ETFs: What Are They?

Ever heard of a “mutual fund,” a basket of investments that gets traded once a day? Well, its cool cousin, the exchange-traded fund (ETF), is similar, but it trades all throughout the day, just like stocks. As the name suggests, ETFs hang out on stock exchanges, making them super accessible to eager investors.

What’s Inside an ETF?

Inside an ETF, you’ll find a diverse crew of stocks, bonds, or other assets. These ETFs give investors an easy way to spread their bets across a range of investments, rather than putting all their eggs in one basket. It’s like having a customizable investment portfolio, but without the hassle of picking and choosing each one.

Take, for example, the mighty SPDR S&P 500 ETF (SPY). This ETF tracks the S&P 500 index, so when the index goes up, SPY generally follows suit. SPY, therefore, provides an easy way to invest in the overall U.S. stock market.

How Do ETFs Do Their Thing?

ETFs are managed by smart folks called fund managers who decide which investments to include in the basket. These managers aim to keep the ETF aligned with its stated objective, whether that’s tracking an index like the S&P 500 or investing in a specific sector like technology or healthcare. So, when you buy an ETF, you’re not just buying a single stock; you’re getting a piece of a carefully curated investment strategy.

ETFs also offer another cool perk: flexibility. Since they’re traded on exchanges, you can buy and sell them throughout the trading day, just like stocks. This means you can jump in or out of an ETF whenever you feel like it, giving you more control over your investments.

Are ETFs Right for You?

Whether ETFs are a good fit for you depends on your investment goals and risk tolerance. They offer diversification, flexibility, and potential growth, but they also come with management fees. If you’re looking for a convenient and cost-effective way to invest in a wide range of assets, ETFs are worth considering.

Just remember, all investments come with some level of risk. ETFs are no exception. Before diving in, it’s wise to do your research and understand the specific ETF you’re interested in. This way, you can make informed decisions that align with your financial goals.

ETFs: What’s the Buzz All About?

Ever wondered what all the fuss is about when it comes to exchange-traded funds (ETFs)? Well, hold on tight, because we’re about to dive into the world of these investment powerhouses and answer your burning question: "What exactly are ETFs?"

ETFs are like flexible investment baskets that track the performance of a collection of stocks, bonds, commodities, or other assets. Think of them as a grab bag full of investments, providing you with instant diversification without having to do all the legwork of handpicking each one.

Types of ETFs

The ETF universe is a vast expanse, with different flavors to suit every investor’s taste. Here’s a closer look at some of the most popular types:

1. Index ETFs

These ETFs track the performance of a specific market index, such as the S&P 500 or the Nasdaq 100. They’re like clones of the index, allowing you to tap into the overall market’s ups and downs.

2. Sector ETFs

Got a favorite industry? Sector ETFs give you exposure to specific sectors of the economy, like tech, healthcare, or energy. It’s like buying a ticket to a particular slice of the market’s pie.

3. Bond ETFs

These ETFs invest in a pool of bonds, making them a haven for fixed-income seekers. They offer a more diversified approach to bond investing than buying individual bonds, reducing your risk in the process.

4. Commodity ETFs

Investing in commodities like gold, silver, or oil? Commodity ETFs make it a snap. They allow you to track the price movements of these raw materials without having to buy and store the actual stuff.

5. Currency ETFs

The world’s currencies can be a foreign language to some. Currency ETFs simplify it all by tracking the fluctuations of different currencies against each other, making it easy to spread your bets across different economic zones.

ETFs: What Is It?

Exchange-traded funds, also known as ETFs, are a mashup of stocks and mutual funds. They’re like a smorgasbord of investments, offering a diversified mix of assets all wrapped up in one tidy package. But unlike their mutual fund cousins, ETFs trade like stocks, making them a breeze to buy and sell throughout the trading day. If you’re wondering where to start your investing journey, an ETF might just be the perfect stepping stone.

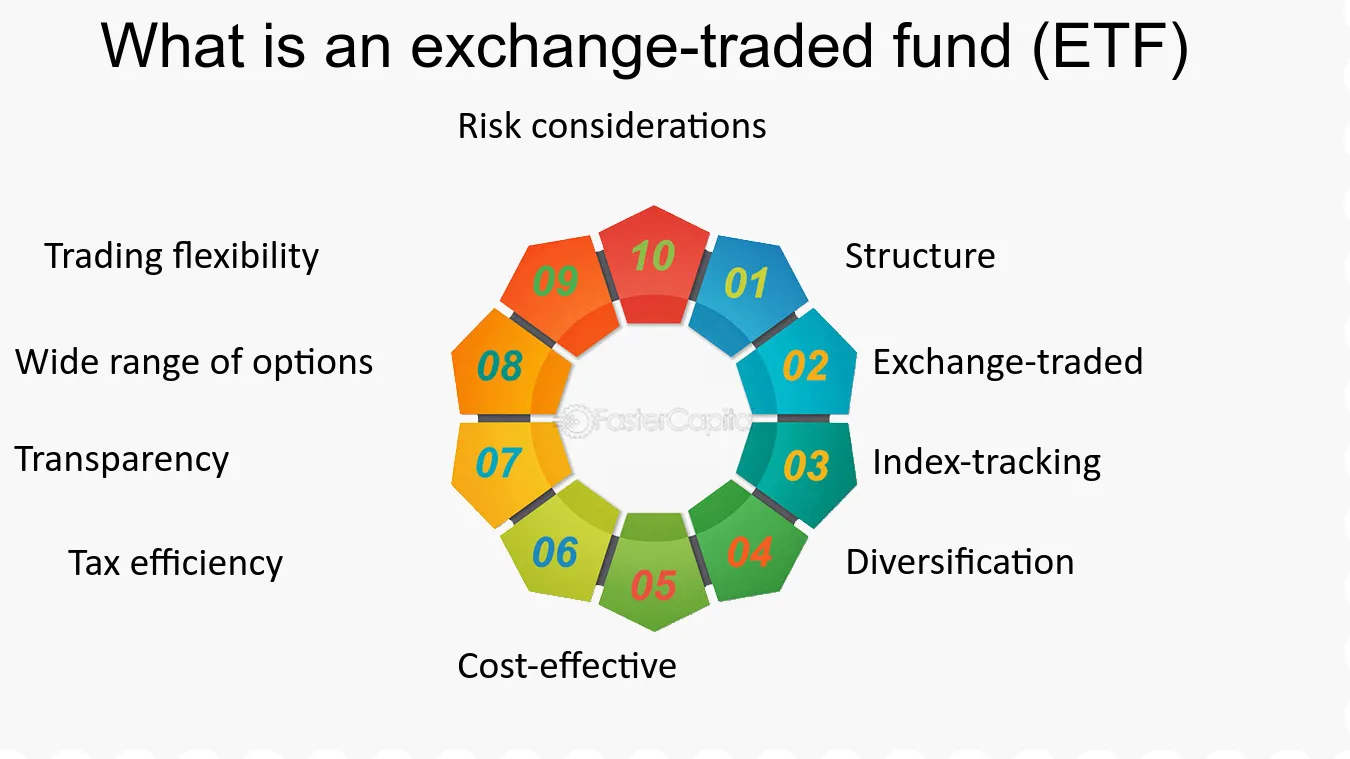

Benefits of ETFs

ETFs have a few tricks up their sleeves that make them stand out in the investing ring.

-

Diversification, baby! ETFs are like a safety net for your investments. They spread your money across multiple assets, reducing the risk of losing big bucks on any one investment. It’s like putting all your eggs in different baskets – if one basket drops, you’ve still got the others to cushion the blow.

-

Cheap thrills! ETFs typically have lower costs than mutual funds. No hefty fees or sales commissions eating into your returns. It’s like finding a treasure chest without the pesky pirate guarding it.

-

Tax-friendly treat! ETFs can be tax-efficient, especially when compared to mutual funds. They’re designed to minimize capital gains taxes – those pesky charges you pay when you sell an investment for a profit. It’s like getting a tax break without having to file a bunch of paperwork. Plus, ETFs usually distribute dividends on a regular basis, and these payments may be eligible for preferential tax treatment depending on your individual circumstances. So, you can potentially earn some extra cash while Uncle Sam gets a smaller slice of the pie.

-

Trading flexibility! ETFs trade just like stocks, making it easy to buy or sell them whenever you want during market hours. No need to wait for the end of the day or deal with pesky brokers. It’s like having a stock market playground at your fingertips.

-

Variety, the spice of life! ETFs cover a vast universe of investments, from stocks and bonds to commodities and real estate. You can find an ETF that aligns with your investing goals and risk tolerance. It’s like a buffet of investment options, where you can pick and choose the ones that tickle your fancy.

What Are ETFs?

ETFs or Exchange-Traded Funds, are investment vehicles that track a basket of assets such as stocks, bonds, commodities, and even real estate. They trade like stocks on exchanges like the New York Stock Exchange (NYSE) and give investors access to a diversified portfolio of assets in an easy and convenient way. ETFs have become increasingly popular in recent years due to their low costs, transparency, and flexibility.

Benefits of ETFs

One of the key benefits of ETFs is their low cost. Compared to traditional mutual funds, ETFs typically have lower expense ratios, which means more of your investment goes towards investing and less towards fees. ETFs are also transparent as they publish their holdings on a daily basis, allowing investors to easily track the underlying investments.

ETFs offer flexibility as they can be easily bought and sold at any time during market hours. This allows investors to respond quickly to market changes and adjust their portfolios accordingly. Additionally, ETFs provide a way to access a wide range of asset classes and investment strategies, allowing investors to diversify their portfolios in a single investment vehicle.

Risks of ETFs

Like any investment, ETFs come with certain risks, such as tracking errors and liquidity risks. Tracking errors occur when the ETF’s performance differs from the underlying index it tracks. This can happen due to factors such as changes in the composition of the index or transaction costs incurred by the ETF. Liquidity risk refers to the risk that an ETF may not be able to easily buy or sell its underlying assets, which can impact the ability of investors to trade the ETF at a fair price.

Other risks associated with ETFs include credit risk, interest rate risk, and currency risk. Credit risk refers to the risk that the issuer of the underlying assets may default on its obligations, which can impact the value of the ETF. Interest rate risk refers to the risk that changes in interest rates can impact the value of the underlying assets, particularly for fixed-income ETFs. Currency risk refers to the risk that changes in exchange rates can impact the value of the underlying assets for ETFs that invest in global markets.

ETFs are generally considered less risky than investing in individual stocks or bonds, but it’s important to note risks still exist. Prior to investing in ETFs, it’s crucial to understand the specific risks associated with each one and ensure they align with your investment objectives and risk tolerance.

ETFs: What Is It All About?

ETFs, short for exchange-traded funds, are a type of investment vehicle that has taken the financial world by storm. Imagine a basket of stocks or bonds that trade on stock exchanges, just like individual company shares. But here’s the kicker: ETFs offer investors a convenient way to diversify their portfolios with a single investment, making them a popular choice for both seasoned and novice investors alike.

How Do ETFs Work?

ETFs are designed to track a specific index or asset class. For instance, an ETF that tracks the S&P 500 index will hold stocks of all the companies included in that index. When the value of those stocks goes up or down, so does the value of the ETF. This makes ETFs an effective tool for investors who want exposure to a particular market sector or asset class without having to buy individual stocks or bonds.

Advantages of Investing in ETFs

ETFs come with a slew of advantages that have made them a darling among investors. For starters, they offer instant diversification, spreading your risk across multiple assets. They’re also relatively low-cost compared to other types of investments, such as mutual funds. Additionally, ETFs are highly liquid, meaning you can buy or sell them quickly and easily on the stock exchange.

Disadvantages of Investing in ETFs

While ETFs are generally a solid investment option, they’re not without their drawbacks. One potential downside is that they can be somewhat inflexible. Unlike individual stocks or bonds, you can’t customize an ETF’s holdings to suit your specific investment goals. Also, ETFs are subject to market fluctuations, so your investment may not always perform as you’d hoped.

How to Choose an ETF

When choosing an ETF, it’s essential to consider a few key factors:

**1. Underlying Index:** Determine the specific index or asset class that the ETF tracks. Make sure it aligns with your investment strategy and risk tolerance.

**2. Fees:** ETFs typically charge management fees that cover expenses such as trading costs and portfolio management. Compare fees across different ETFs to find one that fits your budget.

**3. Liquidity:** Consider the trading volume and bid-ask spread of the ETF. High liquidity ensures that you can buy or sell your shares quickly and at a fair price.

**4. Expense Ratio:** This is the annual percentage of assets that the ETF charges to cover its operating costs. Lower expense ratios mean more of your investment remains invested.

**5. Tracking Error:** This measures how closely the ETF’s performance matches the underlying index it tracks. A lower tracking error indicates that the ETF is effectively replicating the index’s performance.**

What Are ETFs?

ETFs, or exchange-traded funds, are investment vehicles similar to mutual funds, but they trade on stock exchanges like individual stocks. They offer a convenient and cost-effective way for investors to diversify their portfolios and gain exposure to various asset classes, including stocks, bonds, commodities, real estate, and more. ETFs are traded throughout the trading day, providing investors with real-time pricing and liquidity.

Benefits of ETFs

ETFs have numerous advantages for investors. They offer:

- Diversification: ETFs allow investors to spread their risk across multiple assets within a single investment.

- Low costs: ETFs typically have lower expense ratios compared to actively managed mutual funds.

- Transparency: ETFs provide real-time pricing and disclose their holdings daily, offering transparency to investors.

- Flexibility: ETFs can be bought and sold like individual stocks, providing flexibility and liquidity.

Types of ETFs

There are various types of ETFs available, including:

- Index ETFs: These ETFs track a specific market index, such as the S&P 500 or the Nasdaq 100.

- Sector ETFs: These ETFs focus on a particular sector or industry, such as technology, healthcare, or financials.

- Bond ETFs: These ETFs invest in bonds, providing exposure to fixed-income assets.

- Commodity ETFs: These ETFs track the prices of commodities, such as gold, oil, or wheat.

- International ETFs: These ETFs invest in stocks or bonds from companies outside the United States.

Choosing an ETF

Selecting the right ETF depends on your investment goals and risk tolerance. Consider the following factors:

- Investment goals: Determine your investment horizon and objectives.

- Risk tolerance: Assess your willingness to take on risk.

- Expense ratio: Compare the expense ratios of different ETFs to minimize costs.

- Tracking error: Consider the ETF’s tracking error, which measures how closely it follows its underlying index.

Investing in ETFs

Investing in ETFs is straightforward. You can purchase ETFs through an online broker or a financial advisor. You’ll need to open an investment account and fund it with cash. Once your account is funded, you can search for and select the ETFs you want to invest in. The trading process is similar to buying or selling stocks.

Conclusion

ETFs provide a convenient and cost-effective way to invest in a wide range of assets. They offer diversification, transparency, flexibility, and low expenses. By understanding the types of ETFs available, choosing the right ETF for your needs, and investing wisely, you can harness the power of ETFs to grow your wealth over the long term.

No responses yet