Stock Market Trading Basics: A Beginner’s Guide

Navigating the stock market can seem like a daunting task, especially for newcomers. But with a little guidance and the right approach, you can unlock the potential of this dynamic marketplace. In this article, we’ll delve into the basics of stock market trading, from understanding the fundamentals to making informed decisions.

Understanding the Stock Market

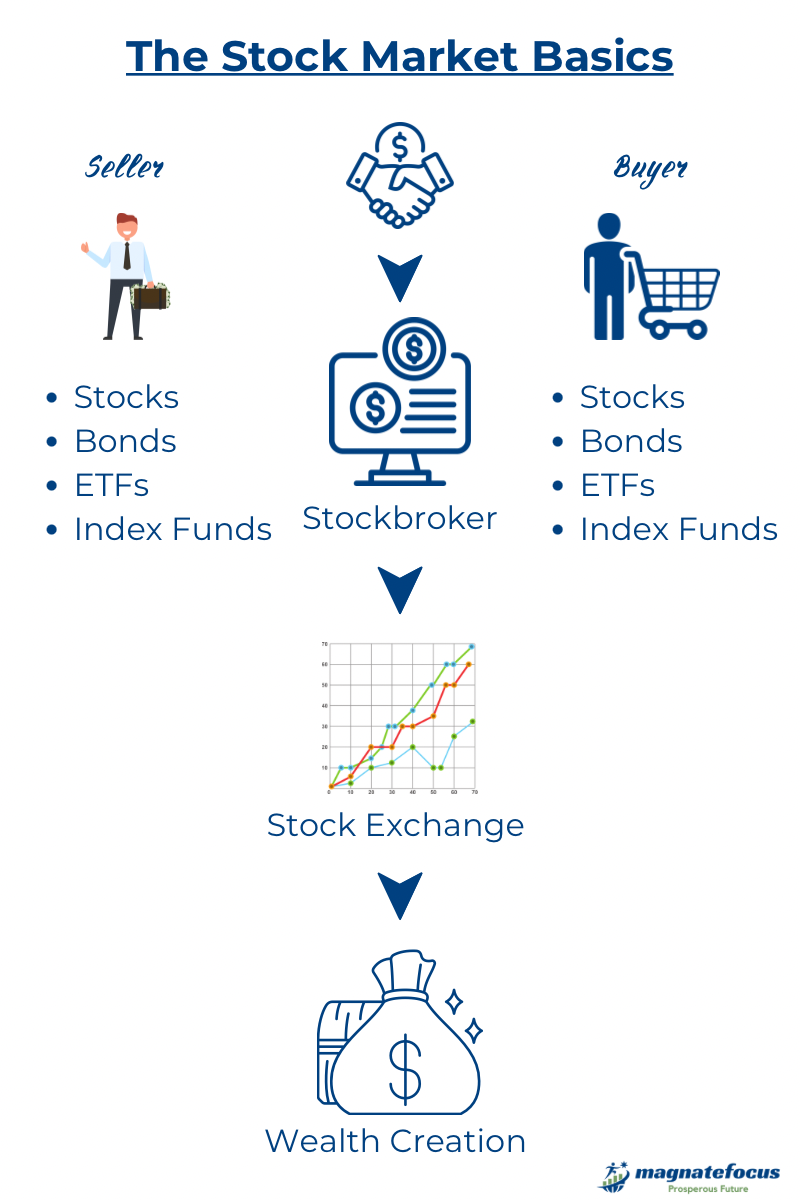

The stock market is a vibrant arena where buyers and sellers meet to trade shares of publicly listed companies. These companies offer a piece of their ownership, represented by stocks, to raise capital for their operations. When you buy a stock, you become a partial owner of the company and share in its profits or losses.

Stock prices fluctuate constantly, reflecting the perceived value of the underlying company by investors. A company’s financial performance, industry trends, economic conditions, and geopolitical events all play a role in determining stock prices. Understanding these factors is crucial for making informed trading decisions.

The stock market operates through exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, which provide a platform for buyers and sellers to connect. These exchanges facilitate the buying and selling of stocks, setting the prices and ensuring a transparent and orderly trading process.

Stock trading can be both exciting and challenging. With the right knowledge and strategies, you can potentially harness the market’s potential for wealth creation. However, it’s equally important to be aware of the inherent risks involved and to invest wisely.

Stock Market Trading Basics

Navigating the stock market can be a daunting task, especially for beginners. However, understanding the basics can empower you to make informed decisions and potentially reap the rewards of this dynamic financial landscape. Dive into the following essential stock market trading basics to set yourself up for success.

Types of Stocks

Stocks, also known as equities, represent ownership shares in publicly traded companies. There are various types of stocks, each with its unique characteristics:

**Common Stocks:** These are the most prevalent type of stock. They represent ownership in a company and generally provide shareholders with voting rights and the potential for dividends (a portion of the company’s profits distributed to shareholders).

**Preferred Stocks:** These stocks offer fixed dividend payments and have a higher claim on a company’s assets than common stocks in the event of liquidation. However, they typically do not carry voting rights.

**Growth Stocks:** These stocks represent companies that are expected to experience rapid growth in the future. They often pay minimal or no dividends, but their price appreciation potential can be substantial.

**Value Stocks:** These stocks represent companies that are considered undervalued compared to their assets and earnings. They typically pay dividends and have a history of stable growth.

**Dividend Stocks:** These stocks pay regular dividends to shareholders, providing a steady stream of income. They are often favored by investors seeking a reliable source of income.

Stock Market Trading Basics: A Journey into the World of Bulls and Bears

Embarking on the stock market trading journey can be an exhilarating yet daunting experience. Understanding the basics is the bedrock upon which successful trading strategies are built. This article will delve into the fundamentals, from understanding stock market indices to navigating the complexities of technical analysis.

Understanding Stock Market Basics

First and foremost, it’s crucial to know that a stock represents a tiny piece of ownership in a company. When you buy a stock, you’re purchasing a stake in its future prospects. Trading stocks involves buying and selling these shares, aiming to capitalize on price fluctuations.

Stock Market Indices

Market indices are a snapshot of the performance of specific industries or the overall market. The Dow Jones Industrial Average, for instance, tracks a group of 30 major companies, while the S&P 500 covers a broader spectrum of 500 large-cap companies. These indices provide a quick way to gauge the market’s direction and identify potential buying or selling opportunities.

Technical Analysis: Delving into the Charts

Technical analysis involves studying historical price movements to predict future trends. Traders use a variety of tools, such as moving averages and candlestick charts, to identify patterns that suggest potential buying or selling points. The goal is to anticipate market movements based on past behavior, understanding that these patterns tend to repeat over time.

Risk Management: Mitigating the Ups and Downs

Trading in the stock market is not without its risks. A sound risk management strategy helps protect your hard-earned capital. Setting stop-loss orders to limit potential losses is a key technique. Diversifying your portfolio by investing in a range of different stocks also helps reduce overall risk.

Staying Informed: Your Edge in the Market

Staying up-to-date with market news and company announcements is essential. The stock market reacts to events, so being aware of potential catalysts that could affect share prices gives you an edge. Reading financial news, subscribing to newsletters, and attending webinars can keep you abreast of the latest developments.

Navigating the stock market trading landscape can be challenging, but with a solid understanding of the basics, you can lay the foundation for informed decision-making. Remember, it’s a marathon, not a sprint. Take the time to learn, practice, and hone your skills. The rewards of successful trading can be substantial, but it’s the journey itself that makes the experience truly worthwhile.

Stock Market Trading Basics: A Guide for Beginners

The stock market, with its dizzying highs and sobering lows, can be a daunting place for newcomers. But fear not, intrepid investor! This beginner’s guide will provide you with the tools you need to navigate the markets like a seasoned pro. Let’s get started, shall we?

Technical Analysis

Technical analysts are like detectives in the world of investing. They pore over historical price data, searching for patterns and trends that can help them predict future price movements. Armed with charts and graphs, they decipher the market’s secret language, identifying opportunities to buy low and sell high.

These analysts use a variety of tools to forecast price movements. One popular tool is moving averages, which smooth out price fluctuations and reveal underlying trends. Another is support and resistance levels, which represent zones where the market has found it difficult to break through. By studying these indicators, technical analysts hope to gain an edge in the relentless battle of buying and selling.

It’s important to note that technical analysis is not an exact science. The patterns and trends it identifies may not always be reliable. But for those willing to dig deep into the data, it can provide valuable insights into the ebb and flow of the market.

Fundamental Analysis

In contrast to technical analysts, fundamental analysts focus on the underlying health of a company. They examine factors such as earnings, cash flow, and management to determine whether a stock is undervalued or overvalued. They read financial statements like detectives, searching for clues that can reveal a company’s true worth.

This approach is based on the belief that the intrinsic value of a company will ultimately be reflected in its stock price. By analyzing a company’s fundamentals, investors can make informed decisions about which stocks to buy, hold, or sell.

Risk Management

The stock market is a treacherous sea, and even the most seasoned investors can get caught in a storm. That’s why risk management is crucial. It’s like putting on a life jacket before diving in—it may not guarantee a safe journey, but it can help you stay afloat when the waves get rough.

There are several strategies for managing risk. One is diversification, which involves spreading your investments across different asset classes to reduce your exposure to any one sector. Another is hedging, which involves using financial instruments to offset potential losses. By implementing effective risk management strategies, you can increase your chances of surviving and thriving in the ever-changing market.

Stock Market Trading Basics: A Beginner’s Guide

If you’re intrigued by the allure of the stock market but unsure where to start, fear not! Embarking on this financial adventure requires a solid understanding of its fundamentals. Here’s your essential guide to stock market trading basics:

What is Stock Market Trading?

The stock market is a buzzing hub where companies offer shares of their ownership for sale. When you buy a stock, you’re essentially becoming a part-owner of that company. The prices of these stocks fluctuate based on supply and demand, offering savvy investors the potential for profit.

Risk and Reward

Remember, the stock market is a double-edged sword. While it holds the promise of handsome returns, it also carries inherent risks. Before diving in headfirst, carefully weigh your tolerance for potential losses.

Understanding Stocks

Stocks represent fractional ownership in a company. They come in two primary types: common stock and preferred stock. Common stock gives you voting rights, while preferred stock typically offers fixed dividends.

Fundamental Analysis

Fundamental analysts meticulously examine a company’s financial health to determine its intrinsic value. They pore over financial statements, industry trends, and management acumen to assess a company’s long-term prospects.

Technical Analysis

Unlike fundamentalists, technical analysts focus solely on a stock’s historical price movements. They rely on charts and patterns to identify potential buy and sell signals.

Investment Strategies

Choosing an investment strategy that suits your risk appetite and financial goals is paramount. Value investing involves buying stocks that trade below their intrinsic value, while growth investing targets companies with high growth potential. Passive investing, on the other hand, involves buying and holding stocks for the long haul.

Stock Market Psychology

Understanding the psychological forces that drive the market is crucial. Fear and greed can often lead to irrational trading behavior. Staying emotionally detached and making well-informed decisions is the key to success in the volatile world of stock market trading.

Stock Market Trading Basics: A Beginner’s Guide

Navigating the stock market can seem like a daunting task, but understanding the basics can help you get started. Here’s a comprehensive guide to stock market trading basics that will get you up to speed in no time.

Stock Market Strategies

Traders employ a variety of strategies to maximize their returns. Here are a few popular approaches:

Stock Market Trading Basics: A Beginner’s Guide

Stock market trading, like any worthwhile endeavor, requires knowledge, strategy, and a dash of courage. If you’re just starting out, it’s like diving into a vast ocean—exciting yet intimidating. Understanding the market’s ebb and flow is essential, and that’s where this guide comes in. So, buckle up, my friend, and let’s venture into the world of stock market trading.

Risk Management

Managing risk in stock market trading is not just a suggestion; it’s a necessity. Picture it like walking a tightrope—you don’t want to fall on your face, do you? That’s where diversification comes in, and it’s like spreading your bets across multiple stocks. It’s like putting all your eggs in different baskets instead of one.

And just when you think you’ve got the risk under control, enter stop-loss orders. They’re like your trusty sidekick, automatically selling your stocks when the price hits a certain point, ensuring you don’t lose more than you planned.

Stock Market Trading Basics: A Beginner’s Guide to Getting Started

Are you intrigued by the rollercoaster ride of the stock market, wondering how you can join the thrill? Well, strap yourself in, because this guide will give you the stock market trading basics you need to navigate the financial landscape like a pro.

Understanding the Basics

Before diving into the trading arena, it’s crucial to understand the fundamentals. Know what stocks are, how they work, and the different types available. Don’t let jargon intimidate you; it’s all just a matter of learning the language of the market.

Trading Platforms and Tools

Just like carpenters need their tools, traders rely on trading platforms and analytical tools to access market data and execute trades. These platforms provide a window into the market, allowing you to monitor stocks, analyze trends, and place orders with just a few clicks.

Risk Management: A Lifeline in the Trading World

When it comes to trading, risk management is your financial life jacket. Understand that every trade carries a level of risk. That’s why it’s essential to set clear limits, manage your positions, and never risk more than you can afford to lose. Remember, the stock market can be a turbulent ocean, so be prepared to weather the waves.

Technical Analysis: Decoding the Market’s Language

Charting is the secret weapon of many traders, and with technical analysis, you can decipher the language of price movements. By studying historical data and patterns, you can predict future price trends and make more informed trading decisions. It’s like reading the tea leaves of the market!

Fundamental Analysis: A Deeper Dive into Company Health

If technical analysis tells you about the symptoms, fundamental analysis reveals the root cause. Dig into a company’s financial statements, industry trends, and management team to understand its intrinsic value. It’s all about getting a comprehensive picture of a company’s heartbeat.

Trading Strategies: A Map through the Market Maze

Whether you’re a cautious tortoise or a speedy hare, there’s a trading strategy out there for you. Choose a strategy that aligns with your risk tolerance, time frame, and trading style. It’s like customizing a car to suit your driving preferences.

Trading Psychology: Mastering Your Emotions

Emotions can be the Achilles’ heel of traders. Learn how to control your impulses, avoid common psychological traps, and make rational trading decisions. It’s all about keeping a cool head in the heat of the trading battle.

Education and Constant Refinement

The stock market is a dynamic beast, constantly evolving. To stay ahead of the curve, continuous education is key. Read books, attend seminars, and engage with other traders. Remember, knowledge is the fuel that powers successful trading.

No responses yet