Introduction

Investing is all about making your money work for you. And one of the best ways to do that is by investing in dividend-paying stocks. Dividends are payments that companies make to their shareholders out of their profits. And while they’re not guaranteed, they can provide a steady stream of income that can help you reach your financial goals.

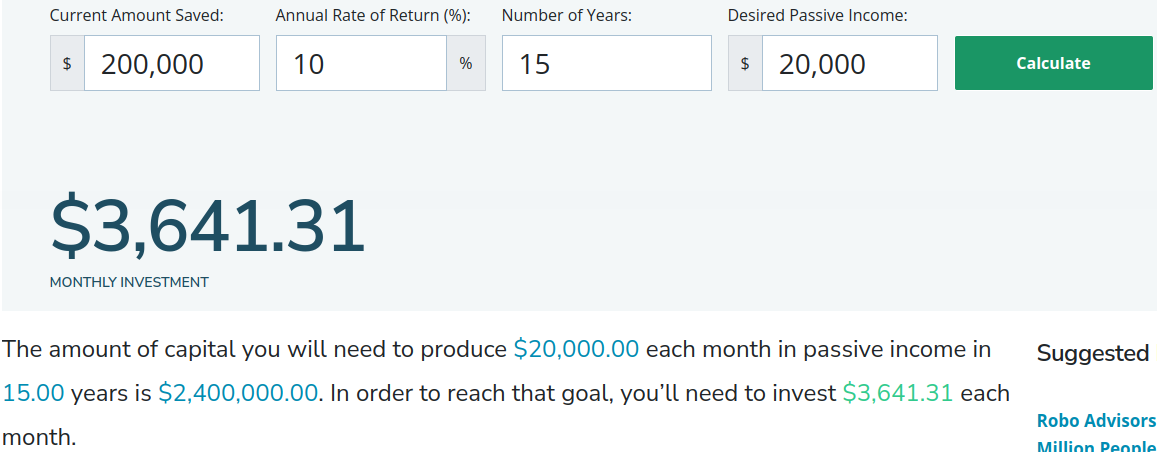

That’s where an investment dividend calculator comes in. This handy tool can help you estimate the potential dividend income you could earn from an investment. Simply enter the stock’s ticker symbol, the number of shares you own, and the dividend yield. The calculator will then do the math for you and give you an estimate of your potential dividend income.

Of course, there’s no guarantee that you’ll actually receive the dividend income that the calculator predicts. But it can give you a good starting point for your research. And if you’re looking for a way to generate a steady stream of income from your investments, dividend-paying stocks are a great place to start.

How to invest in dividend paying stocks

If you’re interested in investing in dividend-paying stocks, there are a few things you should keep in mind. First, it’s important to do your research and choose companies that have a history of paying dividends. You should also consider the company’s financial health and its dividend yield.

Once you’ve chosen a few companies that you’re interested in, you can start buying shares of their stock. You can do this through a broker or directly through the company itself.

Once you own shares of stock, you’ll be eligible to receive dividends. Dividends are typically paid out quarterly, but some companies pay them out monthly or annually. The amount of the dividend you receive will depend on the number of shares you own and the dividend yield.

Investing in dividend-paying stocks can be a great way to generate a steady stream of income. However, it’s important to do your research and choose companies that have a history of paying dividends. You should also consider the company’s financial health and its dividend yield.

A Handy Tool for Investors: Unveiling the Investment Dividend Calculator

Are you an investor eager to estimate your potential dividend income? Look no further than our state-of-the-art investment dividend calculator. This nifty financial wizardry allows you to plug in essential details, including the stock symbol or company name, the number of shares you own or plan to purchase, and the expected dividend yield. Voilà! With a click of a button, you’ll have a precise estimate of your anticipated dividend earnings. It’s that simple!

Delving into the Details of Dividend Calculations

Let’s dive deeper into the inner workings of our dividend calculator. First, let’s talk about the dividend yield. This crucial indicator reveals the percentage of the stock’s current market price that the company distributes to shareholders as dividends. Armed with this information, you can multiply it by the number of shares you hold to arrive at your estimated dividend income.

For example, if a stock trades at $50 per share and boasts a dividend yield of 5%, you’ll receive an annual dividend payment of $2.50 per share ($50 x 5% = $2.50). And guess what? The calculator automates this entire process for you, providing you with lightning-fast and accurate dividend estimates, like a financial wizard at your fingertips.

Understanding the Significance of Dividends

Why, you might ask, are dividends so darn important? For one, they offer a consistent source of passive income. Unlike capital gains, which are dependent on the whims of the stock market, dividends are regular payments made by the company to its shareholders. This steady stream of income can significantly enhance your financial stability and provide a dependable cushion during market downturns.

Moreover, dividends often serve as a barometer of a company’s financial health. Companies that consistently pay and increase their dividends are generally considered to be financially sound and committed to rewarding their investors. By considering the dividend history of a stock before you invest, you’ll gain invaluable insights into its long-term viability and potential for growth.

Scrutinize Your Dividends: A Guide to the Factors Influencing Your Payouts

Hey there, fellow investors! Ready to embark on a journey into the realm of dividend investing? Before you take the plunge, let’s arm ourselves with knowledge about the factors that can make all the difference in our dividend returns. Our handy-dandy investment dividend calculator is your trusty companion to get started.

Factors Affecting Dividends

Buckle up, because we’re about to uncover the factors that dance around dividends. Just like the weather, dividends can be unpredictable, influenced by a symphony of elements.

Company’s Financial Performance

When it comes to dividends, the company’s financial health is the star of the show. Think of it like a trusty car. When the engine is purring, dividends can flow like honey. But when times get tough, even the most reliable car can sputter and dividend payments may take a hit. The company’s earnings, revenue, and profitability are like the gas that keeps the dividend engine running.

Dividend Payout Ratio

Every company has a unique personality, and their dividend payout ratio is a reflection of that. It’s the percentage of their earnings they sprinkle back to you as dividends. Some companies, like cautious squirrels, stash away most of their earnings, resulting in a lower payout ratio. Others, like generous grandmas, delight in sharing a larger chunk, leading to a higher payout ratio.

Market Conditions

The stock market is like a moody ocean, its waves can rock the dividend boat. When the market is calm and seas are smooth, companies are more likely to keep dividends steady or even raise them. But when the storm clouds gather and the waves crash, dividends may become more vulnerable to cuts or freezes.

The Company’s Future Prospects

Companies don’t just live in the present; they’ve got their eyes on the horizon. If they foresee a bright future with ample growth potential, they may prioritize investing in that growth over doling out dividends. On the flip side, if a company’s future looks a bit hazy, they may hit the brakes on dividends to ensure financial stability.

Industry Trends and Competitive Landscape

Every company swims in a sea of competitors and industry trends. Like sharks, these factors can have a bite on dividends. If an industry is booming and companies are raking in the dough, dividends may blossom. But in a fiercely competitive landscape, companies may need to sharpen their pencils and find creative ways to keep dividends afloat.

Investment Dividend Calculator: Unlocking the Key to Informed Decisions

Investing in dividend-paying stocks can be a smart way to generate passive income. But how can you estimate the potential returns before diving in? Enter the investment dividend calculator, a handy tool that helps you crunch the numbers.

Benefits of Using a Dividend Calculator

Easy and Convenient

Calculating dividend income manually can be a pain. But a dividend calculator does the heavy lifting for you, providing instant estimates based on your input. It’s like having a personal money-making oracle at your fingertips.

Informed Decision-Making

Guesswork has no place in investing. A dividend calculator empowers you to make educated decisions by assessing potential dividends. It’s like having a roadmap to financial success, showing you the clear path to achieving your investment goals.

Realistic Expectations

No one wants to be disappointed with their investments. A dividend calculator helps you set realistic expectations by accurately estimating dividend income. It’s like a crystal ball that peeks into the future, giving you a glimpse of your potential financial gains.

Planning for the Future

Investing isn’t just about the present; it’s about securing your financial future. A dividend calculator helps you plan for the long haul by estimating future dividend income. It’s like a financial GPS that guides you towards a comfortable retirement or any other financial milestone you’re aiming for.

Finding Hidden Gems

Not all dividend-paying stocks are created equal. Some may offer higher yields than others. A dividend calculator can help you uncover hidden gems with attractive dividend payouts. It’s like a treasure map for investors, leading you to stocks that can potentially boost your passive income.

Don’t let uncertainty cloud your investment decisions. Use an investment dividend calculator today and unlock the power of informed decision-making. Let it be your guide to financial success, helping you maximize your dividend income and reach your financial aspirations with confidence.

Investment Dividend Calculator: A Guide to Estimating Your Earnings

Ready to dive into the world of dividend investing? Our investment dividend calculator can help you estimate how much you might earn based on historical data, current share prices, and estimated dividend yields. Simply input the necessary details, and we’ll crunch the numbers to provide you with a ballpark figure of your potential earnings.

Limitations of Dividend Calculators

While dividend calculators can be a helpful tool, they’re not without their limitations. It’s crucial to understand that these calculators provide estimates based on historical data, which means that actual dividends may deviate from the projections. Furthermore, dividend yields can fluctuate over time, especially during periods of economic uncertainty or corporate changes.

Consideration of Other Financial Metrics

When making investment decisions, relying solely on a dividend calculator is not advisable. It’s equally important to consider other relevant financial metrics, such as a company’s earnings per share (EPS), debt-to-equity ratio, and price-to-earnings (P/E) ratio. These indicators can provide insights into a company’s overall financial health and stability, which can impact the sustainability of its dividend payments.

Consultation with Financial Professionals

Investing is a complex endeavor, and consulting with financial professionals can be invaluable. They can provide personalized advice based on your specific financial situation, risk tolerance, and long-term goals. They can also help you navigate the complexities of dividend investing and make informed decisions that align with your overall financial strategy.

The Importance of Due Diligence

Before investing in any dividend-paying company, it’s essential to conduct thorough due diligence. This involves researching the company, its industry, and its track record of dividend payments. It’s also a good idea to check if the company has consistent cash flow and a reasonable debt-to-equity ratio. This helps minimize the risk of potential dividend cuts or suspensions in the future.

No responses yet