Best Dividend-Producing Stocks

Unlock your financial future with the best dividend-producing stocks. These stocks offer a steady stream of income, providing a reliable source of passive income. As an investor, you’ll reap the benefits of these dividends, which can be reinvested or used to supplement your lifestyle. Get ready to elevate your portfolio and secure a comfortable retirement with our expert insights on the top dividend-producing stocks today.

What Are Dividend-Producing Stocks?

Dividend-producing stocks are like a gift that keeps on giving. These stocks are issued by companies that share a portion of their profits with their shareholders. Dividends are typically paid quarterly or annually, providing you with a regular income stream. It’s like having a reliable tenant who pays their rent on time, except instead of a physical property, you own a piece of a thriving company. These dividends can add up over time, boosting your overall financial health.

Factors to Consider When Choosing Dividend-Producing Stocks

Before diving headfirst into the world of dividend-producing stocks, it’s essential to consider a few key factors. Firstly, examine the company’s financial stability. A company with a solid track record of profitability and a low debt-to-equity ratio is more likely to maintain consistent dividend payments. Secondly, consider the dividend yield, which is the percentage of your investment that you receive back in dividends. A higher dividend yield may be tempting, but it’s important to ensure it’s sustainable and doesn’t compromise the company’s long-term growth prospects. Lastly, keep an eye on the dividend payout ratio, which indicates the proportion of earnings the company distributes as dividends. A payout ratio below 70% generally suggests the company has room to increase dividends in the future.

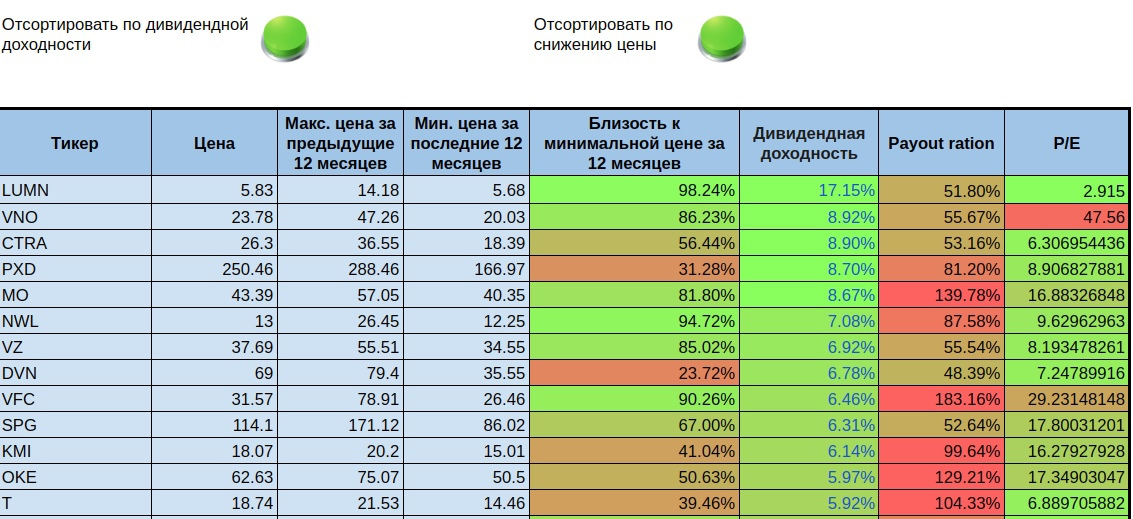

Unveiling the Top Dividend-Producing Stocks

Now, let’s unveil the crème de la crème of dividend-producing stocks. Johnson & Johnson (JNJ), the healthcare giant, has a long history of increasing its dividend, with 60 consecutive years of dividend growth. Berkshire Hathaway (BRK.B), led by the legendary investor Warren Buffett, offers a high dividend yield combined with a diversified portfolio of businesses. Microsoft (MSFT), the tech behemoth, has a growing dividend and a strong balance sheet, making it a reliable option. Procter & Gamble (PG), the consumer goods giant, has a reputation for consistent dividend payments, even during economic downturns. Coca-Cola (KO), the beverage king, has been paying dividends for over a century and continues to offer a solid dividend yield.

Best Dividend-Producing Stocks: A Smart Way to Supercharge Your Portfolio

Dividend-producing stocks are investment powerhouses that can turbocharge your portfolio. Think of them as a steady stream of income that can help you weather financial storms and amplify your long-term wealth. But not all dividend stocks are created equal, so it’s crucial to know how to pick the cream of the crop.

Choosing the Right Stocks

When it comes to dividend stocks, three key factors separate the winners from the also-rans: dividend history, payout ratio, and industry stability. A proven dividend history indicates a company’s commitment to rewarding its shareholders. The payout ratio, or the percentage of earnings paid out as dividends, sheds light on the company’s financial health and ability to sustain its dividend stream. Last but not least, industry stability provides a glimpse into the company’s future prospects and its capacity to withstand economic ups and downs.

A company with a consistent dividend history, a healthy payout ratio, and a track record of thriving in its industry has the potential to become a dependable dividend machine. Let’s dive into each of these considerations in more detail.

Dividend History

Dividend history is your time machine into a company’s past performance. It tells you whether the company has been a reliable dividend payer over the years, even during tough economic times. A company with a long and uninterrupted dividend history deserves your attention. After all, consistency is the lifeblood of dividend investing

But don’t just look at the number of years a company has been paying dividends. Also, consider the company’s dividend growth rate. A company that steadily increases its dividend payments indicates a growing business that values shareholder returns. These are the dividend stocks you want to set your sights on.

Here’s a pro tip: Look for companies that have increased their dividends for at least five consecutive years. This demonstrates a commitment to shareholders and a belief in the company’s long-term growth prospects.

Payout Ratio

The payout ratio is a financial stethoscope that helps you assess a company’s ability to sustain its dividend payments. It’s calculated by dividing the total dividends paid in a year by the company’s net income. A payout ratio above 100% means the company is paying out more in dividends than it earns, which can be unsustainable in the long run.

A payout ratio of 50% or less is considered healthy. This indicates that the company retains a portion of its earnings to invest in its business, research, and development, and other growth initiatives. A low payout ratio also gives the company a financial cushion to withstand economic downturns.

Remember, a high payout ratio is not always a deal-breaker. Some companies, especially those in mature industries, may have payout ratios above 50%. However, it’s wise to proceed with caution and do your due diligence before investing in such companies.

Best Dividend-Producing Stocks: A Guide to Smart Investing

In the tumultuous world of finance, dividend-producing stocks stand as beacons of stability, offering investors a wellspring of passive income. For the savvy investor, uncovering the best of these dividend stalwarts can be a daunting task, but armed with the right strategies and insights, you can navigate the market and reap the rewards.

Evaluating the Market

When setting out on your quest for dividend-rich gems, it’s crucial to cast a discerning eye on the market landscape. Keep a close watch on economic indicators, such as GDP growth, inflation, and interest rates. These factors can provide valuable clues as to which companies are poised for financial success and, by extension, dividend growth.

Moreover, scrutinize the industry landscape. Are there any emerging sectors with strong prospects for future growth? Companies operating in these industries tend to have a higher likelihood of increasing their dividends over time.

Company Analysis: Unveiling Dividend Potential

Once you’ve identified potential companies, it’s time to dig deeper. Analyze their financial statements, paying particular attention to their earnings per share (EPS) and dividend payout ratio. A company with consistently growing EPS and a moderate dividend payout ratio is a strong indicator of sustainable dividend growth.

Other factors to consider include the company’s debt-to-equity ratio, cash flow from operations, and management quality. These elements provide valuable insights into the company’s financial health and ability to maintain dividend payments even during economic downturns.

Example: A Dividend Powerhouse

To illustrate the power of dividend investing, let’s examine the case of Johnson & Johnson (JNJ). For over a century, this healthcare giant has consistently delivered dividends to its shareholders, boasting a remarkable track record of 60 consecutive years of dividend increases.

Johnson & Johnson’s unwavering commitment to dividends stems from its strong financial performance, driven by a diversified portfolio of businesses and a relentless focus on innovation. Its products, ranging from pharmaceuticals to medical devices, enjoy global recognition and strong market shares.

Best Dividend-Producing Stocks: Solid Options for Income-Oriented Portfolios

Investing in dividend-producing stocks, or “income stocks,” can be an excellent way to generate steady income from your portfolio while potentially enjoying capital appreciation over the long term. These stocks offer a combination of current income and potential growth, making them a great choice for investors looking for a balance between risk and reward.

Noteworthy Dividend Producers: Consider stocks like AT&T (T), Johnson & Johnson (JNJ), and Coca-Cola (KO) for their long-standing dividend track records and strong fundamentals.

Diversifying Your Portfolio

When investing in dividend stocks, it’s important to diversify your portfolio across different sectors and industries. This strategy helps spread your risk and maximize returns. For example, rather than putting all your eggs in the technology basket, allocate your investments across utilities, healthcare, consumer staples, and financials. By doing so, you’re less likely to be adversely affected by industry-specific downturns.

Analogy: Think of it like building a balanced house. You don’t want to build it entirely out of wood, as termites could compromise its integrity. Instead, you might combine wood with brick and concrete for a more robust structure.

Analyzing Dividend Stocks

Before investing in a dividend stock, it’s crucial to analyze its dividend yield, payout ratio, and growth potential. The dividend yield is the annual dividend per share divided by the stock price. A higher yield isn’t always better, as it can indicate the company is struggling to maintain its dividend. Focus on companies with a sustainable dividend yield and a low payout ratio, which indicates they’re not overextending themselves on dividend payments.

Assessing the Company’s Health

It’s equally important to assess the financial health of the company issuing the dividend. Check its earnings per share (EPS), cash flow from operations, and debt-to-equity ratio. A healthy company will have consistently positive EPS, strong cash flow, and a low debt-to-equity ratio.

Metaphor: You wouldn’t buy a car without checking under the hood, so don’t invest in a dividend stock without understanding the company’s financial performance.

Monitoring and Rebalancing

Once you’ve invested in dividend stocks, it’s important to monitor their performance regularly and rebalance your portfolio if necessary. This means adjusting the allocation of your investments to maintain your desired level of risk and return. If a particular sector or industry is outperforming or underperforming, you may need to increase or decrease your exposure accordingly.

Best Dividend-Producing Stocks: A Lucrative Investment Option

Savvy investors are always on the lookout for stocks that not only provide reliable returns but also generate a steady stream of passive income. Dividend-paying stocks fit this bill perfectly, offering investors a dual benefit of capital appreciation and income generation. But before you jump in, it’s crucial to understand the tax implications of dividend income.

Managing Tax Implications

Dividend income is subject to taxation, but the exact treatment depends on your tax bracket and the type of dividend. Qualified dividends, which meet certain criteria, are taxed at a lower rate than ordinary dividends. Consulting a financial advisor can help you optimize your tax strategy and minimize the impact of dividend taxation.

5 Essential Tips for Choosing the Best Dividend-Producing Stocks

-

Examine the dividend yield: This ratio, expressed as a percentage, measures the annual dividend per share divided by the current stock price. A higher yield can indicate a more attractive return, but it’s not always the best indicator.

-

Check the dividend payout ratio: This ratio shows what percentage of a company’s earnings are paid out as dividends. A high payout ratio can suggest that the company may not have enough retained earnings for future growth.

-

Review the dividend history: A company with a consistent history of paying dividends is more likely to continue doing so in the future. Look for companies that have increased their dividends over time.

-

Evaluate the underlying business: The fundamentals of the company are just as important as the dividend yield. Consider industry trends, company management, and financial health.

-

Don’t fall for dividend traps: Some companies may artificially inflate their dividend yields to attract investors. Beware of companies with high debt levels or questionable earnings that could lead to future dividend cuts.

Best Dividend-Producing Stocks

If you’re looking to supplement your income with passive earnings, it’s time to get acquainted with dividend-producing stocks. These stocks are like the gift that keeps on giving, disbursing a portion of their profits to shareholders in the form of cash dividends. While selecting the best dividend stocks requires some due diligence, the returns can be well worth it.

Factors to Consider

Before you dive headfirst into dividend investing, let’s take a closer look at some key factors to consider.

- Dividend Yield: This represents the annual dividend payment divided by the current stock price.

- Dividend Growth Rate: A high dividend growth rate indicates that the company is increasing its dividends over time, providing you with a potential for income growth.

- Dividend Payout Ratio: This is the percentage of earnings that a company distributes as dividends. A high payout ratio may indicate that the company has limited room for dividend growth.

- Dividend History: A company with a long and consistent track record of paying dividends showcases stability and financial strength.

Monitoring Performance

Once you’ve selected your dividend-producing stocks, it’s essential to monitor their performance. Regularly review your portfolio to ensure that the dividend payments are meeting your expectations. If they’re falling short or if the company’s financial health is deteriorating, it may be time to reconsider your investment. Additionally, keep an eye on the dividend growth rate and adjust your holdings as needed to maintain a balanced income stream.

Rebalancing Your Portfolio

As your dividend portfolio grows, it’s important to rebalance it periodically. This involves selling some of your winners and investing the proceeds in underperformers to maintain a diversified portfolio. Rebalancing helps reduce risk and ensures that your income stream remains stable.

The Power of Compounding

The magic of dividend investing lies in the power of compounding. When you reinvest your dividends, you’re essentially buying more shares at a lower price. Over time, this snowball effect can significantly increase your income stream.

Expert Picks

To give you a head start, here are a few top-rated dividend-producing stocks:

- Johnson & Johnson (JNJ): A healthcare giant with a long history of dividend payments and growth.

- Coca-Cola (KO): A consumer staples behemoth with a steady stream of dividend income.

- Microsoft (MSFT): A tech giant with a solid dividend yield and growth potential.

- Procter & Gamble (PG): A consumer goods powerhouse with a consistent dividend history.

- Realty Income (O): A real estate investment trust (REIT) that specializes in commercial properties and offers a high dividend yield.

No responses yet