Standard & Poor’s 500 Index Fund

Investing in the stock market can be a daunting task, especially for beginners. One way to simplify the process is to invest in an index fund, which is a type of mutual fund that tracks a specific market index, like the Standard & Poor’s 500 Index.

The S&P 500 Index is one of the most well-known and widely followed stock market indices in the world. It consists of 500 large, publicly traded companies in various industries and sectors. When you invest in an S&P 500 index fund, you’re essentially investing in a diversified portfolio of these companies, which gives you exposure to the overall U.S. stock market.

Investing in an S&P 500 index fund can offer several advantages. First, it’s a cost-effective way to diversify your portfolio. Instead of buying individual stocks, which can be expensive and time-consuming, you can invest in an index fund that already provides you with instant diversification. Second, index funds are passively managed, which means they don’t require a lot of research or active trading. The fund manager simply follows the index, so you don’t have to worry about making investment decisions yourself.

What is the Standard & Poor’s 500 Index?

The S&P 500 is a stock market index that tracks the performance of 500 large, publicly traded companies in the United States. It’s calculated by taking the market capitalization of each company—that is, the total value of its outstanding shares—and dividing it by a divisor. The divisor is adjusted periodically to ensure that the index remains representative of the overall U.S. stock market.

The S&P 500 is a diversified index, meaning it includes companies from a variety of industries and sectors. This diversification helps to reduce risk, as the performance of different industries and sectors tends to vary over time. The index is also weighted by market capitalization, meaning that larger companies have a greater impact on the index’s performance than smaller companies.

The S&P 500 is widely regarded as a benchmark for the U.S. stock market. It’s often used by investors to track the overall performance of the market and to compare the performance of individual stocks or mutual funds to the broader market. The index can also be used as a tool for asset allocation, as it provides a convenient way to invest in a broad range of U.S. stocks.

Standard & Poor’s 500 Index Fund: A Comprehensive Guide for Investors

Investing in the stock market can be a daunting task, but it doesn’t have to be. Index funds, such as the Standard & Poor’s 500 (S&P 500) index fund, offer a convenient and cost-effective way for investors to gain exposure to a broad market.

History of the S&P 500

The S&P 500 was first published in 1923 by Standard & Poor’s, a leading provider of financial data and analytics. It initially tracked the stock prices of 233 companies, but has since expanded to include 500 of the largest publicly traded companies in the United States. The index is weighted by market capitalization, meaning that the stocks of larger companies have a greater influence on the index’s overall performance.

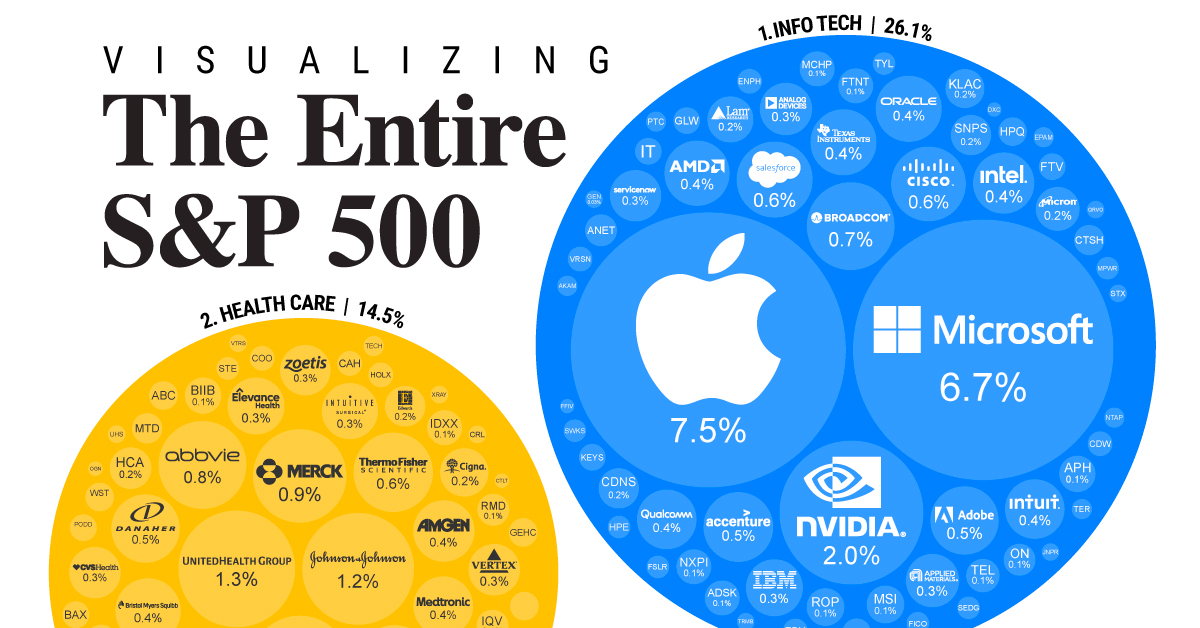

Components of the S&P 500

The S&P 500 is a broad market index that represents a wide range of industries and sectors. As of December 31, 2023, the index included companies from the following sectors:

- Information technology (29.5%)

- Health care (14.7%)

- Financials (12.3%)

- Consumer discretionary (12.2%)

- Industrials (11.6%)

The composition of the index is reviewed and adjusted regularly by a committee of investment professionals to ensure that it remains representative of the U.S. market.

Benefits of Investing in an S&P 500 Index Fund

Investing in an S&P 500 index fund offers several benefits for investors:

- Diversification: Index funds provide instant diversification, spreading your investments across hundreds of companies. This helps to reduce your overall risk.

- Low costs: Index funds typically have lower management fees than actively managed funds. This can save you money in the long run.

- Transparency: The components and performance of index funds are publicly available, making it easy to track your investments.

- Long-term growth: Over the long term, the S&P 500 has consistently outperformed inflation and other major asset classes. This makes it a suitable investment for building wealth over time.

Considerations for Investors

While index funds offer many benefits, there are some considerations to keep in mind before investing:

- Market volatility: The S&P 500 is subject to market volatility, meaning that its value can fluctuate significantly over time.

- No guarantee of returns: Past performance is not a guarantee of future returns. The value of your investment in an S&P 500 index fund could go up or down.

- Tax implications: Index funds are subject to capital gains taxes when you sell your shares.

Conclusion

Investing in an S&P 500 index fund is a smart choice for many investors, offering diversification, low costs, transparency, and the potential for long-term growth. However, it’s important to understand the considerations before investing and to consult with a financial advisor if you have any questions.

Standard & Poor’s 500: A Guide for Investors

If you’re looking for a way to gauge the health of the U.S. stock market, look no further than the Standard & Poor’s 500 (S&P 500) index fund. This widely followed index consists of 500 of the largest publicly traded companies in the U.S., making it a bellwether for the overall market.

Uses of the S&P 500

The S&P 500 serves a multitude of purposes in the financial world:

Benchmark for the Stock Market

As mentioned earlier, the S&P 500 is a key indicator of the stock market’s performance. Its fluctuations provide investors with a snapshot of market trends and overall economic health.

Investment Products

The S&P 500 is also a popular benchmark for index funds and ETFs because it provides diversification and a low-cost way to track the market.

Asset Allocation

Investors often use the S&P 500 as a starting point for asset allocation, which involves dividing investments based on risk tolerance and investment goals.

Performance Evaluation

Fund managers often compare their performance to the S&P 500 to gauge their success. This comparison helps investors assess whether their investments are meeting their expectations.

Economic Indicator

The S&P 500 is also closely watched by economists as a leading economic indicator. Strong performance in the S&P 500 can indicate economic growth, while poor performance often precedes economic downturns.

By understanding the uses of the S&P 500, investors can make informed decisions about their investments and stay abreast of market trends. It’s an invaluable tool for anyone looking to navigate the complexities of the stock market.

Standard & Poor’s 500 Index Fund: A Comprehensive Guide

When it comes to long-term investing, the Standard & Poor’s 500 (S&P 500) index fund has emerged as a cornerstone for savvy investors. This index fund offers a diversified portfolio that mirrors the performance of the 500 largest publicly traded companies in the United States, making it a formidable tool for capturing the growth potential of the American economy. But what exactly are the benefits of investing in an S&P 500 index fund? Let’s dive into the details.

Benefits of Investing in an S&P 500 Index Fund

Diversification: The Ultimate Risk-Reducer

Diversification is the financial equivalent of the old adage, “Don’t put all your eggs in one basket.” By investing in an S&P 500 index fund, you’re spreading your money across a vast array of companies in various industries and sectors. This diversity helps minimize risk and reduces the impact of any one company’s performance on your overall portfolio.

Long-Term Growth Potential: A Steady Climb to Success

The S&P 500 has consistently demonstrated impressive growth over the long term. Historically, the index has returned an average of 10% per year. While past performance is no guarantee of future returns, the index’s track record suggests that it offers a solid foundation for building wealth over time.

Low Fees: A Bargain for Investors

Compared to actively managed funds, which employ investment managers and charge hefty fees, S&P 500 index funds typically come with extremely low fees. These low costs help preserve your investment returns, giving you more bang for your buck.

Simplicity: Investing Made Easy

Investing in an S&P 500 index fund is incredibly easy. You can purchase shares through a brokerage account, and there’s no need to worry about selecting individual stocks or managing your portfolio actively. It’s a simple, hands-off approach to investing that’s perfect for beginners and busy individuals alike.

Tax Efficiency: A Tax-Savvy Choice

S&P 500 index funds are generally tax-efficient, meaning they produce relatively low capital gains distributions. This feature helps minimize your tax liability, allowing you to keep more of your hard-earned money.

Standard & Poor’s 500 Index Fund: A Comprehensive Guide

Investing in a Standard & Poor’s 500 index fund can be a smart move for many investors. These funds offer a diversified portfolio of large-cap stocks, providing exposure to the overall U.S. stock market. However, it’s crucial to understand the potential risks associated with investing in an S&P 500 index fund before making a decision.

Risks of Investing in an S&P 500 Index Fund

While S&P 500 index funds are generally considered less risky than investing in individual stocks, they are still subject to market fluctuations and other factors that could lead to losses. Here are some key risks to watch out for:

Market Volatility

The stock market is inherently volatile, meaning its value can fluctuate significantly over time. When the market experiences a downturn, the value of your S&P 500 index fund may decline in value as well. This is especially important to consider if you may need to sell your shares on short notice.

Potential Losses

It’s possible that the value of your S&P 500 index fund could decline and you could lose money. This could happen during a market downturn or if certain sectors of the economy underperform. While the S&P 500 has historically recovered from downturns over time, there’s no guarantee that it will always do so.

Inflation

Inflation can erode the value of your investments over time. If inflation rises faster than the return on your S&P 500 index fund, the purchasing power of your investment will decrease. This is especially concerning for long-term investors who may rely on their investments for retirement income.

Concentration Risk

S&P 500 index funds are heavily concentrated in a small number of large-cap stocks. This means that the performance of your fund is heavily dependent on the performance of those stocks. if a few of those stocks underperform or the entire index underperforms, it could have a significant impact on the value of your investment.

Fees

S&P 500 index funds typically have lower fees than actively managed funds. However, it’s still important to compare the fees of different funds before investing. even a small difference in fees can make a big impact on your returns over time.

No responses yet