주식 분할 회계 처리

주식 분할은 기업이 주식 수를 늘리고 가격을 낮추는 회계 처리입니다. 이는 기업의 자본 구조나 소유권에 변화를 주지 않습니다.

주식 분할의 유형

- 순수 분할: 주식 수가 증가하고 가격이 감소합니다. 예: 1주당 100원에서 10주당 10원으로 분할

- 역분할: 주식 수가 감소하고 가격이 증가합니다. 예: 10주당 10원에서 1주당 100원으로 분할

- 스톡 디비던드: 기존 주주에게 추가 주식을 지급합니다. 예: 100주당 10주 무료 지급

주식 분할의 이점

- 유동성 증가: 주가가 낮아져 소액 투자자가 접근하기 쉬워집니다.

- 관심 증가: 잠재적 투자자의 주목을 끌 수 있습니다.

- 주가 조정: 주가가 지나치게 높거나 낮을 때 균형을 맞추는 데 사용할 수 있습니다.

주의 사항

- 주식 분할은 기업의 근본적인 가치에는 영향을 미치지 않습니다.

- 역분할은 회사가 재무적 어려움에 처했다는 인식을 줄 수 있습니다.

- 주식 분할은 주식 옵션이나 전환사채와 같은 파생 상품에 영향을 미칠 수 있습니다.

예시

- 애플: 2020년 4:1 순수 분할

- 테슬라: 2022년 3:1 순수 분할

- 버크셔 해서웨이: 1996년 2:1 역분할

결론

주식 분할은 기업이 자신의 주식에 유연하게 대처할 수 있는 도구입니다. 투자자는 주식 분할의 잠재적 이점과 위험을 고려하여 의사 결정을 내려야 합니다.

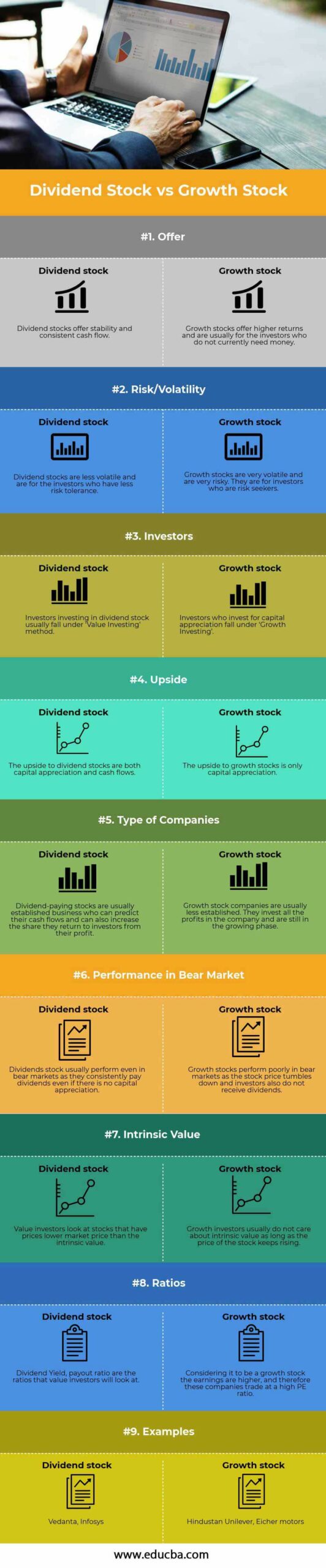

Best Dividend and Growth Stocks

Dividend and growth stocks are two popular investment strategies that can provide investors with a combination of income and capital appreciation. Dividend stocks pay regular dividends to their shareholders, while growth stocks are companies that are expected to experience above-average growth in their earnings and stock price. Both types of stocks can be good investments, but they have different risk and reward profiles. Dividend stocks tend to be less volatile than growth stocks, but they also tend to offer lower returns. Growth stocks have the potential to generate higher returns, but they also come with more risk.

Dividend Stocks

Dividend stocks are a good option for investors who are looking for income and stability. Dividend-paying companies are typically well-established and have a history of profitability. They tend to be less volatile than growth stocks, which makes them a good choice for investors who are risk-averse. Some of the best dividend stocks include:

-

Johnson & Johnson (JNJ)

- Coca-Cola (KO)

- Procter & Gamble (PG)

- AT&T (T)

- Verizon (VZ)

Growth Stocks

Growth stocks are a good option for investors who are looking for capital appreciation. Growth companies are typically in high-growth industries and have the potential to generate above-average returns. They tend to be more volatile than dividend stocks, but they also have the potential to offer higher rewards. Some of the best growth stocks include:

-

Amazon (AMZN)

- Apple (AAPL)

- Alphabet (GOOGL)

- Microsoft (MSFT)

- Tesla (TSLA)

Dividend and Growth Stocks

Dividend and growth stocks can both be good investments, but they have different risk and reward profiles. Dividend stocks are a good option for investors who are looking for income and stability, while growth stocks are a good option for investors who are looking for capital appreciation. The best way to decide which type of stock is right for you is to consider your own investment goals and risk tolerance.

Best Dividend and Growth Stocks to Supercharge Your Portfolio

In the realm of investing, dividend and growth stocks reign supreme as beacons of financial stability and future potential. Whether you’re a seasoned investor or just starting your journey, these stocks can form the cornerstone of your portfolio, providing both income and growth over the long haul.

Dividend Stocks: A Steady Stream of Income

Dividend stocks are like financial workhorses, rewarding investors with regular payments known as dividends. These payments are typically a portion of the company’s profits, providing you with a steady stream of income. Imagine dividend stocks as the water cooler of your investment portfolio—always there to quench your thirst for financial stability.

One of the key attributes of dividend stocks is their ability to weather market downturns. When the stock market takes a plunge, dividend stocks often remain afloat, continuing to pay out dividends. It’s like having a trusty umbrella during a storm, protecting your investments from the unpredictable winds of the market.

Growth Stocks: A Catalyst for Future Wealth

Unlike dividend stocks that focus on current income, growth stocks are all about future potential. These companies are often in rapidly growing industries, poised to expand their earnings and stock prices over time. Think of growth stocks as the rocketships of your portfolio, propelling you towards long-term financial success.

However, growth stocks can also be volatile, especially in the early stages of their journey. It’s like riding a roller coaster—there will be ups and downs along the way. But if you have the stomach for it, growth stocks can be the key to unlocking exponential returns.

Best Dividend and Growth Stocks to Consider

Now that you have a grasp of the basics, let’s dive into some specific dividend and growth stocks that are worth considering for your portfolio:

-

Dividend Stocks:

- Johnson & Johnson (JNJ): A healthcare giant with a long history of paying dividends, offering investors a reliable source of income.

- Coca-Cola (KO): A global beverage powerhouse with a rock-solid balance sheet and a track record of increasing dividends.

- Procter & Gamble (PG): A household name in consumer products, known for its consistent dividend payments and stable earnings.

-

Growth Stocks:

- Tesla (TSLA): A pioneer in the electric car revolution, with ambitious plans to dominate the automotive industry.

- Amazon (AMZN): An e-commerce titan with a vast ecosystem of products and services, poised for continued growth.

- Square (SQ): A fintech innovator transforming the way people pay and receive money, with a focus on small businesses.

Best Dividend and Growth Stocks for Your Portfolio

Are you in the market for investments that offer both dividend income and potential growth? Look no further! In this article, we’ll guide you through the ins and outs of dividend and growth stocks and help you find the perfect ones to boost your portfolio in today’s market.

Dividend Stocks

Dividend stocks are companies that share a portion of their profits with shareholders through regular cash payments. These payments provide a steady stream of income, making dividend stocks a favorite among investors seeking passive income.

To find quality dividend stocks, focus on factors such as the dividend yield (the ratio of dividend payments to stock price), dividend consistency (how reliably the company has paid dividends over time), and dividend growth (the rate at which dividends have increased in recent years).

Growth Stocks

Growth stocks are companies with high potential for above-average earnings and revenue growth. These companies often reinvest heavily in research and development, product development, or market expansion, driving their growth. As a result, growth stocks tend to have higher price-to-earnings ratios than dividend stocks.

When investing in growth stocks, it’s crucial to consider the company’s industry, competitive advantages, and management team. Look for companies with strong barriers to entry, a clear path to continued growth, and a proven track record of innovation.

However, it’s important to note that growth stocks carry more risk than dividend stocks due to their dependence on future earnings. Nevertheless, they can be a valuable addition to a diversified portfolio aiming for long-term capital appreciation.

Finding the Right Mix

The best mix of dividend and growth stocks for you depends on your investment goals and risk tolerance. If you prefer a steady income stream with lower risk, dividend stocks may be a better fit. If you’re willing to take on more risk in pursuit of higher growth potential, growth stocks could be a good option.

Remember, investing in stocks involves risk. Before you make any investment decisions, do your research and consider consulting with a financial advisor. By understanding the differences between dividend and growth stocks and finding the right mix for your goals, you can set your portfolio up for success.

Finding the Best Dividend and Growth Stocks

For investors seeking a balance of income and growth, dividend and growth stocks are a compelling choice. These stocks offer the potential for both regular income through dividends and long-term capital appreciation. In this article, we’ll delve into the key factors to consider when selecting the best dividend and growth stocks.

Dividend Yield and Payout Ratio

Dividend yield, expressed as a percentage, reflects the annual dividend payment per share relative to the current stock price. A higher yield indicates a greater immediate income stream. However, it’s crucial to assess the payout ratio, which represents the percentage of earnings paid out as dividends. A high payout ratio above 100% may compromise the company’s financial stability and ability to sustain dividends in the long term.

Earnings Growth

Earnings growth is a vital metric for dividend and growth stocks. Companies with consistent and increasing earnings per share (EPS) demonstrate the potential to grow their dividends over time. Consistent earnings growth indicates the company’s ability to generate sustainable profits, which supports dividend payments and overall stock value appreciation.

Industry Outlook

The industry outlook plays a significant role in the success of dividend and growth stocks. Investing in companies operating in growing industries with favorable tailwinds increases the likelihood of sustained dividend growth and stock price appreciation. Research industry trends, market size, and competitive landscapes to identify promising sectors and industries poised for long-term success.

Dividend Growth Potential

Evaluating a company’s dividend growth potential is crucial. Look for companies with a history of consistently increasing dividends, often referred to as “dividend aristocrats.” These companies have demonstrated a commitment to returning value to shareholders and have the financial strength to sustain and increase dividends over time. Past dividend growth is a reliable indicator of a company’s ability to deliver future income growth for investors.

Best Dividend and Growth Stocks

Here are a few examples of companies that meet the criteria outlined above and are considered strong dividend and growth stock candidates:

- Johnson & Johnson (JNJ): Healthcare conglomerate with a history of consistent dividend growth and earnings growth.

- Procter & Gamble (PG): Consumer goods giant with a strong brand portfolio and a track record of stable dividend growth.

- Microsoft Corporation (MSFT): Technology leader with a strong balance sheet and a commitment to returning value to shareholders through dividends.

Investing in Dividend and Growth Stocks

Investing in the stock market can be a great way to grow your wealth over time. But with so many different stocks to choose from, it can be tough to know which ones to buy. Dividend and growth stocks are two popular options for investors, but what’s the difference between them? And which type of stock is right for you? If you put in the time and do your research, you’ll be able to make good investments.

Dividend Stocks

Dividend stocks are stocks that pay out a portion of their profits to shareholders in the form of dividends. Dividends are typically paid quarterly, and they can be a great way to generate income from your investments. Some of the best dividend stocks for 2023 include Johnson & Johnson (JNJ), Coca-Cola (KO), and Procter & Gamble (PG).

Growth Stocks

Growth stocks are stocks of companies that are expected to grow rapidly in the future. These stocks don’t typically pay dividends, but they can offer the potential for significant capital gains. Some of the best growth stocks for 2023 include Amazon (AMZN), Alphabet (GOOGL), and Tesla (TSLA).

Diversifying Your Portfolio

One of the best ways to reduce risk in your investment portfolio is to diversify. This means investing in a variety of different stocks, including dividend stocks and growth stocks. By diversifying your portfolio, you can reduce the impact of any one stock’s performance on your overall portfolio.

Investing for the Long Term

The stock market is volatile, and it’s important to invest for the long term. Don’t try to time the market, and don’t panic sell when the market takes a dip. If you invest for the long term, you’re more likely to ride out any market downturns and come out ahead in the end.

Additional Tips

Here are a few additional tips for investing in dividend and growth stocks:

* Do your research. Before you invest in any stock, take the time to learn about the company and its financials.

* Consider your risk tolerance. Not all stocks are created equal, and some are riskier than others. Make sure you understand the risks involved before you invest.

* Invest for the long term. The stock market is volatile, and it’s important to invest for the long term. Don’t try to time the market, and don’t panic sell when the market takes a dip. If you invest for the long term, you’re more likely to ride out any market downturns and come out ahead in the end. -

-

No responses yet