Introduction

Imagine investing in a company and receiving a portion of its profits without lifting a finger. That’s the beauty of dividends, regular payments made by companies to their shareholders. If you’re curious about how much you could potentially earn in dividends, an investment dividends calculator can be your financial compass.

This handy tool crunches the numbers, giving you a ballpark estimate of the dividends you can expect based on several factors, including the stock’s price, dividend yield, and the number of shares you own. Simply plug in the details, and voila! You’ll have a clearer picture of your potential returns.

How it Works

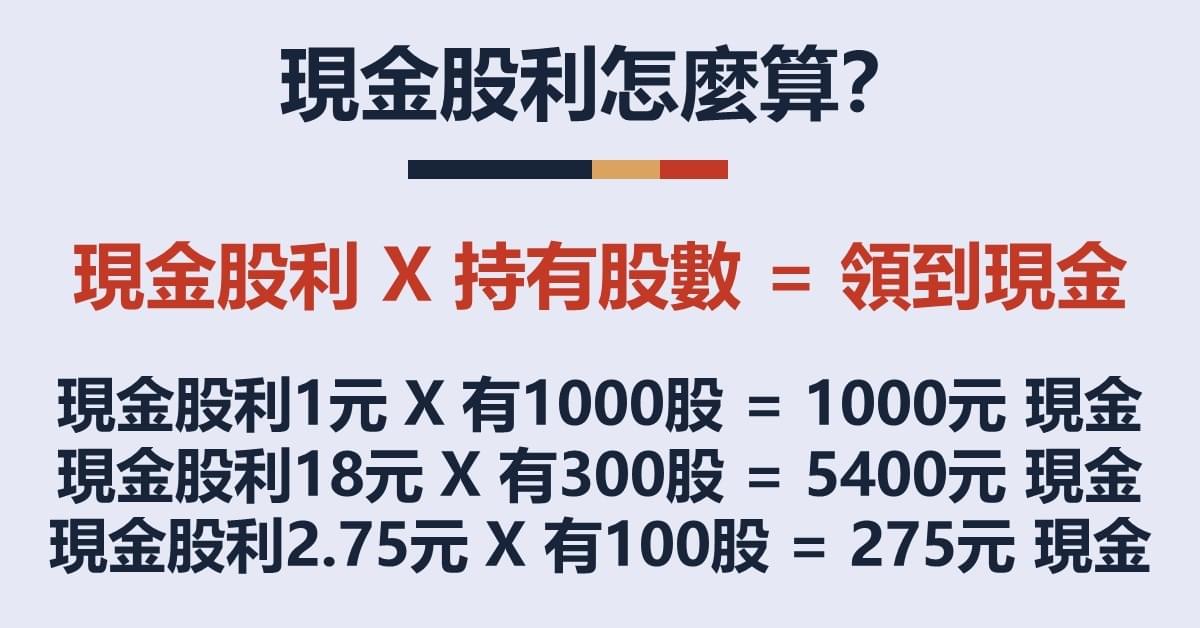

An investment dividends calculator works by using a simple formula: Dividends = Stock Price x Dividend Yield x Number of Shares. The stock price is the current market value of the share, the dividend yield is the percentage of the stock price that’s paid out as dividends, and the number of shares is the total number of shares you own.

For instance, if a stock is trading at $$100 per share, has a dividend yield of 5%, and you own 100 shares, your annual dividends would be $100 x 0.05 x 100 = $500.

Factors that Affect Dividends

Several factors can influence the amount of dividends you receive, including:

- Company’s financial health: A company’s profitability and cash flow determine its ability to pay dividends.

- Industry trends: Some industries, such as utilities and consumer staples, tend to have higher dividend yields than others.

- Interest rates: When interest rates are low, investors are more likely to seek income from dividends.

- Share price performance: If the stock price increases, the dividend yield decreases, and vice versa.

Using the Calculator

To use an investment dividends calculator, simply enter the following information:

- Stock symbol or name

- Current stock price

- Dividend yield

- Number of shares you own

The calculator will then provide you with an estimate of your annual dividend income. Keep in mind that this is just an approximation, and actual dividends may vary.

Investment Dividends Calculator: Your Guide to Calculating Dividend Income

As an investor, you may be drawn to the allure of earning dividends—those regular income payments from your investments. Whether you’re a seasoned pro or just dipping your toes into the world of dividends, an investment dividends calculator can be an invaluable tool. In this article, we’ll delve into how these calculators work, explore the factors that influence dividend income, and provide you with a comprehensive calculator that will empower you to make informed investment decisions.

How do Investment Dividends Calculators Work?

Investment dividends calculators are essentially mathematical wizards that help you estimate the potential dividend income you may earn from a specific investment. They employ a formula that takes into account three key factors:

-

Investment amount: How much money you’re planning to invest.

-

Dividend yield: The annualized dividend rate paid by the company or fund you’re investing in. This rate is typically expressed as a percentage of the current stock or fund price.

-

Holding period: How long you plan to hold the investment before selling it.

These calculators use these three variables to determine how much dividend income you’ll accumulate over a certain period. They’re akin to financial crystal balls, providing you with a glimpse into the potential returns of your investment.

Factors that Influence Dividend Income

Dividend Yield:

The dividend yield is a crucial factor that determines your dividend income. It’s a percentage that represents the annual dividend amount divided by the current stock or fund price. A higher dividend yield means potentially higher dividend income. Just like a high-interest savings account, a stock with a higher dividend yield means you’ll earn a larger dividend return on your investment.

Investment Amount:

The amount you invest also has a significant impact on your dividend income. It’s like filling up a bucket with water; the larger the bucket (your investment amount), the more water (dividend income) you can accumulate.

Holding Period:

The duration of your investment, or the holding period, matters too. Think of it as a marathon. The longer you hold the investment, the more dividend income you’ll accumulate. It’s like letting your dividend-paying stocks grow and multiply like a flock of rabbits.

Investment Dividends Calculator: Your Empowering Tool

Here’s the investment dividends calculator we promised: [link to calculator]. It’s your financial navigator, ready to help you estimate your dividend income. Simply enter the investment amount, dividend yield, and holding period, and let the calculator work its magic. You’ll get an estimate of the total dividend income you may earn.

So, whether you’re considering investing in dividend-paying stocks or funds, or you’re curious about your current dividend-earning potential, an investment dividends calculator can be your trusted guide. Use it to empower your investment decisions and navigate the world of dividends with confidence!

Investment Dividends Calculator: Unlocking Potential Income and Growth

Investing shouldn’t feel like a shot in the dark. That’s why we’ve put together the ultimate investment dividends calculator – your trusty compass in the world of financial planning. With this handy tool, you can effortlessly calculate the potential dividends you could earn from your investments, giving you a clearer roadmap to your financial goals.

Benefits of Using Investment Dividends Calculators

Hey there, savvy investors! Unleashing the power of investment dividends calculators is like opening the floodgates to financial knowledge. These calculators empower you with the following benefits:

- Precision Planning: Say goodbye to guesswork and hello to pinpoint accuracy. Our calculator precisely estimates dividend income based on your investment details, ensuring you stay on track with your financial aspirations.

- Investment Optimization: Calculators act as financial microscopes, helping you identify the investments that offer the most bang for your buck. They analyze dividend yields, payout ratios, and other key metrics to guide you towards wiser choices.

- Informed Decisions: Your financial future is like a jigsaw puzzle – every piece matters. Dividend calculators provide the missing pieces by offering clear insights into the potential income streams associated with different investments. This empowers you to make educated decisions that align with your financial goals.

- Time-Saving Tool: In today’s fast-paced world, time is precious. Dividend calculators eliminate the need for tedious manual calculations, freeing up your valuable time to focus on what matters most – growing your wealth.

- Peace of Mind: Knowing is half the battle, and when it comes to investments, knowledge is power. Dividend calculators give you peace of mind by providing a clear understanding of your potential income, reducing financial anxiety and boosting confidence.

Investment Dividends Calculator: Guide to Estimating Your Earnings

Kickstart your investment journey with our indispensable investment dividends calculator! This nifty tool crunches numbers to help you uncover the potential dividends your investments might bear. Simply input details like share price, dividend yield, and number of shares, and voila! You’ll have a clear picture of your potential income stream.

Limitations of Investment Dividends Calculators

While investment dividends calculators are a valuable resource, it’s crucial to remember they’re not a crystal ball. Like any financial projection, they rely on historical data and assumptions that may not always paint a perfect picture of the future. Dividends, as we all know, can fluctuate depending on a myriad of factors that can’t always be foreseen.

One key limitation is that these calculators can’t account for unexpected economic downturns or changes in company performance. Economic headwinds can lead to reduced profits for companies, which could result in lower dividends for shareholders. Similarly, companies can undergo internal restructuring or face industry challenges that impact their ability to pay dividends.

Additionally, these calculators don’t consider the tax implications of dividends. Depending on your tax bracket, you may end up paying a significant chunk of your dividend earnings to Uncle Sam. It’s important to factor in these potential tax ramifications when using an investment dividends calculator.

Furthermore, investment dividends calculators generally don’t provide insights into the long-term growth potential of your investments. They focus primarily on short-term dividend income, which may not paint the complete picture of your investment’s performance. It’s crucial to consider both dividend income and capital appreciation when making investment decisions.

Investment Dividends Calculator

Harnessing the power of dividends just got a whole lot easier! Dive into the realm of investing with our cutting-edge, user-friendly Investment Dividends Calculator. This tool will help unravel the complexities of dividend investing, letting you explore potential returns and make informed decisions.

How to Use Investment Dividends Calculators Effectively

Unlocking the full capabilities of dividend calculators is all about understanding how they operate. Step into the shoes of a seasoned investor as we delve into the key components that drive your calculations:

- Principal Investment: The starting point of your investment journey, where you decide how much you’re willing to put in.

- Dividend Yield: The percentage of the stock’s price that’s paid out to shareholders as dividends each year; expect it to fluctuate.

- Dividend Growth Rate: How much the dividend increases over time, expressed as a percentage; keep in mind that this rate may vary.

- Number of Years: Ride the investment timeline with this factor, deciding how long you’ll keep your money invested.

With these building blocks in place, calculators crunch the numbers to provide you with crucial dividend-related data. They reveal how much you can expect to earn based on historical dividend yields and the impact of dividend growth rates over time.

Benefits of Using Investment Dividends Calculators

Harnessing dividend calculators offers a treasure trove of benefits for savvy investors:

- Illuminating Potential Returns: Get a clear picture of what your dividends could potentially yield over time, even amidst market fluctuations.

- Guiding Investment Decisions: Use the insights gained from calculators to shape your portfolio, identifying companies with attractive dividend profiles.

- Strategic Planning: Plan your financial future with confidence, seeing how dividends fit into your long-term investment strategy.

Leveraging Calculators for Informed Investing

Maximize the potency of dividend calculators by weaving them into your broader investment research and analysis. They serve as invaluable tools, yet should not be taken as gospel; combine their insights with other sources to make well-rounded decisions.

The Power of Dividends: Unlock Your Investment Potential

Dividends are veritable pillars of wealth creation, offering a steady stream of income that can compound over time. By delving into the depths of dividend investing and wielding the Investment Dividends Calculator, you’ll gain a distinct advantage, unlocking doors to a brighter financial future. Don’t let this opportunity pass you by; seize the power of dividends today!

Investment Dividends Calculators: A Guide for Investors

Investing in dividend-paying stocks can be a great way to generate passive income. But how can you estimate how much you might earn? That’s where investment dividends calculators come in handy. These online tools allow you to input information about your investment, such as the share price, dividend yield, and number of shares, and they’ll calculate your potential dividend income.

Benefits of Using an Investment Dividends Calculator

There are several benefits to using an investment dividends calculator:

- It can help you estimate your potential dividend income.

- It can help you compare different dividend-paying stocks.

- It can help you make informed investment decisions.

Here is an example of an investment dividend calculator: Dividend Calculator

Factors that Affect Dividend Income

Several factors can affect your dividend income, including:

- The share price of the stock

- The dividend yield of the stock

- The number of shares you own

- The company’s dividend policy

- The overall performance of the stock market

- Use a reputable calculator. There are many different investment dividends calculators available online, so it’s important to choose one that is reputable and accurate.

- Be realistic about your expectations. Investment dividends calculators can give you a good estimate of your potential dividend income, but it’s important to remember that these are just estimates. The actual amount of dividend income you receive may vary.

- Use calculators to compare different stocks. Investment dividends calculators can be a helpful tool for comparing different dividend-paying stocks. By entering the information for each stock into the calculator, you can see which stocks offer the highest potential dividend income.

It’s important to consider all of these factors when estimating your potential dividend income.

How to Use an Investment Dividends Calculator

Using an investment dividends calculator is simple. First, you’ll need to gather some information about your investment, including the share price, dividend yield, and number of shares. Once you have this information, you can enter it into the calculator and click “calculate.” The calculator will then display your estimated dividend income.

Tips for Getting the Most Out of Investment Dividends Calculators

Here are a few tips for getting the most out of investment dividends calculators:

Conclusion

Investment dividends calculators can be a helpful tool for investors seeking to estimate their potential dividend income. However, it’s important to remember that these calculators are just estimates. The actual amount of dividend income you receive may vary. By using these tips, you can get the most out of investment dividends calculators and make informed investment decisions.

No responses yet