Understanding the Basics of the Stock Market

Investing in the stock market can be a daunting task, especially for beginners, but it doesn’t have to be a mystery. So, let’s break down the basics and demystify the world of stocks! The stock market is essentially a marketplace where companies offer pieces of ownership, known as shares, to the public. Investors, like you and me, buy these shares to become partial owners of the company. The main players in this market are companies seeking funds and investors seeking returns.

Imagine the stock market as a giant auction house, where companies are selling tickets to their businesses. Investors, eager to get their hands on these tickets, bid against each other to own a slice of these companies. The more investors want a particular company’s shares, the higher the price of those shares will climb. And just like any other auction, the goal of investors is to buy low and sell high, aiming to make a profit off the difference.

Ready to join the stock market adventure? Before you dive in headfirst, let’s cover some key terms:

– **Stock:** A share of ownership in a company.

– **Stock Market:** The marketplace where stocks are bought and sold.

– **Stock Exchange:** A regulated marketplace where stocks are traded.

– **Share Price:** The current market value of one share of stock.

– **Dividend**: A portion of a company’s profits paid out to shareholders.

Understanding the Basics of the Stock Market for Beginners

When it comes to investing, the stock market can seem like a daunting maze—but fear not, my fellow newbies! We’re here to break it down for you, one step at a time. Get ready to dive into the exciting world of stocks, where patience, strategy, and a touch of luck can lead to financial rewards.

Investing in Stocks

So, what does it mean to "invest in stocks"? Think of it as owning a tiny piece of a company. When you buy a stock, you become a shareholder, which entitles you to a slice of the company’s profits (if it makes any!). As the company grows and its value increases, so does the value of your stock. And that’s where the fun begins.

Understanding Stock Market Basics

Now, let’s get to grips with some stock market lingo. When the value of a stock goes up, we say it has "appreciated." Conversely, when its value drops, it has "depreciated." The difference between the purchase price and the selling price is your "profit" or "loss."

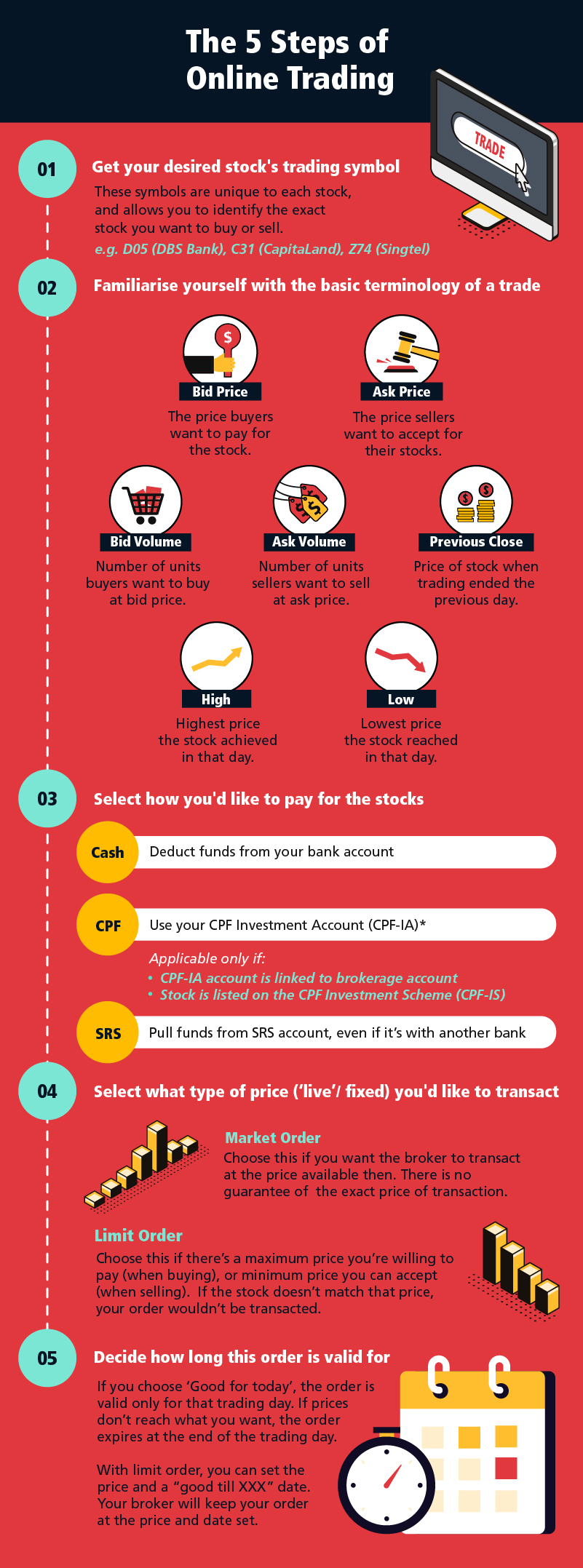

Stocks are traded on exchanges, where buyers and sellers come together to negotiate prices. The "bid price" is the highest price someone is willing to pay for a stock, while the "ask price" is the lowest price a seller is willing to accept. When the bid and ask prices meet, a trade occurs.

Factors Influencing Stock Prices

What makes stock prices fluctuate like a rollercoaster ride? It all boils down to supply and demand. When more people want to buy a stock (i.e., demand is high), its price tends to rise. Conversely, when more people want to sell a stock (supply is high), its price falls.

Other factors that can sway stock prices include economic conditions, political events, company news, and even global events. It’s like a giant game of Monopoly, where external events can shake up the board and change your fortune in an instant.

Types of Stocks

Not all stocks are created equal. There are two main types: common stocks and preferred stocks. Common stocks represent ownership in a company and entitle you to voting rights and the potential for dividends. Preferred stocks, on the other hand, offer a fixed income, but usually don’t carry voting rights.

Getting Started with the Stock Market

Ready to take the plunge? Here are some tips for getting started:

- Do your research. Learn about different companies, industries, and investment strategies.

- Start small. Don’t risk more money than you can afford to lose.

- Diversify your portfolio. Invest in a variety of stocks to reduce your risk.

- Don’t try to time the market. It’s nearly impossible, so focus on long-term investing instead.

- Be patient. Building wealth in the stock market takes time and patience.

Basics of the Stock Market for Beginners

Navigating the stock market can seem daunting for beginners, but understanding its fundamentals is crucial. Let’s break it down into manageable chunks, starting from scratch.

What is the Stock Market?

The stock market is where companies sell pieces of themselves called “shares” to investors. Investors buy these shares with the hope of making a profit when the value of the shares goes up, allowing the company to raise money to grow its business.

Stock Prices

The value of a stock is determined by supply and demand. When more people want to buy a stock than sell it, the price goes up. Conversely, if more people want to sell a stock than buy it, its price falls.

Stock Market Indexes

Indexes like the S&P 500 track the performance of a group of stocks, providing an overview of the market’s health. For example, the S&P 500 tracks the performance of the largest 500 U.S. companies. When the S&P 500 goes up, it usually means the overall stock market is doing well.

Types of Stocks

There are two main types of stocks: common stock and preferred stock. Common stock represents ownership in a company and usually comes with voting rights. Preferred stock has a higher claim on the company’s assets and dividends than common stock but typically doesn’t carry voting rights.

Making Money in the Stock Market

There are two main ways to make money in the stock market: capital appreciation and dividends. Capital appreciation is when you sell a stock for more than you paid for it. Dividends are regular payments made by companies to shareholders, usually out of their profits.

Risks of the Stock Market

Investing in the stock market involves risk. The value of stocks can go up and down, and you can lose money. However, over the long term, the stock market has historically trended upward.

Conclusion

Understanding the basics of the stock market is essential for beginners. By learning about stock prices, indexes, types of stocks, and risks, you can make informed investment decisions and potentially grow your wealth over time.

Basics of the Stock Market for Beginners

Are you ready to learn the ABCs of the stock market? Don’t worry, we’ve got you covered. Investing in stocks can seem daunting, but it doesn’t have to be. Strap on your thinking caps, folks, and let’s dive into the financial playground.

What Are Stocks?

Think of stocks as tiny pieces of a huge puzzle. Each piece represents a slice of ownership in a company. When you buy a stock, you’re essentially becoming a fractional owner of that business. The price of the stock fluctuates based on supply and demand, so it’s like playing a game of musical chairs with your money.

Understanding the Market

The stock market is a vast ecosystem where buyers and sellers mingle. It’s like a giant flea market, but instead of trinkets, they’re trading pieces of companies. The prices of stocks are determined by a complex dance of factors, such as company performance, economic conditions, and even the weather!

Stock Exchanges

Meet the matchmakers of the stock market: stock exchanges. These venues are where buyers and sellers meet to exchange their stock shares. The New York Stock Exchange, for example, is one of the most famous exchanges in the world. Think of it as the Grand Central Station of stock trading.

Types of Stocks

Just like snowflakes, no two stocks are exactly alike. There are different types, each with its own flavor. Common stocks give you a piece of the company’s earnings, while preferred stocks offer a fixed dividend. It’s like choosing between a pepperoni pizza or a veggie delight.

Risk and Reward in Stocks

Every investment comes with a side of risk. Stocks are no exception. They can go up in value, but they can also take a nosedive. It’s like bungee jumping: the thrill is real, but so is the potential for a nasty landing. However, if you play your cards right, stocks can offer the potential for big rewards. It’s the age-old adage: "With great risk comes great reward."

Basics of the Stock Market for Beginners

Exploring the stock market can be daunting for beginners, but understanding its fundamentals will set you on the path to financial literacy. This article will provide you with a comprehensive guide to the basics of the stock market, empowering you to make informed decisions about your investments.

Getting Started with Stocks

Investing in stocks involves considering your financial aspirations and researching potential companies. Creating a diversified portfolio is crucial to spread your risk across various industries and assets. Remember to invest gradually, avoiding large, risky bets.

Understanding Stocks

Stocks represent ownership shares in publicly traded companies. When you buy a stock, you become a partial owner of that company and are entitled to a share of its profits (dividends) and any potential appreciation in its value.

Stock Market Indexes

Stock market indexes are benchmarks that track the performance of a group of stocks. Well-known indexes include the Dow Jones Industrial Average (DJIA), Nasdaq Composite, and S&P 500. These indexes provide insights into the overall health of the stock market.

Types of Stocks

There are various types of stocks, including common stocks, preferred stocks, and growth stocks. Common stocks represent the majority of publicly traded companies and offer voting rights to shareholders. Preferred stocks provide consistent dividends but typically don’t offer voting rights. Growth stocks are issued by companies expected to experience rapid growth in the future.

Stock Exchanges

Stock exchanges are marketplaces where stocks are bought and sold. The New York Stock Exchange (NYSE) and Nasdaq are two of the world’s largest stock exchanges. Investors can access these markets through brokerage firms.

Stock Market Volatility

The stock market is constantly fluctuating, experiencing both gains and losses. Volatility can be influenced by economic factors, political events, and company-specific news. It’s important to understand that investing in stocks entails potential risks and rewards.

Investing Strategies

There are various investing strategies to choose from, such as value investing, growth investing, and income investing. Value investing involves buying stocks that are undervalued relative to their intrinsic worth. Growth investing focuses on companies with high growth potential. Income investing prioritizes stocks that pay regular dividends.

No responses yet