Introduction

Investing in the stock market can be a daunting task, especially considering the numerous options available. But if you’re looking for a simple and diversified way to grow your wealth, index funds are a solid choice. And an index fund calculator can be your secret weapon for estimating the potential returns of these funds. Think of it as a financial GPS, guiding you towards your financial goals with greater clarity.

An index fund is a type of mutual fund that tracks a specific market index, such as the S&P 500 or the Nasdaq 100. By investing in an index fund, you’re essentially buying a piece of the entire market, rather than just a few individual stocks. This diversification helps reduce risk and provides exposure to the overall performance of the market. And with an index fund calculator at your disposal, you can get a better understanding of the potential return on your investment.

How to Use an Index Fund Calculator

Index fund calculators are straightforward to use. Simply input the initial investment amount, the expected annual return rate, and the number of years you plan to invest. The calculator will then estimate the potential future value of your investment, taking into account the effects of compounding. It’s like having a crystal ball for your finances, giving you a glimpse into the potential growth of your nest egg.

For example, let’s say you invest $5,000 in an index fund with an expected annual return rate of 7%. If you leave your investment untouched for 20 years, the calculator might show you a potential future value of around $23,600. Of course, actual returns may vary, but the calculator provides a valuable starting point for your financial planning.

Factors that Affect Returns

Several factors can affect the returns on an index fund. One key factor is the performance of the underlying index. If the index performs well, so will the index fund. Economic conditions, interest rates, and geopolitical events can all impact the performance of the market and, consequently, index funds.

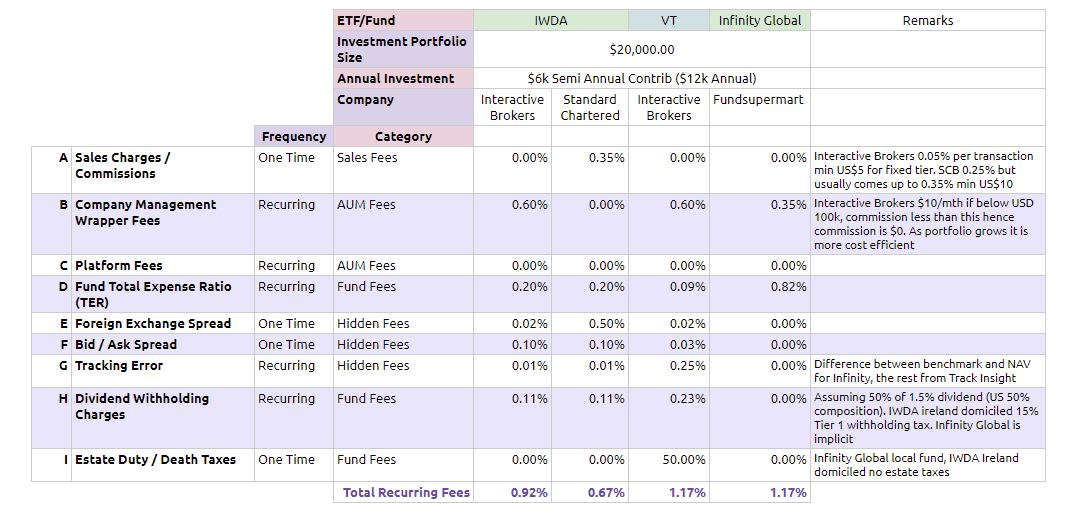

Another factor to consider is the expense ratio of the index fund. The expense ratio is a percentage fee that covers the fund’s operating expenses. A higher expense ratio can eat into your returns over time, so it’s important to choose an index fund with a low expense ratio.

Benefits of Using an Index Fund Calculator

Index fund calculators offer several benefits for investors. They can help you:

- Estimate the potential value of your investment

- Compare different index funds and choose the best one for your goals

- Track your progress towards your financial goals

- Make informed decisions about your investments

Index Fund Calculator: A Tool for Informed Investing

Tired of sifting through countless investment options? An index fund calculator is your financial compass, helping you navigate the market’s complexities with ease. It’s like having a GPS for your investments, providing clear directions towards your retirement dreams.

Benefits of Using an Index Fund Calculator

Investing doesn’t have to be a guessing game. An index fund calculator empowers you with valuable information to make confident investment decisions. Here’s how it can benefit you:

- Estimate Potential Returns: Just like weather forecasts, an index fund calculator gives you a glimpse into the future performance of your investment. It projects potential returns based on historical data, so you can plan your finances accordingly.

- Compare Index Funds: With so many index funds out there, it’s like searching for a needle in a haystack. An index fund calculator lets you compare the returns and fees of different funds side by side, making it easier to choose the ones that fit your needs like a tailored suit.

- Set Realistic Goals: Investing is not a magic bullet. An index fund calculator sets realistic expectations for your investment journey. It shows you how long it will take to reach your financial goals, so you can adjust your strategy if needed, just like a navigator adjusting the course during a long voyage.

- Avoid Emotional Decisions: When the market gets rocky, it’s easy to panic and make impulsive decisions. An index fund calculator helps you stay grounded by providing data-driven projections. It prevents you from making hasty choices that could derail your investment plans.

- Empower Your Financial Knowledge: Investing should be accessible to everyone, not just the financial elite. An index fund calculator demystifies the investment process, empowering you with knowledge and confidence to make smart financial decisions.

No responses yet