Vanguard High Dividend Yield ETF

In the realm of investing, generating passive income through dividends has long been a popular strategy. For those seeking exposure to high-yield dividend-paying stocks, the Vanguard High Dividend Yield ETF (VYM) stands out as a compelling option. This ETF offers investors the opportunity to tap into a diversified portfolio of dividend-rich companies, providing a steady stream of income while potentially enjoying long-term capital appreciation.

Vanguard High Dividend Yield ETF: A Closer Look

Launched in 2006, VYM has become one of the largest and most well-known dividend ETFs in the market. It tracks the FTSE High Dividend Yield Index, which consists of approximately 400 companies listed on U.S. exchanges. These companies are carefully selected based on their high dividend yields, sustainable dividend payout ratios, and long-term growth potential.

VYM’s portfolio is heavily concentrated in sectors known for paying high dividends, such as utilities, financials, and consumer staples. By investing in a broad range of companies across different industries, VYM aims to minimize risk while maximizing dividend income. The ETF’s dividend yield currently stands at around 3.5%, which is significantly higher than the average dividend yield of the S&P 500 Index.

One of the key advantages of VYM is its low expense ratio of just 0.06%. This means that investors can keep more of their hard-earned returns, as they are not paying hefty fees to the fund manager. Additionally, VYM reinvests its dividends, which allows investors to benefit from the power of compounding over time.

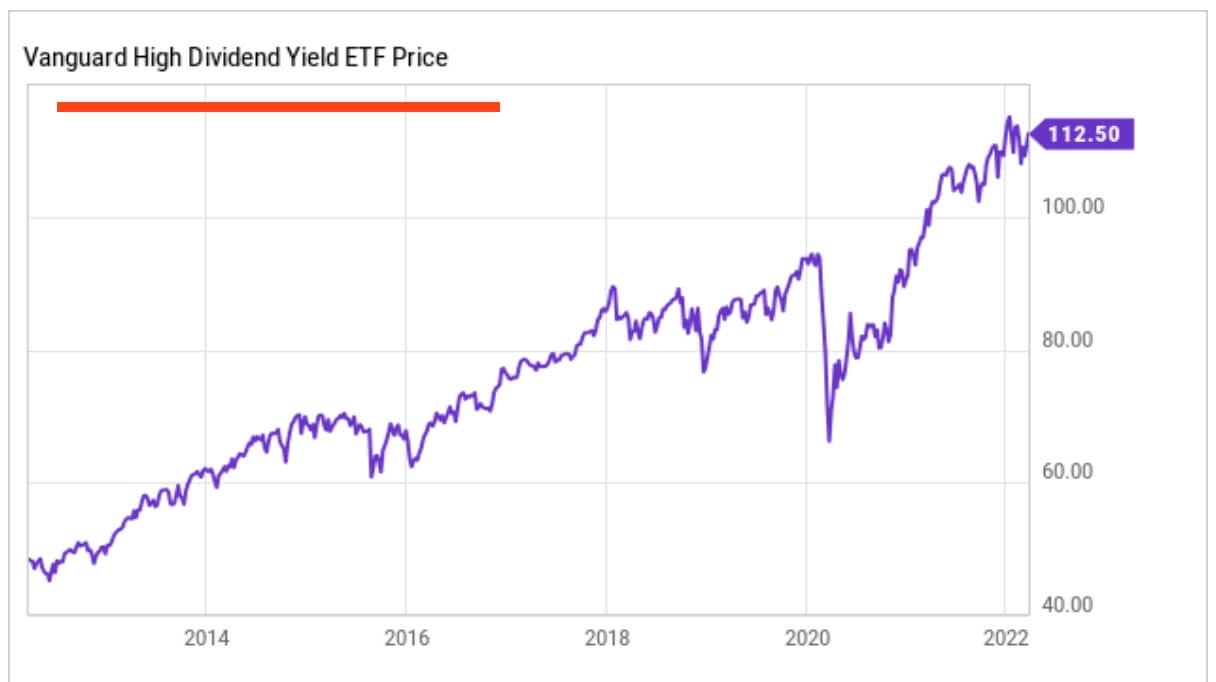

VYM has a proven track record of delivering consistent dividend income and capital appreciation. Since its inception, the ETF has outperformed the S&P 500 Index in terms of total return. However, it’s important to remember that all investments carry some level of risk, and dividend yields can fluctuate over time.

Is VYM Right for You?

If you’re looking for an ETF that can provide you with a steady stream of dividend income while potentially delivering long-term growth, VYM is worth considering. It’s a well-diversified ETF with a low expense ratio and a strong track record. Whether you’re a seasoned investor or just starting out, VYM can be a valuable addition to your portfolio.

High Dividend Yield ETF Vanguard

Investing in a high dividend yield ETF Vanguard is an attractive option for income-minded investors seeking regular income streams and potential capital appreciation over the long haul. These ETFs offer a basket of dividend-paying stocks, providing diversification and potentially reducing the risk associated with investing in individual companies.

Benefits

Investing in high dividend yield ETF Vanguard offers several potential benefits, including:

1. Income generation: These ETFs primarily invest in companies with a history of paying regular dividends. By distributing a portion of their earnings to shareholders, these ETFs provide a steady stream of income that can supplement other sources of income or be reinvested for future growth.

2. Potential capital appreciation: While dividend-paying stocks tend to be less volatile than growth stocks, they still have the potential for capital appreciation over the long term. As the underlying companies grow their earnings and dividend payments, the value of the ETF shares may also rise.

3. Diversification: High dividend yield ETF Vanguard typically invest in a broad range of companies across different industries and sectors. This diversification helps to reduce the overall risk of the investment, as the performance of any one company is unlikely to significantly impact the overall value of the ETF.

4. Tax efficiency: Dividend payments from ETFs are generally considered qualified dividends, which are taxed at a lower rate than ordinary income. This tax advantage can further enhance the overall return on investment for investors.

5. Convenience: Investing in high dividend yield ETF Vanguard provides a convenient way to access a diversified portfolio of dividend-paying stocks. Instead of researching and selecting individual stocks, investors can invest in a single ETF that provides exposure to a broad range of companies.

High Dividend Yield ETF Vanguard

In the ever-evolving landscape of investment opportunities, exchange-traded funds (ETFs) have emerged as formidable contenders. Among these, the High Dividend Yield ETF from Vanguard stands out as a beacon for income-seeking investors. But before diving into this dividend-rich pool, let’s delve into the intricacies of this fund and explore its potential rewards and potential pitfalls.

Rewards

The High Dividend Yield ETF Vanguard offers an enticing blend of current income and long-term growth potential. By investing in a basket of high-dividend-paying stocks, the fund provides investors with a steady stream of dividend payments. These dividends can be an invaluable source of income, especially for retirees or those seeking to supplement their monthly cash flow.

Moreover, the fund’s dividend yield is typically higher than the yields offered by traditional fixed-income investments such as bonds or money market accounts. This higher yield has the potential to outpace inflation and provide investors with a hedge against rising prices.

Risks

As with any investment, there are inherent risks associated with the High Dividend Yield ETF Vanguard. One of the key risks to consider is market volatility. The fund’s dividend yield is not guaranteed and can fluctuate based on the performance of the underlying stocks. Market downturns can lead to reduced dividends or, in extreme cases, dividend cuts.

Another risk to be aware of is interest rate risk. Interest rates have a significant impact on the value of dividend-paying stocks. Rising interest rates can make fixed-income investments more attractive, leading to a decrease in the demand for dividend stocks and a potential decline in their share prices.

Furthermore, the fund’s focus on high-dividend-paying stocks can lead to a concentration of holdings in certain sectors or industries. This concentration can increase the fund’s vulnerability to downturns in specific sectors or economic conditions. For instance, if the fund has a heavy concentration in utilities stocks and interest rates rise, the fund’s performance may suffer as investors shift their investments to higher-yielding fixed-income investments.

Lastly, the fund’s expense ratio, which covers the costs of managing the fund, can reduce the overall return for investors. It is important to consider the expense ratio when evaluating the potential benefits of the fund.

High Dividend Yield ETF: Vanguard’s Income-Boosting Opportunity

Vanguard, a renowned investment management company, offers a tantalizing investment opportunity for those seeking a steady stream of income and long-term growth potential: the High Dividend Yield ETF (VYM). This ETF is a carefully curated basket of high-dividend-paying stocks, providing investors with a chance to capitalize on the income-generating prowess of established companies.

Dividend Yield Magic

The High Dividend Yield ETF boasts an impressive dividend yield, far exceeding that of the broader market. This yield stems from the ETF’s focus on companies with a history of consistent dividend payments. In essence, it’s like having a collection of income-producing powerhouses working for you day and night.

Suitability

The VYM ETF is tailor-made for investors who prioritize income while balancing moderate risk. If you’re looking to shore up your retirement savings, supplement your current income, or simply seek a steady flow of dividends, this ETF is worth considering. It’s not just a short-term fix; the ETF’s underlying stocks have a track record of long-term growth potential, paving the way for both current income and future appreciation.

Risk Management

Investing always carries some degree of risk, and the VYM ETF is no exception. However, the ETF’s diversification strategy helps mitigate risk. By investing in a wide range of high-dividend-paying companies across various industries and sectors, the ETF reduces the impact of any single company’s performance on the overall portfolio. Think of it as not putting all your eggs in one basket, but rather spreading them across several baskets.

Performance History

The VYM ETF has a proven track record of delivering on its promise. Over the past decade, the ETF has consistently outperformed the broader market, generating substantial returns for investors. Its dividend yield has remained stable even during market downturns, providing a much-needed income stream when other investments were struggling.

No responses yet