The Untold Secret: How Millionaires Leverage Life Insurance for Wealth Creation

Millionaires have mastered the art of building wealth, and one of their best-kept secrets is using life insurance as a strategic tool. It’s not just about protecting loved ones; it’s about creating a financial fortress that will provide stability and growth for years to come.

Unveiling the Secrets of the Ultra-Wealthy

In the realm of finance, millionaires don’t just stumble upon wealth; they cultivate it with meticulous planning and savvy investment strategies. One of these strategies is leveraging life insurance, an often-overlooked tool that offers a unique blend of protection and wealth accumulation.

By tapping into the power of life insurance, millionaires are able to build a foundation for financial freedom, securing their families’ futures while simultaneously generating passive income. This secret weapon, once only accessible to the elite, is now within reach for anyone willing to explore its potential.

Life insurance may seem like a morbid topic, but it’s anything but. It’s a lifeline for families in the face of tragedy and a cornerstone of financial planning for the wise. It’s like wearing a financial suit of armor, protecting against unforeseen events while simultaneously building a nest egg for the future.

Is a life insurance policy right for you? It depends on your needs and financial goals. However, if you’re looking to build wealth and provide unwavering protection for your loved ones, it’s definitely worth considering. Dive into the details and discover how life insurance can be the secret weapon in your financial arsenal.

**How Millionaires Build Wealth Using Life Insurance**

In the realm of wealth building, millionaires have mastered a secret weapon: life insurance. It’s not just about protection anymore. By leveraging permanent life insurance policies, they’ve unlocked a powerful tool for tax-advantaged savings and long-term growth.

The Power of Permanent Policies

Unlike term life insurance, which provides coverage for a set period, permanent life insurance offers lifelong protection and includes a cash value component. This cash value, which grows tax-deferred, is like a personal piggy bank that you can access tax-free through loans or withdrawals.

How It Works

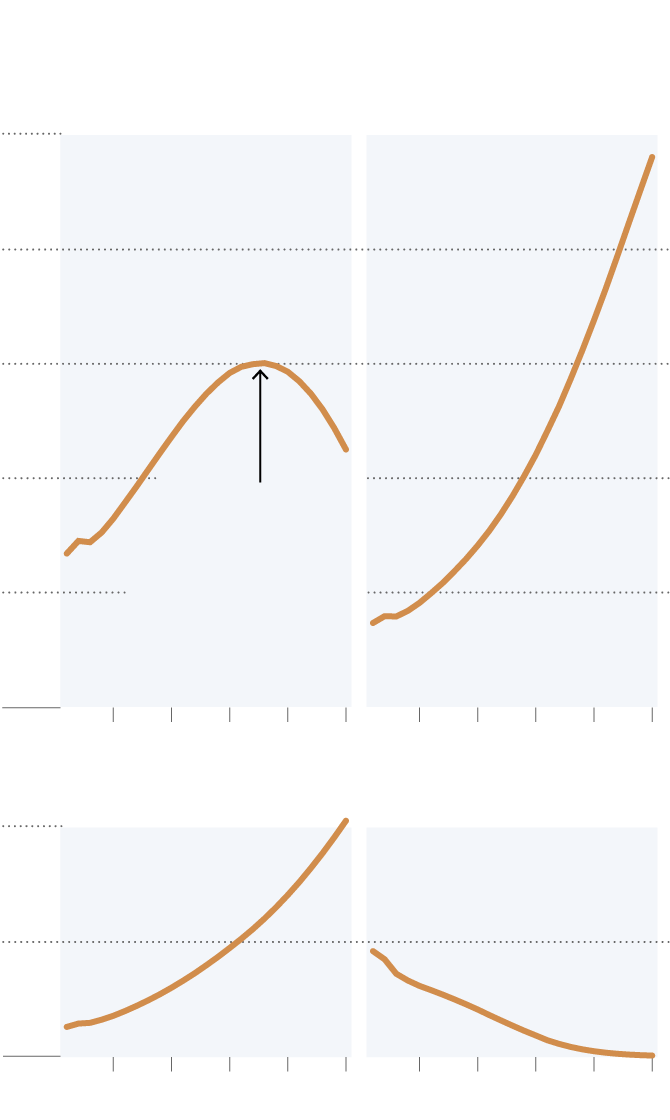

Millionaires understand the time value of money. By investing in permanent life insurance early on, they tap into the compounding effect of tax-deferred growth. Over time, the cash value accumulates, providing a valuable nest egg.

What’s more, life insurance policies offer a “living benefit.” Just like withdrawing funds from a bank account, you can access the cash value of your policy while you’re still alive to cover unexpected expenses, education costs, or even retirement income.

Tax advantages are another major perk. Unlike other investments, the cash value of permanent life insurance grows tax-deferred. This means you won’t pay taxes on the gains until you withdraw or borrow against the policy.

Imagine it like a snowstorm, where the cash value is the accumulating snow. The snow keeps piling up, but you don’t have to shovel it (pay taxes) until you decide to use it.

Why Millionaires Love It

For millionaires, permanent life insurance is a cornerstone of their wealth-building strategies. It’s a safe and reliable way to accumulate tax-advantaged wealth, hedge against inflation, and provide financial security for their families.

In essence, life insurance has become a modern-day wealth engine for those who want to build a secure financial future. By harnessing its power, millionaires are safeguarding their legacies and leaving a lasting impact on generations to come.

How Millionaires Build Wealth Using Life Insurance

Millionaires aren’t just born with a silver spoon in their mouths. They’re not even the lucky winners of a lottery jackpot, although that would be nice. Instead, they’ve worked hard and made astute financial decisions. One of the ways many wealthy people have built their wealth is through life insurance.

Tax-Free Growth of Cash Value

Life insurance policies offer a tax-advantaged investment through their cash value component. A portion of each premium is allocated to a tax-deferred account that earns interest or dividends. The cash value accumulates on a tax-free basis, unlike other investment vehicles where earnings are regularly taxed.

This tax-advantaged growth is a key reason why millionaires have used life insurance to build wealth. It allows them to accumulate a substantial amount of money that can be used for various purposes, such as retirement planning, emergency funds, or purchasing investments. Over time, the cash value can grow exponentially, providing a significant nest egg for individuals.

Tax-Free Access to Cash Value

Policyholders have the ability to access the cash value of their policies through tax-free loans. This feature provides a source of funds for various needs, such as starting a business, investing in real estate, or covering unexpected expenses. The loans are non-recourse, meaning they’re not secured by any collateral. And the interest payments are often tax-deductible.

The ability to borrow against the cash value without affecting the death benefit makes life insurance a versatile financial tool. Millionaires have harnessed this feature to opportunistically invest and grow their wealth without depleting their life insurance coverage. It’s like having a savings account that grows tax-free and can be accessed when needed without incurring tax penalties.

No responses yet