Retirement Portfolio by Age Calculator

Planning for retirement is a crucial step in securing financial stability during your golden years. The earlier you begin, the better equipped you’ll be to enjoy a comfortable lifestyle without worrying about money. Our comprehensive retirement portfolio by age calculator provides a personalized assessment of your progress towards achieving your retirement goals. This tool empowers you to make informed decisions about your savings, investments, and lifestyle choices, ensuring a fulfilling future.

Why Is It Important?

Retirement may seem like a distant reality, but it’s never too early to start planning. The power of compound interest, coupled with the discipline of consistent saving, can significantly boost your retirement savings over time. Moreover, planning early allows you to make gradual adjustments to your lifestyle and spending habits, minimizing the financial burden later on. Failing to plan for retirement can lead to a stressful and financially insecure chapter in your life, a scenario you certainly want to avoid. So, seize the opportunity to take control of your financial future and secure a comfortable retirement.

Assessing Your Current Situation

Our retirement portfolio by age calculator serves as an invaluable tool for assessing your current financial situation and identifying areas for improvement. It considers factors such as your age, income, savings, and expenses to provide a comprehensive snapshot of your retirement readiness. The calculator helps you determine if your current savings are on track to meet your retirement goals, or if adjustments are needed to ensure a comfortable lifestyle during your golden years. By providing a clear understanding of your financial standing, the calculator empowers you to make informed decisions and take proactive steps towards securing your future.

Setting Realistic Goals

Setting realistic retirement goals is essential for achieving financial security during your golden years. Our retirement portfolio by age calculator utilizes sophisticated algorithms to project your future income and expenses, helping you determine the amount of savings you need to reach your desired retirement lifestyle. It considers factors such as your age, income, and desired retirement age to provide personalized recommendations that align with your unique circumstances. By setting realistic goals, you can avoid the pitfalls of over-saving or under-saving, ensuring that you have sufficient funds to live comfortably during retirement.

Making Informed Decisions

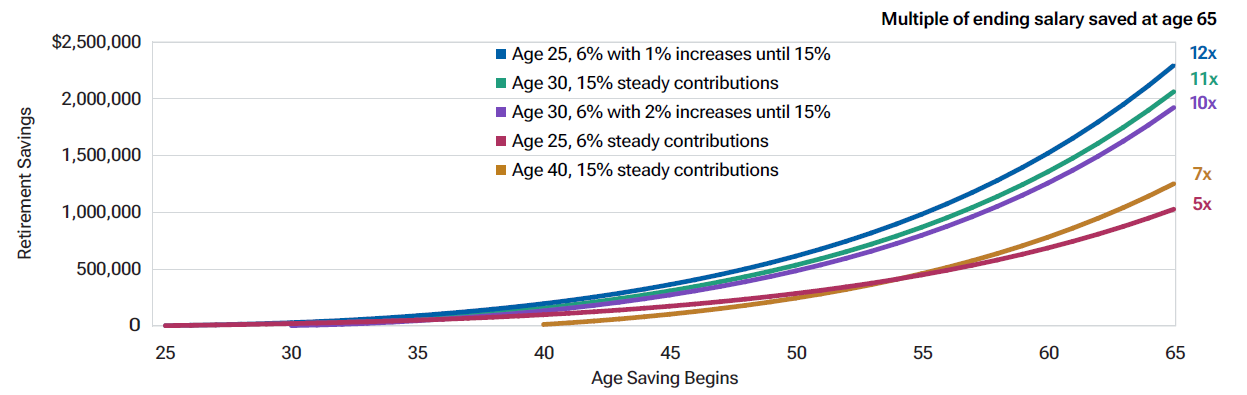

The information provided by the retirement portfolio by age calculator empowers you to make informed decisions about your savings and investment strategies. The calculator simulates the impact of different saving rates, investment returns, and retirement expenses on your projected retirement savings. This allows you to experiment with various scenarios and determine the optimal allocation of your financial resources. By understanding the potential outcomes of different investment and savings strategies, you can make informed decisions that maximize your chances of achieving a secure and comfortable retirement.

Taking Control of Your Future

Planning for retirement is an empowering experience that allows you to take control of your financial future. Our retirement portfolio by age calculator is a powerful tool that provides personalized insights into your current financial situation, helps you set realistic goals, and empowers you to make informed decisions. By utilizing this tool and embracing the principles of saving and investing, you can secure a comfortable retirement and enjoy the peace of mind that comes with financial stability during your golden years.

No responses yet