Mortgage Rates for Investment Properties

Navigating the world of investment property mortgages can be akin to navigating a labyrinth. From the get-go, it’s imperative to grasp a fundamental truth: rates for investment properties tend to eclipse those for owner-occupied homes. This disparity is the brainchild of heightened risk perception among lenders. After all, investment properties often entail an additional layer of complexity that can give lenders a case of the jitters.

Investment property mortgage rates are a microcosm of the real estate market, mirroring the ebb and flow of economic tides. They’re not immune to the whims of inflation, recession, and other macroeconomic factors that shape the financial landscape. Tracking these trends is akin to deciphering a celestial map, providing valuable insights into the optimal time to embark on an investment property purchase.

The mortgage rates for investment properties tend to hover a few percentage points higher than their owner-occupied counterparts. This premium reflects the added risk that lenders perceive when financing investment properties. After all, these properties are typically rented out to tenants, which introduces an element of uncertainty that can make lenders a tad queasy. For instance, if the tenants decide to pack up and leave, the property owner could be left holding the bag for a vacant property and a dwindling cash flow. That’s not exactly the kind of scenario that sends lenders into raptures.

Investment property mortgage rates are a bit like a fickle lover – they can change their tune in the blink of an eye. A variety of factors can influence their trajectory, including the loan-to-value ratio, the borrower’s credit score, and the property’s location. A higher loan-to-value ratio, for instance, can make lenders more apprehensive, leading them to demand a higher interest rate to compensate for the increased risk. Similarly, a lower credit score can be akin to a red flag for lenders, prompting them to tack on a higher interest rate to offset the perceived riskiness of the borrower.

When it comes to investment property mortgage rates, location, location, location is the mantra. Properties in prime areas with strong rental demand tend to command lower interest rates than those in less desirable locations. That’s because lenders are more confident that properties in popular areas will attract tenants and generate a steady stream of rental income, reducing the risk of default.

Unlocking the Secrets of Investment Property Mortgage Rates

Navigating the complexities of the mortgage market can be a formidable task, especially when it comes to securing financing for investment properties. However, demystifying the factors that determine investment property mortgage rates can significantly empower you as a savvy investor.

Factors Affecting Rates

When lenders assess your eligibility for an investment property mortgage, they meticulously evaluate various criteria that shape the interest rate you qualify for. Let’s dive into the key factors that can make all the difference:

1. Loan-to-Value Ratio (LTV)

Your LTV is the ratio of your loan amount to the appraised value of your property. Put simply, it measures the percentage of your property that is financed. The higher your LTV, the greater the risk to the lender, leading to potentially higher interest rates.

2. Credit Score

Your credit score is like a financial report card, reflecting your history of responsible borrowing. Lenders rely heavily on this score to assess your trustworthiness. A stronger credit score demonstrates your ability to manage debt, resulting in lower interest rates. Conversely, a lower score may signal increased risk, leading to higher rates.

3. Property Type

The type of property you intend to invest in plays a role in your mortgage rates. Single-family homes and multi-family properties have different risk profiles for lenders, which can influence the interest rates charged.

4. Loan Term

The length of your loan term also affects your interest rates. Typically, shorter loan terms (15 or 20 years) carry lower rates than longer terms (30 years).

5. Interest Rate Environment

External economic factors, such as the Federal Reserve’s interest rate policies, can impact mortgage rates. When the general interest rates rise, investment property mortgage rates tend to follow suit.

6. Lender Competition

The level of competition among lenders can also influence interest rates. When lenders are competing aggressively for your business, they may offer lower rates to secure your loan.

7. Mortgage Insurance

If you’re unable to provide a sufficient down payment to reach a low LTV, you may be required to purchase mortgage insurance. This additional coverage for the lender often results in higher interest rates.

8. PMI for Investment Properties

Private mortgage insurance (PMI) for investment properties works differently from PMI for owner-occupied homes. Lenders often charge higher PMI premiums for investment properties, which can increase your overall mortgage costs.

Additional Tips for Securing Favorable Rates

- Compare rates from multiple lenders to find the best deal.

- Consider negotiating with your lender to lower your interest rate.

- Make a substantial down payment to improve your LTV.

- Build a strong credit score before applying for financing.

- Be prepared to provide additional documentation to support your application.

Navigating the Maze of Investment Property Mortgage Rates

So, you’ve set your sights on investing in real estate. Congratulations! Now it’s time to navigate the often-confusing world of mortgage rates for investment properties. Before you embark on this financial adventure, it’s essential to understand the different loan types available.

Types of Investment Property Loans

When it comes to financing your investment property, you’ll encounter a range of options tailored specifically to this type of investment. Let’s take a closer look at some of the most common:

Portfolio Loans

Portfolio loans are a popular choice for experienced investors who own multiple properties. These loans allow you to bundle your rental properties under a single mortgage, which can streamline your financing process. They typically offer competitive interest rates and flexible terms, but they can also come with higher down payment requirements and closing costs.

Commercial Mortgages

Commercial mortgages are designed for properties used for commercial purposes, such as apartment complexes or office buildings. They often feature longer loan terms and higher interest rates compared to residential mortgages. Commercial mortgages also require a more stringent underwriting process, as lenders will need to assess the property’s income-generating potential and the borrower’s financial stability.

Conventional Loans

Conventional loans, typically used for owner-occupied homes, can also be an option for investment properties. These loans generally have stricter qualification requirements and lower interest rates than investment property loans. However, they may not be suitable for investors who own multiple properties or who are using the property as a rental unit.

FHA Loans

FHA loans, backed by the Federal Housing Administration, are designed to make homeownership more accessible for first-time buyers and those with lower credit scores. They typically require lower down payments and closing costs than conventional loans. However, FHA loans come with mortgage insurance, which can increase the overall cost of the loan over time.

VA Loans

VA loans, backed by the Department of Veterans Affairs, are available to eligible veterans, service members, and their surviving spouses. These loans offer competitive interest rates and flexible terms, including the option of no down payment. However, VA loans have specific eligibility requirements and may not be suitable for all investors.

By understanding the different types of investment property loans available, you can make an informed decision about which option best suits your financial situation and investment goals. Remember to consult with a mortgage lender to discuss your options and find the right loan for your specific needs.

Investment Property Mortgage Rates

In today’s competitive real estate market, securing financing for an investment property can be a daunting task. However, with careful planning and preparation, you can increase your chances of qualifying for an investment property mortgage and securing favorable interest rates.

Qualifying for an Investment Property Mortgage

To qualify for an investment property mortgage, lenders will typically consider several key factors:

- Credit history: A strong credit score is essential for qualifying for any type of mortgage, including investment property mortgages. Lenders will review your credit report to assess your history of on-time payments, outstanding debts, and overall financial management.

- Stable income: Lenders want to see that you have a consistent and reliable source of income to make your mortgage payments. You will need to provide documentation of your income, such as pay stubs, tax returns, or bank statements.

- Sufficient down payment: The amount of down payment you make will impact your interest rate and the size of your monthly payments. Generally, lenders prefer a down payment of at least 20% to reduce their risk.

- Debt-to-income ratio: This ratio measures the amount of debt you have relative to your income. Lenders want to make sure that you have enough income to cover your monthly housing expenses as well as your existing debts.

- Property type: The type of investment property you purchase can also affect your mortgage rates. Single-family homes typically have lower interest rates than multi-family properties or commercial properties.

Additional Considerations

In addition to the factors listed above, lenders may also consider other factors when underwriting an investment property mortgage, such as:

- Loan-to-value ratio: This ratio measures the amount of the loan relative to the value of the property. A higher loan-to-value ratio may result in higher interest rates.

- Property location: The location of the investment property can also impact your mortgage rates. Properties in desirable areas with strong rental markets may have lower interest rates than properties in less desirable areas.

- Loan term: Shorter loan terms typically have lower interest rates than longer loan terms, but the monthly payments will be higher.

Getting Pre-Approved

Before you start shopping for an investment property, it is a good idea to get pre-approved for a mortgage. This will give you a better understanding of your budget and will make the home buying process more efficient.

Shopping for the Best Rates

Once you are pre-approved for a mortgage, you can start shopping for the best interest rates. Compare rates from multiple lenders and be sure to consider all of the factors that can affect your rates, such as the loan amount, down payment, loan term, and property type.

Investment Property Mortgage Rates: A Guide to Securing the Best Deals

Investment property mortgages can be a smart financial move, but securing the best rates can make a significant difference in your bottom line. With interest rates fluctuating constantly, it’s crucial to do your research and compare lenders.

Loan Types

Before diving into the mortgage market, familiarize yourself with the different loan types available. Conventional loans require a higher down payment but typically offer lower interest rates. FHA loans are government-backed and have more lenient credit requirements, but they come with a higher upfront cost.

Credit Score and Debt-to-Income Ratio

Your credit score and debt-to-income ratio (DTI) play a pivotal role in determining your mortgage rates. A higher credit score indicates lower risk, which translates into better rates. DTI measures your ability to repay your monthly debts relative to your income. A lower DTI ratio improves your chances of qualifying for a favorable mortgage.

Down Payment

The size of your down payment has a direct impact on your mortgage rates. A larger down payment reduces the loan amount, which in turn lowers your interest payments. Aim for a down payment of at least 20% to avoid paying private mortgage insurance (PMI), which can significantly increase your monthly costs.

**Comparing Lenders**

Don’t settle for the first lender you come across. Comparing multiple lenders is essential to secure the best rates and terms.

1. Gather Quotes:

Reach out to several lenders and request quotes for your specific loan request. Compare interest rates, loan terms, and fees from each lender.

2. Check Reviews and Testimonials:

Read online reviews and testimonials from past customers to gauge their experience with different lenders. This can provide valuable insights into the lender’s responsiveness, professionalism, and customer service.

3. Consider Local vs. National Lenders:

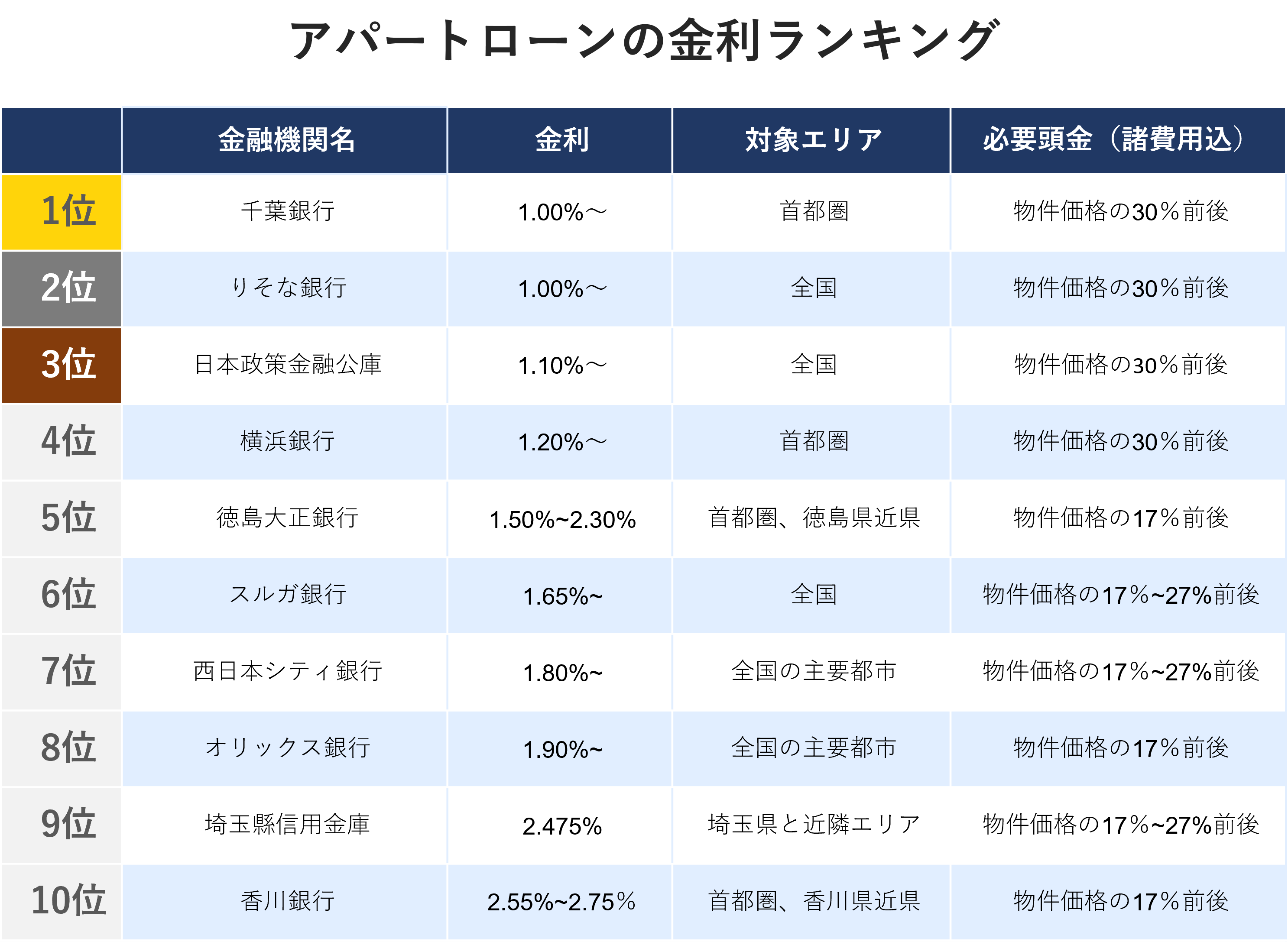

Local lenders may offer more personalized service and an understanding of the local market, but national lenders may have wider access to competitive rates.

4. Ask About Additional Benefits:

Inquire about any additional benefits or discounts offered by lenders, such as automated mortgage payments, discounted closing costs, or lender credits.

5. Negotiate:

Once you’ve narrowed down your choices, don’t be afraid to negotiate for better terms. Lenders are often willing to adjust rates and fees to secure your business. Be prepared to provide documentation of your financial situation and explain your case for a lower rate.

No responses yet