Introduction

Dividend-paying stocks are like dependable companions in the unpredictable world of investing. They offer a consistent stream of income, akin to a gentle breeze that fills your sails, even when the market’s waves threaten to toss you around. And among these income-generating stocks, high dividend yield stocks stand out like beacons, promising generous rewards for your investment. In this guide, we’ll delve into the world of high dividend yield stocks, exploring their benefits, risks, and strategies for navigating this lucrative corner of the market. Along the way, we’ll introduce you to some of the top-yielding stocks that can potentially supercharge your portfolio’s income potential. So, buckle up, investors, and let’s dive into the world of high dividend yield stocks.

Understanding High Dividend Yield Stocks

High dividend yield stocks are companies that distribute a substantial portion of their earnings to shareholders in the form of dividends. These dividends are typically expressed as a percentage of the stock’s price, known as the dividend yield. Stocks with dividend yields above the market average are considered high dividend yield stocks.

There are several reasons why companies may choose to pay high dividends. Some companies have a long history of paying dividends and are committed to maintaining that tradition. Others may be in industries that generate stable cash flow, allowing them to consistently distribute dividends to shareholders.

Investing in high dividend yield stocks can provide several benefits. First and foremost, they offer a steady stream of income, which can be especially appealing to retirees or investors seeking regular cash flow. Second, dividends can provide a hedge against market volatility. When the market takes a downturn, dividend-paying stocks can help offset losses in other parts of your portfolio.

Third, high dividend yield stocks can potentially boost your overall portfolio returns. Over time, reinvested dividends can compound and significantly increase the value of your investment. However, it’s important to note that dividend yield alone should not be the sole factor in your investment decisions. Consider the company’s financial health, industry outlook, and overall investment goals before making any decisions.

High Dividend Yield Stocks: A Comprehensive Guide

High dividend yield stocks are a popular investment choice for income-oriented investors, offering a steady stream of passive income. These stocks typically pay dividends that are higher than the average market yield, making them an attractive option for those looking to supplement their income or retirement savings.

Types of High Dividend Yield Stocks

There are two main types of high dividend yield stocks: value stocks and income stocks.

Value Stocks

Value stocks are companies that trade at a discount to their intrinsic value. These stocks tend to be undervalued by the market due to factors such as a temporary slowdown in business or negative sentiment. Value investors look for companies with strong fundamentals, such as solid cash flow, low debt, and a strong balance sheet. When these companies eventually recover, their stock prices can rise, providing investors with both dividend income and capital appreciation.

Income Stocks

Income stocks are companies that have a long history of paying reliable dividends. These companies typically have stable earnings and cash flow, making them less susceptible to economic downturns. Income investors focus on companies that pay consistent dividends, even during challenging times. While income stocks may not offer the same potential for capital appreciation as value stocks, they provide a more stable source of income.

Factors to Consider When Choosing High Dividend Yield Stocks

When choosing high dividend yield stocks, there are several factors to consider:

-

Dividend Yield: The dividend yield is the annual dividend divided by the current stock price. A higher dividend yield means a higher income stream. However, it’s important to note that a very high dividend yield could be a sign that the stock is overvalued or that the company is facing financial difficulties.

-

Dividend Coverage: Dividend coverage is a measure of a company’s ability to pay its dividends. It is calculated by dividing the company’s earnings per share by its annual dividend per share. A dividend coverage ratio of 1 or more indicates that the company has sufficient earnings to cover its dividend payments.

-

Company Financials: It is essential to review a company’s financial statements before investing in high dividend yield stocks. Look for companies with strong cash flow, low debt, and a solid balance sheet.

-

Growth Potential: While income-oriented investors may not be primarily focused on capital appreciation, it is still important to consider a company’s growth potential. Companies with strong growth prospects may offer both dividend income and capital appreciation over the long term.

High Dividend Yield Stocks to Consider

Here are a few examples of high dividend yield stocks that meet the criteria discussed above:

-

AT&T (T): AT&T is a telecommunications company with a long history of paying reliable dividends. The company has a dividend yield of over 5% and a dividend coverage ratio of over 1.

-

Verizon (VZ): Verizon is another telecommunications company with a strong dividend history. The company has a dividend yield of over 4% and a dividend coverage ratio of over 1.

-

Realty Income (O): Realty Income is a real estate investment trust (REIT) that invests in single-tenant commercial properties. The company has a dividend yield of over 4% and a dividend coverage ratio of over 1.

-

PPL Corporation (PPL): PPL Corporation is a utility company that provides electricity and natural gas to customers in the eastern United States. The company has a dividend yield of over 5% and a dividend coverage ratio of over 2.

-

ExxonMobil (XOM): ExxonMobil is a large oil and gas company. The company has a dividend yield of over 3% and a dividend coverage ratio of over 1.

High Dividend Yield Stocks: A Smart Investment for Passive Income

High dividend yield stocks have become increasingly popular among investors seeking stable income and long-term growth. These stocks offer attractive dividends, providing investors with a regular cash flow. But what are the specific benefits of investing in high dividend yield stocks?

Benefits of Investing in High Dividend Yield Stocks

1. Regular Income Stream:

One of the primary benefits of high dividend yield stocks is the regular stream of income they provide. Dividends are typically paid quarterly or annually, allowing investors to supplement their income or reinvest in their portfolio. This is particularly valuable for retirees, investors with stable financial needs, or those looking for a passive income stream.

2. Reduced Volatility:

Dividend-paying companies tend to be more mature and financially stable than growth stocks. This stability typically translates into reduced price volatility, meaning high dividend yield stocks can provide a cushion against market fluctuations. They can help balance a portfolio and reduce overall risk.

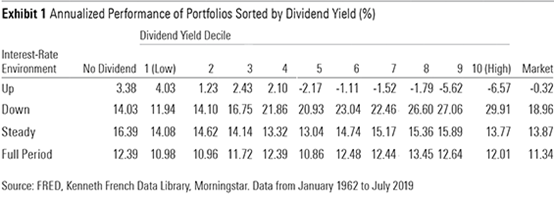

3. Potential for Long-Term Outperformance:

While not always the case, historical data suggests that high dividend yield stocks have the potential to outperform the broader market over the long term. This is because dividend payments are a sign of a company’s health and profitability. Companies that can consistently pay dividends are likely to have sustainable business models and strong earning streams. Over time, these companies tend to grow in value, potentially leading to capital appreciation in addition to dividend income.

4. Tax Advantages:

In some jurisdictions, dividend income is taxed at a lower rate than other types of investment returns. This tax advantage can further enhance the overall return on investment in high dividend yield stocks.

5. Diversification:

Investing in high dividend yield stocks can help investors diversify their portfolios. By allocating a portion of their portfolio to these stocks, investors can reduce their exposure to growth stocks or other riskier investments. This diversification can help reduce the overall risk of the portfolio while potentially generating a steady income stream.

The Allure of High Dividend Yield Stocks

In the world of investing, high dividend yield stocks often grab attention like a siren’s song. These stocks, often from established companies with a track record of paying out generous dividends, can seem like a safe haven in volatile markets. But before you dive in, it’s crucial to understand the potential risks involved.

Potential for Dividend Cuts

One of the biggest risks associated with high dividend yield stocks is the potential for dividend cuts. While companies may strive to maintain their dividend payments, economic downturns or unexpected events can force them to slash or even eliminate dividends. Remember, dividends are not guaranteed, and they can be reduced or eliminated at any time.

Interest Rate Risk

Interest rates play a significant role in the valuation of high dividend yield stocks. When interest rates rise, the value of these stocks tends to fall. This is because investors can now earn higher returns on their money in low-risk investments like bonds, making high dividend yield stocks less attractive. Conversely, when interest rates decline, high dividend yield stocks often become more desirable.

Impact of Inflation

Inflation can erode the value of dividends over time. If inflation outpaces the dividend growth rate, the purchasing power of those dividends will diminish. Investors need to consider the inflation rate when evaluating the attractiveness of high dividend yield stocks.

Additional Risks: A Closer Look

In addition to these core risks, there are several other factors that investors should be aware of. Some companies may use debt to maintain their dividend payments, which can increase financial risk. High dividend yield stocks can also have low growth potential, as companies prioritize dividend payments over investment in their businesses. Lastly, these stocks may be more sensitive to market fluctuations than other investments due to their perceived risk.

High Dividend Yield Stocks: A Golden Egg or a Rotten Apple?

When it comes to investing in stocks that pay out handsome dividends, it’s like walking on a tightrope—the potential rewards are tempting, but the risks can be equally daunting. That’s why savvy investors tread carefully when venturing into the realm of high dividend yield stocks.

The Allure of High Dividends

Who doesn’t love a steady stream of passive income? High dividend yield stocks offer exactly that—a juicy chunk of the company’s profits paid out to shareholders on a regular basis. But hold your horses, there’s more to these stocks than meets the eye.

Unveiling the Secrets of High Dividend Yields

Before you dive headfirst into the pool of high dividend yield stocks, let’s explore what makes them tick:

1. Company’s Financial Health:

A company’s financial health is like a crystal ball—it reveals its ability to sustain those luscious dividends. Look for companies with strong cash flow, low debt levels, and a proven track record of profitability.

2. Dividend History:

A consistent dividend history is like a reliable old friend—you can count on it. Choose companies with a history of paying dividends for years, even during tough times.

3. Growth Prospects:

Don’t just settle for a steady dividend; look for companies with the potential to grow their dividends over time. This means investing in companies with strong growth opportunities and a solid management team.

4. Dividend Coverage Ratio:

This metric tells you how easily a company can cover its dividend payments. A ratio of 1 or above is a good sign, indicating that the company has enough cash flow to keep its shareholders happy.

5. Unlocking the Value of High Dividend Yields:

Now, for the pièce de résistance: understanding how high dividend yields can work their magic:

- Passive Income: Dividends provide a steady stream of income, regardless of market fluctuations. It’s like having a part-time job that pays you every quarter.

- Hedging Against Inflation: Dividends can help protect your portfolio from inflation’s sneaky bite. Over time, the value of your dividends may increase along with the cost of living.

- Total Return: Dividends contribute to a stock’s total return, which includes both price appreciation and dividend income. In the long run, high dividend yield stocks can deliver impressive total returns.

Cautionary Notes:

Like any investment, high dividend yield stocks come with their share of risks. Keep these in mind:

- Dividend Cuts: Companies can and do cut their dividends, especially during economic downturns.

- Overvaluation: Sometimes, high dividend yield stocks can be overvalued, leading to potential losses.

- Interest Rate Risk: Rising interest rates can make high dividend yield stocks less attractive to investors.

So, are high dividend yield stocks right for you? It depends on your investment goals, risk tolerance, and financial situation. If you’re looking for a steady stream of passive income, willing to weather some risks, and have a long-term investment horizon, high dividend yield stocks may be worth a closer look. Just remember to do your due diligence and invest wisely.

No responses yet