How to Unlock the Wealth-Building Power of Home Equity

Harnessing the power of home equity is a savvy move for homeowners looking to build wealth and secure their financial future. By tapping into the equity you’ve built up in your home, you can access a wealth of opportunities that can help you achieve your financial goals.

Debt Consolidation and Lower Interest Rates

One of the most strategic ways to use home equity is to consolidate debt. When you have multiple high-interest debts, such as credit cards or personal loans, they can eat up a significant chunk of your income. By consolidating these debts into a single home equity loan or line of credit, you can secure a lower interest rate, potentially saving thousands of dollars in interest over time.

Home Improvement and Value Enhancement

Investing in home improvements can not only make your living space more comfortable and enjoyable, but it can also significantly increase the value of your home. By tapping into your home equity, you can finance home improvement projects such as remodeling your kitchen, adding a new bathroom, or upgrading your landscaping. The increased value of your home will not only provide you with a higher selling price when you decide to sell, but it can also qualify you for a higher mortgage amount in the future.

Cash-Out Refinancing and Financial Flexibility

If you have a substantial amount of equity in your home, you may consider a cash-out refinance. This allows you to replace your existing mortgage with a new loan that gives you a lump sum of cash. This cash can be used to fund major expenses, such as educational costs, medical bills, or an investment in a promising business venture. The flexibility of a cash-out refinance provides you with the financial freedom to pursue your aspirations without draining your savings.

How to Use Home Equity to Build Wealth

Harnessing the power of your home’s equity can be a potent tool for financial growth. By accessing the value you’ve built through your mortgage payments, you can unlock a wealth of possibilities to enhance your financial well-being.

Home equity, the difference between the current market value of your property and the outstanding mortgage balance, represents the cushion you’ve created. With prudent planning and savvy strategies, you can tap into this equity to fuel your financial aspirations.

Seeking Professional Advice

Navigating the complexities of home equity can be daunting. Don’t hesitate to seek professional guidance from a financial advisor, attorney, or mortgage specialist. Their expertise can help you:

- Assess your financial situation and goals

- Identify the most suitable strategies for your needs

- Understand the potential risks and rewards

Unlocking Home Equity

There are several avenues to access your home equity:

- Home Equity Loan: A lump-sum loan secured by your home, offering fixed or adjustable interest rates.

- Home Equity Line of Credit (HELOC): A revolving line of credit that allows you to borrow funds as needed up to a predetermined limit.

- Cash-Out Refinance: Replacing your existing mortgage with a new one with a higher loan amount, allowing you to cash out the difference.

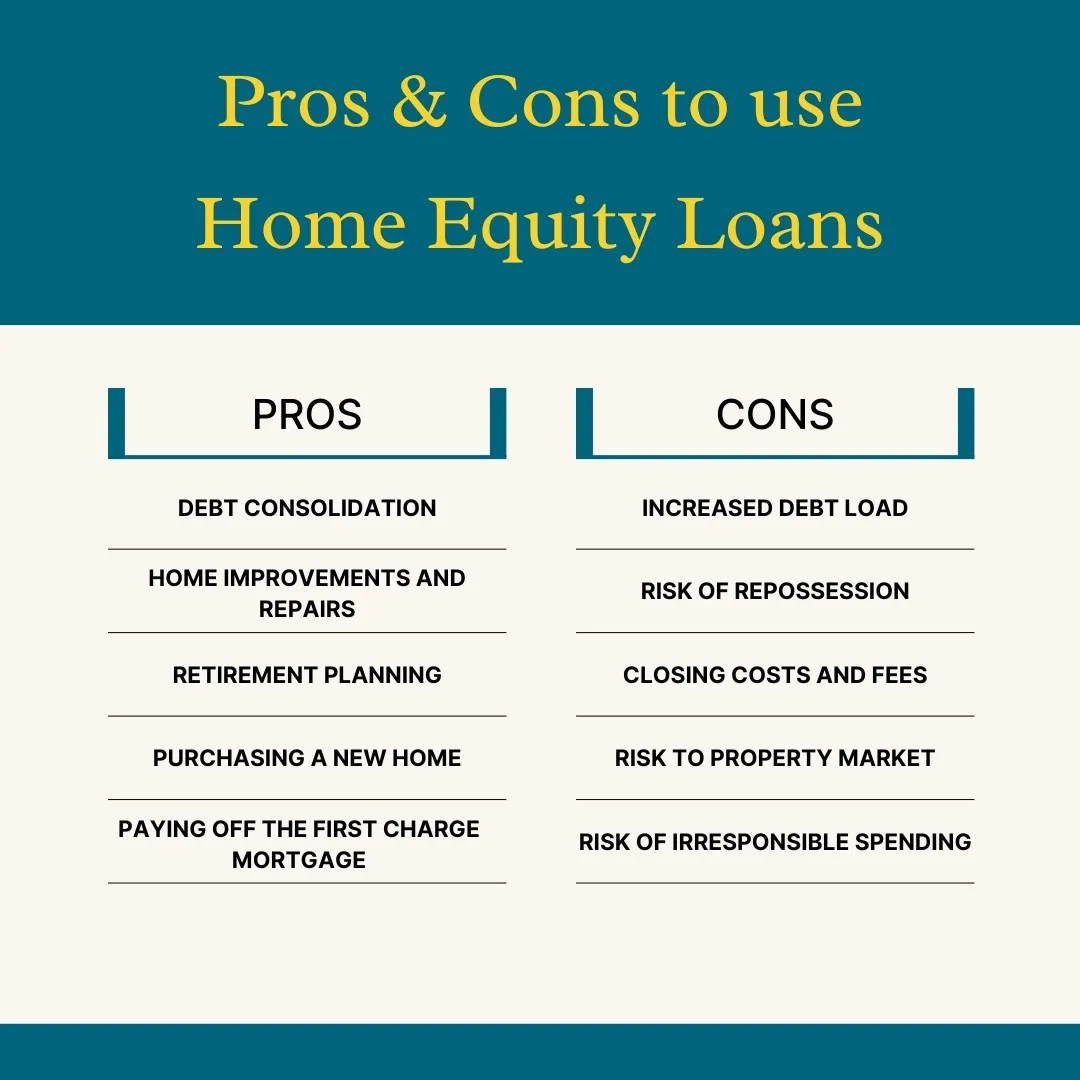

Advantages of Using Home Equity

Leveraging home equity offers various advantages:

- Lower Interest Rates: Home equity loans and lines of credit typically have lower interest rates than personal loans or credit cards.

- Tax Benefits: Interest paid on home equity loans used to finance home improvements may be tax-deductible.

- Increased Borrowing Capacity: Home equity can provide additional borrowing capacity to fund major expenses or investments.

Risks and Considerations

However, tapping into home equity also carries potential risks:

- Collateral Risk: Your home serves as collateral for home equity loans. Defaulting on payments can lead to foreclosure.

- Higher Debt: Increasing your mortgage balance through home equity withdrawals may increase your overall debt burden.

- Investment Risk: Using home equity to invest carries risks that could lead to financial losses.

Strategic Uses of Home Equity

Home equity can be deployed strategically to build wealth:

- Home Improvements: Renovating or expanding your home can increase its value and equity.

- Debt Consolidation: Transferring high-interest debt to a lower-interest home equity loan or line of credit can save money.

- Investments: Using home equity to fund investments, such as real estate or stocks, can potentially generate returns.

- Education Expenses: Home equity loans can help finance college tuition, graduate school, or career training.

- Retirement Funding: Accessing home equity through a reverse mortgage can provide additional income during retirement.

No responses yet