Introduction

Investing in the stock market can be a lucrative venture, but it can also be daunting, especially for beginners. Buying and selling stocks is a fundamental aspect of stock market investing, and mastering this skill can significantly enhance your chances of success. This article will delve into the intricacies of buying and selling stocks, providing you with the essential knowledge to navigate the financial markets with confidence. We have compiled a comprehensive guide to help you understand the basics of stock trading, including a step-by-step guide to buying and selling stocks. Additionally, we’ll provide tips and strategies to help you make informed decisions and maximize your returns.

Understanding the Basics

Before you start buying and selling stocks, it’s crucial to understand the basics of stock trading. Stocks represent ownership in a company. When you buy a stock, you’re essentially becoming a part-owner of that company. The value of your stock will fluctuate based on the company’s performance, the overall market conditions, and other factors. It’s important to remember that investing in stocks carries inherent risks, and you should always do your research before making any investment decisions.

Choosing a Broker

Once you’re ready to start trading stocks, you’ll need to choose a broker. A broker is a financial institution that facilitates the buying and selling of stocks. There are many different brokers to choose from, each with its own fees, services, and features. It’s important to do your research and find a broker that meets your specific needs and investment style. Consider factors such as the broker’s trading platform, fees, research tools, and customer support.

Placing an Order

When you’re ready to buy or sell a stock, you’ll need to place an order with your broker. You can do this through your broker’s online platform or by phone. When placing an order, you’ll need to specify the stock you want to trade, the number of shares you want to buy or sell, and the price you’re willing to pay. There are different types of orders, such as market orders, limit orders, and stop orders. Understanding the different order types and how they work can help you control your risk and achieve your investment goals.

Executing the Trade

Once you’ve placed an order, your broker will execute the trade on your behalf. Depending on the type of order you placed, the trade may be executed immediately or at a later time. Once the trade is executed, your broker will update your account to reflect the purchase or sale of the stock. It’s important to monitor your trades and be aware of any changes in the market that may affect your investments.

Buy and Sell Stock LeetCode: A Beginner’s Guide to Mastering Stock Trading

Stock markets are like bustling marketplaces where investors buy and sell pieces of ownership in companies, represented by stocks. If you’re ready to dive into the thrilling world of stock trading, the LeetCode platform offers a perfect sandbox for honing your skills.

Understanding Stock Markets

Picture this: you own a slice of a favorite pizza place, and that slice represents a share of the business. The stock market is essentially a giant marketplace where people can buy and sell these slices of ownership in companies. Each share holds a small piece of the company’s value, and its price fluctuates based on factors such as the company’s performance, market demand, and global events.

Trading Stocks: Buy Low, Sell High

The ultimate goal of stock trading is to buy low and sell high. When you buy a share, you’re hoping its value will increase so you can sell it for a profit. Conversely, if you sell a share, you’re hoping its value will drop so you can buy it back at a lower price. But don’t be fooled by its simplicity; stock trading is an intricate dance that requires patience, strategy, and a deep understanding of market dynamics.

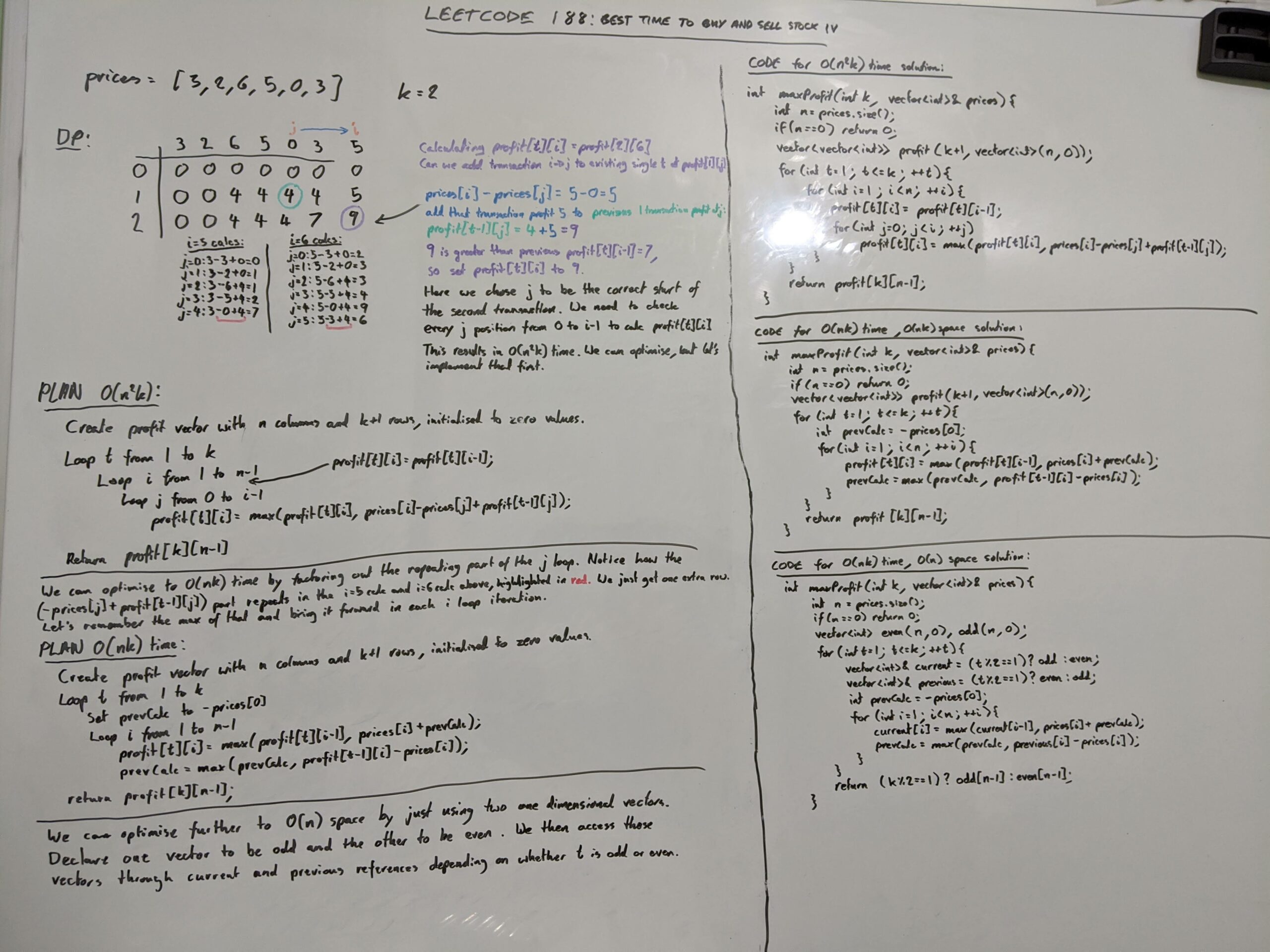

Buy and Sell Stock LeetCode

Now, let’s turn our attention to LeetCode’s buy and sell stock problem. This algorithmic challenge is designed to test your ability to find the maximum profit from buying and selling a single stock, given an array of daily prices. The goal is to buy the stock at the lowest price and sell it at the highest price within the given time frame.

Solving the Problem

To crack this problem, you’ll need to iterate through the price array, keeping track of the minimum price (representing the potential buying point) and the maximum profit (representing the difference between the lowest buying price and the highest selling price). By constantly updating these values, you can find the optimal time to buy and sell the stock for maximum profit.

Tips for Success

Mastering stock trading is a journey that requires discipline, research, and a willingness to learn from your mistakes. Here are a few tips to help you navigate the stock market confidently:

- Do your homework: Research the companies you’re investing in, understand their industry, and stay informed about market trends.

- Start small: Don’t jump into the deep end; start by investing small amounts you can afford to lose.

- Diversify your portfolio: Spread your investments across different stocks, industries, and asset classes to reduce risk.

- Invest for the long term: Don’t chase quick profits; focus on building a solid portfolio that will grow over time.

Buy and Sell Stocks with LeetCode’s Insightful Platform

The stock market, often likened to a roller coaster, offers thrilling highs and heart-stopping lows. Seasoned investors and novice traders alike seek strategies to navigate its unpredictable terrain. LeetCode, renowned for its programming challenges, now offers an invaluable tool for those looking to venture into the world of stock trading: the Buy and Sell Stock tool.

With LeetCode’s intuitive platform at hand, gaining insights into stock price fluctuations and making informed trading decisions becomes a breeze. Its user-friendly interface and comprehensive features provide a solid foundation for aspiring stockbrokers to embark on their financial journey.

Types of Stock Orders

When it comes to buying and selling stocks, understanding the types of orders available is paramount. Each order type serves a specific purpose, tailored to different trading strategies. Let’s delve into the three most commonly used stock orders.

Market Orders

Market orders, the most straightforward and widely used order type, are executed immediately at the prevailing market price. If you’re looking to quickly buy or sell a stock without any fuss, a market order is your go-to choice. However, be prepared for the price you receive to differ slightly from the quoted price due to market volatility.

Limit Orders

Limit orders, as their name suggests, allow you to set a specific price at which you want to buy or sell a stock. When the market price matches your specified limit, the order is executed. Limit orders offer more control over trade execution but may take longer to fill if the market price doesn’t align with your desired limit.

Stop Orders

Stop orders, a type of contingent order, are triggered when the stock price reaches a predetermined level, known as the stop price. These orders are designed to protect against significant losses or lock in profits. Stop orders can be set as stop-loss orders, which sell a stock when it falls to a certain price, or stop-buy orders, which buy a stock when it rises to a desired level.

Buy and Sell Stock LeetCode

The stock market can be a rollercoaster ride, but it can also be a great way to grow your wealth. If you’re thinking about investing in stocks, it’s important to do your research and understand the different strategies that you can use. One popular strategy is buying and selling stocks based on the LeetCode platform. LeetCode is a website that provides coding challenges and interview preparation materials for software engineers. By solving LeetCode problems, you can improve your coding skills and learn about different algorithms and data structures. Once you’ve mastered the basics, you can start using LeetCode to identify stocks that are undervalued or overvalued.

Stock Market Strategies

There are many different stock market strategies that you can use, but some of the most popular include:

- Value investing involves buying stocks that are trading below their intrinsic value. Intrinsic value is the value of a stock based on its fundamentals, such as its earnings, cash flow, and assets.

- Technical analysis involves using charts and other technical indicators to identify trading opportunities. Technical analysts believe that past price movements can be used to predict future price movements.

- Growth investing involves buying stocks that are expected to grow faster than the overall market. Growth stocks are typically priced at a higher multiple of their earnings than value stocks.

- Income investing involves buying stocks that pay dividends. Dividends are payments that companies make to their shareholders. Income investors typically look for stocks with a high dividend yield.

- Speculative investing involves buying stocks that are expected to make a big move in the short term. Speculative stocks are typically more volatile than other types of stocks.

The best stock market strategy for you will depend on your individual goals and risk tolerance. If you’re not sure which strategy is right for you, it’s a good idea to talk to a financial advisor.

Buy and Sell Stock LeetCode

One way to use LeetCode to identify stocks that are undervalued or overvalued is to look at the company’s problem-solving skills. Companies that are able to solve difficult problems are more likely to be successful in the long run. You can also look at the company’s interview process. Companies that have a rigorous interview process are more likely to hire talented engineers.

Once you’ve identified a few companies that you’re interested in, you can start tracking their stock prices. You can use a stock screener to find companies that meet your criteria, and you can set up alerts to notify you when a stock price reaches a certain level.

When you’re ready to buy or sell a stock, you can use a brokerage account. A brokerage account is an account that you can use to buy and sell stocks, bonds, and other investments. There are many different brokerage accounts available, so it’s important to compare them before you open an account.

Investing in stocks can be a great way to grow your wealth, but it’s important to remember that there is always risk involved. Before you invest in any stock, it’s important to do your research and understand the risks involved.

Buy and Sell Stock LeetCode

Seasoned investors and enthusiastic novices alike are probably well-acquainted with the popular coding problem “Buy and Sell Stock” on LeetCode. The task challenges programmers to find the maximum profit achievable by buying and selling a single stock, with its price fluctuating over time. However, for those who wish to venture beyond the realm of hypothetical trading and step into the real world of stock markets, a robust understanding of trading platforms and reputable brokers is paramount. In this comprehensive guide, we’ll break down the ins and outs of these intermediaries and delve into the specifics of using the “Buy and Sell Stock” algorithm in practice.

Trading Platforms and Brokers

At the heart of stock trading lie platforms and brokers, the gatekeepers to the bustling marketplaces where stocks are exchanged. These entities provide the necessary tools and features to execute trades efficiently, making them indispensable partners in the pursuit of financial success. However, selecting the right platform and broker can be a daunting task, as the sheer number of options available can be overwhelming. To simplify your decision-making process, we’ve compiled a list of essential factors to consider:

- Fees and commissions: Every trade incurs costs, and these fees can vary significantly between platforms and brokers. It’s crucial to compare these expenses carefully to optimize your profits and avoid any unpleasant surprises.

- Features and tools: Different platforms offer varying degrees of sophistication when it comes to their features and tools. Some platforms cater to experienced traders with advanced charting capabilities, while others focus on user-friendliness for beginners. Choose a platform that aligns with your trading style and skill level.

- Security and reliability: entrusting your hard-earned money to a trading platform is a serious matter, so it’s essential to prioritize security and reliability. Look for platforms that employ robust encryption measures and have a proven track record of safeguarding customer funds.

- Customer support: Inevitably, you’ll encounter questions or issues while trading. Prompt and efficient customer support is crucial in resolving these matters quickly and effectively. Check out the platform’s reputation for customer service before committing to a long-term relationship.

- Mobile trading: In today’s fast-paced world, the ability to trade on the go is more important than ever. Look for platforms that offer robust mobile apps to ensure you can stay on top of market movements and execute trades from anywhere.

Once you’ve selected a reliable trading platform and broker, you can confidently apply the “Buy and Sell Stock” algorithm to maximize your returns. But remember, the stock market is a dynamic and unpredictable environment, so make sure to approach trading with a well-informed strategy and a healthy dose of caution.

No responses yet