Introduction

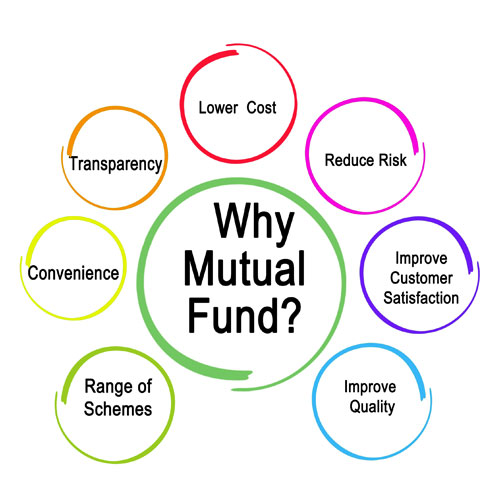

So, you’re ready to take the plunge into investing, huh? Whether you’re a seasoned pro or just starting out, mutual funds are a great way to get your foot in the door of the legal sector. They offer a convenient and diversified way to invest, meaning you can spread your money across a variety of stocks and bonds in one fell swoop. Plus, they’re managed by professional fund managers, so you can sit back and relax while they do all the heavy lifting.

But with so many mutual funds out there, how do you know which ones are the best? Don’t worry, we’ve got you covered. Here’s a rundown of the top mutual funds to invest in, so you can make an informed decision and start growing your wealth today.

What are mutual funds?

Mutual funds are investment vehicles that pool money from many investors and invest it in a variety of stocks, bonds, or other assets. They’re a great way to diversify your portfolio and reduce risk, since you’re not putting all your eggs in one basket. Mutual funds are managed by professional fund managers, who make decisions about which investments to buy and sell. This means you can sit back and relax while they do all the hard work for you.

There are many different types of mutual funds, each with its own investment objective. Some of the most common types include:

- Stock Funds: These funds invest primarily in stocks, and they can be further divided into different categories, such as large-cap, mid-cap, and small-cap funds.

- Bond Funds: These funds invest primarily in bonds, and they can be further divided into different categories, such as government bonds, corporate bonds, and high-yield bonds.

- Balanced Funds: These funds invest in a mix of stocks and bonds, and they can be further divided into different categories, such as conservative, moderate, and aggressive funds.

How to choose the best mutual funds

When choosing a mutual fund, there are a few key factors to consider:

- Investment Objective: What are your investment goals? Are you looking for growth, income, or a combination of both? Once you know your investment objective, you can start to narrow down your choices.

- Risk Tolerance: How much risk are you willing to take? Mutual funds can range from conservative to aggressive, so it’s important to choose a fund that matches your risk tolerance. If you’re not sure what your risk tolerance is, you can talk to a financial advisor.

- Fees: Mutual funds charge fees, such as management fees and operating expenses. These fees can eat into your returns, so it’s important to compare the fees of different funds before you invest.

- Past Performance: While past performance is not a guarantee of future results, it can give you a good idea of how a fund has performed in different market conditions. However, it’s important to remember that past performance is not always indicative of future results.

**Best Mutual Funds to Invest In: A Comprehensive Guide**

Navigating the world of mutual funds can be a daunting task, especially for those seeking the most optimal investment opportunities. We’ve got you covered with our comprehensive guide to help you identify the best mutual funds to invest in, backed by expert insights and practical advice.

Identifying Top Mutual Funds

Sifting through the vast ocean of mutual funds requires a discerning eye. Prioritize funds with a proven track record of success, demonstrating consistent returns over extended periods. Steer towards funds managed by experienced investment teams with a deep understanding of the market and the specific industry you’re targeting. Additionally, consider funds with a specific focus on the legal industry, providing you with exposure to the unique investment opportunities within this dynamic sector.

Evaluating Fund Performance

Delve into the fund’s performance metrics to assess its historical returns. Scrutinize the fund’s alpha and beta, which gauge its excess returns over the benchmark and its volatility, respectively. Evaluate the fund’s Sharpe ratio, which measures the return-to-risk ratio, providing insights into its efficiency. Don’t overlook the fund’s R-squared, which indicates the percentage of its return that can be attributed to the benchmark, offering a glimpse into its diversification.

Considering Management Expertise

The fund’s management team plays a pivotal role in its success. Seek out funds managed by seasoned professionals with a proven ability to navigate market fluctuations and identify promising investment opportunities. Explore the managers’ educational background, professional certifications, and prior experience in the legal industry. Their track record and reputation can provide valuable insights into their investment acumen.

Understanding Fund Objectives and Strategy

Before committing your hard-earned funds, thoroughly comprehend the fund’s objectives and investment strategy. Determine whether the fund aligns with your investment goals and risk tolerance. Consider the fund’s asset allocation, sector exposure, and diversification strategy. Seek out funds with a clear and well-defined investment philosophy that resonates with your financial aspirations.

Additional Considerations

Beyond the aforementioned factors, consider additional variables that may influence your decision. Evaluate the fund’s expense ratio, which deducts its operating costs from its returns, impacting your overall profitability. Be mindful of the fund’s minimum investment requirements and any potential redemption fees that may limit your flexibility. Lastly, consider the fund’s tax implications to optimize your investment returns.

By following these recommendations, you’ll be well-equipped to identify the best mutual funds that align with your financial goals and investment preferences. Remember, investing involves inherent risk, so consult with a financial advisor for personalized guidance tailored to your specific circumstances.

**Best Mutual Funds to Invest In: A Comprehensive Guide**

Navigating the vast ocean of mutual funds can be daunting, but fear not! This comprehensive guide will equip you with the knowledge to confidently choose the best mutual funds for your investment portfolio.

Evaluating Fund Performance

Before you take the plunge, it’s crucial to evaluate a fund’s performance. How has it fared against its competitors? This is a telltale sign of its management prowess. Additionally, scrutinize the fund’s risk profile to ascertain if it aligns with your comfort level. Finally, keep an eagle eye on expense ratios. These sneaky fees can nibble away at your returns, so choose funds with low expenses.

Consider Your Investment Objectives

Like a well-tailored suit, your investment strategy should fit your goals like a glove. Are you saving for a dreamy retirement, a child’s education, or a down payment on a cozy nest? Once you’ve defined your objectives, you can narrow down your fund selection to those that align with your financial aspirations.

Don’t Neglect Diversification

Think of your mutual fund portfolio like a delicious smoothie. Just as a smoothie blends different fruits and flavors to create a harmonious concoction, your portfolio should encompass a mix of asset classes and investment styles. This diversification strategy helps to smooth out the inevitable ups and downs of the market, giving you a smoother ride on the financial roller coaster.

Long-Term Mindset

Remember, investing is like a marathon, not a sprint. Avoid chasing short-term fads. Instead, adopt a long-term mindset and focus on funds with a proven track record of consistent performance. Stay the course through market fluctuations, and you’ll reap the sweet rewards of compounding returns over time.

Best Mutual Funds to Invest In: A Comprehensive Guide

Investing in mutual funds can be a smart move for those looking to diversify their portfolios and potentially grow their wealth. But with so many options available, choosing the best ones can be a daunting task. To help you navigate this process, we’ve put together this comprehensive guide to assist you in making informed investment decisions.

Due Diligence and Legal Considerations

Before investing in any mutual fund, it’s crucial to conduct thorough due diligence. Start by reviewing the fund’s prospectus, a legal document that provides detailed information about the fund’s objectives, investment strategy, and fees. Don’t just skim the prospectus; take the time to understand the content thoroughly.

It’s also wise to consult with a financial advisor. A professional can help you assess your investment goals, risk tolerance, and time horizon, and recommend funds that are a good fit for your unique needs. Additionally, ensure that the fund aligns with your legal requirements, such as any tax implications or restrictions based on your residency.

Fund Types and Investment Objectives

Mutual funds come in various types, each with a distinct investment strategy. Some common types include:

- Equity funds primarily invest in stocks, offering potential for growth but also carry higher risk.

- Bond funds invest in fixed-income securities like bonds, providing lower returns but potentially lower risk.

- Index funds track the performance of a specific market index, such as the S&P 500, offering diversification and lower costs.

- Hybrid funds combine stocks and bonds, providing a balance between potential growth and stability.

- Sector funds focus on specific sectors or industries, offering more exposure to particular areas of the market.

Consider your investment goals when selecting a fund type. For example, if you’re seeking long-term growth, an equity fund may be appropriate. Conversely, if you’re prioritizing stability, a bond fund could be a better choice.

Fund Selection Criteria

Once you’ve narrowed down your fund type, it’s time to evaluate specific funds. Consider the following criteria:

- Performance: Review the fund’s historical returns, but remember that past performance doesn’t guarantee future results.

- Fees: Fund expenses, including management fees and other operating costs, can impact your returns. Look for funds with low expense ratios.

- Management team: Evaluate the experience and track record of the fund managers.

- Size: Consider the fund’s size, as larger funds may have more resources but could also be less agile.

- Tax implications: Determine if the fund is subject to any tax inefficiencies or distributions that could affect your returns.

Monitoring and Rebalancing

After you invest in a mutual fund, it’s essential to monitor its performance regularly. Track its returns against its benchmark or similar funds. If the fund underperforms consistently, it may be time to rebalance your portfolio by selling some units and reallocating the proceeds to other funds.

Conclusion

Investing in mutual funds can be a rewarding experience. By following these tips, you can increase your chances of finding the best mutual funds to invest in. However, remember that the stock market is inherently volatile, and no investment is guaranteed. Always invest with a plan and be prepared to accept some risk. Consult with a financial professional for personalized advice and support.

The Best Mutual Funds to Invest In

When it comes to investing, mutual funds are a great option for many people. They offer a diversified portfolio of stocks and bonds, which can help to reduce risk. They’re also professionally managed, so you don’t have to worry about making all the investment decisions yourself. That said, there are a lot of mutual funds out there, so it can be hard to know which ones are the best.

1. Consider Your Investment Goals

The first step in choosing a mutual fund is to consider your investment goals. What are you saving for? Retirement? A down payment on a house? A child’s education? Once you know your goals, you can start to narrow down your choices.

2. Do Your Research

Once you have a general idea of what you’re looking for, it’s time to start doing your research. There are a number of resources available to help you compare mutual funds. You can read reviews online, talk to a financial advisor, or use a mutual fund screener.

3. Consider the Fees

Mutual funds charge fees, so it’s important to compare the fees of different funds before you invest. The fees will eat into your returns, so it’s important to choose a fund with low fees. Some of the most common fees include expense ratios, management fees, and sales charges.

4. Past Performance

When you’re looking at mutual funds, it’s natural to want to look at past performance. However, it’s important to remember that past performance is not a guarantee of future results. That said, it can give you some idea of how a fund has performed in different market conditions. If you’re worried about risk, you may want to consider a fund with a more conservative track record.

5. Tax Implications

When choosing a mutual fund, it’s also important to consider the tax implications. There are two types of mutual funds: taxable and tax-advantaged. Tax-advantaged funds allow you to defer paying taxes on your earnings until you withdraw the money. This can be a big advantage, especially if you’re investing for the long term. Some of the most common tax-advantaged funds include 401(k)s and IRAs.

Conclusion

Choosing the right mutual fund can be a daunting task, but it’s important to take the time to find a fund that meets your needs. By following these steps, you can increase your chances of finding the best mutual funds to invest in.

No responses yet