Investment Options for Beginners: A Guide for Navigating the Legal Landscape

Are you a newbie to the world of investing and feeling overwhelmed by the myriad of options available? Don’t fret! This comprehensive guide will equip you with the knowledge you need to make informed investment decisions. We’ll delve into the legal landscape of investing, ensuring you navigate it confidently. Additionally, we’ll provide you with a range of investment options tailored specifically for beginners, giving you a head start in building your financial future.

Types of Investments

When it comes to investing, there are numerous options to choose from depending on your risk tolerance, investment goals, and time horizon. Some popular investment options include:

a) Stocks: These represent ownership in a publicly traded company, offering growth in your portfolio’s value, potential income through dividends, and participation in company profits.

b) Bonds: Consider these as IOUs from governments or corporations. They generally provide consistent interest payments but may not offer the same growth potential as stocks.

c) Mutual Funds: These are professionally managed investment funds that invest in a diversified portfolio of stocks, bonds, and other assets, offering a way to spread your risk.

d) Exchange-Traded Funds (ETFs): These are similar to mutual funds but trade on stock exchanges like stocks. They offer a convenient, low-cost way to track an index or sector.

e) Real Estate: Investing in property can provide passive income through rent, appreciation in value, and tax benefits, although it requires higher capital and can be illiquid.

Legal Considerations

Navigating the legal side of investing can be daunting, but it’s crucial to understand the rules and regulations that govern financial markets. Here are some key legal considerations:

a) Registration Requirements: Financial professionals must register with regulatory agencies like the Securities and Exchange Commission (SEC) to operate legally.

b) Disclosure Laws: Companies and investment firms are required to disclose material information about their offerings, ensuring transparency in the market.

c) Insider Trading: It’s illegal to trade stocks or other securities based on non-public knowledge.

d) Investment Fraud: Be wary of fraudulent schemes that promise unrealistic returns. Always do your research and invest only with reputable firms.

e) Tax Implications: Investments can have different tax implications. It’s essential to understand the tax laws applicable to your investments to optimize your returns.

Investment Options for Beginners: A Beginner’s Guide to Navigating the Financial World

For those new to the realm of investing, the array of options can feel daunting. However, with a bit of research and understanding, you can embark on this exciting journey with confidence. Let’s dive into the basics of investing, exploring the different types of investment options that cater to beginners.

Choosing the Right Investment Options

When selecting investment options, it’s crucial to align them with your risk tolerance and financial goals. Let’s explore some of the most common investment options that are well-suited for beginners like you.

Government Bonds: A Safe Haven

Government bonds, issued by the government, are known for their stability and low risk. They offer a steady stream of income through periodic interest payments. However, they may offer lower returns compared to other investment options. Think of them as a cozy blanket on a chilly night, providing comfort and security.

Money Market Accounts: A Liquid Option

Money market accounts are akin to high-yield savings accounts, offering easy accessibility to your funds. They typically provide modest returns, but their liquidity makes them a convenient option for those who may need to tap into their investments quickly. Consider them your trusty sidekick, always there when you need them.

Certificates of Deposit (CDs): A Fixed-Term Investment

Certificates of deposit, offered by banks and credit unions, are similar to money market accounts but with a twist. You commit to keeping your funds invested for a fixed term in exchange for a higher interest rate. It’s like locking your savings away in a vault for a specific period, earning a guaranteed return.

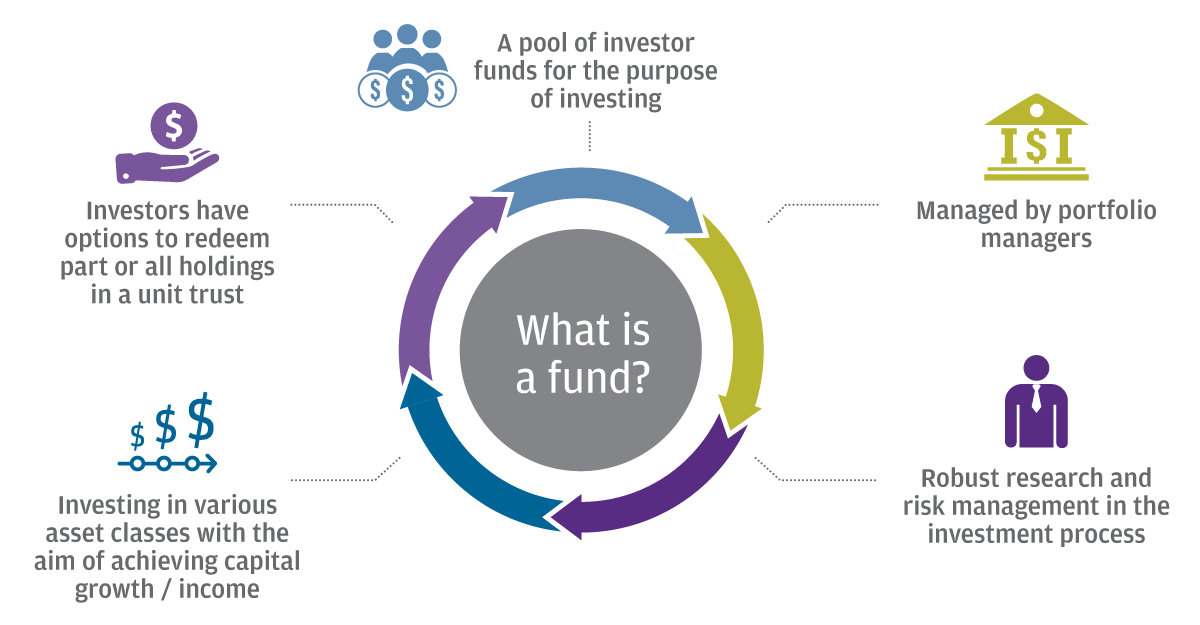

Mutual Funds: A Basket of Stocks

Mutual funds pool the investments of many individuals into a single fund that invests in a diversified portfolio of stocks, bonds, or other assets. This diversification can help spread the risk and potentially enhance returns. Think of it as joining a club of investors, sharing the ups and downs of the market together.

Exchange-Traded Funds (ETFs): A Traded Option

Exchange-traded funds (ETFs) are similar to mutual funds but are traded on stock exchanges like individual stocks. They provide instant diversification and offer flexibility to buy and sell shares throughout the trading day. Imagine them as a hybrid between a mutual fund and a stock, allowing you to dip your toes into the stock market without buying individual stocks.

Individual Stocks: A Higher-Risk, Higher-Reward Approach

Individual stocks represent ownership in a specific company. They offer the potential for higher returns but also carry more risk. Consider them your wild card, with the potential to soar or stumble. Before investing, it’s essential to research the company thoroughly, understanding its financial health and industry dynamics.

No responses yet