.

Passive Income: Examples

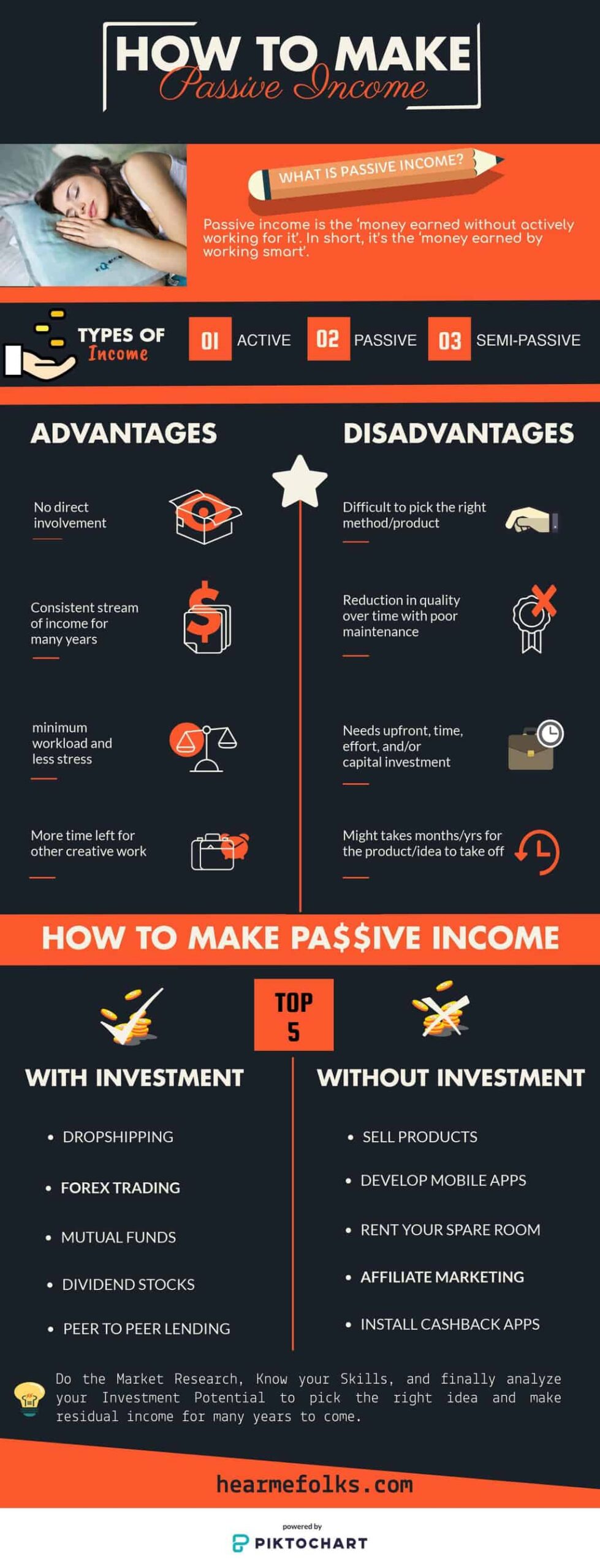

Passive income is a dream for many people. Who wouldn’t want to make money while they sleep? The good news is that passive income is possible – with a little effort. There are many different ways to generate passive income, and we’ll explore some of the most popular examples in this article.

Blogging

Starting a blog is a great way to share your knowledge and expertise with the world – while also earning some passive income. Once you’ve built up a following, you can start monetizing your blog through advertising, affiliate marketing, or even selling your own products or services. The key to success with blogging is to create high-quality content that your readers will find valuable. The more valuable your content is, the more likely people are to visit your blog and stick around.

Affiliate Marketing

Affiliate marketing is another great way to generate passive income. With affiliate marketing, you partner with other businesses to promote their products or services. When someone clicks on your affiliate link and makes a purchase, you earn a commission. The key to success with affiliate marketing is to choose products or services that you’re passionate about and that you know your audience will find valuable. The more relevant your affiliate links are to your content, the more likely people are to click on them and make a purchase.

Selling Digital Products

If you have a passion for writing, photography, or design, you can create and sell digital products such as ebooks, courses, or printables. Once you’ve created your digital product, you can sell it on platforms such as Etsy, Gumroad, or your own website. The key to success with selling digital products is to create high-quality products that your customers will find valuable. The more valuable your products are, the more likely people are to buy them.

Dividend Investing

Dividend investing is a great way to generate passive income from the stock market. When you invest in dividend-paying stocks, you receive regular payments from the company. The key to success with dividend investing is to choose companies that have a history of paying dividends and that are likely to continue paying dividends in the future. The more stable the company’s dividend payments are, the more likely you are to receive consistent passive income.

Rental Properties

Rental properties are a classic way to generate passive income. When you own a rental property, you can collect rent from tenants. The key to success with rental properties is to choose properties that are in good condition and that are located in desirable areas. The more desirable your properties are, the more likely you are to attract tenants and generate passive income.

Examples of Passive Income: A Path to Financial Freedom

Passive income is like a cozy campfire on a chilly night—it warms you up without any effort. It’s the holy grail of financial freedom, allowing you to earn money while you sleep, travel, or simply enjoy life. Here are a few examples to spark your imagination:

Dividend Investing

Imagine a company that’s like a generous grandfather—it regularly gives you a "dividend." These are payments made to shareholders from the company’s profits. When you invest in dividend-paying stocks, you can earn a steady stream of income as long as the company continues to make money.

Rental Properties

Owning rental properties is akin to having an army of little money-making machines. Renters pay you a monthly fee to use your property, and you essentially earn money from your investment without having to do much work. Of course, there are responsibilities like maintenance and repairs, but it’s generally a passive source of income.

High-Yield Savings Accounts

These accounts are like a safe haven for your money. They offer a higher interest rate than traditional savings accounts, so your savings grow at a faster pace. While they’re not quite as lucrative as other passive income streams, they’re a low-risk option and can provide a steady flow of income.

Affiliate Marketing

Picture this: you become an online ambassador for products or services you love. When someone buys something through your unique affiliate link, you earn a small commission. It’s like getting paid to share your thoughts and recommendations with others.

Online Courses

If you’ve mastered a particular skill, why not share your knowledge? Create an online course and sell it to anyone who wants to learn from your expertise. This can be a great way to generate passive income while also helping others grow.

So there you have it—five examples of passive income that can help you achieve financial freedom. Remember, it takes time and effort to set up these streams of income, but once they’re established, they can provide you with a steady flow of income for years to come.

Passive Income: A Path to Financial Freedom

Do you yearn for a life where you can earn a steady income without actively working for it? Passive income offers just that—a way to generate wealth while you sleep, travel, or pursue your passions. Here are some compelling examples of how you can tap into this financial utopia:

Real Estate Rental

Investing in rental properties is a time-honored way to create passive income. When you own a property and rent it out to tenants, you receive regular payments that can cover your mortgage, property taxes, and other expenses, potentially leaving you with a profit. Just remember, being a landlord requires ongoing responsibilities, such as maintenance, repairs, and tenant management.

Dividend Stocks

Dividend stocks are shares in publicly traded companies that pay out a portion of their earnings to shareholders on a regular basis. When you invest in dividend stocks, you become eligible for a cut of the company’s profits, even if the stock price itself doesn’t increase. Dividend payments can provide a steady stream of passive income, but keep in mind that they are not guaranteed and can fluctuate based on the company’s financial performance.

Online Courses

Creating and selling online courses is a fantastic way to generate passive income by sharing your knowledge and expertise. Once you’ve developed your course, you can upload it to platforms like Udemy or Coursera, where students can purchase and access it on demand. Passive income from online courses can continue to flow in long after you’ve put in the initial work to create them.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors who are willing to lend money at a predetermined interest rate. When you invest in peer-to-peer loans, you receive regular interest payments based on the loan terms. While peer-to-peer lending can be a lucrative passive income source, it also carries some risk, as there is no guarantee that borrowers will repay their loans.

Blog or Website with Ads

If you enjoy writing or sharing your thoughts on specific topics, starting a blog or website can lead to passive income through advertising. By partnering with companies that want to reach your audience, you can display ads on your website and earn a commission when visitors click or interact with them. Blog or website advertising can provide a sustainable source of passive income if you can attract sufficient traffic and engagement.

Examples of Passive Income: A Comprehensive Guide

Passive income, otherwise known as the holy grail of financial freedom, conjures images of never having to work a day in your life. While achieving this elusive dream may require a bit more effort, establishing passive income streams can provide you with a supplemental or even primary source of income without the need for active involvement.

Online Courses

Creating and selling courses on platforms like Udemy or Coursera offer an opportunity to generate passive income. Share your expertise and create courses that teach valuable skills or knowledge. Students who enroll in your courses pay a one-time fee, providing you with a recurring stream of income as long as your courses remain available.

Affiliate Marketing

As an affiliate marketer, you promote products or services of other businesses and earn a commission for every successful sale you generate. By partnering with reputable companies and promoting products that genuinely align with your niche or interests, you can create a passive income stream that scales with your audience.

Rental Income

Owning and renting out real estate can be a conventional but lucrative form of passive income. However, this typically requires a substantial initial investment and ongoing maintenance costs. Consider investing in rental properties if you’re comfortable with the responsibilities of property management.

High-Yield Savings Accounts

High-yield savings accounts offer competitive interest rates, allowing you to earn interest on your savings without actively managing your funds. While the returns may not be as substantial as other passive income sources, they can provide a steady and risk-free way to accumulate wealth over time.

Dividend Stocks

Investing in dividend-paying stocks can generate passive income in the form of regular dividend payments. Dividends are a portion of a company’s profits that are distributed to shareholders. Consider investing in companies with a history of consistent dividend payments and a strong track record of financial performance.

Stock Options

Buying stock options, which give you the right to buy or sell a specific stock at a predetermined price in the future, can also generate passive income. If the stock price moves in your favor, you can exercise your options and sell the stock for a profit, while simultaneously reducing your investment risk.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors. As an investor, you can lend money to borrowers and earn interest on your loans. While this can be a higher-risk investment, it also has the potential for higher returns compared to traditional savings accounts or bonds.

Royalty Income

If you’re an artist, musician, or writer, you can earn royalty income from your creative works. Every time your book sells, your song is streamed, or your painting is sold, you receive a portion of the proceeds as royalty payments. This can provide a passive income stream that lasts as long as your works remain in circulation.

Conclusion

Exploring these passive income sources can open doors to financial freedom and provide you with a supplemental income stream. Remember, passive income takes time and effort to establish, but the potential rewards can be substantial. By diversifying your income sources and investing wisely, you can create a secure financial future for yourself and your loved ones.

Unlocking the Power of Passive Income: A Deep Dive into Its Diverse Streams

Passive income, akin to a financial oasis, offers a tantalizing escape from the constraints of traditional employment. It’s a stream of revenue that flows into your bank account with minimal effort on your part. But how can you tap into this lucrative realm? Let’s explore some of the most popular and effective ways to generate passive income:

Affiliate Marketing: A Commission-Based Connection

Affiliate Marketing

**Partnering with businesses and recommending their products or services to your audience can earn you commissions on sales generated through your unique affiliate link.** Embarking on this path requires building a loyal audience that trusts your recommendations. Whether you’re a blogger, social media influencer, or website owner, the key lies in promoting products or services that align with your niche and resonate with your audience.

Online Courses: Sharing Knowledge, Earning Profits

Online Courses

**Packaging your expertise into online courses can turn knowledge into a revenue-generating asset.** By sharing your insights, skills, or hobbies with others, you create a passive stream of income that continues to earn even when you’re not actively engaged. Platforms like Udemy, Coursera, and Skillshare make it accessible to create and sell your courses, reaching a global audience eager to learn.

Dividend Investing: Owning a Piece of Corporate Profits

Dividend Investing

**Investing in dividend-paying stocks or mutual funds allows you to reap a portion of a company’s profits.** As long as the company remains profitable and continues to pay dividends, you’ll receive a regular income stream. The beauty of dividend investing lies in its potential for compounding returns over time, making it a powerful long-term wealth-building strategy.

Royalties: Earning from Creative Content

Royalties

**If you’re an artist, writer, musician, or inventor, royalties can provide a steady stream of income.** Royalties are payments made to creators who license their intellectual property to others. Whether it’s a song played on the radio, a book sold in a bookstore, or an invention used in a product, every time your creation generates revenue, you earn a portion as a royalty.

Rental Properties: Brick-and-Mortar Income Streams

Rental Properties

**Acquiring rental properties can generate passive income through rent payments from tenants.** While this option requires significant capital investment and ongoing responsibilities, such as property management and maintenance, it can offer a stable and potentially lucrative income stream in the long run. The rental market’s resilience and demand for shelter make it a classic form of passive income.

Unlocking the Power of Passive Income: Examples and Strategies

Passive income, the holy grail of financial freedom, is no longer an elusive dream. By harnessing its power, you can create multiple income streams that work for you even when you’re not. Here are some compelling examples to ignite your passive income journey:

Digital Products

Unleash your inner creator by crafting digital products like ebooks, printables, or software. These products offer endless earning potential as they can be sold countless times with minimal effort. Design ebooks that provide valuable insights, share exclusive knowledge, or entertain readers. Create printables, from meal plans to worksheets, that streamline life’s tasks. Develop software solutions that solve common problems and meet specific niche needs.

Affiliate Marketing

Become an affiliate marketer and earn commissions by promoting other people’s products or services. Join affiliate programs that align with your interests and target audience. Showcase products through your blog, social media, or email campaigns. Each time a purchase is made through your affiliate link, you’ll receive a slice of the profit. It’s like owning a virtual storefront without the hassle of stocking inventory.

Dividend Stocks

Invest in dividend-paying stocks to generate a regular income stream. When companies make a profit, they often share a portion with shareholders in the form of dividends. By diversifying your portfolio with dividend stocks, you can create a steady flow of passive income that compounds over time. Just like a cash-generating machine that keeps working for you.

Real Estate Rental Properties

Own and rent out properties to create a passive income stream. Rental properties offer the potential for long-term appreciation and a steady flow of rental income. It’s a classic form of passive income that has been utilized for generations. Just be prepared for the responsibilities of being a landlord, such as maintenance, repairs, and tenant management.

Peer-to-Peer Lending

Participate in peer-to-peer lending platforms and earn interest on loans made to other individuals or businesses. By diversifying your investments across a pool of borrowers, you can minimize risk and generate a passive income stream. It’s like being a bank without the overhead costs and regulatory headaches.

Online Courses

Create and sell online courses that teach valuable skills or knowledge. Package your expertise into bite-sized modules and deliver them through an online platform. Once created, your courses can generate passive income for years to come. It’s like having your own digital academy that works for you 24/7.

No responses yet