Passive Income: A Guide to Earning Money While You Sleep

In this fast-paced world, earning extra income can be a daunting task. But what if you could generate money without actively working? Passive income is the answer, and here are a few examples to get you started:

Dividend Stocks

Dividend-paying stocks are a time-tested way to create passive income. Companies that earn profits often distribute a portion of those profits to shareholders in the form of dividends. This can provide you with a regular stream of income, regardless of whether the stock price goes up or down.

Over time, dividends can accumulate and compound, growing your wealth even further. However, it’s important to note that dividend payments are not guaranteed and can be reduced or eliminated at any time.

Rental Properties

If you’re willing to invest in real estate, rental properties can be an excellent source of passive income. By renting out a home or apartment, you can collect monthly rent payments from tenants. This can provide you with a steady cash flow, as long as the property is well-maintained and occupied.

However, being a landlord comes with its own set of responsibilities, such as finding tenants, collecting rent, and dealing with repairs. It’s important to weigh the potential income against the potential headaches before making a decision.

Affiliate Marketing

Affiliate marketing is a low-risk way to earn passive income. By partnering with businesses, you can promote their products or services on your website or social media channels. If someone clicks on your affiliate link and makes a purchase, you earn a commission.

The key to success in affiliate marketing is finding products or services that you’re genuinely interested in and that align with your audience’s interests. This way, you can create content that is both valuable and persuasive.

Online Courses

If you have a specialized skill or knowledge, you can create and sell online courses. Once you’ve created the course, it can generate passive income for years to come. As long as people are interested in the topic, you’ll continue to make sales.

The beauty of online courses is that they can be automated. You can set up a system to deliver the course content, answer questions, and process payments. This allows you to focus on creating new content and growing your business.

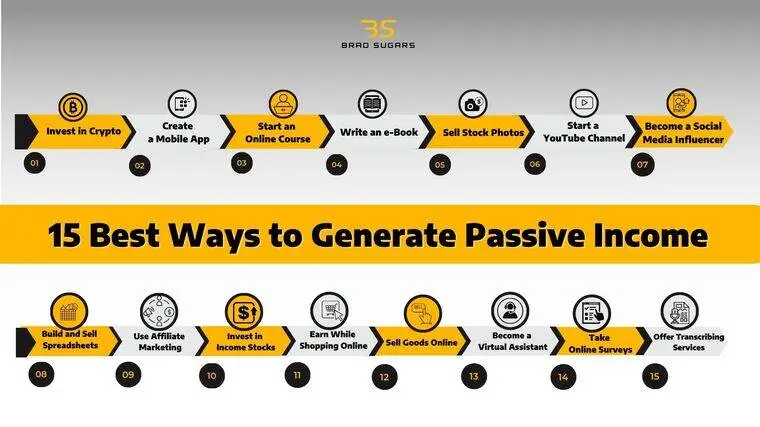

Examples of Passive Income: Ways to Make Money While You Sleep

Passive income has become an increasingly popular concept in today’s digital age. It allows individuals to generate income without actively working, providing a potential source of financial freedom. Let’s explore some practical examples that showcase the diverse ways one can create passive income streams.

Affiliate Marketing

Affiliate marketing is a classic form of passive income. You partner with businesses and promote their products or services on your platform. For every sale made through your unique referral link, you earn a commission. This method requires building a loyal audience or following, but it can be a lucrative endeavor with minimal upfront costs.

Online Courses

Creating and selling online courses is another excellent passive income option. Share your knowledge and expertise by crafting courses that teach valuable skills or information. Once you’ve developed your content, it can continue to generate income passively as students purchase and enroll in your courses.

Dividend Investing

Investing in dividend-paying stocks can provide a steady stream of passive income. When a company distributes profits to its shareholders, you may receive regular dividends, which can supplement your other income sources. It’s important to note that dividend payments are not guaranteed and can vary depending on the company’s financial performance.

Rental Properties

Owning and renting out properties can be a more traditional but still effective way to generate passive income. Rental income can cover your mortgage payments and generate a profit, providing a potential source of financial stability. However, it does require a significant upfront investment and ongoing costs, such as property maintenance and repairs.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors. As an investor, you can lend money to individuals or businesses and earn interest on the loans. Returns can vary depending on the risk profile of the borrowers and the platform you choose. Peer-to-peer lending provides an alternative way to diversify your passive income streams while also supporting economic growth.

No responses yet