Hey there, investing enthusiasts! If you’re on a quest to conquer the world of finance, you’ve probably stumbled upon the Standard & Poor’s 500 Index Fund. It’s like the A-list of American companies, rolled up into one nifty package. But hold your horses, because along with the glam comes some risks. Let’s take a closer look at this investment heavyweight and what you ought to watch out for.

Risks of Investing in the S&P 500 Index Fund

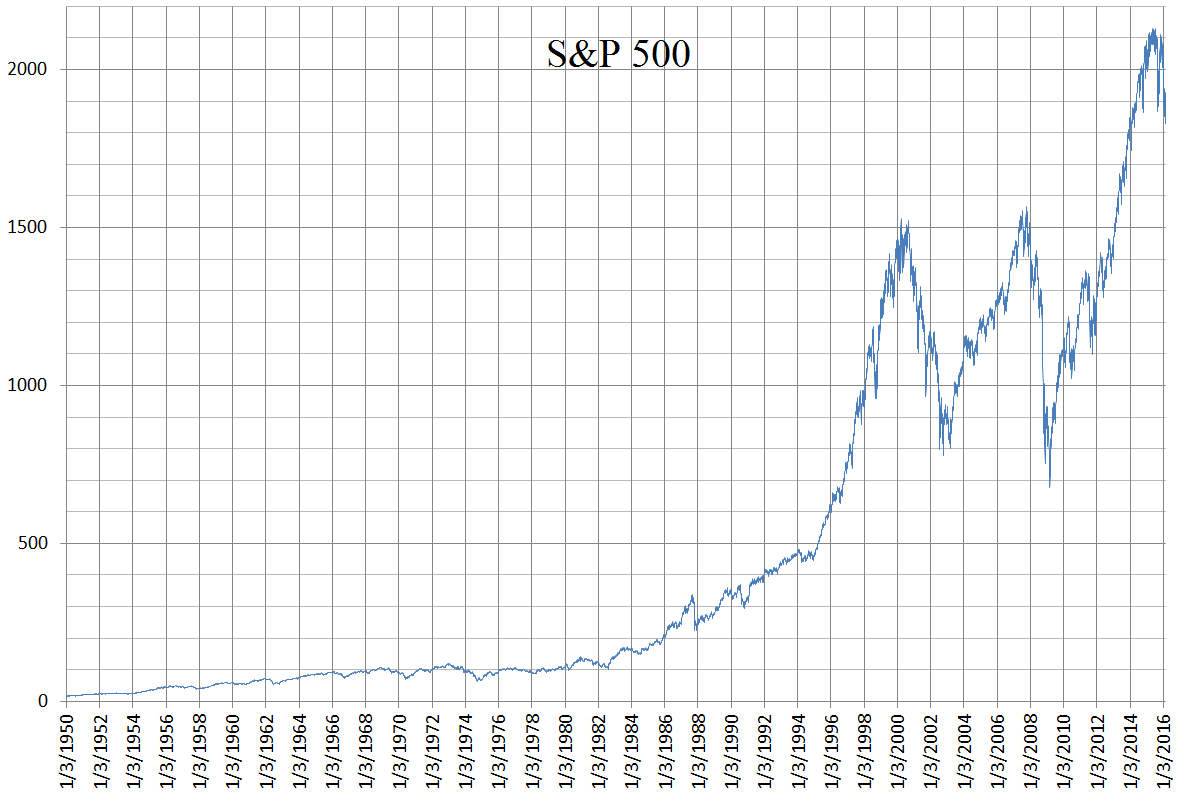

Investing in the S&P 500 Index Fund is like taking a ride on a rollercoaster. Sometimes, you’ll soar to new heights; other times, you’ll feel like you’re dropping like a rock. That’s because the fund’s performance is tied to the ups and downs of the stock market. When the market’s on a roll, so is the fund. But when the market takes a tumble, so does the fund. So, if you’re not comfortable with the idea of your investments going through wild swings, you might want to consider a less adventurous option.

Another risk to keep in mind is that the S&P 500 Index Fund is heavily concentrated in a handful of large companies. These companies are the giants of the American economy, like Apple, Microsoft, and Amazon. While this can be a good thing in rising markets, it can also make the fund more vulnerable to losses during market downturns. If just one or two of these companies hit a rough patch, it can have a significant impact on the fund’s performance. It’s like putting all your eggs in one basket. If the basket breaks, well, you know the rest.

Now, let’s talk about the potential for losses. As with any investment, there’s always the chance that you could lose money when you invest in the S&P 500 Index Fund. The stock market can be unpredictable, and even the largest companies can experience setbacks. So, before you dive in, make sure you’re prepared for the possibility that your investment could decline in value. It’s like going on a hike in the mountains. Sometimes, the path is easy and you can breeze through it. But other times, you might encounter some unexpected obstacles and have to work hard to reach the summit. Investing in the S&P 500 Index Fund is no different. It’s a journey with its own set of challenges, and you need to be prepared for the ups and downs along the way.

Standard & Poor’s 500 Index Fund: A Gateway to Market Gains

The Standard & Poor’s 500 Index Fund, or S&P 500 Index Fund, is a popular investment vehicle that tracks the performance of the 500 largest publicly traded companies in the United States. As a diversified portfolio, it offers investors a single investment that provides exposure to a broad swath of the American stock market.

How to Invest in the S&P 500 Index Fund

Investing in the S&P 500 Index Fund is relatively straightforward. There are several avenues you can take:

Mutual Funds: Mutual funds pool money from multiple investors and invest in a basket of stocks, including those that make up the S&P 500 index. This option provides diversification and professional management, but typically entails higher fees.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer lower fees than mutual funds and allow for more flexibility in trading.

Individual Stocks: You can also invest in individual companies that comprise the S&P 500 index. However, this approach requires significant research and time to manage, and it poses greater risk than investing in a diversified fund.

Benefits of Investing in the S&P 500 Index Fund

Investing in the S&P 500 Index Fund offers several advantages:

Diversification: By investing in 500 different companies, you mitigate the risk associated with any single company’s performance. The index’s broad diversification makes it less susceptible to sector- or company-specific downturns.

Long-Term Growth Potential: Over the long term, the S&P 500 index has historically performed well, providing investors with steady growth over time. It serves as a reliable core holding for a diversified portfolio.

Low Fees: Both mutual funds and ETFs that track the S&P 500 index typically have relatively low fees, making them a cost-effective way to invest.

Considerations for Investing in the S&P 500 Index Fund

While the S&P 500 Index Fund is a solid investment option, it’s important to consider its inherent risks:

Market Volatility: The stock market is inherently volatile, and the S&P 500 index is not immune to ups and downs. Investors should be prepared for short-term fluctuations and potential losses.

Economic Downturns: Economic recessions and downturns can negatively impact the S&P 500 index, leading to potential losses. Investors should factor this risk into their investment strategies.

Lack of Control: As a passive investment, the S&P 500 index fund does not allow investors to pick individual stocks or time the market. This can be limiting for those seeking more active investment strategies.

No responses yet