Introduction

Are you looking for a way to generate income from your investments? If so, you may want to consider high yield dividend investing. This strategy involves investing in companies that pay high dividends relative to their stock price. Dividends are payments made by companies to their shareholders, and they can be a great source of passive income. In this article, we will discuss the basics of high yield dividend investing and provide you with some tips for getting started.

What is High Yield Dividend Investing?

High yield dividend investing is a strategy that involves investing in companies that pay high dividends. Dividends are payments made by companies to their shareholders, and they can be a great source of passive income. Companies that pay high dividends tend to be large, well-established companies with a history of profitability. They may also be companies that are in industries that are not expected to grow rapidly in the future.

The yield on a stock is calculated by dividing the annual dividend by the current stock price. For example, if a stock is trading at $50 per share and pays an annual dividend of $2, the yield would be 4%. High yield dividend stocks typically have yields of 5% or more.

There are a number of benefits to investing in high yield dividend stocks. First, dividends can provide you with a steady stream of income. Second, dividend payments can help to offset the effects of inflation. Third, high yield dividend stocks can provide you with some protection against market downturns.

However, there are also some risks associated with investing in high yield dividend stocks. First, high yield dividend stocks may be more volatile than other stocks. Second, companies that pay high dividends may be more likely to cut or eliminate their dividends in the future. Third, high yield dividend stocks may not be a good investment if you are looking for capital appreciation.

High Yield Dividend Investing: A Path to Financial Stability and Growth

High yield dividend investing is a smart investment strategy that allows you to generate passive income while diversifying your portfolio for enhanced returns. Dividends, which are payments made to shareholders from a company’s earnings, offer several notable advantages.

Benefits of High Yield Dividend Investing

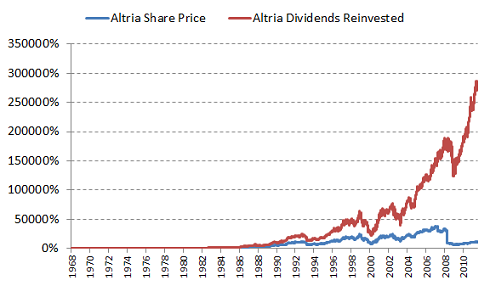

Firstly, high yield dividend investing provides a steady stream of income. Unlike interest payments on bonds, dividends are typically paid out quarterly or annually. This regular income can be a valuable supplement to your retirement fund or help you reach your financial goals sooner. Secondly, dividends can help diversify your portfolio. Stocks and bonds tend to have different risk profiles, so adding dividend-paying stocks to your portfolio can help spread out your risk and reduce volatility. Finally, dividends have the potential to enhance your overall returns. Over the long term, reinvested dividends can compound significantly, potentially boosting your investment value.

How to Invest in High Yield Dividend Stocks

Selecting high yield dividend stocks requires careful analysis and consideration. Start by looking at the company’s financial health, including its earnings, debt, and cash flow. A strong financial position indicates a greater ability to pay dividends consistently. Additionally, consider the company’s industry and economic conditions.

Next, evaluate the dividend yield. The yield, expressed as a percentage, shows how much a company pays in dividends compared to its stock price. While a high yield may be tempting, don’t chase after it recklessly. It’s essential to look at the company’s history of dividend payments and its commitment to maintaining dividends in the future.

Finally, consider the company’s payout ratio, which shows the percentage of earnings paid out as dividends. A high payout ratio may indicate that the company is prioritizing dividends over reinvestment in its business. Look for companies with a moderate payout ratio that allows for both dividend payments and future growth.

The Bottom Line

High yield dividend investing can be a rewarding strategy for generating steady income, diversifying your portfolio, and potentially boosting your returns. By carefully selecting dividend-paying stocks with strong fundamentals and a commitment to dividend payments, you can unlock the power of this investment strategy and put yourself on a path to financial stability and growth.

High Yield Dividend Investing: A Lucrative but Risky Endeavor

In the realm of investing, there’s an alluring beacon that draws seekers of high returns: high yield dividend investing. These investments promise tantalizing returns, often much higher than traditional bonds or savings accounts. But like any siren’s song, this allure comes with its share of pitfalls.

Risks of High Yield Dividend Investing

Before casting your lot with high yield dividend stocks, it’s imperative to understand the potential risks lurking beneath their alluring surface. These risks can be as treacherous as walking a tightrope without a safety net.

Volatility: High yield dividend stocks are considered more “flighty” than their low-yielding counterparts. Their prices can swing wildly, leaving investors on a roller coaster of emotions. Just as a storm can uproot a towering oak, a sudden market downturn can send high yield dividend stocks plummeting.

Underlying Financial Issues: Companies that offer high yield dividends often do so as a form of compensation for their underlying financial struggles. These companies may be carrying a heavy debt burden or facing declining revenues. Investing in such companies is akin to buying a car with a faulty engine – you’re likely to encounter costly repairs down the road.

Dividend Cuts: The allure of high yield dividends can be fleeting. If a company’s financial health deteriorates, it may be forced to slash its dividend payments. This can leave investors with a rude awakening – like a boxer who suddenly finds himself on the ropes after a devastating punch.

Investing in High-Yield Dividends: A Path to Financial Stability

High yield dividend investing has emerged as a popular strategy for income-oriented investors seeking financial stability. By selecting companies with a track record of paying dividends and strong financial fundamentals, investors can potentially enjoy consistent income while growing their wealth over time.

How to Identify High Yield Dividend Stocks

Identifying high yield dividend stocks requires careful research and analysis. Here are some key factors to consider:

-

Dividend History: Companies with a long and consistent history of paying dividends are more likely to continue doing so in the future. Look for companies that have paid dividends for at least five years, preferably longer.

-

Financial Fundamentals: Dividend-paying companies should have strong financial fundamentals, including profitability, low debt levels, and positive cash flow. Examine their income statements, balance sheets, and cash flow statements to assess their financial health.

-

Payout Ratio: The payout ratio measures the percentage of earnings paid out as dividends. A payout ratio below 50% indicates that the company is retaining sufficient earnings for growth and stability.

-

Coverage Ratio: The coverage ratio measures the number of times earnings per share (EPS) exceeds dividend per share (DPS). A coverage ratio of two or more is generally considered safe, as it provides a buffer against potential dividend cuts.

-

Industry Outlook: Companies in growing industries are more likely to maintain or increase their dividends over time. Consider the industry trends, competitive landscape, and regulatory environment to assess the long-term prospects of potential investments.

High-Yield Dividend Investing: A Lucrative Approach

High-yield dividend investing offers a tantalizing opportunity to generate passive income. With carefully selected investments, investors can reap significant rewards while mitigating risks. Here’s a journalistic exploration of this alluring investment strategy, complete with tips to help you navigate the world of high-yield dividends.

Tips for High Yield Dividend Investing

Company Fundamentals: The Foundation of Success

When considering a high-yield dividend-paying company, it’s crucial to delve into its fundamentals. Scrutinize the company’s industry and competitive landscape. A stable and growing industry bodes well for dividend sustainability. Similarly, a strong management team with a proven track record of navigating market challenges can inspire confidence.

Moreover, don’t overlook a company’s long-term growth prospects. A company with a solid business plan and a visionary leadership team is more likely to maintain or even increase dividend payments down the road. Remember, dividends should not be the sole basis for investment decisions.

Dividend Sustainability: A Balancing Act

Dividend sustainability is paramount for any high-yield dividend investor. While a high dividend yield can be alluring, it’s not a guarantee of future payments. Assess a company’s debt levels and cash flow to verify its ability to continue paying dividends. A company with low debt and consistent cash flow can usually sustain dividend payments even during market downturns.

Earnings and Payout Ratio: Keeping an Eye on Cash Flow

Earnings per share (EPS) is a key metric for dividend investors. A company’s EPS should consistently exceed its dividend payout ratio. This ensures that the company has enough earnings to cover both capital expenditures and dividend payments. A low payout ratio indicates that the company has ample room to raise dividends in the future.

Historical Dividend Records: A Tale of Consistency

A company’s dividend history can reveal its commitment to rewarding shareholders. Look for companies with a track record of consistent dividend increases over an extended period. Such stability provides assurance that the company is focused on delivering value to its investors. However, be wary of companies that have recently increased dividends significantly, as this may be a sign of financial strain.

Market Conditions: Riding the Waves

It’s imperative to consider the broader market conditions when investing in high-yield dividends. During periods of strong economic growth, dividend-paying companies tend to thrive. Conversely, during recessions or market downturns, dividend payments may be reduced or even eliminated. Investors should be mindful of these risks and adjust their portfolio accordingly.

In conclusion, high-yield dividend investing can be a lucrative endeavor with the potential for significant returns. By adhering to these tips and conducting thorough due diligence, investors can increase their chances of finding companies that can provide a steady stream of passive income while mitigating risks. Remember, investing in high-yield dividends is not a get-rich-quick scheme; it’s a strategy that requires patience, research, and a keen eye for value.

What Is High Yield Dividend Investing?

In the realm of dividend investing, the allure of high yield can be captivating. High yield dividend investing involves seeking stocks that pay dividends with a yield far above the market average. These companies may be tantalizing for income-minded investors looking to earn a steady stream of passive income.

Benefits of High Yield Dividend Investing

The appeal of high yield dividend investing is undeniable. First and foremost, it can provide investors with a reliable source of income, especially during market volatility. Dividends can supplement their regular income or help cover expenses, offering a degree of financial stability.

Moreover, dividend stocks tend to exhibit lower volatility than non-dividend paying stocks. This stability is due to the fact that companies that pay dividends are typically financially sound and have a history of profitability. As a result, dividend-paying stocks can serve as a ballast in a well-diversified portfolio.

Risks of High Yield Dividend Investing

While high yield dividend investing can be alluring, it is not without its risks. One of the primary concerns is that companies with extremely high dividend yields may be facing financial difficulties. In such cases, the high yield could be a warning sign rather than a sign of strength.

Another risk is that the dividend may be cut or eliminated altogether. This can happen for a variety of reasons, such as a downturn in the company’s business or a change in management strategy. Dividends are never guaranteed, so investors need to be aware of this possibility.

Factors to Consider When Choosing High Yield Dividend Stocks

Selecting high yield dividend stocks requires careful consideration. It’s not simply a matter of picking the stock with the highest yield. Investors need to assess the company’s overall financial health, profitability, and dividend payout history.

One key factor is the dividend payout ratio. This ratio measures the percentage of a company’s earnings that are paid out as dividends. A high payout ratio can be a red flag, as it suggests that the company may not have enough cash flow to sustain the dividend.

Similarly, a company’s debt-to-equity ratio is worth examining. A high ratio can indicate that the company is taking on too much debt, which could put the dividend at risk.

Finding High Yield Dividend Stocks

There are several ways to find high yield dividend stocks. One approach is to screen for stocks with dividend yields above a certain threshold. Another strategy is to look for companies that have a history of increasing their dividends over time, known as dividend growers.

Online resources like Morningstar and Dividend.com can provide valuable data on dividend yields, payout ratios, and other metrics. These tools can help investors narrow down their search and identify potential high yield dividend stocks.

Conclusion:

High yield dividend investing can be a compelling strategy for investors seeking income, diversification, and potential return enhancement. However, it’s crucial to understand the risks and approach it with a thoughtful and balanced perspective. By carefully considering the factors discussed above, investors can increase their chances of success in this often-lucrative realm of dividend investing.

No responses yet