ETF vs. Mutual Fund

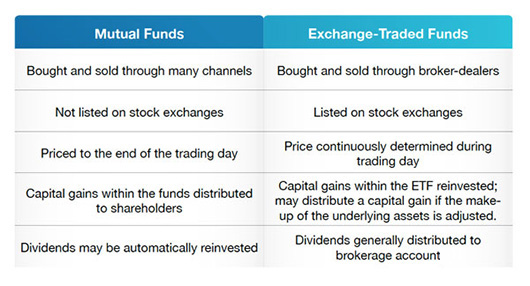

When it comes to investing, there are numerous options to choose from. Two of the most popular are exchange-traded funds (ETFs) and mutual funds. While both serve a similar purpose, there are some fundamental differences to be aware of before making your choice.

Exchange-Traded Funds (ETFs)

ETFs are a type of investment fund that tracks a specific index, sector, or commodity. They are similar to stocks in that they trade on exchanges throughout the day. However, unlike mutual funds, ETFs can be bought and sold just like any other stock. This allows for greater flexibility and control over your investments.

ETFs offer a number of advantages over mutual funds, including lower expense ratios, greater transparency, and increased liquidity. Expense ratios are the annual fees charged by the fund to cover its operating expenses. ETFs typically have lower expense ratios than mutual funds, which can save you money in the long run.

ETFs are also more transparent than mutual funds. They are required to disclose their holdings daily, so you always know what you’re invested in. Mutual funds, on the other hand, are only required to disclose their holdings once per quarter.

Finally, ETFs are more liquid than mutual funds. This means that you can buy and sell ETFs more easily, which can be important if you need to access your money quickly.

ETF vs. Mutual Fund: Which One Should You Choose?

Investing can be a daunting task, especially when you’re trying to decide between different investment options. Two popular choices are exchange-traded funds (ETFs) and mutual funds. But what’s the difference between the two? And which one is right for you?

ETFs

ETFs are traded on exchanges, just like stocks. This means that you can buy and sell ETFs throughout the day, just like you would with any other stock. ETFs are typically baskets of securities, such as stocks or bonds, that track a particular index, sector, or asset class. For example, you can buy an ETF that tracks the S&P 500 index or an ETF that invests in emerging market stocks.

One of the biggest advantages of ETFs is that they offer investors diversification and liquidity. Because ETFs are baskets of securities, they provide investors with instant diversification. Additionally, because ETFs are traded on exchanges, they offer investors the ability to buy and sell them throughout the day, just like they would with any other stock.

ETFs also tend to have lower fees than mutual funds. This is because ETFs are passively managed, meaning that they don’t have a portfolio manager who is actively making investment decisions. As a result, ETFs can pass on the savings to investors in the form of lower fees.

However, ETFs also have some disadvantages. One disadvantage is that ETFs can be more volatile than mutual funds. Because ETFs are traded on exchanges, their prices can fluctuate more frequently than the prices of mutual funds.

Mutual Funds

Mutual funds are pooled investment funds that are managed by professional portfolio managers. These managers buy and sell stocks, bonds, and other securities on behalf of the fund’s investors. Mutual funds offer investors a way to diversify their portfolios and potentially earn a profit from the stock market.

One of the biggest advantages of mutual funds is that they offer investors professional management. Portfolio managers have the experience and expertise to make investment decisions that can potentially lead to profits for investors. Additionally, mutual funds can offer investors a wider range of investment options than ETFs.

However, mutual funds also have some disadvantages. One disadvantage is that mutual funds have higher fees than ETFs. This is because mutual funds are actively managed, meaning that they have a portfolio manager who is actively making investment decisions. As a result, mutual funds have to pay the portfolio manager’s salary, as well as other operating costs.

Another disadvantage of mutual funds is that they are not as liquid as ETFs. Because mutual funds are not traded on exchanges, investors cannot buy and sell them throughout the day. Instead, investors must wait for the end of the trading day to buy or sell mutual funds.

ETFs vs. Mutual Funds: Which Investment Is Right for You?

Investing can be a smart way to grow your wealth over time, but with so many options available, it can be tough to know where to start. Two popular investment vehicles are exchange-traded funds (ETFs) and mutual funds. Both offer the potential for diversification and growth, but they have their own unique advantages and disadvantages. Let’s break down the key differences and help you decide which one is the better fit for your financial goals.

What’s the Deal with ETFs?

ETFs are baskets of securities that trade on stock exchanges, making them accessible to investors like you and me. They offer several benefits, including:

- Flexibility: ETFs can be bought and sold throughout the trading day, just like stocks. This gives you the power to react quickly to market movements.

- Transparency: The holdings of ETFs are publicly disclosed, so you always know what you’re invested in.

- Cost-effectiveness: ETFs typically have lower fees than mutual funds, which can save you money over the long term.

Mutual Funds: The OG Investment Vehicle

Mutual funds have been around for ages and remain a popular choice for investors. They pool money from multiple investors and invest it in a variety of assets, such as stocks, bonds, or a mix of both. Mutual funds offer a few key advantages:

- Professional management: Mutual funds are overseen by investment professionals who make decisions about which investments to buy and sell. This can be helpful for investors who don’t have the time or expertise to manage their own investments.

- Diversification: Mutual funds by their very nature offer diversification because they invest in a wide range of assets. This can help reduce risk and smooth out your returns over time.

- Accessibility: Mutual funds are available through a variety of financial institutions, making them easy to invest in.

ETFs vs. Mutual Funds: The Bottom Line

So, which investment vehicle is right for you? Well, that depends on your specific needs and preferences. Here’s a quick comparison to help you decide:

| Feature | ETF | Mutual Fund |

|---|---|---|

| Trading | Traded throughout the trading day | Traded once per day, after the market closes |

| Fees | Typically lower fees | Typically higher fees |

| Management | Passive management | Active management |

| Transparency | Holdings are publicly disclosed | Holdings are not always publicly disclosed |

| Accessibility | Available through stock exchanges | Available through financial institutions |

If you’re looking for a flexible, transparent, and cost-effective investment option, an ETF might be a good choice for you. If you prefer professional management and are willing to pay a bit more in fees, a mutual fund could be a better fit.

No matter which investment vehicle you choose, remember that investing is a long-term game. Don’t get caught up in short-term market fluctuations. Stay invested, stay diversified, and you’ll be well on your way to achieving your financial goals.

ETF vs. Mutual Fund: Which One’s Right for You?

When it comes to investing, there are a lot of different options out there. Two of the most popular options are ETFs (exchange-traded funds) and mutual funds. So, what’s the difference between the two? And which one is right for you?

In this article, we’ll take a closer look at ETFs and mutual funds. We’ll compare their fees, returns, and risks. And we’ll help you decide which one is the better choice for your investment goals.

Expense Ratio

Expense ratios are one of the most important factors to consider when choosing an ETF or mutual fund. The expense ratio is a percentage of your investment that goes towards the fund’s operating costs. These costs can include management fees, marketing fees, and other administrative expenses.

ETFs typically have lower expense ratios than mutual funds. This is because ETFs are passively managed, which means that they don’t require a team of portfolio managers to make investment decisions. Mutual funds, on the other hand, are actively managed, which means that they have a team of portfolio managers who make investment decisions on behalf of the fund’s investors.

The lower expense ratios of ETFs can make a big difference over time. For example, if you invest $10,000 in an ETF with an expense ratio of 0.10%, you’ll pay $10 in fees over the course of a year. If you invest $10,000 in a mutual fund with an expense ratio of 1.00%, you’ll pay $100 in fees over the course of a year.

Over time, the lower fees of ETFs can add up to a significant amount of savings. This is why it’s important to consider the expense ratio when choosing an ETF or mutual fund.

ETFs vs. Mutual Funds: Which One’s Right for You?

When it comes to investing, you’ve got a lot of options to choose from. Two popular choices are exchange-traded funds (ETFs) and mutual funds. Both ETFs and mutual funds can be a great way to diversify your portfolio and potentially grow your wealth. But there are some key differences between the two that you should be aware of before you invest.

Tax Efficiency

One of the key differences between ETFs and mutual funds is their tax efficiency. ETFs are more tax-efficient than mutual funds because they’re structured as a basket of securities that are traded on an exchange.

When you buy an ETF, you’re not actually buying the underlying securities. You’re buying a share of the ETF, which represents a portion of the underlying securities.

This means that when you sell an ETF, you’re not actually selling the underlying securities. You’re selling your share of the ETF. This can be a big advantage from a tax standpoint.

When you sell a mutual fund, you’re actually selling the underlying securities. This can trigger capital gains taxes, even if you’ve only held the mutual fund for a short period of time.

ETFs, on the other hand, are not subject to capital gains taxes when you sell them. This is because you’re not actually selling the underlying securities. You’re selling your share of the ETF.

The tax efficiency of ETFs can be a major advantage, especially if you’re planning on trading your investments frequently.

ETF vs. Mutual Fund: Which Investment Vehicle is Right for You?

Investing your hard-earned money can be daunting. With various investment options available, choosing the right one can be a challenge. Among the most popular choices are exchange-traded funds (ETFs) and mutual funds. Both ETFs and mutual funds offer investors a way to diversify their portfolios and potentially grow their wealth. However, they also have key differences that investors should understand before making a decision.

Liquidity

Liquidity refers to how easily an investment can be bought or sold. ETFs are generally considered more liquid than mutual funds. ETFs trade on exchanges, much like stocks, so investors can buy or sell them throughout the trading day. Mutual funds, on the other hand, are typically traded once per day at the end of the trading day. As a result, if you need to access your money quickly, an ETF may be a better option.

Expense Ratios

Expense ratios are the annual fees that cover the costs of managing an investment fund. ETFs typically have lower expense ratios than mutual funds. This is because ETFs are passively managed, meaning they track an index, such as the S&P 500, and do not require a portfolio manager. Mutual funds, on the other hand, are actively managed, which means a portfolio manager makes decisions about which investments to buy and sell. As a result, mutual funds typically have higher expense ratios.

Investment Options

ETFs offer a wider range of investment options than mutual funds. ETFs can track indices, sectors, countries, and commodities. Mutual funds, on the other hand, are typically more focused and may only invest in stocks or bonds in a particular sector or country. This can limit the diversification opportunities available to investors.

Tax Efficiency

ETFs are generally more tax-efficient than mutual funds. This is because ETFs are structured as pass-through entities, meaning that capital gains are passed on to investors and taxed at their individual tax rate. Mutual funds, on the other hand, are taxed at the fund level, which can result in higher taxes for investors.

Transparency

ETFs are more transparent than mutual funds. ETFs are required to disclose their holdings on a daily basis, so investors always know what they are invested in. Mutual funds, on the other hand, are only required to disclose their holdings once per quarter. This can make it more difficult for investors to track the performance of their investments.

Ultimately, the best investment vehicle for you depends on your individual circumstances and investment goals. If you are looking for a liquid, low-cost, and diversified investment option, an ETF may be a good choice. If you are looking for a more actively managed investment option with a narrower focus, a mutual fund may be a better choice.

ETF vs. Mutual Funds: A Comprehensive Guide for Savvy Investors

When it comes to investing, there’s no shortage of options. Two popular vehicles that investors often consider are exchange-traded funds (ETFs) and mutual funds. While they share some similarities, these investment options have distinct characteristics that cater to different investor needs.

How They’re Made

ETFs are like baskets filled with various stocks, bonds, or other assets. They’re traded on stock exchanges, just like individual stocks. Mutual funds, on the other hand, are managed by professional fund managers who strategically select and hold a portfolio of investments.

Trading Flexibility

One key difference between ETFs and mutual funds lies in their trading flexibility. ETFs are bought and sold throughout the trading day, allowing investors to capitalize on market fluctuations and adjust their positions in real-time. Mutual funds, on the other hand, are typically traded once per day, after the market closes. This limited trading flexibility can make it more challenging to respond to market movements quickly.

Tax Implications

Tax implications can vary between ETFs and mutual funds. ETFs generally have lower tax implications than mutual funds because they’re more tax-efficient. When an ETF is sold or traded, only the shares sold or traded are taxed. Mutual funds, however, may incur capital gains taxes when underlying investments are sold within the fund, even if the investor doesn’t sell their shares.

Cost Structure

Expense ratios, typically expressed as a percentage of assets, cover the costs of managing and operating ETFs and mutual funds. ETFs often have lower expense ratios compared to mutual funds due to their more passive management style. Lower expense ratios translate to higher returns for investors over the long term.

Transparency

ETFs provide real-time pricing and detailed information about their holdings. This transparency gives investors a clear understanding of what they’re investing in and how their investments are performing. Mutual funds, while providing regular reporting, may have less transparency regarding their holdings and management decisions.

Which Is Right for You?

Choosing between an ETF and a mutual fund depends on several factors, including your investment goals, risk tolerance, and trading preferences. If you value trading flexibility, tax efficiency, transparency, and lower costs, an ETF might be a good fit for you. However, if you prefer a more actively managed portfolio and don’t mind trading less frequently, a mutual fund could be a suitable option.

Conclusion

ETFs and mutual funds offer distinct advantages and disadvantages that cater to different investor needs. Understanding these differences is crucial for making informed investment decisions. By carefully considering your investment goals and preferences, you can choose the option that best aligns with your financial objectives.

No responses yet