Introduction

Are you looking for a way to use whole life insurance to build wealth? This type of permanent life insurance offers coverage for your entire life and builds cash value over time. But how can you make the most of it to grow your wealth?

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and accumulates a cash value component. The cash value grows over time on a tax-deferred basis, meaning you don’t pay taxes on the earnings until you withdraw them. This cash value can be borrowed against or withdrawn for various purposes, such as funding retirement or paying for unexpected expenses.

How to Use Whole Life Insurance to Build Wealth

To maximize the wealth-building potential of whole life insurance, consider the following strategies:

- Maximize Contributions: Consistently contributing to your whole life insurance policy will help build cash value more quickly. Consider setting up automatic payments to ensure regular contributions.

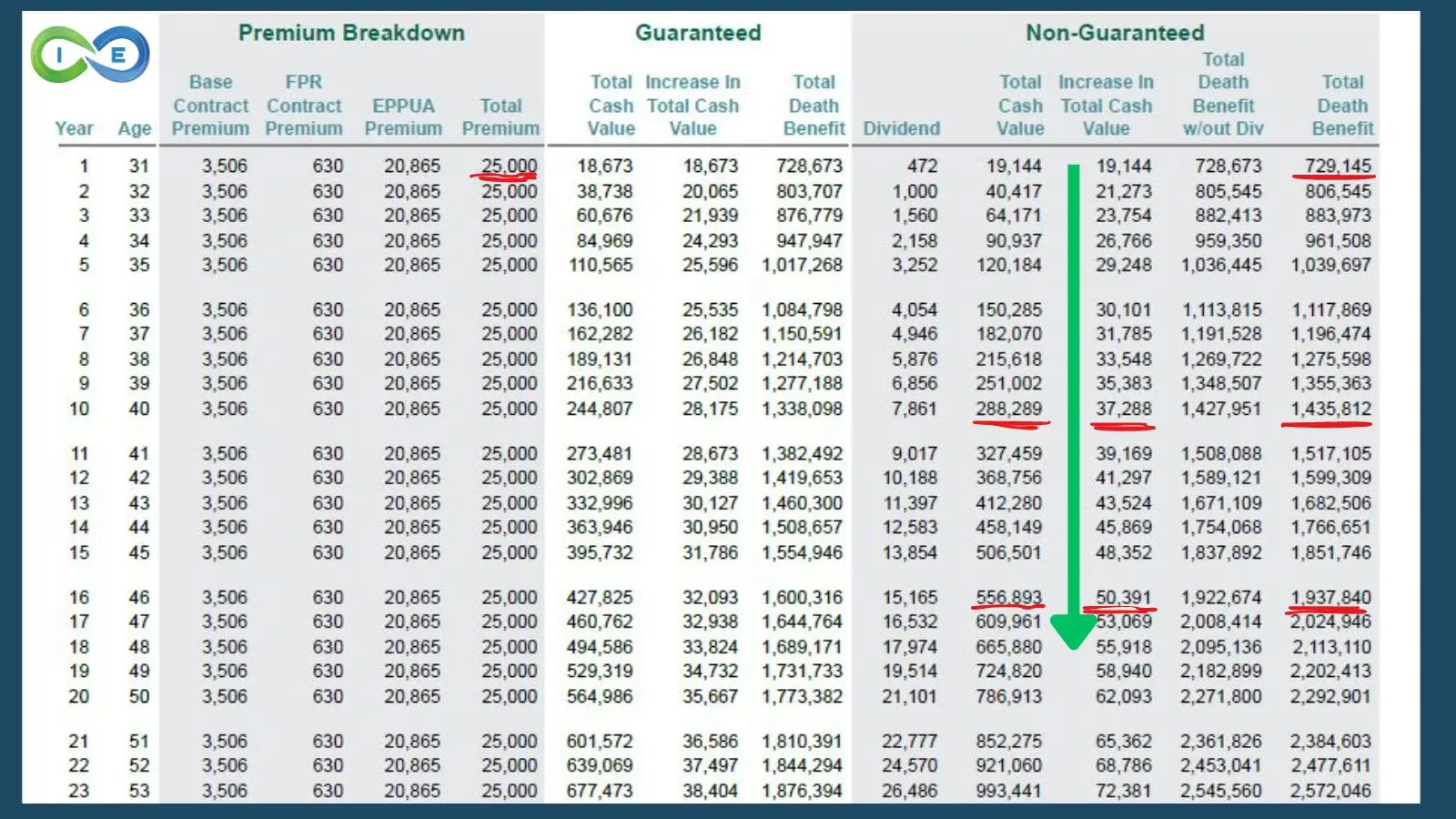

- Dividend-Paying Policies: Choose a whole life insurance policy that pays dividends. These dividends can be used to increase the cash value or purchase additional coverage.

- Borrow Against Cash Value: You can borrow against the cash value of your whole life insurance policy to access funds for investments or other financial needs without affecting your death benefit. Just be aware of any interest charges or fees associated with borrowing.

- Tax-Deferred Growth: The cash value in your whole life insurance policy grows on a tax-deferred basis, meaning you won’t pay taxes on the earnings until you withdraw them. This can be a significant advantage for long-term wealth accumulation.

- Consider Inflation: Whole life insurance policies generally provide a fixed death benefit, which may not keep pace with inflation over time. Consider purchasing additional coverage or riders to supplement your death benefit as needed.

Additional Tips

Here are some additional tips to help you get the most out of your whole life insurance policy:

- Shop Around: Compare policies and premiums from multiple insurance companies to find the best coverage and value.

- Seek Professional Advice: Consider consulting with a financial advisor or insurance agent to discuss your specific needs and goals.

- Monitor Your Policy: Regularly review your policy and make adjustments as necessary to ensure it aligns with your changing circumstances.

By following these tips, you can harness the power of whole life insurance to build wealth for your future.

How to Use Whole Life Insurance to Build Wealth

Are you curious about how to harness the power of whole life insurance to amass wealth? If so, this comprehensive guide will illuminate the path to financial prosperity. Whole life insurance is not just a safety net for your loved ones; it’s a versatile tool that can help you secure your financial future. Dive in and discover the secrets of unlocking its wealth-building potential.

How Whole Life Insurance Works

When you delve into the world of whole life insurance, you’ll embark on a unique financial journey. Unlike its term life counterpart, which provides temporary coverage, whole life insurance offers lifelong protection. With each premium payment, you contribute to both a death benefit and a cash value component. The cash value, like a trusty piggy bank, grows steadily over time, fueled by a portion of your premiums and interest earned.

The Cash Value: Your Wealth-Building Ally

The cash value within your whole life insurance policy is not just an abstract number; it’s a gateway to wealth creation. As it accumulates, you can tap into it through policy loans or withdrawals without affecting the death benefit. It’s like having a secret stash that you can access when life throws unexpected curveballs or when you’re ready to embark on new financial adventures.

The cash value’s growth is not subject to the whims of the stock market. Instead, it enjoys a steady upward trajectory, providing a sense of stability and confidence in your financial plan. It’s a reliable companion that will be there for you when you need it most, whether it’s to fund a child’s education, supplement your retirement income, or pursue entrepreneurial dreams.

However, it’s crucial to remember that policy loans and withdrawals may reduce the cash value and the death benefit, so it’s essential to use them wisely. Consider them as valuable tools in your financial arsenal, not as quick fixes that could jeopardize your long-term goals. As you navigate the complexities of whole life insurance, seek guidance from a trusted financial professional who can help you make informed decisions that align with your wealth-building aspirations.

Whole life insurance is not a get-rich-quick scheme. It’s a long-term commitment that requires discipline and patience. But by harnessing its power, you can lay a solid foundation for your financial future, secure peace of mind, and achieve your wealth-building dreams.

How to Use Whole Life Insurance to Build Wealth

When it comes to financial planning, putting all of your eggs in one basket is usually a bad idea. But there’s one asset that can serve as a foundation for your financial future while also providing peace of mind for your loved ones: whole life insurance. In this article, we’ll dive into how you can use whole life insurance to build wealth and secure your financial future.

The Power of Cash Value

Unlike term life insurance, which only provides coverage for a specific period, whole life insurance offers lifelong protection. But what sets whole life insurance apart is its cash value component. This is a tax-advantaged savings account that grows steadily over time. The cash value grows tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them. This tax-advantaged growth can make a significant difference in the long run.

Building Wealth Through Loans and Withdrawals

There are several ways you can access the cash value in your whole life insurance policy. You can take out a loan against the cash value, which allows you to borrow money without affecting your coverage. The interest you pay on the loan is typically low, and the loan itself is not taxable. You can also withdraw money from your cash value, but this will reduce your death benefit. However, if you’ve built up a substantial cash value, you may be able to withdraw funds without affecting your coverage or paying taxes on the withdrawal.

Investing for the Future

Once you’ve established a solid cash value in your whole life insurance policy, you can begin using it to invest for the future. You can use the policy to purchase stocks, bonds, or mutual funds. The earnings on these investments will also grow tax-deferred, further boosting your wealth potential.

Tax-Efficient Estate Planning

Whole life insurance can also be a valuable tool for estate planning. When you pass away, your beneficiaries will receive the death benefit tax-free. This means that your assets will pass on to your loved ones without being diminished by estate taxes. Additionally, the cash value in your policy can be used to pay for estate expenses, such as probate fees or funeral costs.

Conclusion

Whole life insurance is a versatile financial tool that can help you build wealth, secure your family’s future, and plan for the unexpected. By understanding how to use the cash value component and leveraging the tax advantages, you can harness the power of whole life insurance to achieve your financial goals.

No responses yet