How to Find ROI: A Comprehensive Guide

Every business owner wants to know if their marketing efforts are paying off. That’s where return on investment (ROI) comes in. Calculating ROI tells you how much money you’re making or losing on a specific investment or campaign. It’s a critical metric for determining what’s working and what isn’t. But how do you actually calculate ROI?

Identify and Measure

The first step in calculating ROI is to identify the relevant costs and benefits associated with the investment. This includes things like the cost of acquiring new customers, the amount of revenue generated by those customers, and any other costs or benefits associated with the investment. Once you have a clear understanding of the costs and benefits, you can calculate the net profit.

Net profit is simply the revenue generated by the investment minus the costs associated with the investment. To calculate ROI, you divide the net profit by the cost of the investment. The result is a percentage that represents the return on your investment. For example, if you invest $1,000 in a marketing campaign and generate $2,000 in revenue, your net profit is $1,000. Your ROI is 100%, or 1:1.

It’s important to note that ROI is not always a simple calculation. There are many factors that can affect ROI, such as the time frame of the investment, the competition, and the overall economy. However, by following the steps outlined above, you can get a good estimate of your ROI and make informed decisions about your marketing investments.

How to Find ROI

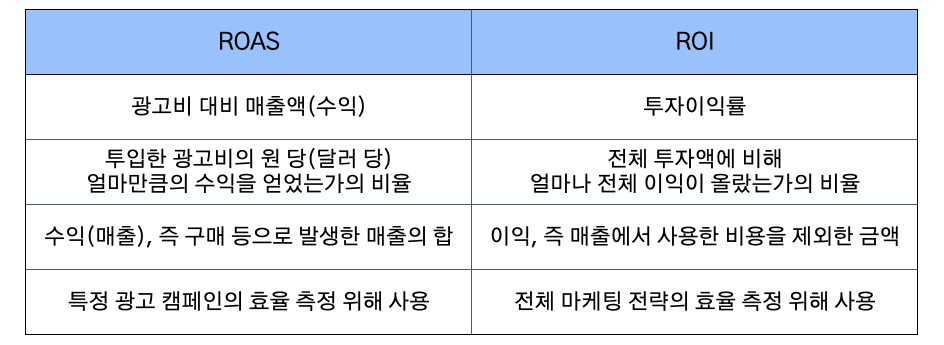

Return on investment (ROI) is a crucial metric for assessing the profitability of your investments. It measures the amount of profit you generate compared to the amount you invested and is expressed as a percentage. Calculating ROI can help you make informed decisions about where to allocate your resources and whether your investments are yielding positive results.

Steps to Calculate ROI

To calculate ROI, you need to gather the following information:

Once you have these figures, you can use the following formula to calculate ROI:

“`

ROI = (Total Revenue – Total Investment Cost) / Total Investment Cost x 100

“`

Analyze Results

Once you have calculated your ROI, it’s important to analyze the results to assess profitability. Compare your ROI percentage to industry benchmarks or other investment options to see how your investment stacks up. If your ROI is below the benchmark or below your expectations, you may need to reconsider your investment strategy.

In addition to comparing your ROI to benchmarks, you can also use it to track the performance of your investment over time. This can help you identify trends and make adjustments as needed. For example, if you see that your ROI is declining, you may need to investigate the reasons why and make changes to improve performance.

Example of ROI Calculation

Let’s say you invested $10,000 in a stock that generated $12,000 in revenue. Using the ROI formula above, we can calculate the ROI as follows:

“`

ROI = (12,000 – 10,000) / 10,000 x 100

“`

“`

ROI = 20%

“`

In this example, your ROI is 20%, which means that you earned a profit of $2,000 on your investment. This information can help you decide whether the investment was worth it and whether you want to continue investing in the same stock or explore other options.

No responses yet