什麼股票值得投資

投資股票是一項極具挑戰的任務,需要深入研究和了解市場。以下是一些適合投資的股票:

- **蘋果 (AAPL):**蘋果是一家全球科技巨頭,產品包括 iPhone、iPad 和 Mac。它擁有強勁的財務狀況和忠實的客戶群。

- **亞馬遜 (AMZN):**亞馬遜是一家電子商務巨頭,提供各種產品和服務。它在雲端運算和人工智能領域也有強勁業務。

- **微軟 (MSFT):**微軟是一家軟體和科技公司,其產品包括 Windows 操作系統和 Office 軟體。它擁有強勁的護城河和穩定的收入來源。

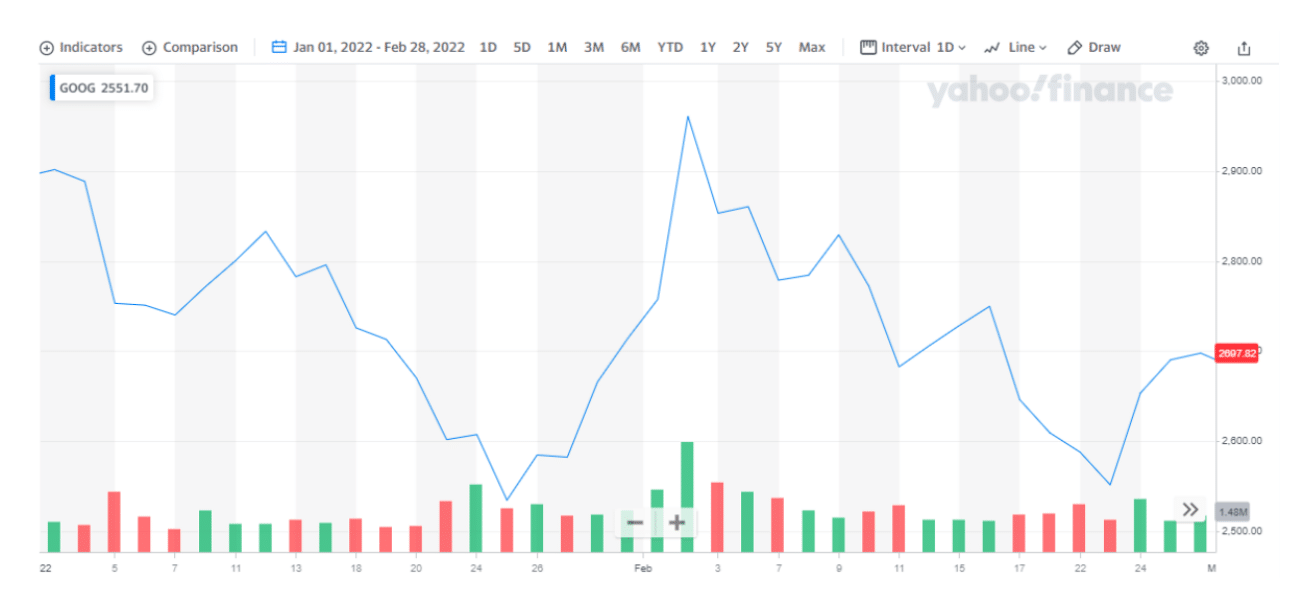

- **谷歌 (GOOGL):**谷歌是一家搜尋引擎和科技公司,擁有包括 YouTube 和 Android 在內的各種產品。它是數字廣告領域的領導者。

- **伯克希爾哈撒韋 (BRK.A):**伯克希爾哈撒韋是一家控股公司,投資於各種業務,包括保險、能源和鐵路。它由沃倫·巴菲特領導,是長期投資者的熱門選擇。

這些股票被認為是穩健且潛在回報高的投資。然而,在投資任何股票之前,請務必進行研究並衡量風險收益率。

What’s a Good Stock to Invest In?

Investing in the stock market can be a great way to grow your money over time, but it’s important to do your research before you dive in. One of the most important things to consider when choosing a stock is the company’s fundamentals.

What are the company’s fundamentals?

A company’s fundamentals are the key financial and operational metrics that give you a snapshot of its overall health. These include things like:

- Revenue: How much money is the company bringing in?

- Earnings: How much profit is the company making?

- Debt: How much debt does the company have?

- Cash flow: How much cash is the company generating?

- Management team: Who is running the company?

- Competitive advantage: What makes the company unique and able to compete in the market?

Why are the company’s fundamentals important?

A company’s fundamentals can tell you a lot about its financial health and its prospects for future growth. For example, a company with strong revenue growth and high profit margins is likely to be a more stable investment than a company with declining revenue and low profit margins. Similarly, a company with a strong management team and a clear competitive advantage is likely to be better positioned for success than a company with a weak management team and a lack of competitive advantage.

How to research a company’s fundamentals

There are a number of ways to research a company’s fundamentals. You can find financial information on the company’s website, in its annual report, and in SEC filings. You can also find news and analysis about the company from financial news sources and investment research firms.

Once you’ve researched a company’s fundamentals, you can start to make informed decisions about whether or not to invest in the stock. By considering the company’s financial health, management team, and competitive advantage, you can increase your chances of making successful investments.

The Company’s Financial Health

The financial statements, such as the income statement, balance sheet, and cash flow statement, can show you:

- How much money the company took in, spent, and earned (income statement)

- What the company owns and owes (balance sheet)

- Where the company got and spent its cash (cash flow statement)

Strong financial performance is one of the most important signs of a healthy company. The revenues and earnings must be strong and growing and the debt should be manageable.

The Management Team

The people at the helm of a company, the management team, can have a major impact on its success. You’ll want to look for a management team with a proven track record of success, strong leadership skills, and a clear vision for the company’s future.

The Competitive Advantage

Every company needs to have something that makes it stand out from the competition. Perhaps it has a unique product or service, a strong brand name, or a cost advantage. Whatever it is, this competitive advantage is what will give the company the edge it needs to succeed.

What’s a Good Stock to Invest In?

Investing in stocks can be a lucrative way to grow your wealth, but it can also be a daunting task for beginners. With so many options available, it’s easy to feel overwhelmed by the choices. If you’re wondering what’s a good stock to invest in, there are a few key factors to consider before making a decision.

The Company

The first step in choosing a stock is to research the company. Consider factors such as its financial performance, growth potential, and competitive landscape. Look for companies with a strong track record of profitability, consistent revenue growth, and a solid management team. It’s also important to analyze the industry in which the company operates and identify any potential risks or opportunities.

The Stock

Once you’ve identified a few promising companies, it’s time to analyze their stocks. Consider the stock’s price, earnings per share (EPS), and price-to-earnings ratio (P/E). A low P/E ratio can indicate that a stock is undervalued, while a high P/E ratio may suggest that the stock is overvalued. It’s also important to look for stocks with a high dividend yield, which can provide you with a steady stream of income.

The Market Conditions

The overall market conditions can also affect the stock price. If the market is bullish, stock prices tend to rise. Conversely, if the market is bearish, stock prices tend to fall. It’s important to be aware of the market conditions and consider how they might impact your investment decisions.

Your Investment Goals:

Before investing, it’s crucial to define your investment goals. Are you looking to build a long-term portfolio or generate short-term gains? Your goals will influence the types of stocks you choose. For long-term growth, consider investing in companies with strong fundamentals and a history of innovation. For short-term profits, you may want to look at stocks with high volatility or that are expected to benefit from upcoming events, such as mergers or acquisitions.

No responses yet