply put, ROI measures the profitability of an investment by comparing the amount of money you get out to the amount you put in. Like a financial report card, it tells you how your investment is performing and whether it’s worth your hard-earned cash.

ROI: A Tale of Two Cities

Let’s delve into the fascinating world of positive and negative ROI. A positive ROI is like striking gold in the investment game. It means you’re raking in the dough, and your investment is generating a profit. On the flip side, a negative ROI is like hitting a financial pothole. It indicates that you’re losing money, and your investment needs some serious TLC.

How to Calculate ROI

Calculating ROI is like baking a financial pie. The recipe is simple: divide the net profit you make from your investment by the total amount you invested and multiply the result by 100 to get a percentage. Here’s the mathematical magic:

ROI = (Net Profit / Investment Cost) * 100%

Applications of ROI

Measuring ROI isn’t just for financial whizzes; it’s a crucial tool for making savvy investment decisions. Businesses use ROI to determine which projects to greenlight and which ones to send to the financial graveyard. Even individuals can harness the power of ROI to assess the profitability of personal investments, like home renovations or stock purchases.

Understanding ROI: The Bottom Line

ROI is the financial equivalent of a crystal ball, providing insight into the future profitability of an investment. By understanding how to calculate and interpret ROI, you can avoid financial faux pas and make investments that will keep your money flowing. So, next time you’re considering an investment, don’t forget to ask yourself: What’s my potential ROI? It’s the golden rule of investing.

What Does ROI Mean?

The ROI Acronym

ROI, short for Return on Investment, is a metric that measures the profitability of an investment by comparing the initial outlay to the net gain or loss over a specified period. It’s like the financial equivalent of a report card, giving investors a quick snapshot of how well their money has performed. A positive ROI means the investment has generated a return, while a negative ROI indicates a loss.

Calculating ROI

Calculating ROI is as simple as dividing the net profit or loss by the initial investment and multiplying the result by 100. For example, if you invested $1,000 and made a profit of $200, your ROI would be 20%. That means for every dollar you put in, you got back $1.20.

Uses of ROI

Knowing your ROI is key for making informed investment decisions. It can help you determine which investments are worth pursuing and which ones to avoid. It’s also a useful tool for tracking the performance of your investments over time and comparing them to benchmarks or other investment options.

Factors Affecting ROI

The ROI of an investment can be influenced by various external and internal factors, including market conditions, management skills, and investment strategy. For example, if the stock market is booming, your stock investments are likely to perform better, resulting in a higher ROI. Similarly, if you have a skilled investment manager who makes wise investment choices, your ROI is likely to be higher.

The Bottom Line

ROI is a powerful metric that can help you make more profitable investment decisions. By understanding how to calculate it and what factors can affect it, you can maximize your returns and reach your financial goals faster. So, the next time you’re considering an investment opportunity, ask yourself: “What’s the ROI?” After all, you wouldn’t buy a car without knowing how many miles per gallon it gets, would you?

What in the World Does ROI Mean?

When you invest your hard-earned dough, you naturally want to know how much bang you’ll get for your buck. That’s where ROI comes in, the magical acronym that stands for return on investment. It’s like a financial translator, turning those complicated numbers into a crystal-clear picture of your investment’s worth.

ROI in Practice

ROI isn’t just a buzzword; it’s a vital tool used across the financial spectrum. It can help you:

- Assess the success of marketing campaigns: Did that glitzy ad campaign pay off? ROI tells you like it is.

- Evaluate new product launches: Will investing in that new widget make you a millionaire? ROI gives you the scoop.

- Compare investment options: Wondering which stock or bond is the better choice? ROI helps you make an informed decision.

- Measure the profitability of projects: Is that new software worth the investment? ROI gives you the green light or the red flag.

Calculating ROI: The Money Math

Figuring out your ROI is like solving a simple equation: ROI = (Net Profit / Investment) x 100. Just plug in the numbers, and voila! You’ll have a percentage that tells you the exact return you’re getting on your investment.

Interpreting ROI: The Green Light or Red Flag

So, what does a good ROI look like? It depends on your goals and industry. A 20% return might be a home run in one scenario but a strikeout in another. The key is to compare your ROI to industry benchmarks or your own past performance. A higher ROI means your investment is paying off handsomely, while a lower ROI tells you it’s time to rethink your strategy.

The Bottom Line

ROI is the financial GPS that guides you towards smarter investments. By understanding how to calculate and interpret it, you can make decisions that maximize your returns and put your money to work for you. So, the next time you’re contemplating an investment, don’t forget to ask: What’s my ROI?

No responses yet