FTSE High Dividend Yield Index: A Deep Dive into the UK’s Income-Generating Powerhouse

As investors seek havens in today’s turbulent markets, the FTSE High Dividend Yield Index has emerged as a beacon of stability and income generation. This index, a curated basket of the UK’s top 100 dividend-paying companies, offers a unique opportunity for investors to tap into the steady stream of cash distributions that these established businesses provide.

What is the FTSE High Dividend Yield Index?

Picture this: the FTSE High Dividend Yield Index is like a meticulously crafted portfolio, handpicked for its ability to dish out generous dividends. It’s a who’s who of the UK’s corporate elite, including household names like BP, Shell, and HSBC. These companies have a proven track record of rewarding their shareholders with consistent payouts, making the index a haven for income-seekers.

Unlike the FTSE 100, which represents the largest companies by market capitalization, the FTSE High Dividend Yield Index is all about finding the most generous dividend payers. This means that dividend yield, the percentage of a company’s share price that is paid out as a dividend, is the key metric that determines a company’s inclusion in the index. The higher the dividend yield, the more attractive the company becomes for index inclusion.

Factors Influencing the FTSE High Dividend Yield Index

Several factors shape the composition and performance of the FTSE High Dividend Yield Index. First and foremost is the overall health of the UK economy. A strong economy typically leads to higher corporate profits, which in turn can boost dividend payments.

The index is also sensitive to interest rate changes. Rising interest rates can make alternative investments like bonds more attractive, potentially reducing demand for dividend-paying stocks. Conversely, falling interest rates can increase the relative appeal of dividends, driving up the index’s value.

Finally, the index is subject to the whims of the wider stock market. When markets are buoyant, dividend-paying stocks tend to fare well. However, during market downturns, these stocks can experience volatility as investors seek shelter in safer assets.

Benefits of Investing in the FTSE High Dividend Yield Index

Investing in the FTSE High Dividend Yield Index offers several potential benefits. First and foremost, it provides investors with a steady stream of income through dividend payments. These dividends can supplement an investor’s regular income, contribute to retirement savings, or simply provide a financial cushion.

Moreover, the index offers diversification. By investing in a basket of companies rather than a single stock, investors can mitigate the risk associated with individual company performance. This diversification can help smooth out fluctuations in the index’s value over time.

Finally, the FTSE High Dividend Yield Index has historically provided a competitive return on investment compared to other asset classes. While dividend yields can fluctuate, the index has generally outperformed the wider stock market over the long term.

Cautions for Investors

While the FTSE High Dividend Yield Index offers attractive potential returns, it’s essential to approach investing with caution. Remember, no investment is without risk. The value of the index can fluctuate, and investors could lose money.

It’s also important to consider that dividend yields are not guaranteed. Companies may reduce or eliminate dividends anytime, especially during challenging economic times. Therefore, investors should carefully consider their financial goals and risk tolerance before investing in the FTSE High Dividend Yield Index.

FTSE High Dividend Yield Index: A Guide to High-Yield Investing

The FTSE High Dividend Yield Index, comprising the 100 UK companies with the highest dividend yields, serves as a valuable tool for investors seeking steady income streams. It represents a curated selection of blue-chip stocks boasting attractive dividend payouts, making it a popular choice for income-oriented portfolios.

How is the Index Calculated?

The index’s calculation is a straightforward process. It takes the average of the dividend yields of the 100 companies within its composition. Dividend yield is a measure of the annual dividend paid per share relative to the stock’s market price. The higher the yield, the greater the income potential for investors. The FTSE High Dividend Yield Index thus provides a reliable gauge of the dividend-generating capacity of the UK stock market’s top performers.

The index is rebalanced quarterly, ensuring that the constituent companies continue to meet the eligibility criteria. This involves reviewing the dividend yields of all UK-listed companies and replacing those that no longer qualify with suitable alternatives. This rigorous process helps maintain the index’s focus on high-yield stocks while ensuring its relevance in the ever-evolving market landscape.

The FTSE High Dividend Yield Index offers investors a means of identifying companies with a strong track record of dividend payments. By investing in the index, investors can potentially capture the benefits of income generation and capital appreciation over time. It’s worth noting that while the index is designed to provide exposure to high-yield stocks, it’s essential to conduct thorough research before investing in any individual company.

FTSE High Dividend Yield Index: A Deep Dive

The FTSE High Dividend Yield Index is an esteemed benchmark in the United Kingdom’s stock market, offering investors a window into the performance of top dividend-paying companies. Composed of the 100 highest dividend-yielding stocks in the FTSE All-Share Index, it serves as a beacon for investors seeking a steady stream of income.

What is the Purpose of the Index?

The FTSE High Dividend Yield Index is an indispensable tool for investors seeking exposure to high-yielding stocks. Its meticulous selection process ensures that only the most reliable dividend payers make the cut, providing investors with a diverse portfolio of income-generating assets. The index’s performance is closely monitored by analysts and investors alike, offering insights into the health of the UK’s dividend-paying companies.

Composition and Selection Criteria

The FTSE High Dividend Yield Index is a dynamically managed index, with its constituents reviewed quarterly. The selection process is stringent, ensuring that only companies meeting specific criteria make the cut. These criteria include:

- Dividend Yield: Companies must consistently pay dividends and have a dividend yield higher than the FTSE All-Share Index median.

- Market Capitalization: Companies must have a minimum market capitalization of £1 billion.

- Liquidity: Stocks must be actively traded to ensure sufficient liquidity for investors.

This rigorous selection process ensures that the FTSE High Dividend Yield Index represents the cream of the crop of the UK’s dividend-paying companies.

Performance and Returns

The FTSE High Dividend Yield Index has delivered consistent returns for investors over the long term. Its dividend yield has historically outperformed the broader market, providing investors with a steady stream of income. The index’s total return has also been impressive, with investors enjoying both dividend income and capital appreciation.

Conclusion

The FTSE High Dividend Yield Index is an indispensable tool for investors seeking exposure to high-yielding stocks in the UK market. Its carefully curated selection of companies ensures that investors receive a steady stream of income from reliable dividend payers. The index’s performance has been consistently strong, offering investors both dividend income and capital appreciation. For those looking to build a portfolio of income-generating assets, the FTSE High Dividend Yield Index is a must-have.

FTSE High Dividend Yield Index: A Haven for Dividend Seekers

When it comes to generating passive income through dividends, the FTSE High Dividend Yield Index stands tall. This index comprises a select group of UK companies known for their generous dividend payouts. For investors seeking a steady stream of income, the index offers a compelling proposition.

What is the FTSE High Dividend Yield Index?

The FTSE High Dividend Yield Index is a market-capitalization-weighted index that tracks the performance of the 100 UK-listed companies with the highest dividend yields. These companies are typically well-established and financially sound, with a history of consistent dividend payments. The index is reviewed and reconstituted quarterly to ensure it reflects the current dividend landscape.

Benefits of Investing in the Index

Investing in the FTSE High Dividend Yield Index provides investors with several tangible benefits:

- Steady Income: The index constituents are known for their generous dividend distributions, providing investors with a regular source of passive income.

- Diversification: The index offers instant diversification across various sectors and industries, reducing the risk associated with investing in individual companies.

- Stability: The companies included in the index are typically large and mature, offering stability and resilience in volatile market conditions.

- Tax Efficiency: Dividends are generally tax-efficient, especially for investors in tax-sheltered accounts such as ISAs or 401(k)s.

- Flexibility: Index funds or exchange-traded funds (ETFs) that track the FTSE High Dividend Yield Index provide investors with flexibility and liquidity, allowing them to buy and sell their investments easily.

How to Access the Index

Investors can gain exposure to the FTSE High Dividend Yield Index through a variety of investment vehicles, including:

- Index Funds: These funds passively track the index, providing investors with a cost-effective way to invest in the underlying companies.

- ETFs: ETFs are similar to index funds but trade like stocks on exchanges, offering investors flexibility and intraday liquidity.

- Direct Investment: Investors can also invest directly in the individual companies included in the index, although this requires more research and diversification efforts.

Conclusion

The FTSE High Dividend Yield Index is an attractive option for investors seeking a steady stream of income through dividends. Its constituents are well-established and financially sound, providing stability and diversification. Whether you choose to invest through index funds, ETFs, or direct investment, the index offers a convenient and cost-effective way to generate passive income while benefiting from the growth potential of the UK stock market.

FTSE High Dividend Yield Index: A Comprehensive Guide

The FTSE High Dividend Yield Index (FTSE HYDI) is a stock market index that tracks the performance of the 100 UK-listed companies with the highest dividend yields. This index is designed to provide investors with exposure to a diversified portfolio of high-yielding stocks, which can be an attractive option for those seeking income-generating investments.

Dividend yield is a measure of the annual dividend payment per share divided by the current share price. Dividend yields are often expressed as a percentage. High dividend yielding companies are favored by investors who are looking for regular income from their investments, as they typically offer higher yields than bonds or other fixed-income securities. If you’re looking to generate income from your investments and are willing to take on more risk than traditional fixed-income investments, the FTSE HYDI may be worth considering.

What are the Benefits of Investing in the FTSE HYDI?

Investing in the FTSE HYDI offers several potential benefits, including:

- **High Dividend Yields:** As mentioned earlier, the index is designed to provide investors with exposure to a diversified portfolio of high-yielding stocks. This can be an attractive option for investors seeking income-generating investments.

- **Dividend Growth Potential:** Many of the companies included in the FTSE HYDI have a track record of increasing their dividends over time. This can provide investors with the potential for growing income over the long term.

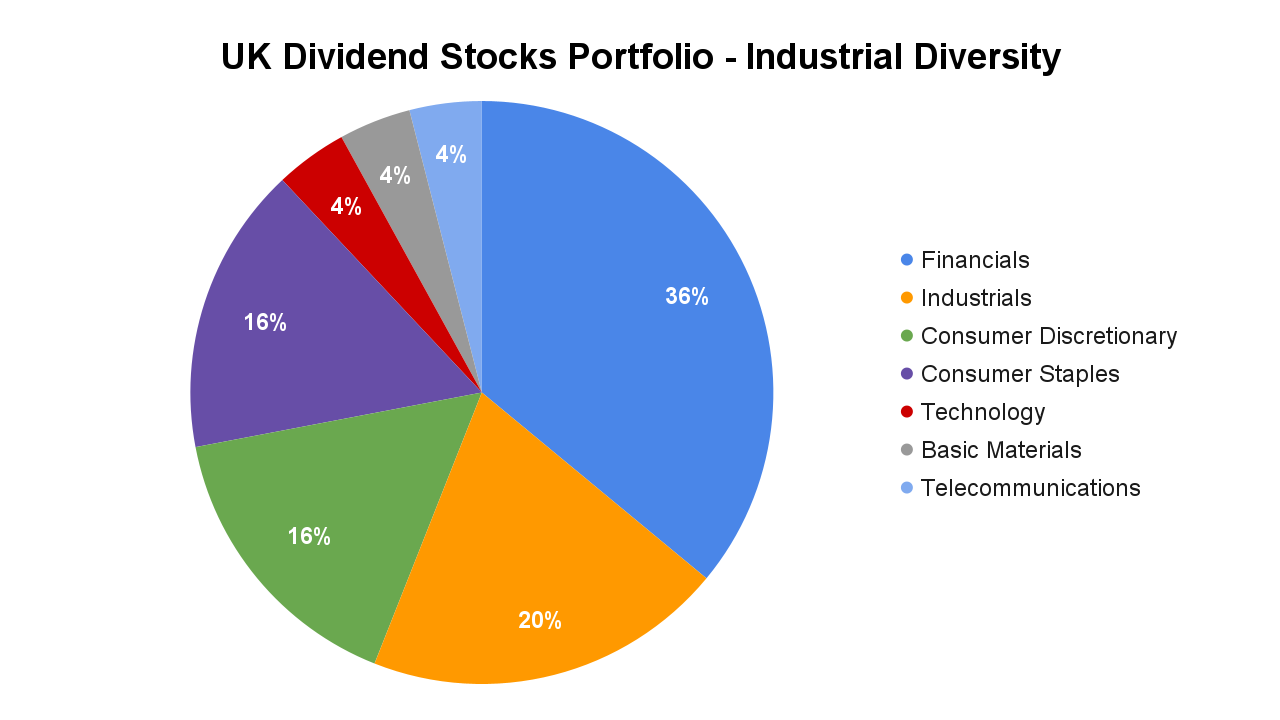

- **Diversification:** The index offers diversification across multiple sectors, which can reduce risk compared to investing in individual stocks.

What are the Risks of Investing in the FTSE HYDI?

The FTSE HYDI is subject to the same risks as any other stock market investment, including the risk of losing money. Some of the specific risks to consider include:

- **Dividend Cuts:** Companies can cut or eliminate their dividends at any time, which can have a negative impact on the value of your investment.

- **Interest Rate Risk:** High-yield stocks are typically more sensitive to interest rate changes than other stocks. If interest rates rise, the value of high-yield stocks can decline.

- **Economic Downturns:** During economic downturns, companies may be more likely to cut or eliminate dividends in order to preserve cash. This can have a negative impact on the performance of the FTSE HYDI.

How to Invest in the FTSE HYDI

There are several ways to invest in the FTSE HYDI. One option is to buy shares of an exchange-traded fund (ETF) that tracks the index. ETFs are a convenient and cost-effective way to gain exposure to a basket of stocks, including the FTSE HYDI.

Another option is to buy shares of individual companies that are included in the FTSE HYDI. This gives you more control over your investment, but it also requires more research and analysis.

Conclusion

The FTSE HYDI can be an attractive option for investors seeking income-generating investments. However, it’s important to understand the risks involved before investing. By carefully considering your investment objectives and risk tolerance, you can make an informed decision about whether the FTSE HYDI is right for you.

No responses yet