Fidelity Investments Low-Cost Index Funds

Fidelity Investments is a well-known provider of financial services, including a wide range of low-cost index funds. These funds offer investors a variety of options for diversifying their portfolios and achieving their financial goals. Index funds are passively managed funds that track a specific market index, such as the S&P 500 or the Nasdaq Composite. This means that investors can gain exposure to a broad range of stocks or bonds with a single investment. Fidelity’s index funds have low expense ratios, which means that more of your money is invested in the fund and less is going to fees.

Benefits of Fidelity’s Low-Cost Index Funds

Diversification: Index funds provide investors with instant diversification, which is the key to reducing risk in a portfolio. By investing in a single index fund, you can gain exposure to hundreds or even thousands of different stocks or bonds. This helps to ensure that your portfolio is not overly concentrated in any one sector or company, which can help to protect your investment if one sector or company underperforms.

Low costs: Fidelity’s index funds have low expense ratios, which means that less of your money is going to fees. This can make a big difference over time, especially if you are investing for a long period of time.

Convenience: Index funds are a convenient way to invest. You can buy and sell index funds through a variety of platforms, including online brokerages and financial advisors. You can also set up automatic investments, which can help you to save money and reach your financial goals.

Transparency: Index funds are transparent investments. You can always see what stocks or bonds are included in the fund, and you can track the fund’s performance online. This transparency can help you to make informed investment decisions.

Choosing the Right Fidelity Low-Cost Index Fund

Investment goals: Consider your investment goals when choosing a Fidelity index fund. If you are saving for retirement, you may want to consider a fund that invests in stocks. If you are looking for a more conservative investment, you may want to consider a fund that invests in bonds.

Risk tolerance: Your risk tolerance should also be a factor in your decision. If you are comfortable with taking on more risk, you may want to consider a fund that invests in a more volatile index. If you are more risk-averse, you may want to consider a fund that invests in a less volatile index.

Fees: Be sure to compare the expense ratios of different Fidelity index funds before you invest. The lower the expense ratio, the more of your money is invested in the fund and less is going to fees.

Conclusion

Fidelity Investments offers a wide range of low-cost index funds that can help investors diversify their portfolios and achieve their financial goals. When choosing a Fidelity index fund, be sure to consider your investment goals, risk tolerance, and fees. By taking the time to choose the right fund, you can set yourself up for success in the long run.

Fidelity Investments Low-Cost Index Funds: The Ultimate Guide for Investors

If you’re searching for a low-cost and convenient way to invest in the stock market, Fidelity Investments’ index funds are worth considering. Index funds are passively managed funds that track a specific market index, such as the S&P 500 or the Nasdaq Composite. This means that you’re essentially investing in a basket of stocks that represent the entire market or a particular sector. Fidelity offers a wide range of low-cost index funds to suit different investment goals and risk tolerances.

Types of Fidelity Low-Cost Index Funds

Fidelity’s index funds cover a broad spectrum of asset classes, including:

* Domestic Stock Index Funds: These funds invest in companies within the United States and track indices like the S&P 500 and the Russell 2000.

* International Stock Index Funds: These funds provide exposure to global markets by tracking indices like the MSCI EAFE and the FTSE All-World ex US.

* Bond Index Funds: These funds invest in bonds issued by governments, corporations, and other entities. They track indices like the Bloomberg US Aggregate Bond Index and the ICE BofA US High Yield Index.

* Real Estate Index Funds: These funds invest in real estate investment trusts (REITs) that own and operate income-producing real estate assets. They track indices like the FTSE NAREIT All REITs Index and the MSCI US REIT Index.

* Sector-Specific Index Funds: These funds focus on specific sectors within the market, such as technology, healthcare, and consumer staples. They track indices like the S&P 500 Information Technology Index and the S&P 500 Health Care Index.

Benefits of Fidelity Low-Cost Index Funds

Investing in Fidelity’s low-cost index funds offers several key benefits:

* Low Fees: Fidelity’s index funds typically have expense ratios below 0.10%, which means more of your investment returns stay in your pocket.

* Diversification: Index funds provide instant diversification, reducing your overall risk. By investing in a basket of stocks or bonds, you’re not putting all your eggs in one basket.

* Convenience: Fidelity’s index funds can be purchased and managed online or through a Fidelity representative, making investing easy and convenient.

* Tax Efficiency: Index funds are generally more tax-efficient than actively managed funds, as they tend to trade less frequently and generate fewer capital gains distributions.

Conclusion

Fidelity Investments’ low-cost index funds provide investors with a convenient and cost-effective way to diversify their portfolios and gain exposure to a wide range of asset classes. Whether you’re a beginner investor or a seasoned pro, Fidelity’s index funds can help you reach your financial goals.

Fidelity Investments Low-Cost Index Funds

If you’re in the market for low-cost index funds, Fidelity Investments has you covered. With some of the lowest expense ratios in the industry, Fidelity’s index funds can help you save money on investment costs. Plus, they offer a wide range of investment options, so you can find the perfect fund for your needs.

Benefits of Fidelity Low-Cost Index Funds

There are many benefits to investing in Fidelity low-cost index funds, including:

- Low expense ratios: Fidelity’s index funds have some of the lowest expense ratios in the industry. This means that more of your money is invested in the fund, and less is going to fees.

- Diversification: Index funds are a great way to diversify your portfolio. By investing in a single fund, you’re getting exposure to a wide range of stocks or bonds.

- Professional management: Fidelity’s index funds are managed by experienced investment professionals. This means that you can rest assured that your money is being invested wisely.

- Investment objective: What are you trying to achieve with your investment? Are you saving for retirement, a down payment on a house, or something else? Once you know your investment objective, you can choose an index fund that is aligned with your goals.

- Risk tolerance: How much risk are you willing to take? Index funds can range from low-risk to high-risk. It’s important to choose an index fund that is appropriate for your risk tolerance.

- Time horizon: How long do you plan to invest? Index funds are a good option for long-term investors. However, if you need to access your money in the short term, you may want to consider a different type of investment.

How to Choose a Fidelity Low-Cost Index Fund

When choosing a Fidelity low-cost index fund, there are a few things to keep in mind:

Fidelity Investments Low-Cost Index Funds: A Comprehensive Guide

Welcome, dear readers! If you’re looking for low-cost, diversified investments with Fidelity, then you’re in luck. Let’s dive into the world of Fidelity investments low-cost index funds and explore how you too can benefit from this investment strategy.

How to Invest in Fidelity Low-Cost Index Funds

Investing in Fidelity’s index funds is a breeze. You can opt to open a brokerage account or simply hop onto Fidelity’s website and get started. Once you’re all set up, you can start selecting the index funds that best align with your financial goals and risk tolerance.

Benefits of Fidelity Low-Cost Index Funds

Why consider Fidelity’s index funds, you ask? Well, there are several compelling reasons. Firstly, they offer an unparalleled level of diversification, spreading your investments across a broad range of assets. This diversification strategy can help you mitigate the ups and downs of the market, ensuring your portfolio remains stable during turbulent times.

Secondly, Fidelity’s index funds boast incredibly low fees. Unlike actively managed funds, which can eat away at your returns with excessive charges, index funds keep their costs to a minimum. This means more of your hard-earned money stays in your pocket, where it belongs!

Finally, index funds passively track an underlying index, such as the S&P 500 or the Nasdaq 100. This means that they don’t require the expertise and attention of an active fund manager, making them a suitable choice for those who prefer a hands-off approach to investing.

Types of Fidelity Low-Cost Index Funds

Fidelity offers an extensive range of low-cost index funds, catering to a variety of investment objectives. Whether you’re saving for retirement, pursuing long-term growth, or seeking international exposure, you’re sure to find an index fund that suits your needs.

Some of the most popular Fidelity low-cost index funds include:

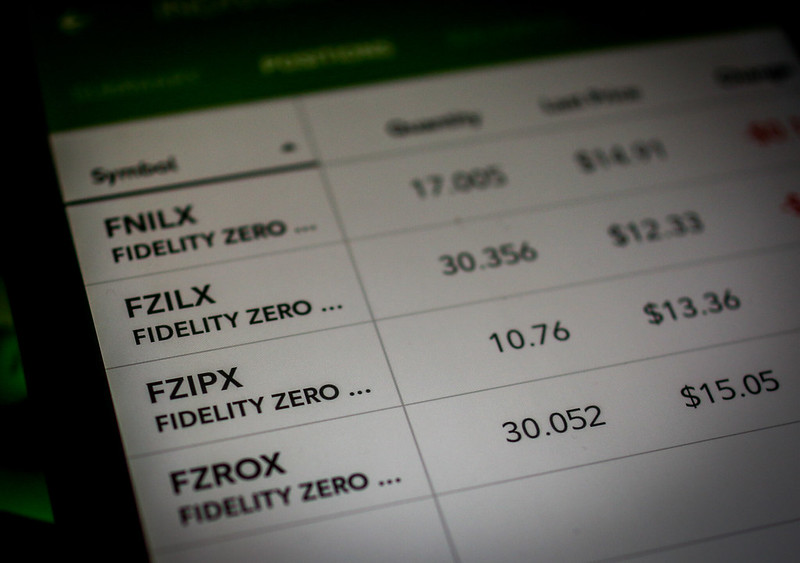

– Fidelity ZERO Total Market Index Fund (FZROX)

– Fidelity 500 Index Fund (FXAIX)

– Fidelity Total International Index Fund (FZILX)

– Fidelity US Bond Index Fund (FXNAX)

Getting Started with Fidelity Low-Cost Index Funds

Ready to dive in and start investing? It couldn’t be simpler. Simply open a Fidelity brokerage account, transfer your funds, and start exploring the vast selection of index funds at your fingertips. If you need guidance, you can always reach out to Fidelity’s customer service team for expert advice.

So, what are you waiting for? Embark on your investment journey today with Fidelity investments low-cost index funds, and watch your financial dreams take flight!

Fidelity Investments Low-Cost Index Funds: A Smart Bet for Savvy Investors

In the realm of investing, finding cost-effective ways to build a diversified portfolio can be a challenge. But fret not, my savvy readers! Enter Fidelity Investments low-cost index funds, a game-changer for investors seeking to maximize their returns without breaking the bank. These funds are meticulously designed to track the performance of a specific market index, such as the S&P 500 or the Nasdaq 100. By investing in an index fund, you gain exposure to a broad range of stocks, spreading your risk and potentially enhancing your long-term returns.

Why Fidelity Investments?

Fidelity Investments has earned its reputation as a titan in the financial industry, boasting a vast array of investment products and services. Their low-cost index funds stand out for their exceptional value and transparency. Fidelity’s commitment to keeping fees low means more of your hard-earned money remains invested, working towards your financial goals. Additionally, their funds are meticulously managed, ensuring they closely track their respective indexes, providing investors with peace of mind.

Benefits of Low-Cost Index Funds

The advantages of Fidelity Investments low-cost index funds are undeniable. First and foremost, they offer instant diversification. By investing in a single fund, you gain exposure to a substantial number of stocks, reducing your risk compared to investing in individual companies. Secondly, index funds are inherently low-maintenance investments. Once you invest, you can sit back and let the fund do the heavy lifting, automatically adjusting to market movements. And lastly, these funds are incredibly cost-effective, with expense ratios typically below 0.20%, saving you a significant amount of money over time compared to actively managed funds.

Types of Fidelity Index Funds

Fidelity Investments offers a comprehensive lineup of low-cost index funds, catering to diverse investment styles and goals. From broad-based funds tracking major market indexes to sector-specific funds focusing on industries like technology or healthcare, the choices are endless. Whether you’re a seasoned investor or just starting your financial journey, Fidelity has an index fund tailored to suit your needs.

Conclusion

In conclusion, Fidelity Investments low-cost index funds are an exceptional choice for investors seeking a cost-effective and diversified way to grow their wealth. With Fidelity’s commitment to low fees, meticulous management, and a wide range of investment options, you can rest assured that your savings are in good hands. So, why wait? Dive into the world of index funds today and unlock a future of financial success, one savvy investment at a time!

No responses yet