**401(k) Investment Options: A Comprehensive Guide**

Investing for your retirement can seem like a daunting task, especially if you’re not familiar with the financial world. But don’t worry, we’re here to break down the basics of 401(k) investment options so you can make informed decisions about your financial future.

Index Funds

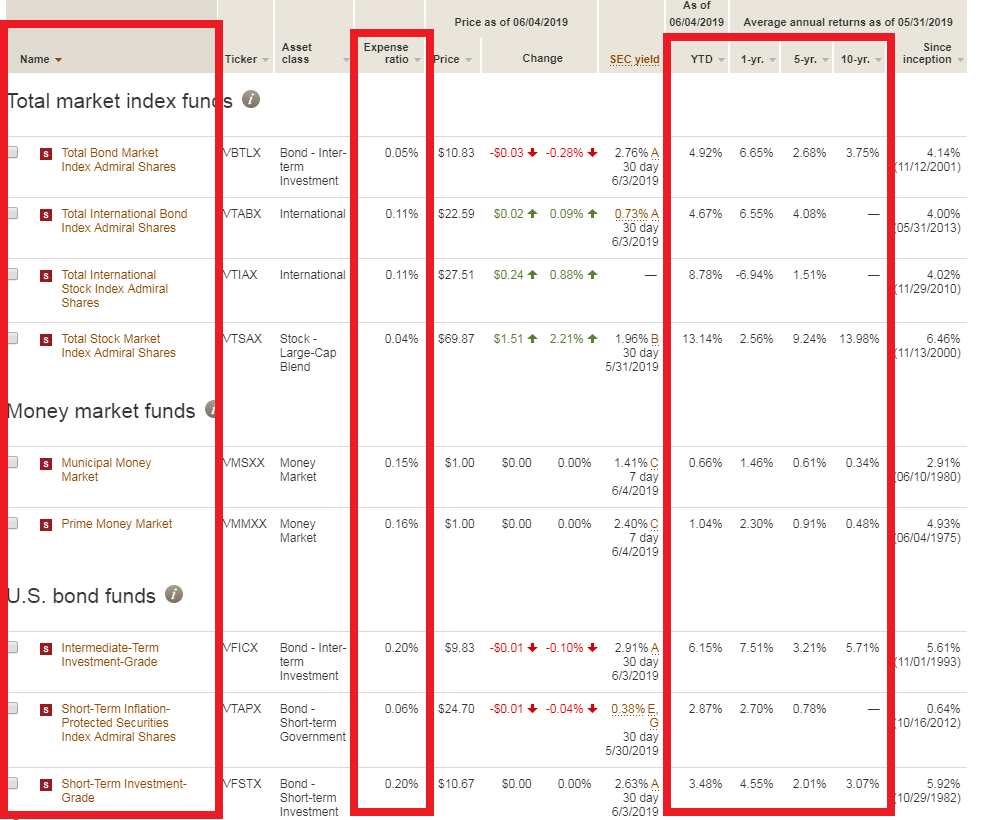

Index funds are a great option for investors who want broad market exposure without having to do a lot of research. These funds simply track a particular market index, such as the S&P 500 or the Nasdaq Composite. Because they’re passively managed, index funds have lower fees than actively managed funds, which can make a big difference over time.

Target-Date Funds

Target-date funds are another popular choice for 401(k) investors. These funds automatically adjust your asset allocation over time, becoming more conservative as you get closer to retirement. This means you can set it and forget it, knowing that your investments are being managed according to your goals.

Individual Stocks

Investing in individual stocks can be a bit riskier than investing in funds, but it also has the potential for higher returns. If you’re comfortable with the risk, investing in a few well-chosen stocks can help you grow your nest egg.

Bonds

Bonds are another type of investment that can be included in a 401(k). Bonds are essentially loans that you make to companies or governments. In return for lending them money, you receive interest payments over time. Bonds are generally considered to be less risky than stocks, but they also have the potential for lower returns.

Real Estate

Real estate is a unique investment that can provide you with both income and appreciation. However, it’s also important to remember that real estate can be illiquid, meaning it can be difficult to access your money quickly if you need it. If you’re interested in investing in real estate, you may want to consider doing so through a real estate investment trust (REIT).

Okay, So How Do I Choose?

The best 401(k) investment options for you will depend on your individual circumstances and goals. If you’re not sure where to start, you may want to consider speaking with a financial advisor. They can help you create a personalized investment plan that meets your specific needs.

No responses yet