.

**Savvy Investment Strategies for Legal Professionals**

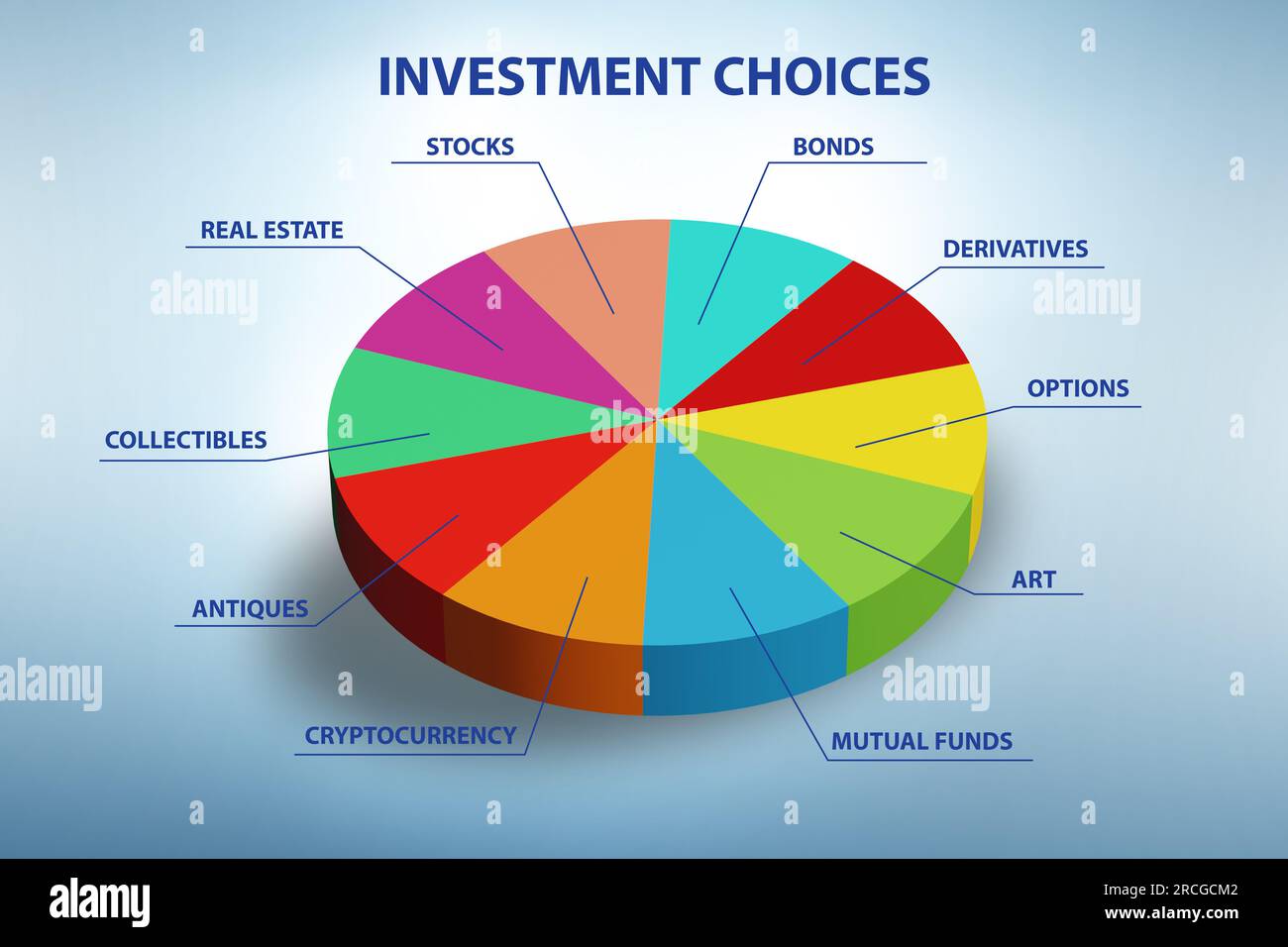

As a legal professional, navigating the world of finance can be daunting, but it’s essential for securing your financial future. One crucial aspect of financial planning is understanding the diverse investment options available to you. Here’s a comprehensive guide to help you make informed decisions and reap the rewards of savvy investing:

Types of Investments

From burgeoning startups to established corporations, stocks represent fractional ownership in companies. Their value fluctuates with market conditions, offering potential for growth but also carrying inherent risk. Conversely, bonds, issued by governments or corporations, provide fixed income streams over time. They offer lower risk but generally yield a smaller return than stocks.

Mutual Funds

Mutual funds are like investment baskets containing a diversified portfolio of stocks, bonds, or other assets. This diversification helps spread risk and potentially amplify returns. They’re managed by professional investment managers and offer a hassle-free way to invest in a variety of assets. However, they come with management fees that can eat into your profits.

Real Estate

Investing in real estate involves purchasing property for the purpose of renting it out or selling it for a profit in the future. While it can provide a steady income stream and long-term appreciation, it’s a more illiquid investment compared to stocks or mutual funds. You’ll need to factor in maintenance costs, property taxes, and potential vacancies when considering real estate.

Other Investment Options

Beyond these traditional investments, there are niche options to consider, such as commodities (e.g., precious metals, oil) and alternative investments (e.g., venture capital, private equity). These can offer potential for high returns but also carry higher risk. It’s important to thoroughly research and understand the risks involved before investing in these alternatives.

Remember, the best investment strategy is the one that aligns with your financial goals, risk tolerance, and time horizon. Consult with a financial advisor to create a personalized plan and maximize your earning potential.

**Investment Options for Lawyers: Weighing Risk and Reward**

As a lawyer, it’s crucial to safeguard your financial future. Investing is an essential part of that equation, but it can be a daunting task, especially considering the wide array of investment options available. To make the best decision, you must understand the risks and potential returns associated with each option.

**Investment Options**

One option to consider is investing in mutual funds. Mutual funds pool money from multiple investors and invest it in a diversified portfolio of stocks, bonds, or other assets. This diversification can help mitigate risk, as the performance of one asset class doesn’t dramatically impact the entire portfolio.

Another option is real estate. Investing in property can provide a steady stream of rental income and the potential for appreciation. However, it also comes with its own set of risks, such as property damage, tenant issues, and market fluctuations.

**Risk and Return**

Investments come with varying levels of risk and return. Understanding these factors is essential for matching your investments to your risk tolerance. Low-risk investments, such as government bonds, offer a modest return but also preserve your capital. High-risk investments, such as penny stocks, have the potential for substantial gains but also carry a higher likelihood of loss.

It’s important to strike a balance between risk and return that aligns with your financial goals and risk appetite. Lawyers with a low risk tolerance may prefer conservative investments like bonds or certificates of deposit. Those with a higher risk tolerance may consider stocks or alternative investments like hedge funds.

**Additional Considerations**

In addition to risk and return, there are other factors to consider when making investment decisions, such as:

* Investment horizon: How long do you plan to invest?

* Tax implications: Different investment options have different tax implications.

* Fees and expenses: Some investments come with fees or expenses that can eat into your returns.

* Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes to reduce risk.

**Conclusion**

Investing is a crucial part of financial planning for lawyers. By understanding the risks and potential returns associated with different investment options, you can make informed decisions that align with your financial goals and risk tolerance. Remember, investing involves careful consideration and a balanced approach to risk and reward.

**Investment Options: Navigating the Financial Landscape**

Investing wisely is crucial for securing your financial future. One key investment option is real estate, which offers potential for capital appreciation, rental income, and tax benefits. But before you dive in, it’s essential to understand the tax implications of such investments.

Tax Implications

Taxes can significantly impact your investment returns, so it’s wise to consult a financial advisor to optimize your tax strategy. Here are some key considerations:

– **Income tax:** Rental income from real estate is taxed as ordinary income. However, expenses related to the property, such as mortgage interest and property taxes, can offset this income.

– **Capital gains tax:** When you sell a property, you may be liable for capital gains tax on any profit you make. The tax rate depends on the length of time you’ve owned the property and your overall income.

– **Property tax:** As a homeowner, you’ll also be responsible for paying property taxes, which vary by jurisdiction. These taxes can be a substantial expense, so it’s important to factor them into your budgeting.

Investment Considerations

Beyond tax implications, there are other factors to consider when evaluating real estate investments:

– **Location:** A property’s location can influence its value and potential for appreciation. Consider factors like proximity to amenities, desirable neighborhoods, and future development plans.

– **Property type:** Different property types come with their own advantages and risks. Single-family homes, apartments, and commercial properties each have unique characteristics to weigh.

– **Market conditions:** Real estate markets fluctuate over time, influenced by economic factors and supply and demand. Research market trends and consult experts to make informed investment decisions.

Additional Investment Options

While real estate is a popular investment vehicle, it’s not the only option. Here are a few alternatives to consider:

– **Stocks:** Shares of publicly traded companies offer the potential for capital appreciation and dividend income. However, stocks also carry higher risk than real estate.

– **Bonds:** Bonds are debt instruments that pay regular interest payments and return the principal at maturity. They typically offer lower returns than stocks but carry less risk.

– **Mutual funds:** Mutual funds pool the investments of many individuals and invest in a diversified portfolio of stocks, bonds, or other assets. This can provide instant diversification and professional management.

By carefully considering the tax implications, investment options, and market conditions, you can make informed decisions that will help you build wealth and secure your financial future.

**Unlocking Smart Investment Options**

Seeking financial security is a universal pursuit, and lawyers are no exception. With a plethora of investment options at their fingertips, it’s crucial to navigate this complex landscape with informed choices. In this article, we’ll delve into the realm of investment options, exploring avenues to maximize potential returns while mitigating risk.

Investment Options

When it comes to investments, the possibilities are vast and varied. One popular option is the stock market, where you buy and sell shares of publicly traded companies. Another is real estate, which offers potential for appreciation and rental income. Bonds, issued by governments and corporations, provide a steady stream of interest payments. And for those seeking a more diversified approach, mutual funds and exchange-traded funds (ETFs) offer a basket of investments under a single umbrella.

Financial Advisors

Financial advisors serve as experienced guides in the investment maze, helping clients navigate the complexities of the market. They can assess individual financial situations, identify long-term goals, and recommend appropriate investment strategies. By leveraging their expertise, lawyers can make sound investment decisions that align with their unique needs and aspirations.

Understanding Risk Tolerance

A key aspect of investing is understanding one’s risk tolerance. This refers to the level of potential losses an individual is comfortable with. Younger investors with a longer investment horizon may be more comfortable with higher risk investments, while those nearing retirement may prefer more conservative options. Financial advisors can help clients determine their risk tolerance and tailor investment recommendations accordingly.

Diversification: Don’t Put All Your Eggs in One Basket

Diversification is a fundamental principle of investing. It involves spreading investments across different asset classes, sectors, and regions. By doing so, investors reduce their exposure to any single risk factor. For example, instead of investing solely in stocks, one might also invest in bonds and real estate, creating a well-rounded portfolio.

Making Informed Decisions

Informed investment decisions are a product of thorough research and knowledge. It’s essential to understand the underlying principles of each investment option and to stay abreast of market trends. Financial advisors can provide valuable insights and guidance, but it’s ultimately the investor’s responsibility to make well-informed choices.

Conclusion

Navigating the investment landscape requires careful consideration, strategic planning, and expert guidance. By understanding investment options, assessing risk tolerance, embracing diversification, and making informed decisions, lawyers can unlock the potential for financial security and achieve their long-term goals.

No responses yet