Best Low-Cost Investment Platforms

Are you looking for a low-cost investment platform to help you save money on your investments? If so, you’re in luck! There are many great options out there, and we’ve compiled a list of some of the best ones for you.

With so many choices, it can be tough to know where to start. But don’t worry, we’re here to help. We’ll give you all the information you need to make an informed decision about which platform is right for you. All that being said, here are a few things to keep in mind when choosing a low-cost investment platform:

- Fees: The first thing you’ll want to consider is the fees associated with the platform. Some platforms charge a monthly fee, while others charge a fee for each trade. Be sure to compare the fees of different platforms before you make a decision.

- Investment options: Another important factor to consider is the investment options offered by the platform. Some platforms offer a wide variety of investments, while others only offer a limited number. Be sure to choose a platform that offers the investments you’re interested in.

- Customer service: If you ever have any questions or problems, you’ll want to be sure that you can get help from the platform’s customer service team. Be sure to read reviews of different platforms before you make a decision to see what other users have to say about their customer service.

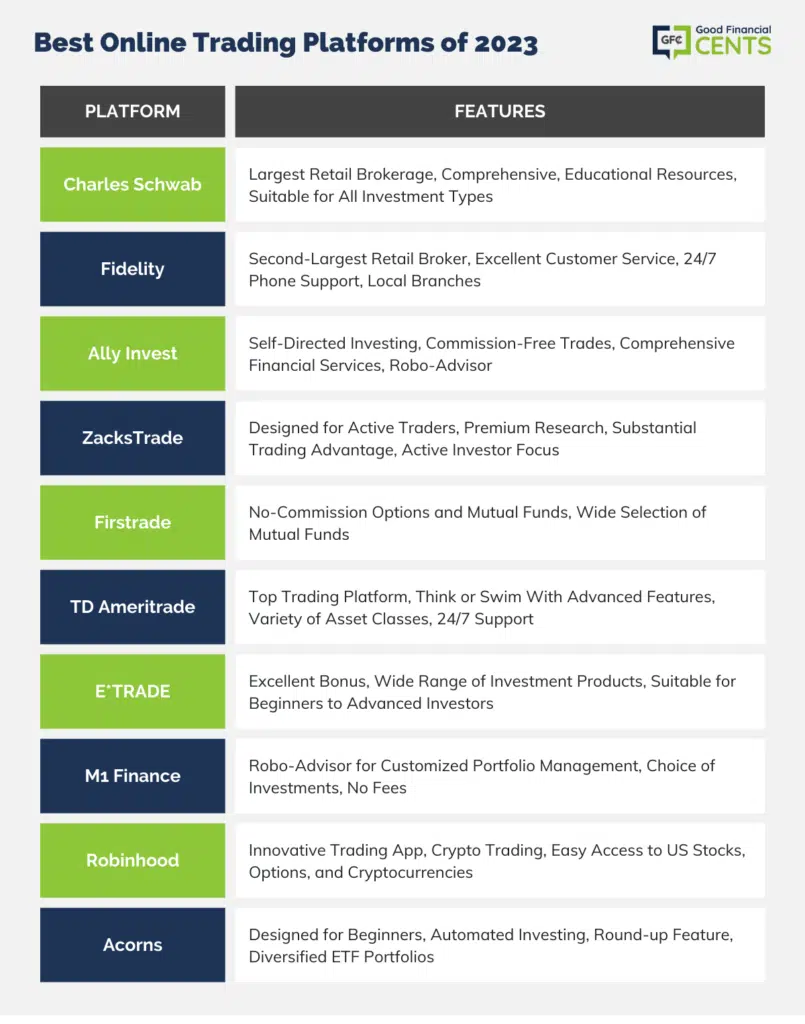

Now that you know what to look for, let’s take a look at some of the best low-cost investment platforms out there.

1. Betterment

If you’re not a financial expert with tons of time to research investments, then Betterment might be a great option for you. The platform offers automated investing, which means it will create and manage a portfolio for you based on your risk tolerance and financial goals. Betterment also has low fees, making it a great option for investors who are looking to save money.

Betterment’s fees are based on a percentage of your assets under management. The fee ranges from 0.25% to 0.40%, depending on the amount of money you have invested. Betterment also offers a variety of investment options, including stocks, bonds, and ETFs.

Another great thing about Betterment is that it offers a variety of tools and resources to help you learn about investing. The platform has a blog, a podcast, and a library of articles and videos. What’s more, Betterment has a team of financial advisors who can answer your questions and help you make informed investment decisions. Whether you’re a new investor or you have more experience, Betterment is a great option to consider if you’re looking for a low-cost investment platform.

2. Vanguard

Vanguard is a pioneer in the low-cost investment space, and it offers a wide range of investment options, including index funds, ETFs, and mutual funds. Vanguard’s fees are some of the lowest in the industry, so you can keep more of your hard-earned money.

One of the things that makes Vanguard unique is its focus on index investing. Index funds are designed to track a specific market index, such as the S&P 500. This means that you can get exposure to a large number of stocks with just one investment.

Vanguard also offers a variety of target-date funds. Target-date funds are designed to automatically adjust your asset allocation as you get closer to retirement. This can help you stay on track to reach your retirement goals.

3. Fidelity

Fidelity is another great option for low-cost investing. The platform offers a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Fidelity also has a variety of tools and resources to help you make informed investment decisions.

One of the things that makes Fidelity unique is its focus on research. The platform has a team of analysts who provide in-depth research on stocks, bonds, and mutual funds. This research can help you make informed investment decisions.

4. Charles Schwab

Charles Schwab is a full-service brokerage firm that offers a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Charles Schwab also has a variety of tools and resources to help you make informed investment decisions.

One of the things that makes Charles Schwab unique is its commitment to customer service. The platform has a team of experienced customer service representatives who are available to answer your questions and help you with your investments.

Are You Looking for the Best Low-Cost Investment Platforms?

In today’s competitive financial market, savvy investors are always on the hunt for ways to maximize their returns. One crucial factor that can make a significant impact on your investment performance is the fees associated with your chosen investment platform. High fees can chip away at your profits over time, leaving you with less money to grow your wealth.

Why Use a Low-Cost Investment Platform?

Fees are unavoidable in the investment world, but that doesn’t mean you have to pay an arm and a leg. Choosing a platform with low fees allows you to keep more of your hard-earned money working for you. It’s like getting a free boost to your returns without lifting a finger.

5 Best Low-Cost Investment Platforms

- M1 Finance

- Fidelity

- Charles Schwab

- Vanguard

- Betterment

What to Look for in a Low-Cost Investment Platform

When selecting a low-cost investment platform, there are a few key factors to consider:

- Account fees: Some platforms charge monthly or annual account fees, which can add up over time. Opt for platforms that offer low or no account fees.

- Trading fees: Trading stocks, bonds, and other investments typically incurs a fee per trade. Look for platforms that offer low or commission-free trading.

- Management fees: If you’re investing in managed portfolios or mutual funds, you may be charged a management fee. Choose platforms with competitive management fees.

- Hidden fees: Watch out for platforms that hide fees in the fine print. Make sure you understand all the fees associated with the platform before signing up.

Our Top Pick: M1 Finance

M1 Finance is our top pick for a low-cost investment platform. With no account fees, commission-free trading, and no minimum investment requirement, M1 Finance makes investing accessible to everyone. Its intuitive user interface and customizable portfolios make it a great choice for both novice and experienced investors alike.

Conclusion

Choosing the right low-cost investment platform can make a substantial difference to your investment returns over time. By carefully comparing fees and features, you can find a platform that aligns with your investment goals and helps you reach your financial dreams sooner.

Top Low-Cost Investment Platforms

If you’re looking for the best low-cost investment platforms, you’ve come to the right place. In this article, we’ll take a look at some of the top options out there and help you decide which one is right for you. Whether you’re a beginner or a seasoned investor, we’ve got you covered.

What to Look for in a Low-Cost Investment Platform

When you’re choosing a low-cost investment platform, there are a few things you’ll want to keep in mind. First, you’ll want to make sure that the platform offers the investments you’re interested in. If you’re looking to invest in stocks, for example, you’ll want to make sure that the platform offers a wide range of stocks to choose from. Second, you’ll want to consider the platform’s fees. Some platforms charge a monthly fee, while others charge a per-trade fee. Be sure to compare the fees of different platforms before you make a decision.

Top Low-Cost Investment Platforms

Now that you know what to look for in a low-cost investment platform, let’s take a look at some of the top options out there. Vanguard, Fidelity, and Charles Schwab are all excellent choices for investors who are looking for a low-cost way to invest. These platforms offer a wide range of investments, low fees, and excellent customer service.

Vanguard

Vanguard is one of the largest and most popular investment platforms in the world. They offer a wide range of investments, including stocks, bonds, and mutual funds. Vanguard also has very low fees. In fact, their expense ratios are among the lowest in the industry. If you’re looking for a low-cost investment platform with a long track record of success, Vanguard is a great option.

Fidelity

Fidelity is another great option for investors who are looking for a low-cost investment platform. They offer a wide range of investments, including stocks, bonds, and mutual funds. Fidelity also has low fees. In fact, they offer a number of no-fee index funds. If you’re looking for a low-cost investment platform with a wide range of investment options, Fidelity is a great option.

Charles Schwab

Charles Schwab is another great option for investors who are looking for a low-cost investment platform. They offer a wide range of investments, including stocks, bonds, and mutual funds. Charles Schwab also has low fees. In fact, they offer a number of no-fee ETFs. If you’re looking for a low-cost investment platform with a wide range of investment options, Charles Schwab is a great option.

No responses yet