Low-Cost Real Estate Investing

The allure of real estate investing is undeniable, but the hefty price tag often acts as a barrier to entry. However, don’t let that deter you, because real estate investing doesn’t have to break the bank. With a little creativity and a smart strategy, even those with limited resources can reap the rewards of this lucrative field. Here are some low-cost real estate investing options to get you started.

1. House Hacking

House hacking is a brilliant way to get into real estate while reducing your living expenses. It involves purchasing a multi-unit property and living in one unit while renting out the others. The rental income can then be used to cover your mortgage, property taxes, and other expenses, potentially leaving you with a profit. With house hacking, you can essentially live for free while building equity in a valuable asset. If you’re looking for a low-cost way to get into the real estate game, house hacking is a strategy worth exploring.

To make house hacking even more affordable, consider renting out rooms in your house instead of entire units. This option, known as “roommate investing,” allows you to generate rental income without having to deal with the hassles of managing multiple tenants. Whether you choose to rent out units or rooms, house hacking is a great way to get your foot in the door of real estate investing without breaking the bank.

To get started with house hacking, look for properties with at least two units or rooms that you can rent out. It’s important to do your research and find a property that is in a desirable location and has the potential to generate enough rental income to cover your expenses. With a little effort, house hacking can be a powerful tool for building wealth and financial freedom.

For example, let’s say you purchase a duplex for $200,000. You rent out one unit for $1,200 per month and live in the other. Your mortgage payment is $1,000 per month, and your property taxes and insurance come to $200 per month. This means you’re generating a profit of $400 per month, which can be used to cover your other expenses or save for future investments.

House hacking isn’t just a temporary solution, either. As you build equity in your property and pay down your mortgage, your monthly cash flow will increase. Over time, you can use the profits from your rental units to purchase additional properties and grow your real estate portfolio.

2. Consider Wholesaling

Wholesaling is another low-cost way to get started in real estate investing. As a wholesaler, you act as a middleman between sellers and buyers. You find properties that are undervalued or distressed and then sell them to investors at a discounted price. The difference between the purchase price and the sale price is your profit.

Wholesaling is a great option for those who have limited funds because it doesn’t require you to purchase any properties yourself. You simply need to find deals and then assign them to other investors. This can be done through networking, marketing, or even bandit signs.

To get started with wholesaling, you’ll need to learn how to find and evaluate properties. You’ll also need to build a network of investors who are interested in buying properties. Once you have a few deals under your belt, you can start generating a profit from wholesaling.

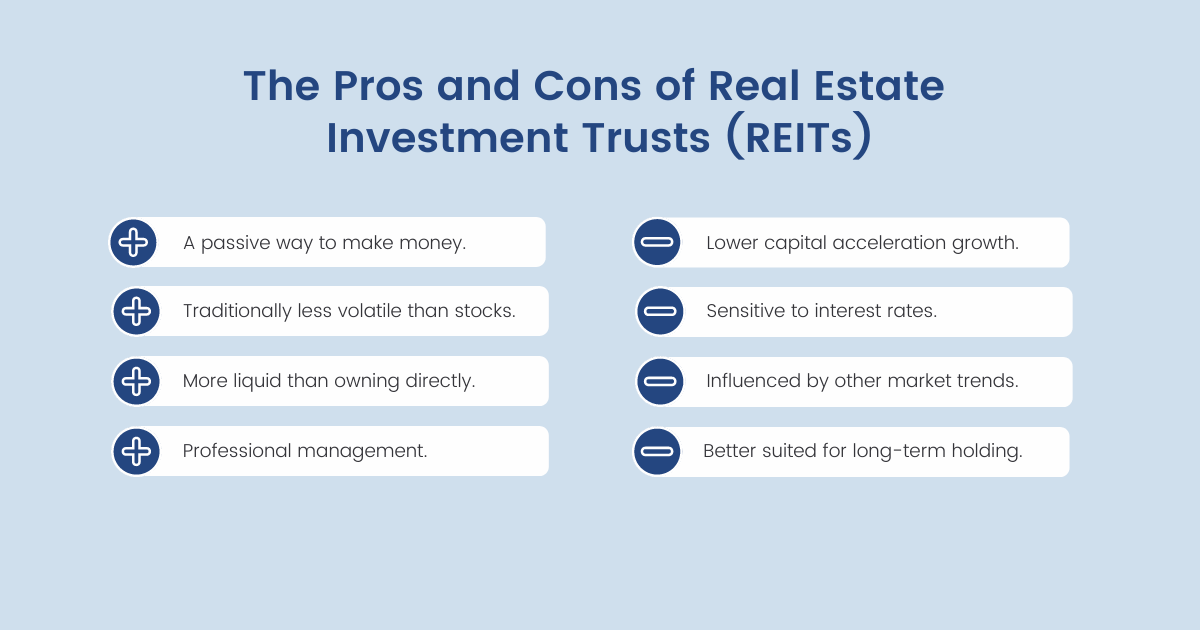

3. Explore Real Estate Investment Trusts (REITs)

REITs are a type of investment vehicle that allows you to invest in real estate without buying properties yourself. REITs own and manage a portfolio of properties, and they distribute the income from these properties to their shareholders. This means you can earn passive income from real estate without having to deal with the hassles of being a landlord.

REITs are a great option for those who are new to real estate investing or who don’t have the time or resources to manage properties themselves. They are also a way to diversify your portfolio and reduce your risk.

Low-Cost Real Estate Investing

Trying to get your foot in the property-investing door can feel like finding a unicorn—unrealistic. Yet, it doesn’t have to be a pipe dream. There are plenty of cost-cutting strategies to help the everyday person invest. And who knows, it could be your ticket to a profitable future.

Before investing, remember, while real estate is a compelling investment, it’s demanding. So, if you don’t relish demands, real estate investing may not be the pot of gold you’re picturing.

Buying in Less Desirable Areas

You may have heard the age-old real estate mantra about the three most important factors: location, location, location. But when you’re trying to get into the game with a shoestring budget, you may have to put half of that mantra on hold and focus on the areas that have yet to hit their prime—the less desirable areas. Wince-inducing, right? But, just like any investment, it’s all about weighing the pros and cons.

On the one hand, you get a lower purchase price, which means less money out of your pocket and a cushier down payment. As the sage Warren Buffett said, “Rule No.1: Never lose money. Rule No.2: Never forget Rule No.1.” And you’re less likely to lose money if you’re not hemorrhaging cash from the get-go. Plus, in an up-and-coming neighborhood, you’re riding the waves of change, the potential for appreciation, and the increased demand that inevitably follows. It’s like buying a stock when it’s still a penny stock and waiting for it to blossom into a blue-chip gem—the thrill of the chase, with, hopefully, a sweet payoff.

Now, if you’re envisioning rolling hills, pristine landscaping, and gourmet coffee shops, you may need to adjust your expectations. Less desirable areas aren’t known for their curb appeal or high-end amenities. But, if you can stomach the thought of a little elbow grease and delayed gratification, it could be well worth the temporary sacrifice. Just remember, investing is a marathon, not a sprint. So, if you’re looking for a quick buck, this strategy may not be for you. But if you’re willing to play the long game and understand the potential payoff, buying in less desirable areas could be your key to unlocking the door to real estate investing.

Low-Cost Real Estate Investing: Strategies to Make Your Money Work for You

The world of real estate investing is often viewed as an exclusive club reserved for the wealthy. But what if we told you that there’s a low-cost way to break into this lucrative market? It’s true! With a little ingenuity and some strategic planning, you can find low-cost real estate investments that will help you build your fortune. Here are a few tips to get you started:

Investing in Properties That Need Work

The old saying goes, “If it ain’t broke, don’t fix it.” But when it comes to real estate investing, sometimes it’s best to look for properties that need a little TLC. These fixer-uppers can be purchased at a discount, giving you the opportunity to add value through renovations. Just be sure to factor in the cost of repairs into your budget.

One way to find undervalued properties is to attend foreclosure auctions. Banks are often eager to sell foreclosed homes quickly, so you may be able to negotiate a great price. Another option is to look for properties that have been vacant for a while. Owners may be willing to sell at a reduced rate to get the property off their hands.

Renting Out Properties

One of the most classic ways to make money in real estate is through rental income. By purchasing a property and renting it out to tenants, you can generate a steady stream of passive income. The key to success in this strategy is to find a property that is in a desirable location and that has a rental rate that will cover your expenses and generate a profit.

There are many different ways to find tenants for your rental property. You can advertise online, in local newspapers, or even on social media. You can also work with a property management company to find and screen tenants for you. Just be sure to do your due diligence to avoid renting to tenants who are likely to cause problems.

Creative Financing Options

If you don’t have a lot of cash on hand, don’t worry! There are many creative financing options available to real estate investors. One option is to use a seller-financed mortgage. With this type of financing, the seller agrees to finance the purchase of their property for you. This can be a great option if you have a good relationship with the seller and you are confident that you can make the payments on time. By contrast, you could use an FHA loan. FHA loans are backed by the government and require a smaller down payment than conventional loans.

There are also a number of government programs that offer financial assistance to first-time homebuyers and investors. These programs can provide you with down payment assistance, closing cost assistance, and even reduced interest rates. If you qualify for a government-backed loan, it can make investing in real estate much more affordable.

Low-Cost Real Estate Investing: A Beginner’s Guide to Making Cash Flow

Are you looking to dive into the world of real estate investing but don’t have a fortune to drop? Don’t worry, my friend; low-cost real estate investing is alive and well, and we’re here to break it down for you. Let’s dive right in, shall we?

Buying Smaller Properties

Kick off your real estate investing journey by targeting smaller properties like condos, apartments, or townhouses. These babies usually come with a lower price tag than their larger counterparts, making them a more accessible option for those just starting out. Don’t let their size fool you; they can still pack a punch when it comes to cash flow and appreciation potential.

House Hacking: Live in Part, Rent Out Part

House hacking is a sneaky little trick that can help you cover your mortgage while also building equity in your property. How does it work? Simple! Move into part of the house while renting out the other portion. It’s like having a sneaky roommate who pays you rent! Not only will you save on expenses, but you’ll also learn the ropes of being a landlord, putting you in a prime position for future ventures.

Investing in Up-and-Coming Neighborhoods

If you’re looking for a true diamond in the rough, don’t be afraid to venture into up-and-coming neighborhoods. These hidden gems often offer properties at a fraction of the cost in established areas. Remember, when the neighborhood starts to shine, so will the value of your investment. Just do your research and make sure the area has the potential to grow.

Rent-to-Own: A Stepping Stone to Homeownership

For those looking to eventually own a home, rent-to-own can be a great option. This unique arrangement allows renters to pay a portion of their monthly payment towards the down payment, inching closer to homeownership. It’s like paying into your own piggy bank while enjoying the benefits of being a homeowner. Plus, it can help build your credit and prepare you for taking on a mortgage.

Low-Cost Real Estate Investing: A Step-by-Step Guide for Beginners

With the rising cost of living, finding affordable housing can be a daunting task. But don’t despair! There are still ways to break into the real estate market without breaking the bank. Here’s a comprehensive guide to low-cost real estate investing to help you get started:

Renting Out Rooms

If you own a larger property, why not turn it into a multi-unit dwelling? Renting out rooms to tenants can be a great way to offset your mortgage costs. This strategy can be particularly lucrative if you live in an area with high demand for rental properties.

Fix-and-Flip Properties

This involves buying a distressed property, renovating it, and then selling it for a profit. While this strategy has the potential for high returns, beginners should approach it cautiously. It requires a strong understanding of the real estate market, construction, and property management.

House Hacking

This is a creative way to live in a property while simultaneously generating income. House hackers typically buy a multi-unit home and live in one unit while renting out the others. This allows them to cover大部分 of their mortgage costs and build equity.

Investing in Rental Properties

Buying a rental property can provide a steady stream of passive income. However, it’s important to do your research and choose a property in a desirable location with good rental potential. Don’t forget to factor in expenses such as property taxes, insurance, and maintenance costs.

Participating in Real Estate Investment Trusts (REITs)

REITs are companies that own, finance, and operate income-producing real estate. By investing in REITs, you can gain access to a diversified portfolio of real estate assets without owning physical properties yourself. This can be a great way to get started in real estate investing with a relatively small amount of money.

Now that you have a better understanding of low-cost real estate investing strategies, it’s time to put them into action. Remember to do your due diligence, seek professional advice when needed, and always invest within your means. Happy investing!

Low-Cost Real Estate Investing: The Path to Financial Freedom

Real estate investing, often seen as a lucrative but daunting endeavor, can be made more accessible than you think with low-cost investment strategies. One such option is house hacking, a clever way to offset housing expenses while building equity in multiple properties.

What is House Hacking?

House Hacking

House hacking is a brilliant strategy where you live in one unit of a multi-family property (such as a duplex, triplex, or even a fourplex) while renting out the remaining units. This allows you to tap into rental income to subsidize your own housing costs, making homeownership more affordable.

Benefits of House Hacking

The advantages of house hacking are numerous. Besides reducing your housing expenses, it offers the potential for additional income, boosts your savings, and accelerates your path to owning more properties. Think of it as hitting multiple financial birds with one stone.

Other Low-Cost Real Estate Investing Strategies

Beyond house hacking, there are other low-cost real estate investing strategies that can help you build wealth. These include:

- Rental properties: Investing in rental properties can generate passive income and long-term appreciation.

- Wholesaling: This involves finding and contracting properties below market value, then assigning the contract to a buyer for a profit.

- Fix-and-flip: Buying distressed properties, renovating them, and selling them for a profit can be a lucrative strategy.

Getting Started with Low-Cost Real Estate Investing

Embarking on your low-cost real estate investing journey requires careful planning and due diligence. Here are some steps to consider:

- Educate yourself: Gather knowledge through books, online resources, and investing classes.

- Determine your investment goals: Define what you want to achieve through investing.

- Explore financing options: Identify financing options that align with your financial situation and investment goals.

- Find a mentor or advisor: Seek guidance from an experienced real estate professional who can provide support and insights.

Conclusion

Low-cost real estate investing strategies, like house hacking and others, offer a gateway to financial freedom. By tapping into these strategies, you can reduce housing expenses, generate income, and build wealth over time. Remember, the path to real estate success is not always paved with high costs; it’s about making smart decisions and leveraging the power of low-cost investing.

Beginners’ Guide to Low-Cost Real Estate Investing

Breaking into the real estate market can seem like a daunting task, especially for those on a tight budget. However, there are plenty of strategies that can make it more affordable for you to become a property owner. In this article, we’ll explore one such approach: low-cost real estate investing.

Why Low-Cost Real Estate Investing?

The allure of low-cost real estate investing lies in its potential for significant financial returns without the need for substantial upfront capital. By targeting properties that are less expensive, you can minimize your risk and maximize your chances of profit. Whether you’re looking to flip a property for a quick gain or rent it out for passive income, there are plenty of opportunities to be found in this niche.

Getting Started

-

Define Your Goals: Before diving into low-cost real estate investing, it’s essential to clarify your goals. Determine whether you want to purchase a property for personal use, rental income, or a combination of both. Clearly defined goals will guide your investment decisions.

-

Research Your Market: Conduct thorough research on the local real estate markets you’re considering. Analyze property values, rental rates, neighborhood demographics, and economic indicators. This will help you identify areas where low-cost properties can be found.

-

Explore Financing Options: While low-cost real estate investing is often associated with cash purchases, there are financing options available for those who need to borrow money. Explore traditional mortgages, FHA loans, and other financing programs that can make it easier to acquire a property.

Partnering with Others

Pooling resources with friends, family, or investors can significantly increase your purchasing power while reducing individual costs. Joint ventures and partnerships can spread the financial burden and allow you to acquire properties that may otherwise be out of reach.

Rehabilitating and Renting

Considering purchasing properties that need some TLC? Renovating and renting them out can be a lucrative low-cost investing strategy. By fixing up homes in sought-after areas, you can increase their value and generate rental income that offsets expenses.

Exploring Creative Strategies

Low-cost real estate investing doesn’t have to be limited to traditional purchases. Consider exploring creative strategies to reduce costs, such as:

- Lease Options: Lease a property with the option to buy it at a future date, giving you flexibility and a way to "try before you buy."

- Owner Financing: Negotiate with sellers who are willing to finance the property themselves, eliminating the need for traditional mortgages.

- Wholesaling: Act as a middleman between buyers and sellers, earning a fee for finding and negotiating deals.

- Fix-and-Flip: Buy properties in need of repairs, renovate them, and resell them for a profit.

- Rent-to-Own: Help tenants become homeowners by allowing them to rent a property with the option to purchase it in the future.

Conclusion

Low-cost real estate investing can be a smart way to build wealth and achieve financial freedom. By considering the strategies outlined in this article, you can reduce costs, increase your purchasing power, and make your real estate investing dreams a reality. With careful planning and execution, you can unlock the potential of this rewarding niche and become a successful low-cost real estate investor.

No responses yet