Low-Cost Investment Accounts: A Penny Saved Is a Penny Earned

In the world of investing, fees can accumulate like a stubborn barnacle, weighing down your returns and keeping you from reaching your financial goals. But there’s a beacon of hope: low-cost investment accounts. These investing havens slash exorbitant fees, freeing up more of your hard-earned cash to work for you. By choosing a low-cost investment account, you’re essentially keeping more pennies in your pocket, which can make a huge difference in the long run. And who doesn’t love a good deal?

Benefits of Low Cost Investment Accounts

Low-cost investment accounts don’t just save you money; they can also boost your returns. Lower fees mean more of your money is invested in the market, where it can grow and multiply. It’s like a magic trick, turning pennies into dollars right before your eyes. Plus, these accounts often offer a wider range of investment options, giving you the flexibility to tailor your portfolio to your specific needs and aspirations. It’s like having a secret weapon in your financial arsenal.

The benefits don’t stop there. Low-cost investment accounts can also make it easier for you to start investing. No more hefty minimum balances or complicated jargon that makes you feel like you need a PhD in finance. These accounts simplify the process, making investing accessible to everyone, whether you’re just starting out or looking to grow your nest egg. It’s time to take control of your financial future and let your money work for you, not the other way around.

Think of low-cost investment accounts as the ultimate financial life jackets, keeping your money afloat in the turbulent waters of the market. They’re your secret weapon for financial success, the key to unlocking a brighter financial future. So, why settle for high-cost accounts that weigh you down when you can choose the low-cost option that sets you free? Invest in a low-cost investment account today, and watch your money soar to new heights.

Low-Cost Investment Accounts: A Guide for Savvy Savers

In an era where inflation looms large and the cost of living gnaws away at our savings, it’s more crucial than ever to find ways to grow our money wisely without breaking the bank. Enter low-cost investment accounts—the savvier alternative to traditional investment options that often bleed us dry with hefty fees and commissions. These accounts offer a lifeline to investors seeking a budget-friendly way to put their money to work.

How to Choose the Right Low Cost Investment Account

When embarking on your low-cost investment journey, it’s essential to take stock of your financial goals, risk appetite, and time horizon. Picture yourself as a seasoned hiker preparing for a challenging trail: you must weigh your ambitions, assess your limits, and plan for the long haul.

Consider your financial goals. Do you aspire to build a nest egg for retirement, secure your child’s education, or simply grow your savings? Your aspirations will shape your investment strategy and the type of account you choose.

Next, evaluate your risk tolerance. Are you comfortable with the ups and downs of the market, or do you prefer a more stable approach? Your risk appetite will determine the asset allocation of your portfolio, the mix of stocks, bonds, and other investments that align with your goals and temperament.

Finally, determine your time horizon. When do you anticipate needing your investments? Whether you’re planning for the near future or the distant horizon, your time frame will impact your investment strategy and the types of accounts that are right for you.

Low-Cost Investment Accounts: A Path to Financial Empowerment

For many, the allure of investing remains tantalizing, promising a brighter financial future. However, the costs associated with traditional investing practices often act as a formidable barrier. Enter low-cost investment accounts, designed to break down these obstacles and empower everyday investors with affordable access to the world of investing.

Tips for Saving on Investment Costs

Investing in Low-Cost Index Funds

Gone are the days when investing required hefty fees or exclusive access to Wall Street’s elite. Index funds, passively tracking market indices like the S&P 500 or FTSE 100, have emerged as cost-effective alternatives. With minimal management fees, these funds offer broad market exposure, reducing risk and maximizing returns over the long term.

Harnessing the Power of Robo-Advisors

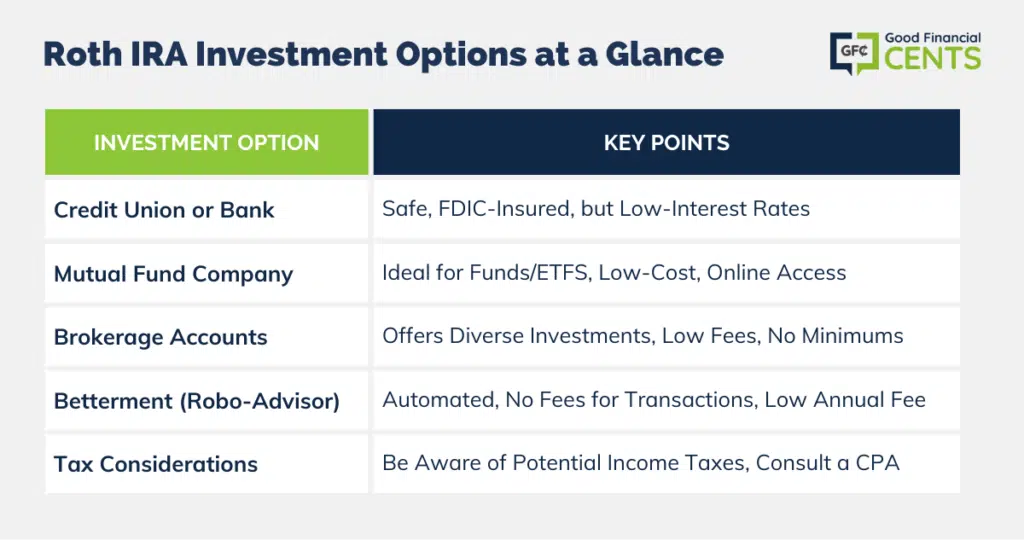

Robo-advisors have revolutionized investing by automating the process. These digital platforms provide personalized investment advice, portfolio management, and rebalancing services, all at a fraction of the cost of traditional financial advisors. Robo-advisors make it easy for beginners to navigate the investing landscape, at a significantly reduced expense.

Negotiating Lower Fees

Fees can add up, silently eroding your investment gains over time. Don’t be afraid to negotiate lower fees with your brokerage firm or advisor. By asking about fee discounts, bundled services, or lower expense ratios, you can potentially save a substantial amount in the long run.

Take Advantage of Tax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k)s and IRAs, offer additional ways to save on investment costs. By deferring taxes on investment earnings or making non-taxable withdrawals, these accounts can significantly enhance your investment growth, maximizing the return on your hard-earned dollars.

Choose a Cost-Effective Brokerage Firm

The brokerage firm you choose can make a big difference in your investment costs. Compare different firms based on their fees, trading commissions, account minimums, and available investment options. By selecting a broker that aligns with your investment strategy and financial goals, you can minimize unnecessary expenses and optimize your investment returns.

In the world of investing, knowledge is power, and by embracing these cost-saving strategies, you can unlock affordable access to financial growth. Remember, every dollar saved is a dollar invested towards a brighter financial future.

No responses yet