Introduction

Are you looking to break into the real estate market without the hassle of managing properties? Real estate investment trusts, or REITs, offer a unique opportunity to invest in real estate without the traditional headaches. Think of REITs as a gateway to the world of real estate investing, providing a diversified portfolio of properties that you can access with a simple investment.

REIT Basics

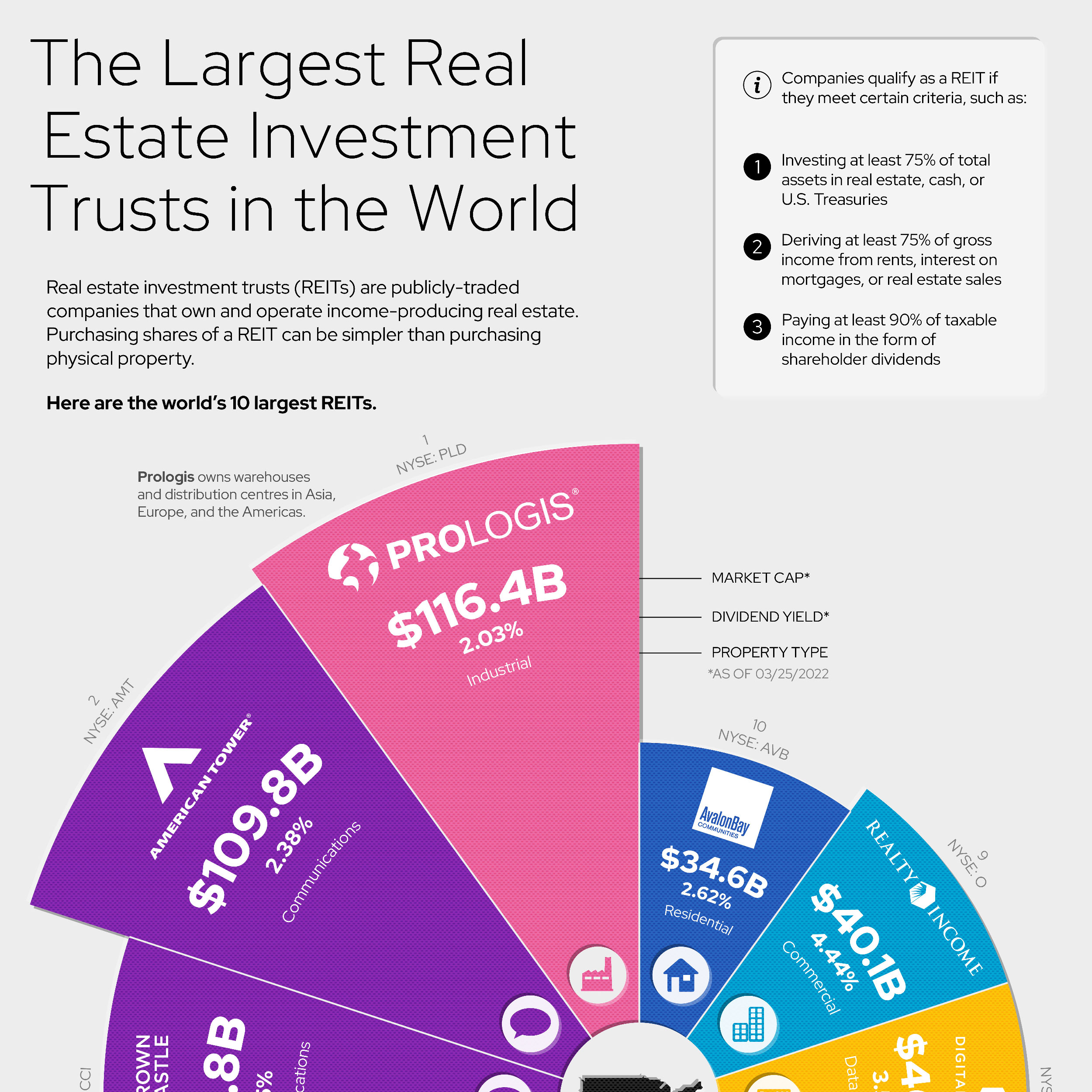

REITs are companies that own and operate income-generating real estate properties. They pass the majority of their profits, at least 90%, on to their shareholders in the form of dividends. This structure allows investors to benefit from the cash flow generated by these properties without the responsibilities of direct ownership. It’s like having a stake in a real estate empire without the need to fix leaky faucets or deal with demanding tenants.

REITs come in various flavors, each specializing in different property types. Whether you’re looking to invest in apartments, office buildings, or healthcare facilities, there’s a REIT that caters to your preference. They offer investors diversification and exposure to a wider range of real estate markets, reducing the risk of putting all your eggs in one basket.

What’s more, REITs are publicly traded, making them easily accessible to individual investors. You can buy and sell REIT shares on the stock market, just like any other stock. This liquidity provides flexibility and allows you to adjust your investment strategy as needed.

However, it’s important to remember that REITs are subject to market fluctuations, and their value can rise and fall. They also carry certain fees and expenses. Before investing, it’s crucial to conduct thorough research, consider your risk tolerance, and consult with a financial advisor if necessary.

Top REITs to Consider

Now that you have a solid understanding of REITs, let’s explore some of the top performers in the industry. These REITs have consistently delivered strong returns to their investors and have a track record of success.

1. Realty Income Corporation (O): Realty Income is a blue-chip REIT with a 50-year history of dividend payments. It specializes in retail properties and has a portfolio of over 11,000 properties.

2. Prologis Inc. (PLD): Prologis is a global leader in logistics real estate, owning and operating warehouses and distribution centers worldwide.

3. Crown Castle International Corp. (CCI): Crown Castle is a telecommunications REIT that owns and leases cell towers and other infrastructure assets.

4. American Tower Corporation (AMT): American Tower is another telecommunications REIT, specializing in wireless communication infrastructure.

5. Hannon Armstrong Sustainable Infrastructure Capital (HASI): Hannon Armstrong is a niche REIT that invests in sustainable infrastructure, such as renewable energy projects and energy-efficient buildings.

Remember, this article is not intended as financial advice, and you should always conduct your own research and consult with a financial professional before making any investment decisions.

Best Real Estate Investment Trusts: Unveiling the Secrets of Smart Investing

In the realm of real estate investment, the term “REITs” resonates like a symphony to investors seeking steady returns and wealth accumulation. These Real Estate Investment Trusts offer a symphony of advantages, making them a prudent choice for savvy investors.

Advantages of Investing in REITs

The allure of REITs lies in their array of benefits, each note harmoniously contributing to their appeal. Firstly, diversification plays a pivotal role. REITs allow investors to spread their investments across a wide spectrum of real estate assets, mitigating the risks associated with any single property.

Secondly, liquidity is a key attribute of REITs. Unlike traditional real estate investments, REITs trade on stock exchanges, providing investors with the ability to enter and exit positions quickly and efficiently. This flexibility is akin to a liquid asset, allowing investors to adjust their portfolios as needed.

Thirdly, professional management is an indispensable aspect of REIT investing. REITs are managed by experienced professionals who possess deep knowledge of the real estate market. This expertise ensures that investors benefit from a team of experts dedicated to maximizing returns and minimizing risks, much like a symphony conductor orchestrating a captivating performance.

Furthermore, REITs offer the potential for stable income through regular dividend payments. These dividends are often supported by long-term lease agreements, providing investors with a steady stream of passive income.

Finally, REITs provide access to a broader range of real estate assets than most individual investors could acquire on their own. This accessibility allows investors to diversify their portfolios with assets that may not be readily available, such as healthcare facilities, data centers, and student housing.

No responses yet