Introduction

Are you looking to revamp your portfolio for 2024? Index funds could be the key to unlocking superior returns. We’ve scoured the market to bring you the best index funds for 2024, meticulously selected to maximize your portfolio’s potential. Get ready to navigate the financial landscape with confidence and reap the rewards of informed investing.

Number 1. Vanguard Total Stock Market Index Fund (VTI)

Consider the Vanguard Total Stock Market Index Fund (VTI) as the backbone of your portfolio. It’s like a diversified buffet of stocks, encompassing the entire U.S. stock market in one convenient package. VTI’s secret sauce lies in its broad exposure, which provides a cushion against market fluctuations and enhances your chances of long-term success. It’s the ultimate one-stop shop for capturing the growth potential of the American economy.

But hold your horses, because the perks don’t end there. VTI boasts an incredibly low expense ratio, meaning more of your hard-earned money stays invested instead of lining someone else’s pockets. It’s like having a financial superpower, allowing you to maximize your returns while keeping costs at bay. And if you’re a Dividend Aristocrat enthusiast, you’ll be thrilled to know that VTI offers a healthy dose of dividend-paying companies. It’s like the cherry on top of an already delectable investment sundae.

VTI is not just an index fund; it’s a gateway to unlocking the potential of the U.S. stock market. With its comprehensive coverage, low fees, and dividend-friendly nature, it’s no wonder VTI reigns supreme as the top index fund for 2024. Jump on board and let VTI be the compass guiding your portfolio towards financial horizons.

Number 2. Schwab Total Stock Market Index (SWTSX)

If you’re looking for a close cousin to VTI, look no further than the Schwab Total Stock Market Index (SWTSX). It’s like the fraternal twin of VTI, offering a similar broad exposure to the U.S. stock market. However, SWTSX comes with a slightly lower expense ratio, making it an even more cost-effective option. It’s the perfect choice for investors who value every penny.

Number 3. Fidelity ZERO Total Market Index Fund (FZROX)

Prepare to have your mind blown with the Fidelity ZERO Total Market Index Fund (FZROX). This game-changer comes with a mind-boggling 0% expense ratio. That’s right, you read it correctly – zero! It’s like having a financial cheat code, allowing you to keep more of your hard-earned cash working for you. FZROX is your ticket to maximizing returns and leaving the competition in the dust.

Number 4. iShares Core S&P 500 ETF (IVV)

If you’re drawn to the allure of the S&P 500, the iShares Core S&P 500 ETF (IVV) is your golden ticket. This index fund tracks the performance of the iconic S&P 500 index, giving you exposure to the 500 largest U.S. companies. It’s like owning a piece of the American corporate elite, all wrapped up in a convenient and affordable package.

Number 5. SPDR S&P 500 ETF Trust (SPY)

Last but not least, we have the SPDR S&P 500 ETF Trust (SPY), another heavyweight in the S&P 500 realm. SPY has been around the block, making it a seasoned veteran in the ETF game. With its massive size and liquidity, SPY is like the sturdy oak tree of index funds, providing stability and resilience in the ever-changing financial landscape.

Best Index Funds for 2024: Shaping Your Financial Future

As we embark on the threshold of 2024, savvy investors are diligently scrutinizing the financial landscape to identify the index funds poised for success. Amidst the plethora of options available, our team of financial experts has meticulously handpicked the top index funds that are worthy of your consideration, each promising to amplify your investment prowess.

Factors to Consider

Before you dive headlong into the index fund pool, it’s imperative to equip yourself with the knowledge necessary to make discerning choices. Here are some crucial factors to keep in mind:

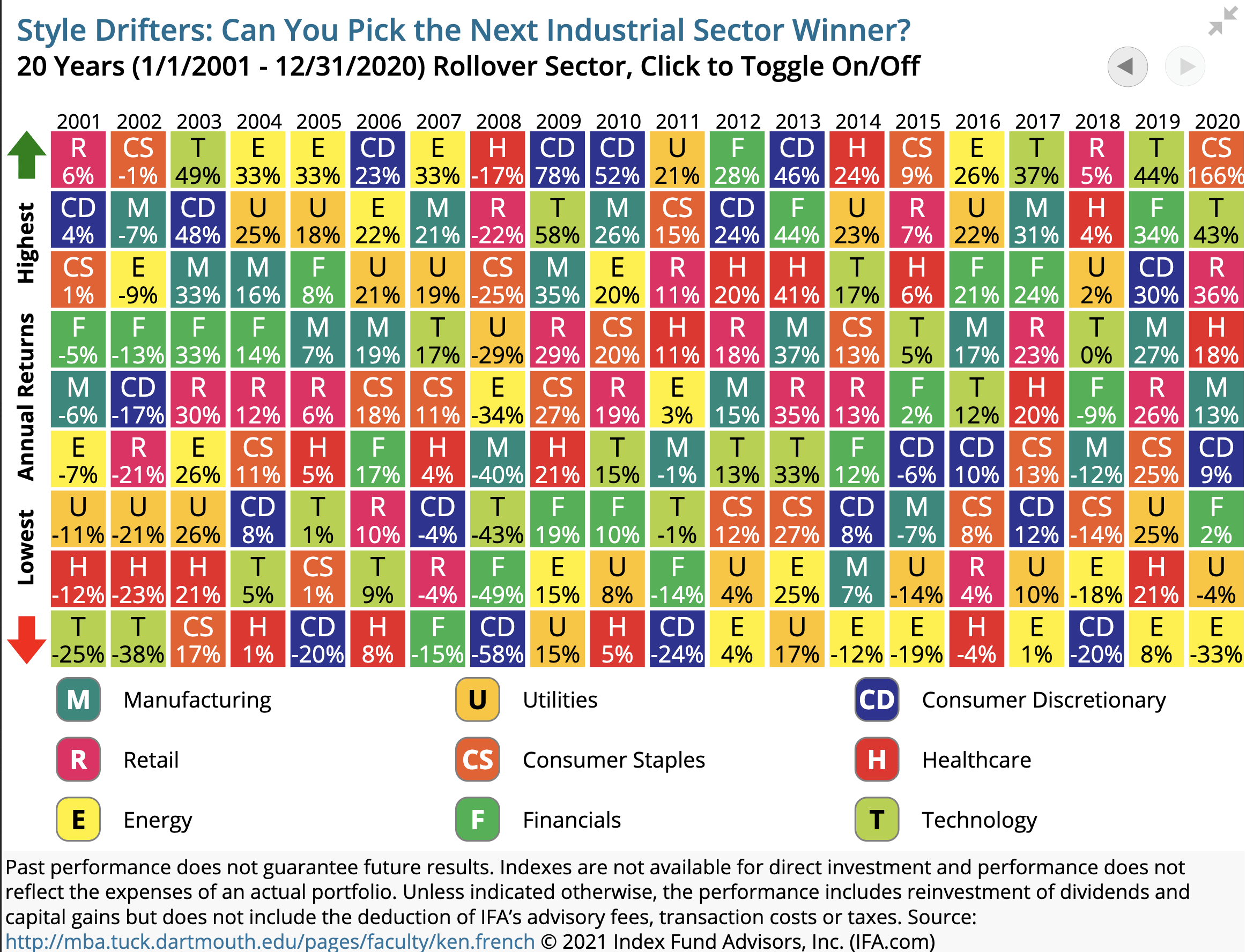

1. Historical Returns: A Window into the Past

Historical returns provide a glimpse into an index fund’s performance over time. While past performance is not a guarantee of future success, it does offer valuable insights into the fund’s consistency and ability to weather market fluctuations.

2. Expense Ratios: Keeping Costs Down

Expense ratios are like pesky fees that nibble away at your returns. The lower the expense ratio, the more of your hard-earned money stays in your pocket. Even a seemingly insignificant difference in expense ratios can accumulate over time, making a substantial impact on your investment’s overall returns.

3. Market Capitalization: A Measure of Size

Market capitalization measures the total value of a company’s outstanding shares, providing an idea of its size and influence within the market. Large-cap index funds invest in the biggest companies, while mid-cap and small-cap funds focus on smaller, potentially faster-growing companies. The level of risk and potential reward varies across these categories, so tailor your choice to your investment goals and tolerance for risk.

4. Tracking Error: How Closely It Follows the Index

Tracking error measures the difference between an index fund’s performance and the performance of the index it tracks. A low tracking error indicates that the fund effectively mirrors the index, while a high tracking error suggests potential inefficiencies or active management.

5. Fund Manager: Expertise and Experience Matter

The fund manager plays a crucial role in the day-to-day operations of an index fund. Consider their track record, investment philosophy, and experience in managing similar funds. A skilled manager can optimize the fund’s performance and protect your investment from unnecessary risks.

Best Index Funds for 2024: Navigating the Road to Financial Success

In the tumultuous waters of the financial markets, index funds have emerged as a beacon of stability and growth for savvy investors. These funds, which track a specific market index such as the S&P 500 or Nasdaq 100, offer a convenient way to diversify your portfolio and potentially outpace inflation. As we navigate the uncharted territory of 2024, let’s delve into the world of index funds and explore the best options to help you reach your financial goals.

Asset Allocation Options

When it comes to investing, it’s all about finding the right balance between risk and reward. Asset allocation, the process of dividing your portfolio among different asset classes, plays a crucial role in achieving this equilibrium. From the more conservative bond funds that cushion you against market downturns to the aggressive growth funds that promise potential for high returns, there’s an asset allocation strategy tailored to every investor’s risk tolerance and financial aspirations.

Exploring the Best Index Funds for 2024

Let’s dive right into the heart of the matter: the best index funds to watch out for in 2024. Remember, the perfect fund for you depends on your unique financial situation and goals, so do your research and consult with a financial advisor before taking the plunge.

Index Funds for Conservative Investors

If you prefer to play it safe, consider index funds that focus on bonds, which generally offer lower returns but also lower risk. Some top picks for 2024 include:

- Vanguard Total Bond Market Index Fund (BND)

- iShares Core U.S. Aggregate Bond Index Fund (AGG)

- Schwab Total Bond Market ETF (SCHZ)

Index Funds for Moderate Investors

For those who strike a balance between risk and reward, here are some index funds to consider:

- Vanguard Total Stock Market Index Fund (VTI) tracks the entire U.S. stock market, providing broad diversification.

- Schwab Total Stock Market Index (SWTSX) offers similar exposure to the U.S. stock market at a lower cost.

- iShares Core S&P 500 ETF (IVV) follows the performance of the S&P 500 index, representing the 500 largest U.S. publicly traded companies.

Index Funds for Aggressive Investors

If you’re willing to embrace more risk in pursuit of higher returns, these index funds could be your allies:

- Vanguard Growth Index Fund (VUG) offers exposure to large-cap growth companies.

- iShares Russell 2000 Growth Index Fund (IWO) tracks small-cap growth companies, providing access to potentially high-growth potential.

- Schwab U.S. Large-Cap Growth ETF (SCHG) invests in large-cap growth stocks.

The Best Index Funds for 2024: A Comprehensive Guide

We’ve got your back if you’re seeking the best index funds to invest in for the upcoming year. We’ve compiled a comprehensive list of top index funds for 2024 that can help you achieve your financial goals. Let’s dive right in and explore the world of index funds!

Diversification and Risk Management

Index funds spread your investments across a wide range of stocks or bonds, effectively minimizing risk through diversification. It’s like not putting all your eggs in one basket – index funds help ensure that a decline in one particular investment doesn’t sink your entire financial ship.

Historical Performance

Index funds have a stellar track record of delivering consistent returns over the long haul. By tracking popular market indexes like the S&P 500 or the Dow Jones Industrial Average, they provide a broad representation of the overall market, leading to steady growth potential.

Low Fees and Expenses

Index funds are known for their low fees, which gives them an edge over actively managed funds with high management fees. These funds are passively managed, meaning they simply track an index instead of relying on stock-picking experts, which keeps their costs down.

Professional Management

Despite being passively managed, index funds are overseen by expert fund managers who ensure adherence to the underlying index and make necessary adjustments to maintain alignment. It’s like having a seasoned navigator guiding your financial journey.

Transparency and Accessibility

Index funds are designed to be easy to understand and invest in. They offer transparent information about their holdings and performance, making them accessible to investors of all levels. Unlike some investment options that require a hefty investment, index funds generally have low minimums, making them a great starting point for new investors.

No responses yet