Formula & Metrics

Calculating the return on investment (ROI) is a key step in assessing the success of your marketing campaigns. By dividing net profit by investment cost, you can determine how much income you’ve generated for every dollar spent.

The ROI formula is a simple one, but it’s important to understand what each component represents. Net profit is the total amount of revenue you’ve earned minus the cost of goods sold, operating expenses, and taxes. Investment cost is the upfront amount you spent on your marketing campaign.

For example, if you spend $1,000 on a marketing campaign and generate $2,000 in revenue, your ROI would be 2.0. This means that you earned $2 for every $1 you invested.

ROI Formula: Empowering Investment Decisions

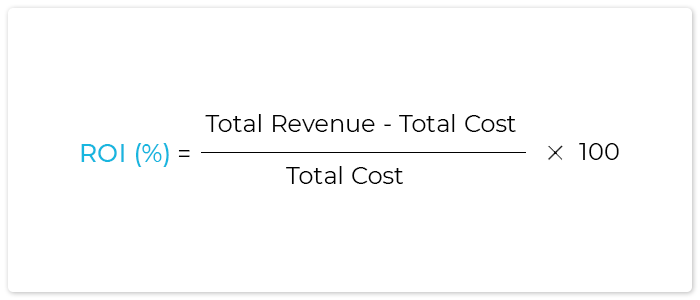

The return on investment (ROI) formula is a powerful tool that quantifies the profitability of an investment. By dividing the gain or loss from an investment by the cost of the investment, we can express ROI as a percentage:

ROI = (Gain or Loss / Cost of Investment) * 100%

This formula provides invaluable insights into how our investments are performing, helping us make informed decisions about where to allocate our resources.

Benefits of ROI

1. ROI provides a clear and concise metric for measuring investment performance, allowing us to compare different investments and identify the ones with the highest potential.

2. It helps us prioritize investments and allocate capital more effectively, directing our resources towards those projects that promise the greatest return.

3. ROI analysis enables us to track the progress of investments over time, providing early warning signs if an investment is underperforming and allowing us to take corrective action.

4. It fosters accountability, as investors are more likely to justify their decisions when they have to track and report on ROI.

5. ROI analysis can enhance transparency and improve communication among stakeholders, as it provides a shared language for discussing investment performance.

6. It can strengthen stakeholder confidence, as a clear understanding of ROI provides reassurance that investments are being made wisely.

ROI Formula: Unveiling the True Return on Your Investments

When it comes to understanding the true value of your investments, there’s no better tool than the return on investment (ROI) formula. This handy calculation, expressed as ROI = (Gain from Investment – Cost of Investment) / Cost of Investment, offers a quantitative measure of your investment’s profitability, providing you with a clear snapshot of its performance.

Limitations of ROI

While the ROI formula is a valuable asset, it’s important to be aware of its limitations. One significant drawback is that it doesn’t take into account the timing of cash flows. Investments often involve cash inflows and outflows over time, and the timing of these flows can have a significant impact on the overall return. For instance, a project that generates higher profits in the later years may have a lower ROI than one with smaller but earlier profits, even if the total return is the same.

Other Caveats to Consider

Beyond timing issues, ROI has other potential pitfalls. It can be sensitive to the initial cost of investment, meaning that projects with higher upfront costs may have a lower ROI even if they generate more profit in the long run. Additionally, ROI doesn’t account for other factors that could impact the value of an investment, such as inflation or changes in the market environment.

Handling ROI with Care

Despite these limitations, ROI can still be a useful tool for assessing the viability of investments. However, it’s crucial to approach ROI calculations with caution and recognize its limitations. By considering the timing of cash flows, the initial cost of investment, and other relevant factors, you can gain a more comprehensive understanding of the true value of your investments.

Unlocking the Potential of ROI

While ROI has its shortcomings, it can be a powerful tool for making informed investment decisions when used in conjunction with other analytical methods. By understanding the limitations and using it with caution, you can harness the power of ROI to maximize the return on your hard-earned investments. So, next time you find yourself evaluating an investment, don’t just rely on ROI alone. Take the time to consider its limitations and use it as part of a broader approach to investment analysis.

The ROI Formula: A Financial Compass for Success

The return on investment (ROI) formula, a financial beacon guiding decision-makers, is a crucial tool for evaluating the profitability of any investment endeavor. It offers a clear snapshot of the relationship between the financial gains and costs associated with a project, serving as a compass that steers organizations toward smart investments. Understanding and leveraging this formula empowers businesses to maximize their returns and ensure financial stability.

Calculating ROI: A Journey Behind the Scenes

The ROI formula is remarkably straightforward: ROI = (Net Profit / Investment Cost) x 100%. Net profit, the difference between revenue and expenses, represents the financial gain derived from the investment. Investment cost, on the other hand, encompasses all expenses incurred in undertaking the project, such as equipment, materials, and labor. By dividing net profit by investment cost and multiplying the result by 100%, businesses obtain a percentage value that quantifies their return on investment.

Harnessing ROI: A Decision-Making Catalyst

The ROI formula serves as an indispensable tool for decision-making, enabling businesses to assess the potential profitability of various investment options. By comparing the ROI of different projects, organizations can prioritize the most promising endeavors and allocate resources accordingly. Moreover, ROI provides a baseline against which companies can measure the performance of their investments, identifying areas for improvement and maximizing returns.

The Importance of Timing: ROI’s Dynamic Nature

ROI is not a static measure but rather a dynamic indicator that fluctuates over time. As external factors like market conditions and technological advancements evolve, the profitability of investments can shift. Hence, businesses must continually monitor ROI and adjust their strategies accordingly to ensure ongoing profitability. Regular ROI calculations allow organizations to stay agile, adapting to changing market dynamics and safeguarding their financial well-being.

ROI in Action: A Practical Example

Imagine a company contemplating investing $100,000 in a new marketing campaign. After implementation, the campaign generates $250,000 in revenue. The company’s expenses for the campaign amount to $75,000, resulting in a net profit of $175,000. Using the ROI formula, we can calculate the ROI as follows: ROI = ($175,000/$100,000) x 100% = 175%. This impressive ROI indicates that, for every dollar invested, the company gained $1.75, highlighting the campaign’s profitability. Armed with this information, the company can confidently allocate additional resources to similar marketing initiatives.

Conclusion

The ROI formula is a powerful tool that empowers businesses to make informed financial decisions, enabling them to embark on profitable ventures with confidence. It provides a clear metric for evaluating the success of investments, guiding resource allocation and ensuring financial sustainability. By embracing the ROI formula, organizations can navigate the ever-changing business landscape, maximizing returns and achieving long-term prosperity.

No responses yet