Investment Property Calculator: A Guide for Real Estate Investors

Are you considering investing in real estate? If so, you’ll need to crunch some numbers to see if the investment makes financial sense. That’s where an investment property calculator comes in.

An investment property calculator is a tool that can help you estimate the potential return on your investment. It takes into account factors such as the purchase price of the property, the rental income you expect to receive, and the expenses you’ll need to pay. By plugging these numbers into a calculator, you can get a good idea of whether or not the investment is worth pursuing.

How to Use an Investment Property Calculator

Investment property calculators are relatively easy to use. Start by entering the purchase price of the property. Then, enter your estimated rental income and expenses. The calculator will then generate a report that shows you your potential return on investment.

It’s important to note that investment property calculators are only estimates. Actual results may vary depending on a number of factors, such as the condition of the property, the local rental market, and your ability to manage the property.

What Factors to Consider

When using an investment property calculator, there are a number of factors to consider:

-

The purchase price of the property: This is the most important factor to consider, as it will have a major impact on your potential return.

-

The rental income you expect to receive: This is the income you expect to receive from renting out the property. It’s important to be realistic about your expectations, as overestimating your rental income can lead to disappointment.

-

The expenses you’ll need to pay: These expenses include things like property taxes, insurance, repairs, and maintenance. It’s important to factor in all of these expenses when calculating your potential return.

-

Your investment goals: What are you hoping to achieve with your investment? Are you looking for a long-term investment or a short-term flip? Your goals will help you determine the type of property you invest in and the amount of risk you’re willing to take.

By considering all of these factors carefully, you can use an investment property calculator to get a good idea of whether or not an investment property is right for you.

What is an Investment Property Calculator?

Are you contemplating investing in rental properties? If so, you’ll need an investment property calculator. This handy tool can help you estimate the potential financial performance of a property before you buy it. Let’s dive into the world of investment property calculators and learn how they can assist you in making informed decisions.

How to Use an Investment Property Calculator?

Using an investment property calculator is pretty straightforward. Simply input information about the property you’re considering, such as the purchase price, mortgage details, rental income, and expenses. The calculator will then estimate your potential cash flow, return on investment, and other important financial metrics. This information can help you determine if the property is a good investment.

What Factors to Consider When Using an Investment Property Calculator?

When using an investment property calculator, it’s important to consider several factors that can affect the accuracy of the results. These include the accuracy of the input data, the assumptions used in the calculator, and the market conditions. It’s also important to remember that investment property calculators are just estimates and should not be relied upon solely when making investment decisions.

The Benefits of Using an Investment Property Calculator

There are several benefits to using an investment property calculator. Firstly, it can help you estimate your potential return on investment. Secondly, it can help you identify potential cash flow problems. Thirdly, it can help you compare different properties and make the best investment decision. Fourthly, it can help you build a financial plan for your investment property.

Tips for Using an Investment Property Calculator

To get the most out of an investment property calculator, here are a few tips: Enter accurate data. Use conservative assumptions. Consider different market conditions. Compare results from multiple calculators. Seek professional advice.

Investment Property Calculator: A Path to Smart Investing

Embarking on the adventure of investing in real estate requires meticulous planning, and that’s where the trusty investment property calculator comes in handy. Like a GPS for your financial journey, this calculator crunches numbers and guides you towards wise decisions, giving you the confidence to navigate the complexities of property ownership.

How to Use an Investment Property Calculator

Using the calculator is as simple as a walk in the park. Input the property’s vital statistics—purchase price, rental income, and operating expenses—and watch the calculator work its magic. In a blink of an eye, it’ll generate crucial financial metrics that paint a clear picture of the property’s potential.

Understanding the Metrics

The calculator unfurls a treasure-trove of information, including cash flow, cap rate, cash-on-cash return, and ROI. Let’s break these down:

-

Cash Flow: This is the money you’ll have in your pocket each month after subtracting all expenses from rental income, giving you a snapshot of your property’s profitability.

-

Cap Rate: It’s a nifty number that tells you the annual return on your investment based solely on rental income, offering a glimpse into the property’s potential for long-term appreciation.

-

Cash-on-Cash Return: This metric dives deeper, revealing the annual return on the cash you invested as a down payment rather than a loan, showcasing the property’s ability to generate income directly into your pocket.

-

ROI: It’s the ultimate measure of your investment’s success, encompassing rental income, property appreciation, and expenses, painting a comprehensive picture of your total return.

Example of Investment Property Calculator

Let’s say you’re eyeing a property with a purchase price of $200,000, a monthly rental income of $2,000, and annual operating expenses of $5,000. When you plug these figures into the calculator, you’ll discover the property boasts a cash flow of $1,500, a cap rate of 6%, a cash-on-cash return of 9%, and a potential ROI of 15%. These metrics paint a rosy picture, suggesting the property could be a sound investment.

Investing in real estate is a marathon, not a sprint. By harnessing the power of the investment property calculator, you can make informed decisions, set realistic expectations, and increase your chances of a fruitful investment journey.

Investment Property Calculator: A Guide to Smart Investing

There’s a world of valuable information out there just waiting to be unlocked, and when it comes to investment properties, there’s no better way to get a clear picture than with an investment property calculator. What is it, you may ask? It’s your trusty financial sidekick, a tool that helps you crunch the numbers, separating the dream properties from the potential pitfalls.

Key Metrics Calculated by Investment Property Calculators

An investment property calculator is a wizard at analyzing potential investments, offering a range of metrics to help you navigate the financial landscape. We’re talking about the nitty-gritty, the hard numbers that can make or break a deal. Let’s dive into the key calculations these calculators provide:

Cash Flow: This one’s all about the green, baby. It helps you estimate the difference between the income you’ll generate from your property and the expenses associated with maintaining it. A positive cash flow means you’ll have some jingle in your pocket after paying the bills; a negative one? Well, let’s just say you might need a side hustle.

Cap Rate: Think of this as the annual rate of return you can expect from your property. It’s calculated by dividing the net operating income by the property’s current market value. A cap rate of 5% means you’ll earn $5 for every $100 you invest, so higher is better here!

Cash-on-Cash Return: This metric gives you a clearer picture of your actual cash flow situation. It’s calculated by dividing the annual pre-tax cash flow by your total cash investment (the down payment plus any closing costs). A 10% cash-on-cash return means you’ll receive $10 for every $100 you invest annually.

Internal Rate of Return (IRR): This one’s a bit more complex, but it’s worth considering. The IRR is the annualized rate of return you’ll need to cover both your initial investment and the ongoing operating costs of the property. It helps you determine if the investment is worth your while in the long run.

Additional Tips for Using an Investment Property Calculator

Now, let’s chat about some extra tidbits to keep in mind when using an investment property calculator:

– Input accurate data: Garbage in, garbage out! Make sure you’re plugging in the correct numbers to get meaningful results.

– Consider different scenarios: Play around with different variables, such as interest rates, rental income, and property values, to see how they impact your returns.

– Understand the limitations: An investment property calculator is a great tool, but it’s not a magic wand. There are other factors to consider, like market conditions and your personal financial situation.

Investment Property Calculator: Your Guide to Informed Decisions

The world of real estate investing can be a daunting one, especially if you’re a newbie. With an investment property calculator, though, you can take the guesswork out of the process and make smarter decisions. Just like a reliable compass guiding you on a trek, this calculator is your beacon of clarity, pointing you towards the most promising investment opportunities.

Benefits of Using an Investment Property Calculator

Simplifying the Investment Process

Investing in properties can be a complex process, but this is where the calculator shines. It takes the heavy lifting off your shoulders, analyzing mountains of data and presenting you with clear, concise results. You won’t have to spend countless hours crunching numbers or poring over spreadsheets.

Streamlining the Analysis

Time is precious, especially in the fast-paced world of real estate. An investment property calculator allows you to analyze properties in a fraction of the time it would take to do it manually. With just a few clicks, you can compare multiple properties, identifying the ones that best meet your goals.

Establishing a Standardized Approach

When you’re evaluating properties, consistency is key. A calculator provides a standardized framework for comparing investments. This ensures that you’re using the same criteria for all properties, making it easier to identify the best fits.

Empowering Informed Decisions

With an investment property calculator, you’re not just blindly jumping into the market. Calculators arm you with the knowledge you need to make well-informed decisions. You can see at a glance how much you’ll need for a down payment, what your estimated monthly expenses will be, and how much you can expect to earn on your investment.

Example Investment Property Calculator

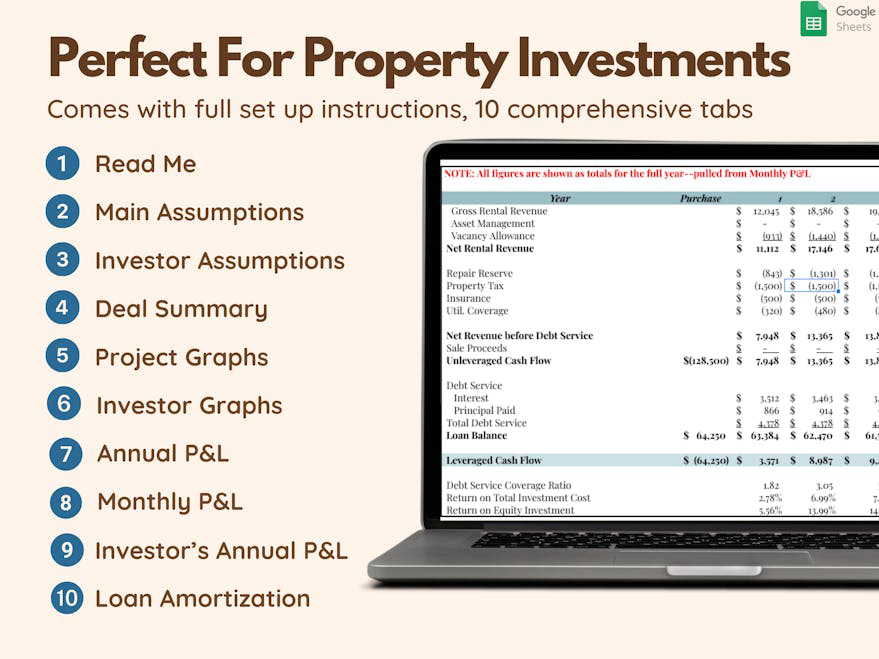

Here’s an example of an investment property calculator that you can use to analyze properties:

[Include investment property calculator here]

Conclusion

Investing in rental properties can be a profitable venture, but it requires careful planning. With an investment property calculator, you can streamline the process and make informed decisions. Think of it as your trusty sidekick, guiding you towards financial success in the world of real estate.

Investment Property Calculator: A Quick and Easy Way to Assess Potential Profits

Thinking about investing in rental properties? An investment property calculator can be a handy tool to help you crunch the numbers and estimate your potential return on investment (ROI). These calculators are readily available online and relatively easy to use, but it’s important to be aware of their limitations before you rely on them too heavily.

To get started, you’ll need to input some basic information about the property you’re considering, such as the purchase price, monthly rent, and estimated expenses. The calculator will then use this data to generate an estimate of your monthly cash flow and annualized ROI. While these estimates can provide valuable insights, it’s crucial to understand that they’re only as good as the data you put in.

Accuracy and Completeness

Inputting inaccurate or incomplete information can lead to misleading results. For example, if you underestimate the monthly expenses associated with the property, the calculator may overestimate your potential ROI. Conversely, if you overestimate the monthly rent, you may underestimate your potential return.

Factors That Can’t Be Measured

Calculators rely on mathematical formulas to generate their estimates, but they can’t account for all the qualitative factors that can impact an investment’s performance. For instance, they can’t predict changes in the local real estate market, the quality of the tenants you attract, or the likelihood of unexpected repairs or maintenance issues.

Local Market Conditions

The performance of an investment property can vary significantly depending on the local market conditions. Calculators typically don’t take into account factors such as the supply and demand of rental properties in the area, the competition from other landlords, or the overall economic climate.

Hidden Costs

Calculators may not include all the potential costs associated with owning an investment property. These could include closing costs, legal fees, property management expenses, and vacancy periods. Failing to account for these costs can lead to an overly optimistic estimate of your potential ROI.

Conclusion

Investment property calculators can be a useful tool for getting a quick and easy estimate of your potential return on investment. However, it’s important to use them with caution and be aware of their limitations. By understanding the accuracy, completeness, and factors that can’t be measured, you can make more informed decisions about your investment strategy and avoid potentially costly mistakes.

Investment Property Calculators: A Real Estate Investor’s Lifeline

Real estate investing just got a whole lot easier! Investment property calculators are becoming indispensable tools for investors like you and me. These calculators are like your secret weapon, crunching numbers and providing insights that can make all the difference in your real estate ventures.

What’s the Buzz All About?

Investment property calculators dissect the nitty-gritty details of a potential investment, giving you a clear picture of costs, potential profits, and risks. They’re like financial GPS devices, guiding you towards properties that can turn your dreams into a reality.

Unveiling the Hidden Gems

These calculators dig deep into a property’s numbers, unearthing hidden gems that might not be immediately apparent. They can show you how much you’ll need to save up, the potential rental income you can expect, and even how long it will take to recoup your investment.

Making Informed Decisions

Armed with this information, you can make well-informed decisions about which properties to pursue. No more shooting in the dark! You’ll have the confidence to invest wisely, maximizing your chances of success.

Identifying Profitability Potential

Investment property calculators don’t just tell you what the bottom line will be. They also highlight potential pitfalls, helping you avoid costly mistakes. Imagine having a crystal ball that shows you where the hidden traps lie—it’s like having an unfair advantage in the real estate game.

A Variety of Choices

There’s no one-size-fits-all investment property calculator. You can find calculators that focus on specific aspects of an investment, such as cash flow, return on investment, and loan affordability. Choose the one that’s right for your unique needs and get ready to make some savvy decisions.

The Numbers Don’t Lie

Let’s not kid ourselves, real estate investing involves a lot of money. That’s why it’s crucial to have an objective, numbers-driven approach. Investment property calculators are your trusty companions on this journey, providing you with the hard data you need to make smart choices.

Conclusion

Investing in real estate can be a lucrative endeavor, but it also comes with its fair share of risks. Investment property calculators are your secret weapon, empowering you to make well-informed decisions and mitigating those risks. So, don’t hesitate to use these tools—they can be the difference between investing wisely and throwing your money down the drain.

No responses yet